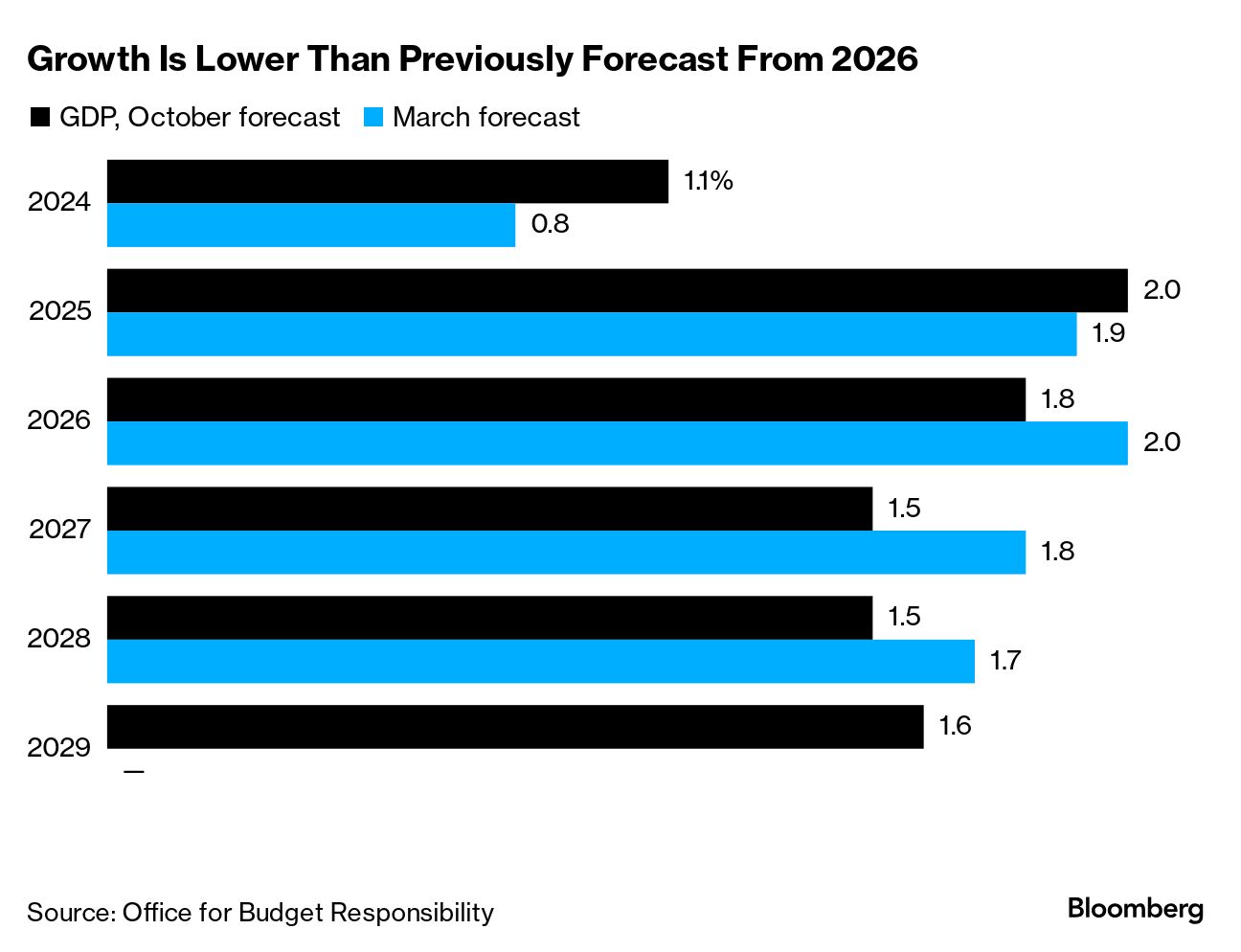

| "These are my choices" the chancellor told us from the despatch box today, and that's right. We've entered an era where the economic choices are now Labour's, not the Tories'. Labour MPs queued up from 8.30 a.m. to get a good seat – three hours before doors to the Commons chamber opened and four hours before the budget. It was box office for them to witness their chancellor announce £40 billion in tax rises. And she said it, just like that: this is a Labour chancellor prepared to be explicit that she is raising tax to spend more. But for all she wanted her own side to be clear that there is tax and spend going on — what many of them need to feel they've got a real-deal Labour government — that £40 billion will also walk into the history books as an uncomfortable contrast to what was promised before the election. Today Rishi Sunak's fury was palpable – time and again during the election he had warned Labour would raise taxes. Remember the TV debate when he said there would be £2,000 worth of tax rises, and the mother of all outrage was unleashed. It probably felt like a Pyrrhic victory today for him to get a semblance of vindication during his very last moments at the Commons despatch box.  And so the nation's businesses are digesting the nuance that allows Labour to insist they have not broken their promise not to raise taxes on working people. Over the parliament, £25 billion of those tax hikes will come from an increase in employer's National Insurance contributions. On the TV sets in the immediate aftermath, Paul Johnson of the Institute for Fiscal Studies was uncomfortable at being asked to repeat his earlier line that if Labour raised National Insurance it would constitute a "straightforward breach" of their manifesto promises. The chancellor herself was resolute when delivering the budget, saying we cannot have healthy businesses without having healthy schools and hospitals first. And there is a powerful case for that. But businesses have also warned of the dangers of a perfect storm of more labor laws, higher minimum wage and increases in capital gains tax hitting them. While she was still speaking the National Institute for Social and Economic Research said the increase in NI would hit growth. By the time she sat down, many were scratching their heads. While she announced gargantuan tax rises, the increase in public spending was less than thought – something that might upset her backbenchers when they have had time to digest. There also appears to be increases in spending this year and next before investment falls off, meaning we're left wondering whether there'll be another round of tax rises in the years ahead. The Office for Budget Responsibility showed that inflation is now not likely to come down by as much had been previously predicted — indeed they think it will rise next year as government stimulates the economy with more spending — which has the potential to keep interest rates higher for longer. And what about the bond market? At first there was relative calm, but since the scale of borrowing in the budget has become clearer, gilts were volatile this afternoon. Pantheon Macroeconomics said that it is the "scale of the extra spending" over the near-term which has caused the reversal for gilts. The verdict from markets, and where the public come down on whether or not a promise has been broken today, are the things to watch. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment