| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, Ray Dalio and Abu Dhabi's G42 shelve an investment venture, UAE stock markets close in on $1 trillion, and Dubai's luxury real estate boom. But first, let's look at the state of play on gambling in the UAE.

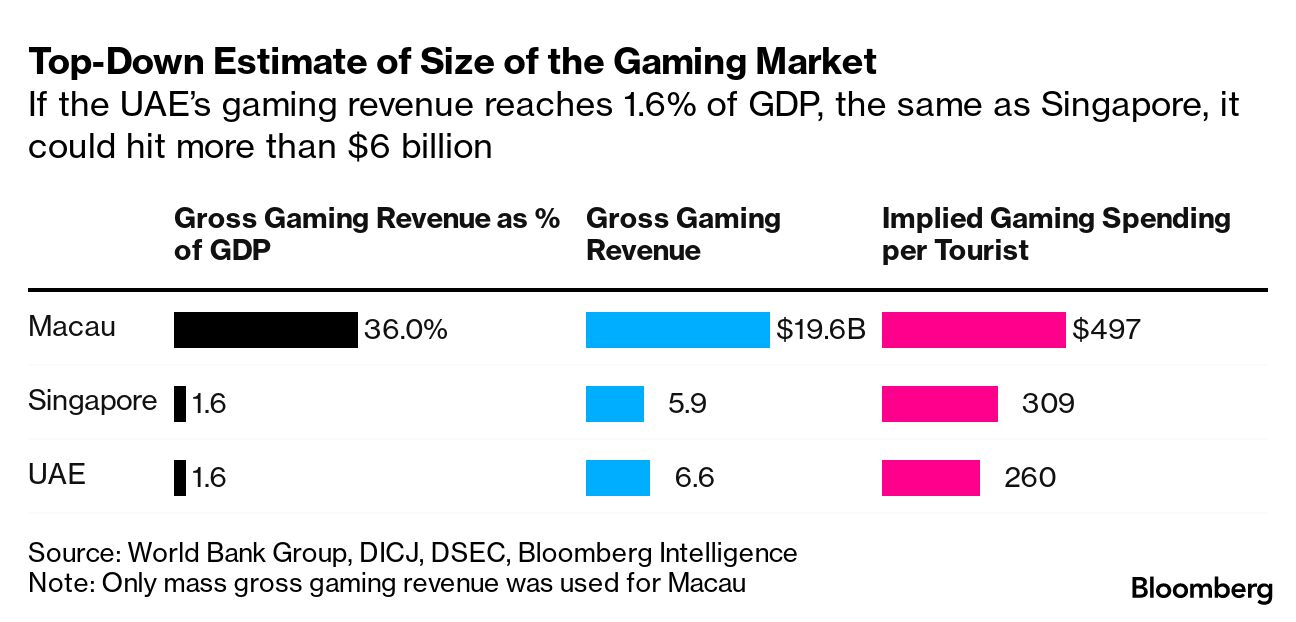

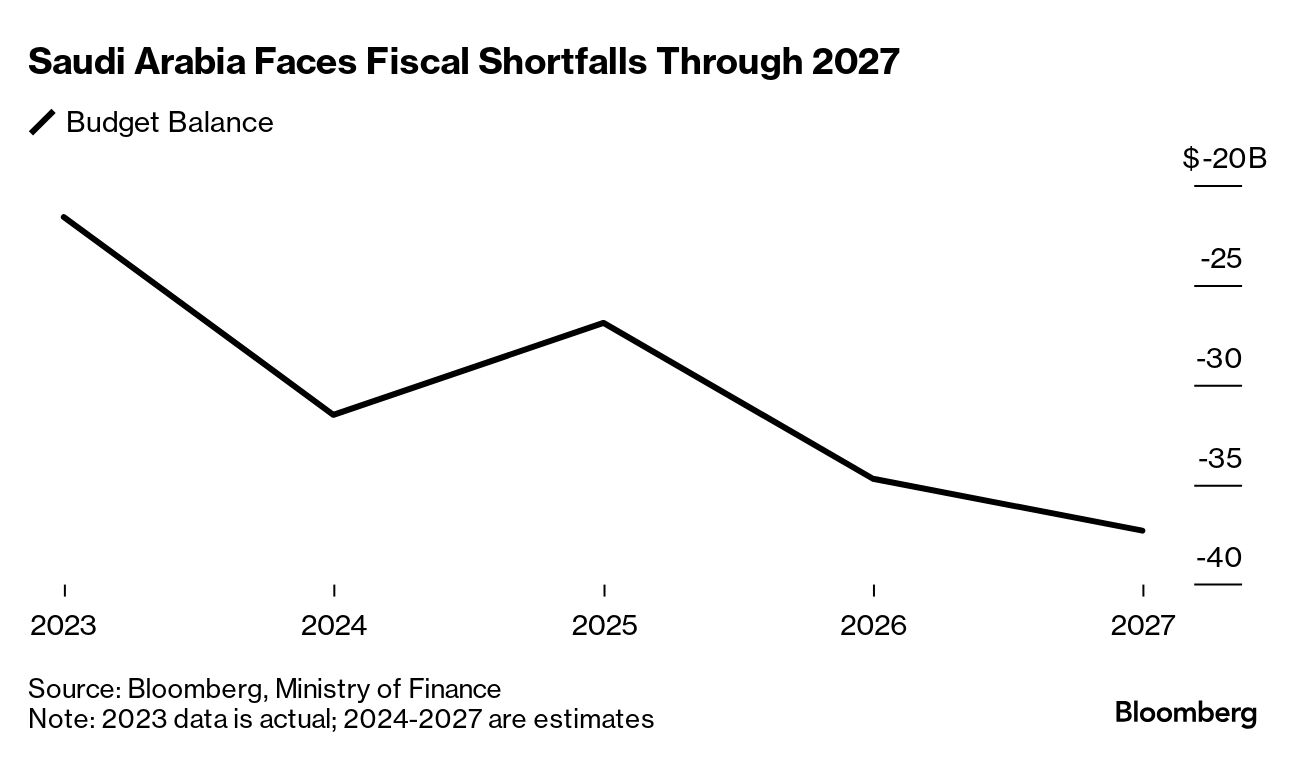

Ever since Las Vegas-based hotel and casino operator Wynn Resorts unveiled plans to set up a multibillion-dollar resort off the coast of the United Arab Emirates — complete with what the firm called a "gaming area" — speculation has swirled over when the Gulf country would legalize gambling. It's taken about three years, but late last week, Wynn was awarded the UAE's first commercial gaming operator license. That will come as a boost for the firm, which is building a $3.9 billion integrated resort in Ras Al Khaimah due to open in 2027.  Rendering of the interior of Wynn Al Marjan Island. Source: Hand-out/Wynn Resorts, Limited Legalizing gambling will be a step change for the UAE, where Sharia law is the main basis for legislation. In one indication of where things are heading, authorities last year established a federal body to regulate the industry. The move will likely come as a shot in the arm for the economy, drawing in more tourists and investment as well as potentially generating gaming revenue equivalent to 1.3% of UAE gross domestic product, according to Bloomberg Intelligence. At roughly $6.6 billion, that would surpass the figure for Singapore. My colleague Zainab Fattah earlier this year laid out the implications for Ras Al Khaimah. While the artificial Marjan islands off the emirate had spent most of the past decade as a lost opportunity, the area is now crawling with construction workers erecting five-star resorts, shops and $7 million villas. Meantime, Abu Dhabi is mapping out what it would look like to open a casino, with Yas Island — home to the Ferrari World and Warner Bros. theme parks, as well as the Yas Marina Formula One Circuit — and a plot near the city's port among the sites being considered, Bloomberg News has reported. MGM Resorts International is said to have applied for a gambling license in Abu Dhabi, and other firms are also weighing up plans. Genting, for instance, has said it is open to pursuing the development of integrated casino resorts in the UAE. Wynn, for its part, has invested $514 million so far in its UAE project, and is likely to reveal further details in a presentation to investors this week. Late last month, analysts at Morgan Stanley upgraded the stock due, in part, to what they said was an underappreciated opportunity in the UAE. Ray Dalio's family office and Sheikh Tahnoon bin Zayed Al Nahyan's artificial intelligence firm G42 have abandoned plans to set up an asset management venture in Abu Dhabi. Adnoc's $13 billion deal to buy German chemical-maker Covestro is its biggest move yet to weather the energy transition. Lumina Capital Advisers' Andrew Nichol spoke to my colleague Joumanna Bercetche on Horizons Middle East & Africa Monday about the outlook for M&A. Qatar Airways plans to buy a 25% stake in Virgin Australia, in a deal that'll give the Gulf carrier better access to a market where it was denied more flights last year. Gulf sovereign wealth funds are finding it easier to hire and retain personnel on the back of their prolific dealmaking. State Street is expanding its presence in the Middle East to tap the growing pools of wealth across family offices and hedge funds. Saudi Arabia slashed its economic growth forecasts and projected deeper budget deficits than previously estimated. An inflation surprise in Turkey has prompted some analysts to push back their expectations for an interest-rate cut. A Saudi billionaire's firm is resuming work on a tower that's set to be the world's tallest skyscraper. Meantime, the firm developing luxury resorts on the kingdom's Red Sea coast is planning to raise around $4 billion.  Kingdom Tower, Jeddah, Saudi Arabia. Photographer: laarow/iStockphoto OpenAI's Altman concentrates power on path to massive funding. Top Chinese chipmaker Semiconductor Manufacturing International led a $13 billion sector rally, after investors bet that Beijing will declare more support for an industry central to its geopolitical ambitions. Also Read: AI Can Only Do 5% of Jobs, Says MIT Economist Who Fears Crash A Goldman Sachs prodigy is finding it hard to make inroads at the top end of the hedge fund industry.  Edward Eisler in September 2015. Photographer: David M. Benett/Getty Images Europe Hedge funds that bet big on China scored returns of more than 25% in September after Beijing's stimulus blitz. On the flip side, quantitative hedge funds that short index futures faced margin calls.

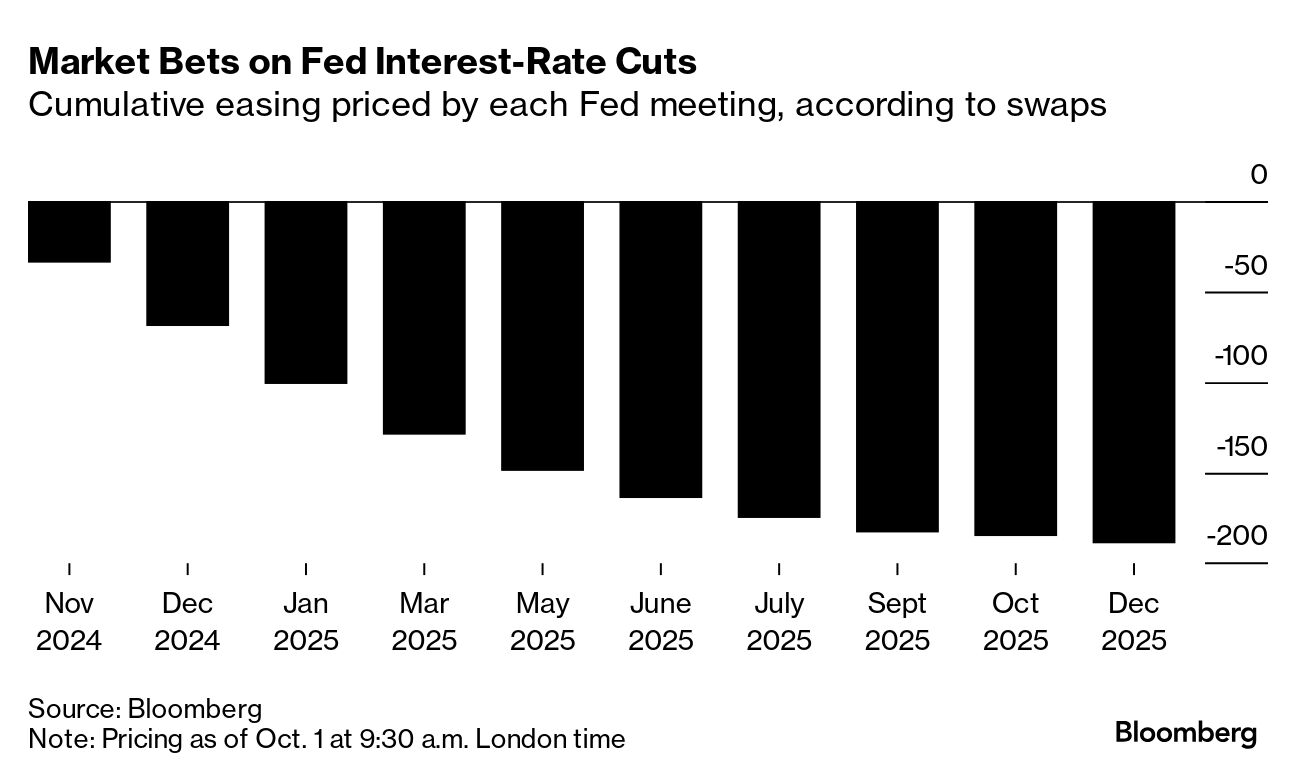

BlackRock CEO Larry Fink said the market is pricing too many interest-rate cuts from the Federal Reserve.

Lazard, the king of emerging-market debt, is being squeezed by China — and new rivals.

Hong Kong fire sales surge as distress ripples from luxury property to the fitness industry.

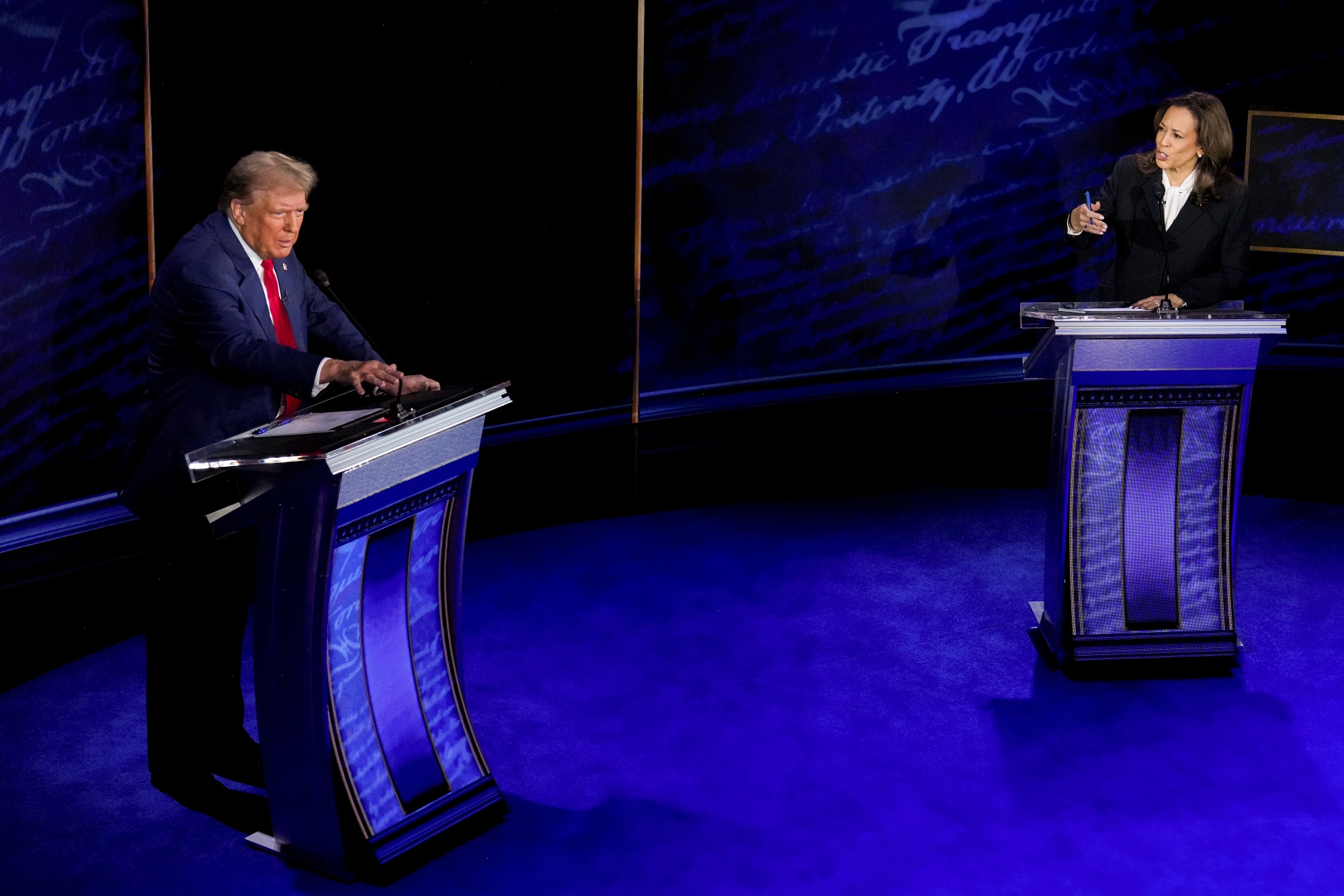

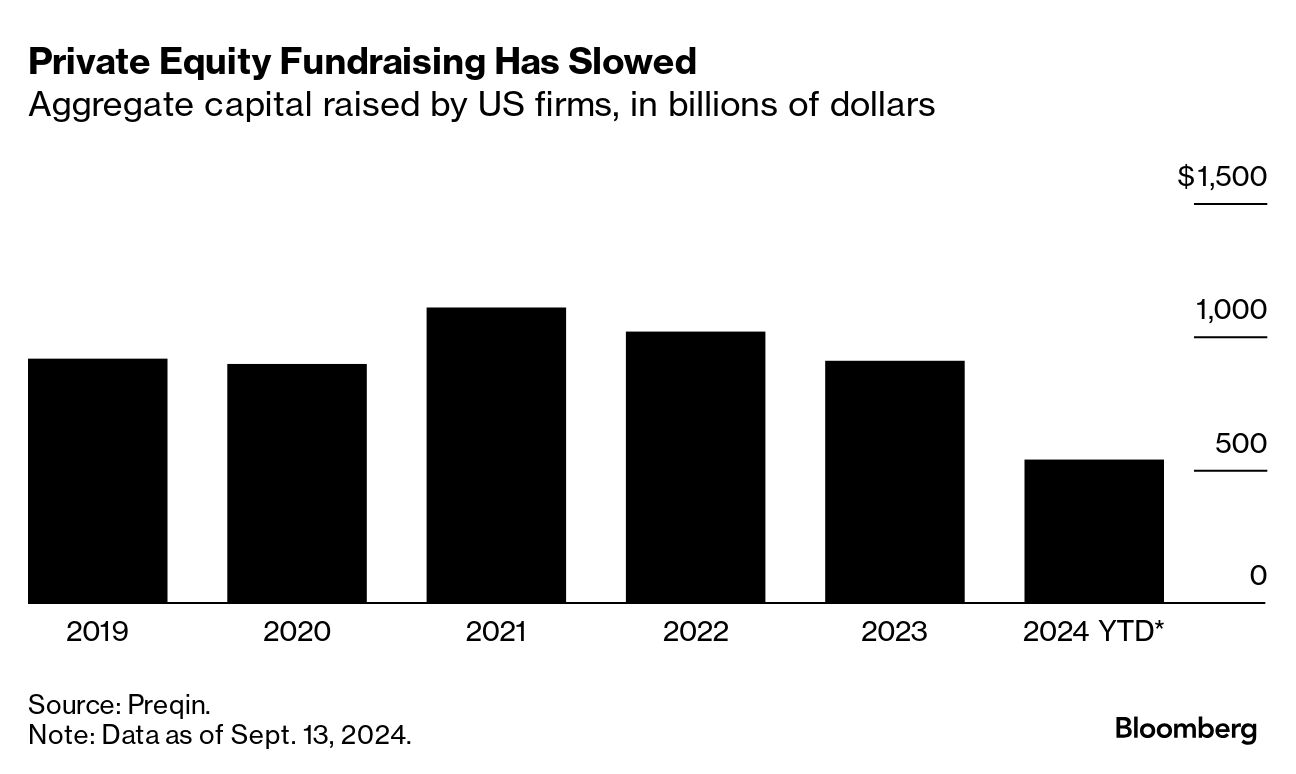

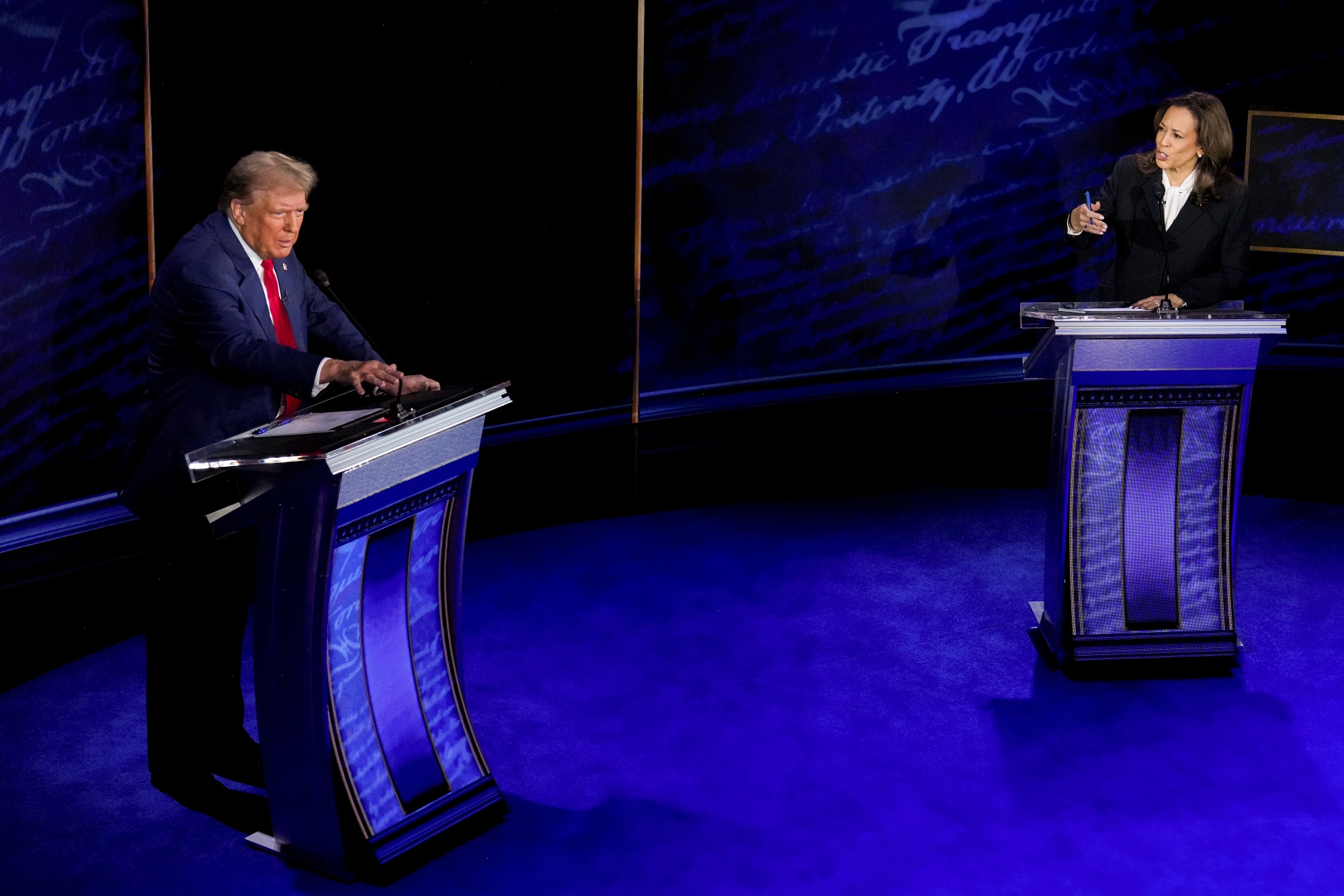

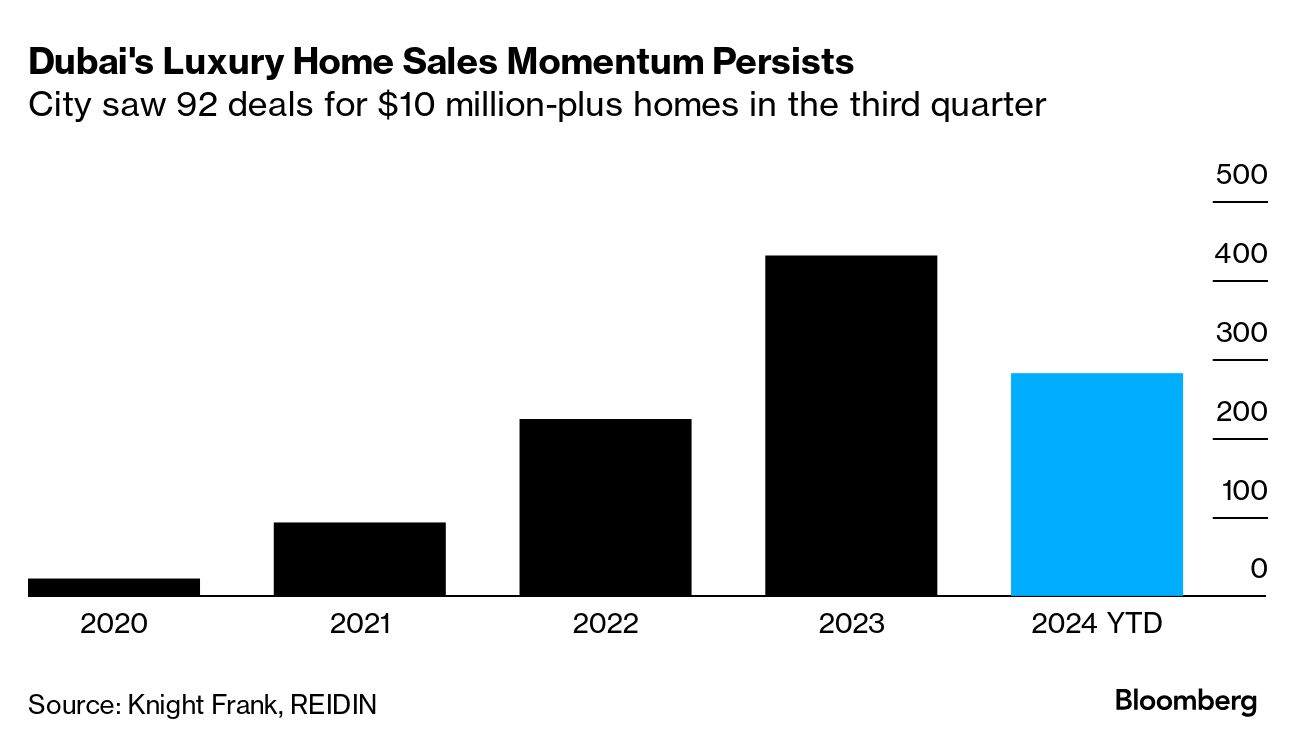

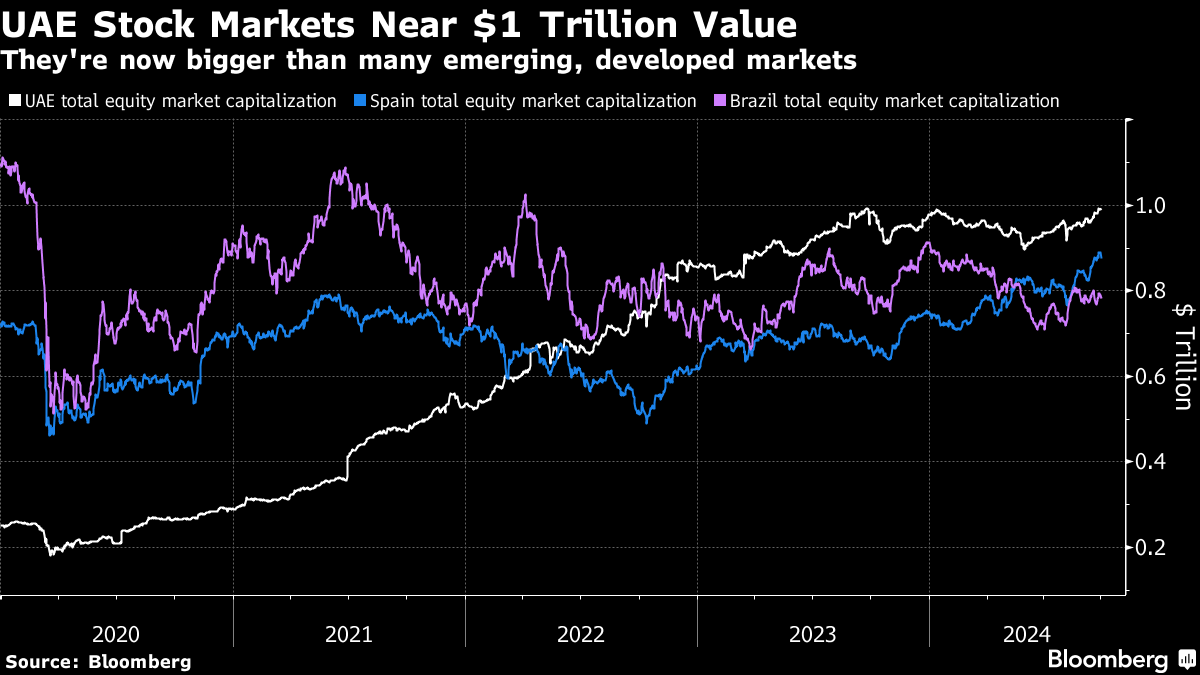

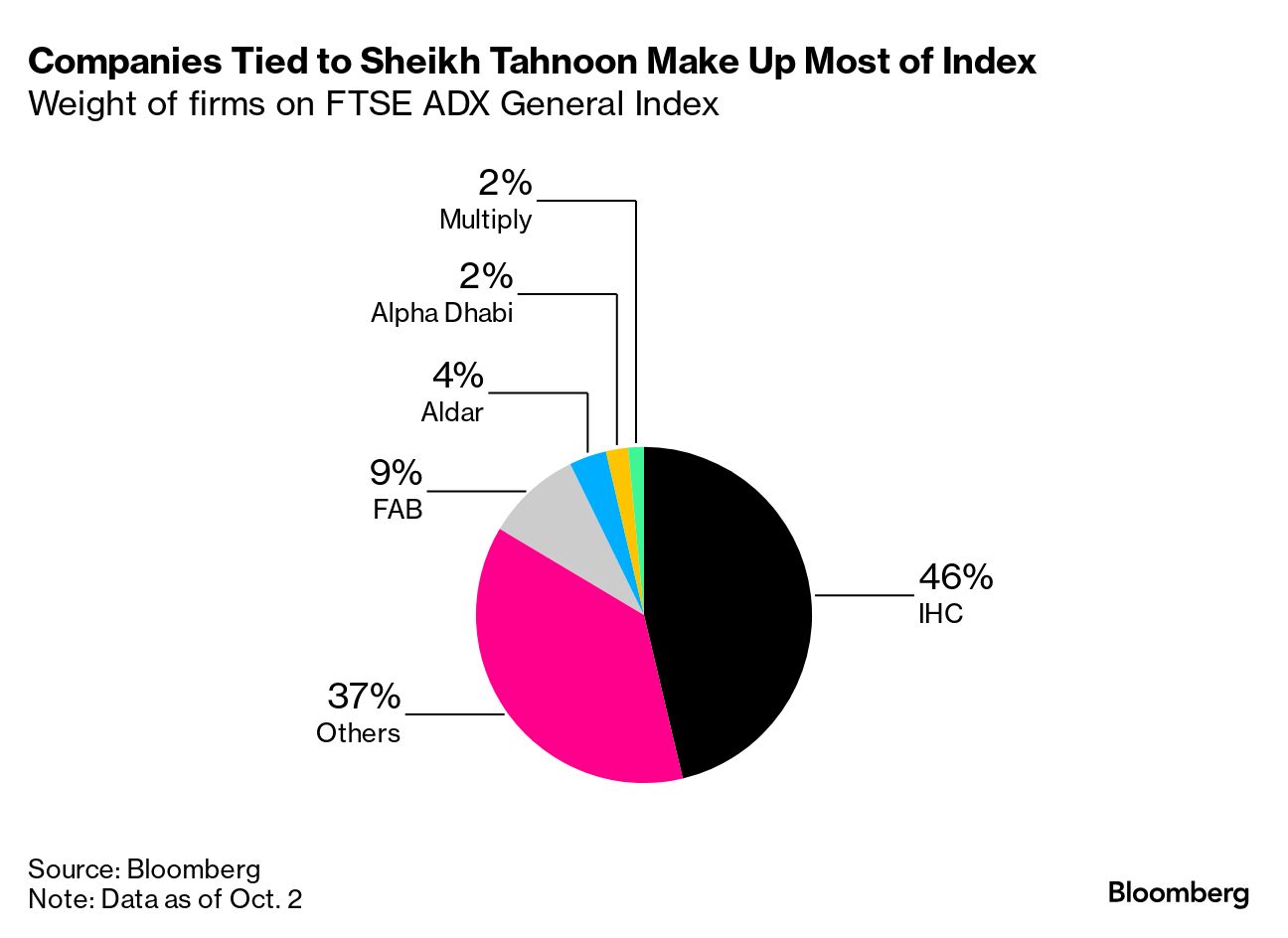

Private equity firms, once the rainmakers of Wall Street, have fallen on hard times. Here's why. What does the future hold for the US economy? Here's what a deep dive into Kamala Harris' and Donald Trump's policies tells us.  US Vice President Kamala Harris, right, and former US President Donald Trump during the second presidential debate. Photographer: Doug Mills/The New York Times Japan ignored climate critics and built a global natural gas empire. Apple is preparing to release a new iPhone SE model that gets rid of the home button. Dubai's luxury real estate boom is holding steady even as listings for high-end properties dwindle. There were 92 transactions for homes worth over $10 million between July and September, an 8.2% increase from the second quarter, according to real estate company Knight Frank. The sales price averaged $15.3 million. Year to date, there've been 282 luxury home sales compared to 277 in the same period in 2023. However, the number of listings for $10 million-plus home slumped to 1,622 between January and September, a 51.1% drop over the same period last year. The steep decline in the city's trophy inventory highlights the fast pace at which luxury units are being sold and not returning to the market, according to Knight Frank. That in turn reflects the 'buy-to-hold' and 'buy-to-live' mentality now prevalent in Dubai's luxury homes market, the report said. Related Coverage Stock markets in the United Arab Emirates are closing in on a milestone that was almost unthinkable some years ago. The combined value of the two bourses in the Gulf country — Abu Dhabi and Dubai — last week hit an all-time high of $994 billion. That's just a shade under the elusive $1 trillion mark. It's higher than the combined valuations of listed firms in developed markets like Madrid and Milan, and also tops many emerging market peers, except a few like China, India and the biggest Gulf bourse — Saudi Arabia. Since the end of October 2023, the two bourses have added about $70 billion despite regional conflict and weaker oil prices. In Abu Dhabi, that rally has been driven by a surge in valuations at firms linked to Sheikh Tahnoon bin Zayed Al Nahyan — one of the emirate's deputy rulers, the country's national security advisor, brother to its president and arguably one of the most important men in global finance. His $1.5 trillion empire includes conglomerate IHC that's rallied 43,000% over the past few years, as well as the wealth fund that controls the emirate's bourse. Firms linked to the sheikh have a weighting of at least 60% on the benchmark FTSE ADX General Index. Related Coverage Meantime, Dubai — which accounts for about a fifth of UAE firms' market capitalization — has had a solid run, with shares hitting a 10-year high last month. The city's economy has boomed in recent years and stocks tied to the resultant growth in population — Emirates NBD Bank, toll gate operator Salik and utility Dubai Electricity & Water Authority — have led the advance. Another factor that's led to the increase, of course, is a string of new share sales in the country. That's likely to continue, with deals including a potential offering of Abu Dhabi flag carrier Etihad Airways and a catering business. Meanwhile, hypermarket chain LuLu is preparing to list in what could be one of the year's biggest regional IPOs. To be sure, there are some notes of caution — mostly around macroeconomic concerns. HSBC strategists recently downgraded their overweight position on the UAE (and Saudi Arabia) to neutral. "Geopolitical risk is a near-term constraint, especially in combination with a fall in oil prices," they said. "Still, while hindered by geopolitical risk, the UAE ought to relatively insensitive to other sources of global macro risk," the firm said, pointing to factors including a strong non-oil economy, and a resilient property market. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment