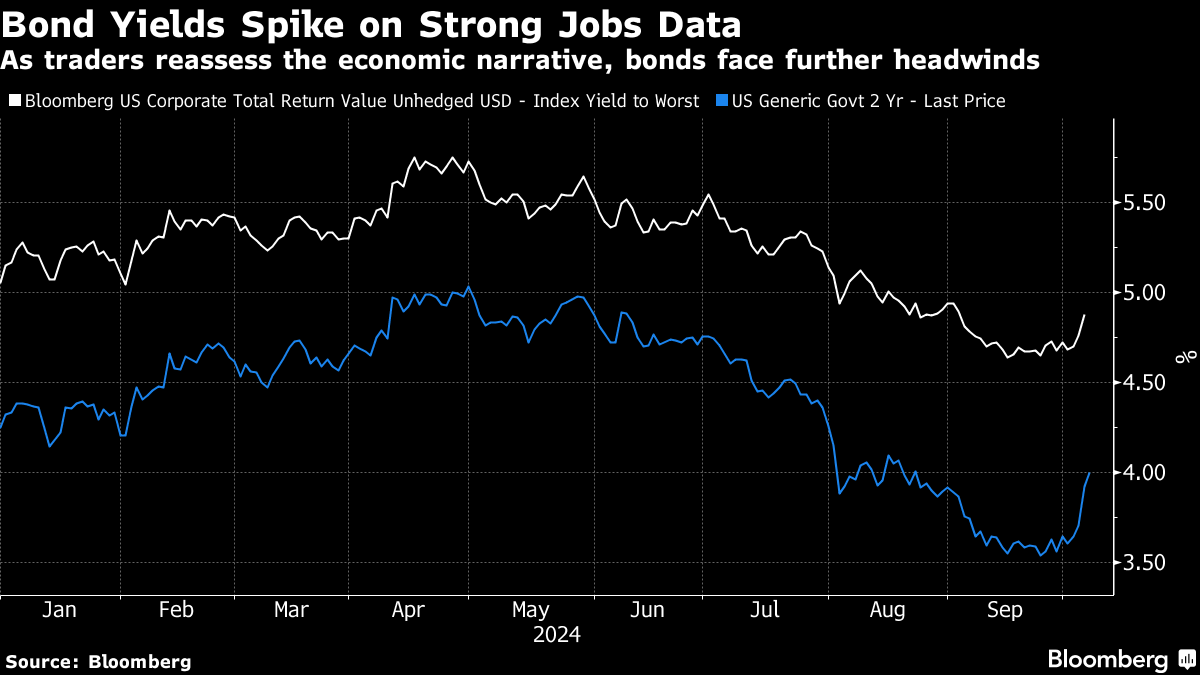

| Good morning. Tech megacaps drag stocks lower. US bond rout deepens. Brokerages in China gear up for a frantic Tuesday. Here's what's moving markets. —Isabelle Lee Five Things will publish its last edition this Friday, Oct. 11. To keep you up to speed, you will automatically begin receiving the new, more expansive subscriber-only Markets Daily newsletter starting Oct. 14. Not a Bloomberg.com subscriber yet? You'll get a complimentary trial of Markets Daily. A selloff in some of the world's largest tech firms dragged down US stocks, extending a slide that was also driven by geopolitical angst and bets that the Federal Reserve will opt for a smaller rate cut next month. With the exception of energy, every major sector in the S&P 500 fell. Brent crude jumped above $80 a barrel amid mounting tensions in the Middle East. In the wake of Friday's solid jobs data, Treasuries continued to drop — with the 10-year yield topping 4%. Wall Street's favored volatility gauge — the VIX — jumped to a two-month high. US bonds tumbled, deepening a rout triggered by strong labor-market data. The declines pushed key yields above 4% as investors abandoned their bullish bets on Treasuries. For the first time since Aug. 1, money markets imply fewer than 50 basis points of rate cuts through the end of the year. Traders now see just an 80% chance that the Fed cut rates by even 25 basis points in November. "The discussion is shifting into whether there's going to be a cut at all," said Jan Nevruzi of TD Securities. Alphabet must lift restrictions which prevent developers from setting up rival marketplaces that compete with its Google Play Store, a court has ruled. A federal judge in San Francisco handed a big victory to Epic Games in its long-running antitrust challenge to the technology giant's app store, which brought in $14.66 billion in revenue in 2020. The ruling comes after Epic, the maker of the popular video game Fortnite, convinced a jury that Google abused its power in the Android app market with its policies. Alphabet shares fell as much as 2.5% in New York. Gold's breathtaking surge this year to repeated record highs hasn't stopped bullion from flying off shelves at Costco stores across the US. Its one-stop shopping convenience is bringing gold buying to the masses by offering prices that undercut traditional precious metals dealers and extra rewards for its most loyal customers. Add to that gold's appeal as a haven and hedge against inflation, and it's easy to see why bullion buyers are turning to the warehouse retailer. Spot gold has jumped nearly 30% this year. Brokerages and stock exchanges in China are gearing up for a frantic Tuesday, when onshore markets reopen after a week-long holiday, with optimism running high that Beijing's stimulus measures will give shares another leg up. If the performance of Chinese shares listed in Hong Kong is anything to go by, markets on the mainland are likely to reopen with a bang on Tuesday. Here's what caught our eye over the past 24 hours: - Maldives pivots back toward India to ease China debt squeeze

- Hedge funds bought yen right before biggest drop in 15 years

- Ex-Goldman CFO returns to Wall Street atop $55 billion Pretium

- Tax-busting tactic loved by tech millionaires is coming to ETFs

- Workday billionaire ' bored silly' of retiring chases another IPO

- Tunisia president wins reelection amid weak turnout

- Southeast Asia scammers stole up to $37 billion in 2023: UN

Blue-chip bonds emerged as a favorite over stocks as the Fed started to cut interest rates, the latest MLIV Pulse survey shows. As a strong jobs report left traders bracing for a "no landing," signs point to this easing cycle being different than previous ones. Yes, yields are still attractive in the $7 trillion US investment-grade bond market. However, duration, which reflects a bond's sensitivity to changes in interest rates, just flipped to a headwind from a tailwind as the resilient labor market continues to roil bond markets. Market pricing for remaining Fed interest-rate cuts this year has been shredded since Friday's strong US payroll numbers. And the repercussions are still reverberating among markets, with Treasury yields higher across the curve. Corporate bonds saw their worst weekly returns since April last week and may face more losses as yields continue to correct for a less dovish narrative. Blue-chip bonds are poised to outperform in the scenario where the economy slows and the Fed reduces rates more aggressively — as they've done historically — but we're likely not there yet. In such a scenario, risk assets continue to do well. Tatiana Darie writes for Bloomberg's Markets Live blog in New York. Follow her on X at @tatianadariee. |

No comments:

Post a Comment