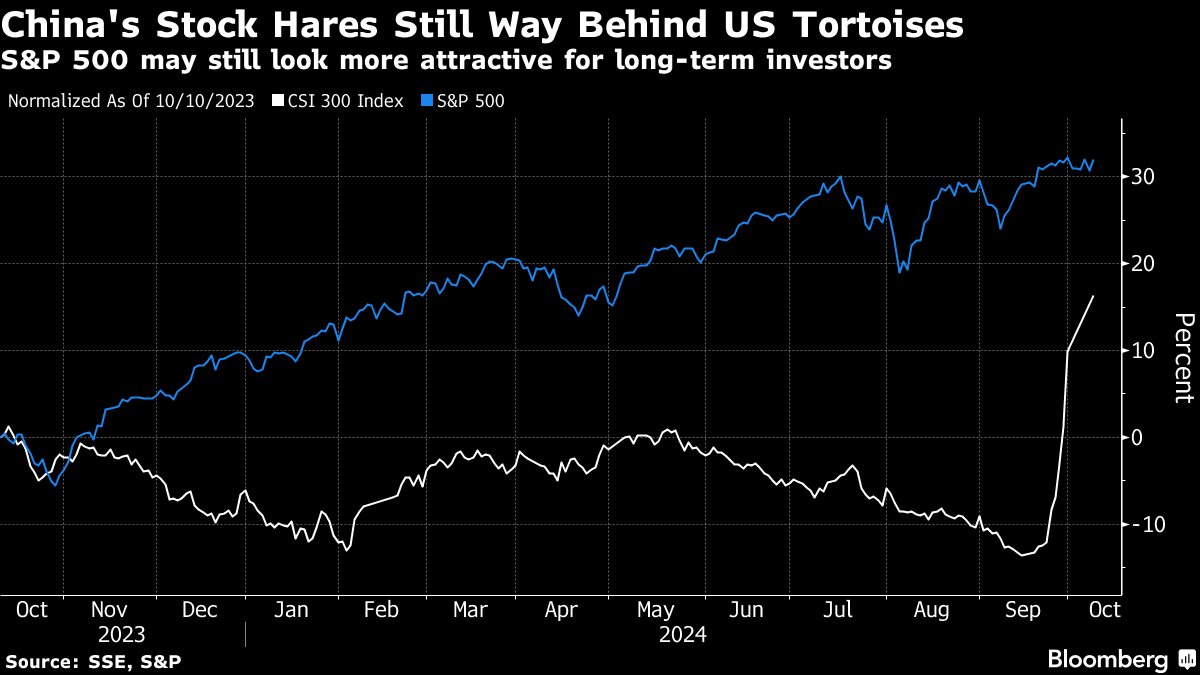

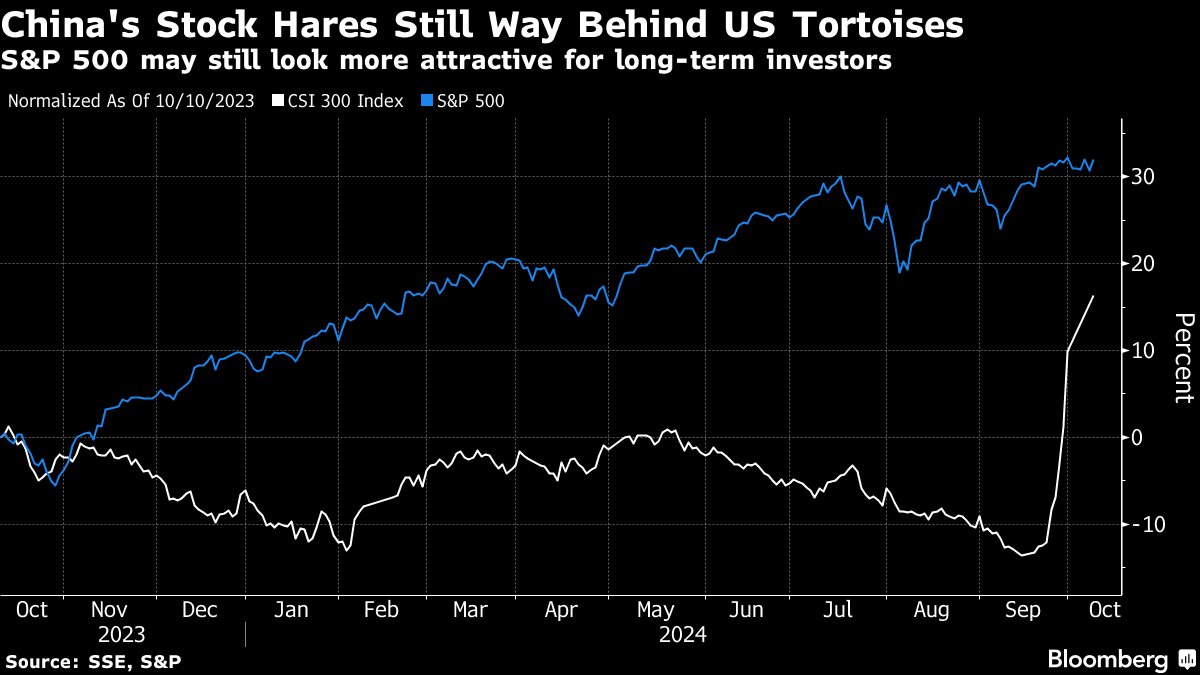

| The strong rebound on Tuesday for US shares reminds investors of one of the key headwinds for Chinese peers as they strive to build on the impressive policy-inspired surge since late September. Even after the rally, the Asian nation's benchmark is lagging well behind its counterpart stateside, and longer-term investors may wonder if the coming year is really going to change that picture. The US economy continues to blow away concerns that high interest rates are sending it toward recession, with the latest reading for the Atlanta Fed's GDP Nowcast gauge jumping to 3.2%. With earnings forecasts looking potentially too weak relative to the underlying fundamentals, and central bank officials making it clear that economic resilience won't stop them from pursuing gradual rate cuts, the bull case for US stocks remains strong, and relatively stable. The left-tail risks -- US election shocks and a revival of inflation if the Fed proves too dovish -- are concerning, but it would take a lot to derail the equity rally unless those lead to an actual recession.  China meantime still faces some fairly dire economic fundamentals, especially with the authorities already showing signs of resting on their laurels after the initial stimulus announcement in late September set off a surge of more than 30% in the CSI 300. There's something of an air of "mission accomplished" now that stocks are back above water for 2024 and with economists talking of the potential that China will meet its seemingly all-important 5% growth target for 2024. Yes, that's stronger growth than the US, but emerging markets like China need to go on outpacing more mature economies. Tuesday's palpable disappointment at the lack of further major stimulus doesn't mean mainland equities are about to come crashing back down, but investors face fresh concerns about the sustainability of China rallies. While the rebound may have been impressive, it is far from certain that investors sitting on these large gains in China are the strong hands. While the rebound may have been impressive, I am less sure of the idea that investors sitting on large gains in China are the strong hands. The temptation would be there to book at least some of those profits and look for other investments that offer a more stable outlook for advancement from here. Wednesday's volatile slide in Chinese assets will also be reinforcing the potential for such moves. Garfield Reynolds leads Bloomberg's Markets Live blog in Asia and is based in Sydney. |

No comments:

Post a Comment