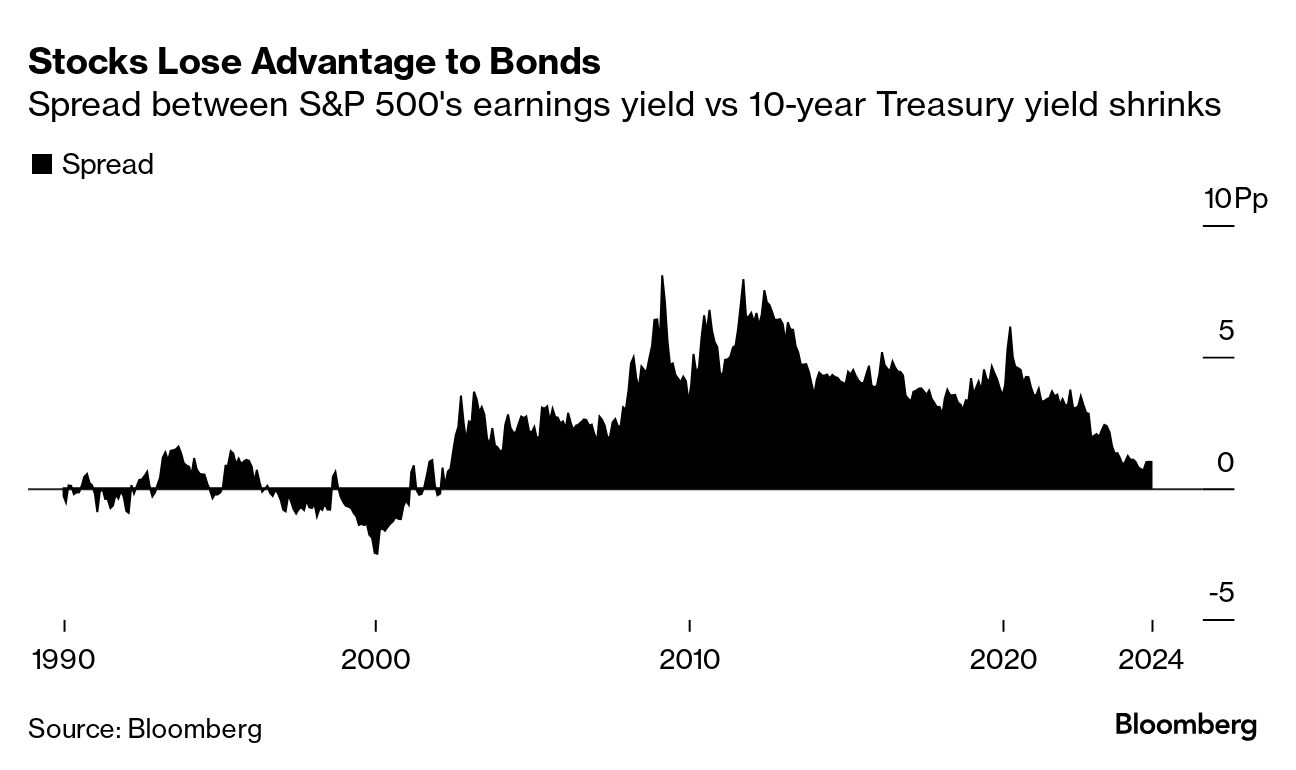

| It's fair to assume the S&P 500 will hold onto most of its gains into year-end. Corrections are always possible, particularly with poor seasonals and election volatility coming up. But there hasn't been a bear market without an accompanying profit or economic recession since at least 1998 — and none seems to be on the horizon now. Bullish reasons for stocks outnumber bearish ones. Those include: ample global liquidity and Federal Reserve support; invincible consumers, and corporate earnings that are set for solid growth in 2024. Still, I'm not turning into a raging bull. To balance out the many positives, one big negative is that stocks are expensive. At a multiple of nearly 22 times price to estimated earnings, the S&P 500 is trading at a record premium to the rest of the world — and a big one versus its own historic norms. Its earnings yield versus bonds is also unappealing. That said, previous periods of exuberance like the dot-com era show that valuations can stretch for a long time before they start bothering investors. For now, while it's premature to declare the all-clear on the economic front, the case for selling has greatly diminished. Tatiana Darie writes for Bloomberg's Markets Live blog in New York. This section is a condensed excerpt from her Macro View column. Follow her on X at @tatianadariee. |

No comments:

Post a Comment