| Your financial playing field just shifted. For the first time in four years, the Federal Reserve reduced interest rates, announcing a jumbo cut of 50 basis points. It's the sort of move usually deployed in a crisis, but the American economy remains strong. Inflation is trending down. Markets are up. What does this mean for you? After Wednesday's cut, I dropped a line to financial advisers across the US asking them that very question. Markets love cuts. Almost every major group in the S&P 500 gained as of noon in New York on Thursday and the index touched a new all-time high. The tech-heavy Nasdaq 100 climbed alongside the Russell 2000's small caps. Bitcoin jumped, too. Meanwhile, Britain's central bank on Wednesday decided against making its second rate cut of the year and the Bank of Japan will announce its decision Friday. The effects of the decision are likely to continue echoing across Wall Street. For those watching from Main Street, here's what to know as we enter a new, lower-rate era: How Cuts Might Help You First, the good news. Lower interest rates are likely to give anyone with debt a little more breathing room. "For the average American, this reduction can lead to lower borrowing costs, making mortgages more affordable and providing opportunities for refinancing existing loans," said Charlie Rocco, managing partner at MONECO Advisors in Fairfield, Connecticut. I spelled out some of the ways your debt situation may benefit in a lower-rate world, and you can read all about those upsides here. Your credit score may become even more important than it usually is, especially if you're thinking of using lower rates to make a big purchase like a house or car. My colleague spells out ways to give your score a boost here. (Quick hints: pay your loans on time, don't be afraid of using your credit, and do not cancel old cards.) John Power of Power Plans in Walpole, Massachusetts, points out that lower rates reduce the costs of doing business, which should help corporate profits. "Stocks will probably go up as the cost of financing goes down," he said, also writing that lower rates mean older bonds will gain in value. How Cuts Might Hurt You Lower interest rates aren't all roses and butterflies. "Probably the least appealing part of rate cuts for consumers is that high-yield savings accounts, CDs, and money-market funds won't be as attractive anymore," says Melissa Caro, founder of My Retirement Network in New York. "These have been a great way to keep your cash accessible while still earning a decent return over the last couple of years, but with rates dropping, the yields on these products will follow." Speaking of yields: Georgia Lord, head of financial planning at Corbett Road Wealth Management in McLean, Virginia, says Americans should be mindful that as rates fall, new bonds issued will offer lower yields than they previously did. "This could affect the average American who is looking to retire soon, as they rely on bond income for stability," she says. "For individuals nearing retirement or relying on fixed income, strategies like bond ladders or adjusting portfolios to include dividend-paying stocks may help mitigate the impact of rate cuts." And there is a broader point to be made: the Fed's dual mandate forces it to balance price stability with the pursuit of maximum employment. Signs of the former were abundant before the cut. Lower rates, then, may be needed to keep the labor market strong and steer the economy away from recession. "The size of the cut suggests the Fed is taking a defensive stance, signaling potential economic challenges," says Alyson Basso, managing principal at Hayden Wealth Management in Middleton, Massachusetts. "The Fed's proactive approach indicates they are aware of possible slowdowns and are acting to prevent a more significant downturn." My take from all this? Enjoy those lower borrowing costs. But use any extra wiggle room you have to make sure your emergency fund is strong. — Charlie Wells Interest rates can get a little theoretical. So this week, I called Anora Gaudiano, vice president and financial adviser at Wealthspire in New York City, to talk about rates and debt. My big question for her: What is the best thing people behind on their bills can do now that interest rates are moving lower? What she said: The best thing Americans can do to catch up on their bills now that interest rates are heading down is reduce their discretionary or non-essential spending and if possible, start saving. In fact, people who are behind on their bills should do this regardless of whether interest rates are going up or coming down. The fact that interest rates are heading down is not some kind of magic bullet. The best way to deal with your debt is by paying it, especially for those who are behind on credit-card bills. Being behind on credit-card bills most likely means that people are paying double-digit rates. If your rate is over 20%, what does a half a percentage point or quarter-percentage point decline in interest rates do to you? Nothing, really. Your best bet is to keep paying down the debt. For some people, consolidation might be a good option, but the devil is in the details. Taking out a home-equity line of credit to pay off a credit card may be helpful if you're disciplined and worked out a payment plan that does not involve borrowing more from credit cards and additional spending. Consolidating credit card debt with the help of a HELOC and then borrowing more from the credit cards will make one's debt problems even worse. As far as other kinds of debt, mortgage rates have been falling and that could be good news for people who have been waiting to buy homes. Wealthier investors may see changes in their portfolios. But just remember that while what the Fed does will impact us, you're not going to go to the grocery store and all of a sudden see prices plummet.

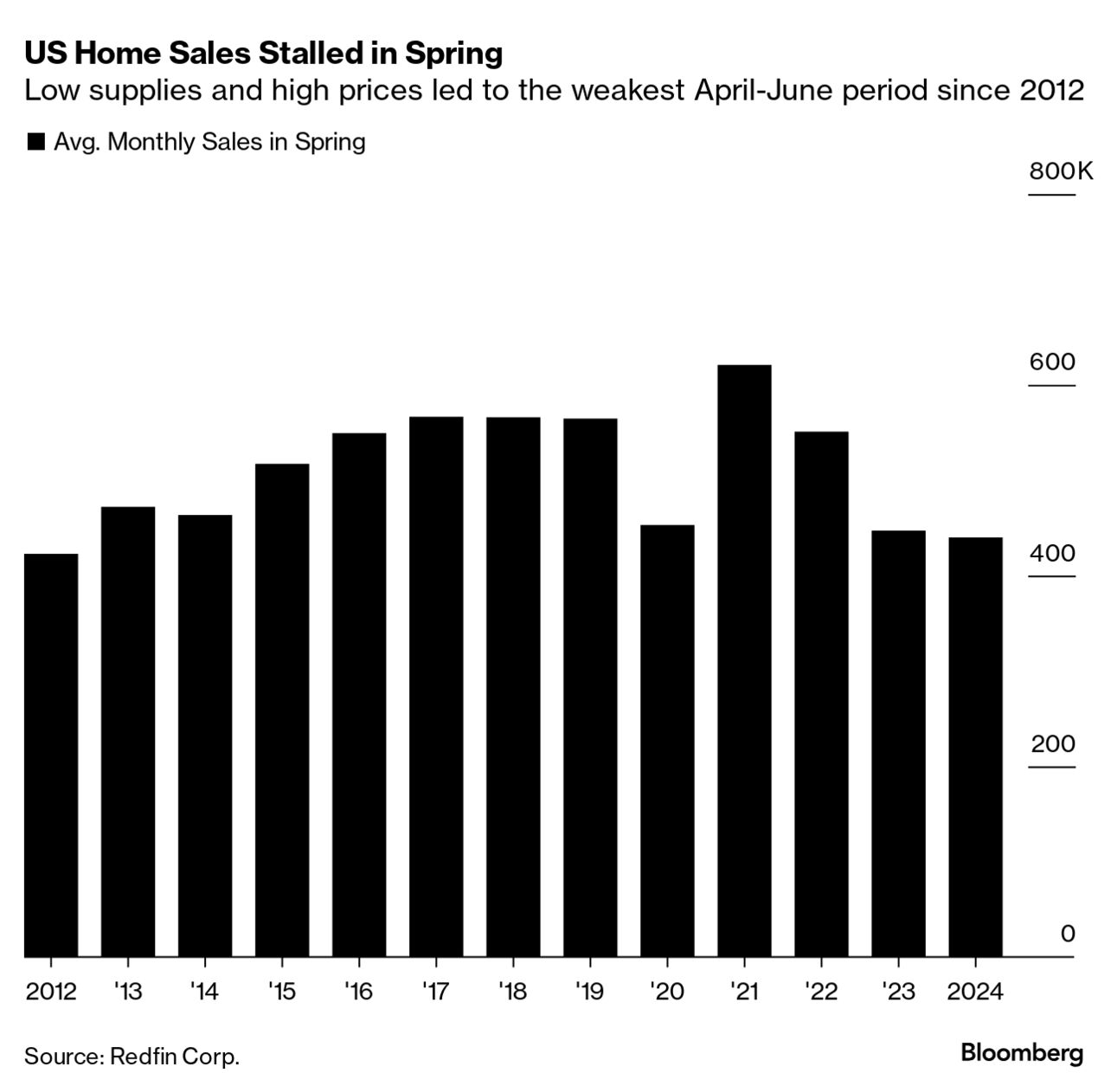

Send questions about your own financial decisions to bbgwealth@bloomberg.net AI stocks: I know, I know. You've been hearing AI hype all year long and may think it's all a bit much. The stocks have taken a beating recently. But traders at Goldman Sachs think this may be an opportunity. "There's too much AI pessimism," Faris Mourad, vice president of Goldman's US custom baskets team, wrote in a recent note. The bank's trading team thinks it's time to buy the dip in AI stocks. Gold: The precious metal set a record this week after the Fed decision. Surges like this are common for haven assets after rate cuts. "It's almost a no-brainer predicting where gold goes from here," Bloomberg Opinion columnist John Authers says. (Hint: Think up.) The biggest gainers and losers on the Bloomberg Billionaires Index over the past week as of Wednesday: Biggest Gains: Mark Zuckerberg was the biggest gainer in dollar terms, adding $9 billion to his net worth, on a boost in Meta's share price. In percentage terms, Richard Cohen and his family clocked an 18% gain, bringing their net worth to almost $15 billion. Cohen is the owner of C&S Wholesale Grocers, the largest wholesale grocer in the US. Cohen also owns a stake in Symbotic, a publicly traded robotics company that automates warehouses whose shares rose this week. Biggest Losses: Nvidia CEO Jensen Huang lost almost $3 billion, taking his net worth down to around $103 billion as shares in the firm slumped. Prajogo Pangestu, founder and chairman of Barito Pacific, the largest petrochemical company in Indonesia, suffered a 7% loss, taking his net worth down to $37 billion. Can Rate Cuts Put Some 'Spring' Back in the Property Market's Step? The data are in, and it's official: The US just had its worst spring selling season since 2012, according to data from Redfin. Spring is the key season for the housing market, when warmer weather draws out more buyers and sellers. This year there was a shortage of both. Many renters are priced out of homeownership and owners who might like to move have held off from listing in order to hang on to rates secured when borrowing costs were cheaper. Experts say lower rates could unlock the market. But it depends on why rates are going down. If it's because the economy is slowing, consumer confidence may weaken, dampening the market instead. As of August, the market remained rather sluggish. Sales of existing US homes fell to a 10-month low during the month preceding the Fed's cut, according to figures released Thursday from the National Association of Realtors. North of the Border, Justin Trudeau Is Wooing Young Home Buyers The Canadian government will make 30-year mortgages available to all first-time buyers and to buyers of newly built homes as the embattled leader tries to win back the approval of younger Canadians. The country cracked down on lengthy mortgage amortizations during the 2008 global financial crisis. Until this year, buyers who required government-backed default insurance on their mortgages were limited to 25-year amortizations. They're Rich. But Don't Worry: They're Still Renting. One is a millionaire founder of a fintech startup. Another is a biotech executive. This story in the Wall Street Journal explains why the rich are still renting and how the industry is looking to capitalize on this trend. This week, we're looking to speak with retail traders who are changing their investment strategies in light of expected market volatility going into the end of the year. Are you making any new moves due to interest rate cuts? The upcoming US election? We'd love to hear from you if so. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net or fill out this form. Trending stories from across Bloomberg Wealth: Humanity has always relied on technology to drive growth. With the emergence of artificial intelligence, society is being asked to trust tech with economies, media and health like never before. Join visionaries, investors and business leaders in London on Oct. 22 to discuss the risks and rewards of this new age. Speakers include Monzo CEO TS Anil, Cohere Co-Founder and CEO Aidan Gomez, ŌURA CEO Tom Hale and ASML President & CEO Christophe Fouquet. Buy tickets today. |

No comments:

Post a Comment