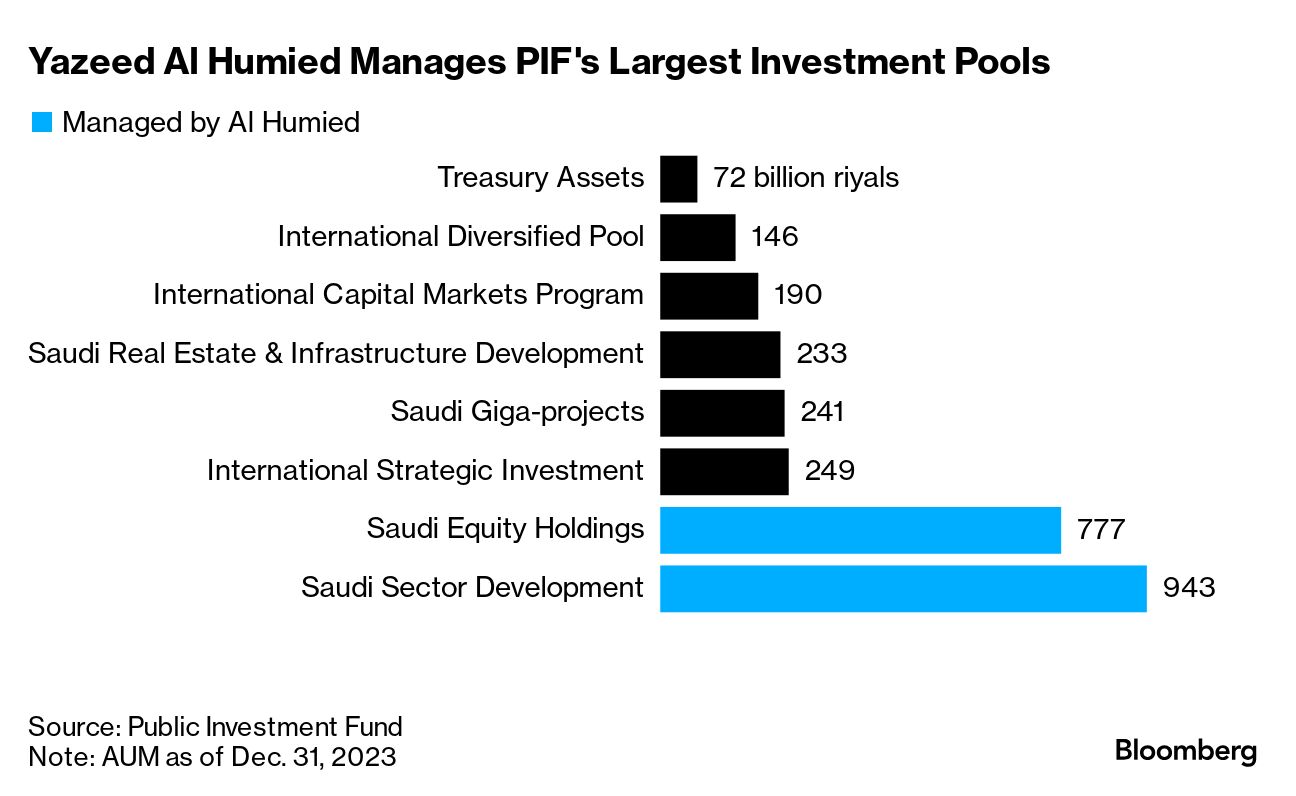

| Welcome to the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here. This week, Abu Dhabi's AI partnerships, Dubai-based firms attract overseas interest and what does the Fed's rate cut mean for Gulf wealth funds? But first, meet the Middle East's most influential power brokers. Starting with Yazeed Al Humied, the Public Investment Fund deputy governor who is emerging as one of the most important executives in global finance. Al Humied runs the Saudi wealth fund's Middle East and North Africa unit — long regarded as the less glamorous arm. But the $925 billion fund's growing domestic focus means that he is now being courted by global firms like BlackRock who're looking to do deals in the kingdom. If you haven't already, do check out the behind-the-scenes account on Al Humied's rise by my colleagues Matthew Martin, Dinesh Nair, Nicolas Parasie and Zainab Fattah. Bloomberg has previously profiled the powerful figures that control regional wealth funds, the biggest of which in Abu Dhabi, Saudi Arabia and Qatar oversee $3 trillion in assets. For instance, Sheikh Tahnoon bin Zayed Al Nahyan, who runs a $1.5 trillion empire that includes the biggest Middle Eastern state-backed investor. Or his brother, Sheikh Mansour bin Zayed Al Nahyan — who owns Manchester City Football Club and is chairman of the $302 billion Mubadala, which counts Khaldoon Al Mubarak as its chief executive officer. In neighboring Qatar, Mansoor Ebrahim Al Mahmoud oversees the $510 billion Qatar Investment Authority, one of the biggest sovereign investors in Europe. And in Riyadh, of course, Yasir Al Rumayyan is governor of the PIF — the main driver behind the kingdom's trillion-dollar Vision 2030 transformation plan. Since these investing giants have become key players in global dealmaking over the years, the men atop them are well known — and hard to get to. And so, increasingly, global investors are seeking out the next rung to build traction for their plans. BlackRock, for instance, has been intensifying efforts to expand in Saudi Arabia. The world's largest asset manager has committed to build a Riyadh-based investments team as part of an agreement shepherded by a team led by Al Humied.  Yazeed Al Humied, from right, Yasir Al Rumayyan and Larry Fink, as BlackRock signs an agreement with PIF in Riyadh on April 30. Source: PIF For foreign deals, firms turn to another one of Al Rumayyan's two deputies — Turqi Al Nowaiser, who oversees international investments, and led the way on the fund's acquisition of the luxury Rocco Forte chain of 14 European resorts. Over in Abu Dhabi, my colleague Ben Bartenstein wrote earlier this year about Sheikh Tahnoon's inner circle, a group that includes Peng Xiao, CEO of G42. The artificial intelligence firm is at the heart of the emirate's push into the space, with plans to potentially back an ambitious plan by OpenAI Chief Executive Officer Sam Altman. It also lined up a $1.5 billion investment from Microsoft earlier this year. Also Read: Abu Dhabi Targets $100 Billion AUM for AI Investment Firm Saudi Arabia, too, has aspirations in that space. Riyadh's push is being led by Alat, a $100 billion technology investor — set by Al Humied's group. Israel stepped up air strikes against Hezbollah in southern Lebanon, as hostilities between the two sides intensified.  An Israeli airstrike in Marjayoun, near the Lebanon-Israel border, on Sept. 23. Photographer: Rabih Daher/AFP/Getty Images The UAE's top AI firm is teaming up with Nvidia to create a climate technology lab. The Abu Dhabi-based G42 is also deepening its partnership with Microsoft. Also Read: Microsoft AI Needs So Much Power It's Tapping Site of US Nuclear Meltdown Dubai-based financial firms are attracting overseas interest. Boutique advisory firm deNovo Partners, founded by May Nasrallah, was acquired by Paul Taubman's investment bank. Meantime, alternative investment manager Gateway Partners sold a minority stake to Japan's SBI Holdings and a former Federal Reserve official. Lazard became the latest Wall Street firm to comply with Saudi Arabia's rules for foreign firms to set up their Middle Eastern headquarters in the kingdom. Saudi Arabia aims to gain control of Bahrain's aluminum smelter as part of the plan for mining and metals to become a "third pillar" of its economy. Former WeWork CEO Adam Neumann is expanding his new residential real estate company globally for the first time with new projects in Saudi Arabia.  The Flow buildings in Riyadh will have both furnished and non-furnished units. Photographer: Flow Also Read: PGA Tour's Saudi Deal Drags On With Players Arguing Over Pay Two Saudi firms are set to launch exchange traded funds tracking Hong Kong shares that are expected to raise close to $1 billion. Hong Kong is zeroing in on rich Middle Eastern investors as it looks for new pools of capital. Meanwhile, Singapore Exchange is looking to expand into Dubai. Egypt's divestment program is picking up pace. The North African nation will sell a stake in state-owned United Bank via an initial public offering. It's also in advanced talks to sell its remaining 20% stake in Alex Bank. Gulf investors are getting more choosy after a deluge of deals, according to the region's top-ranked bank for equity offerings. Abu Dhabi's Masdar is nearing an acquisition of a Spanish renewable energy firm from Brookfield. A shadow network stretching from Dubai to China is involved in a multi-billion dollar effort to ship sanctioned gas from Russia. Billionaire Steve Cohen has stopped trading for Point72 Asset Management, marking the end of an era.  Steve Cohen Photographer: Simon Dawson

JPMorgan and Bank of America are rolling out measures that may ease junior employees' workloads. Meanwhile, Lazard CEO said many young Wall Street bankers are hungry for interesting work and willing to put in long hours.

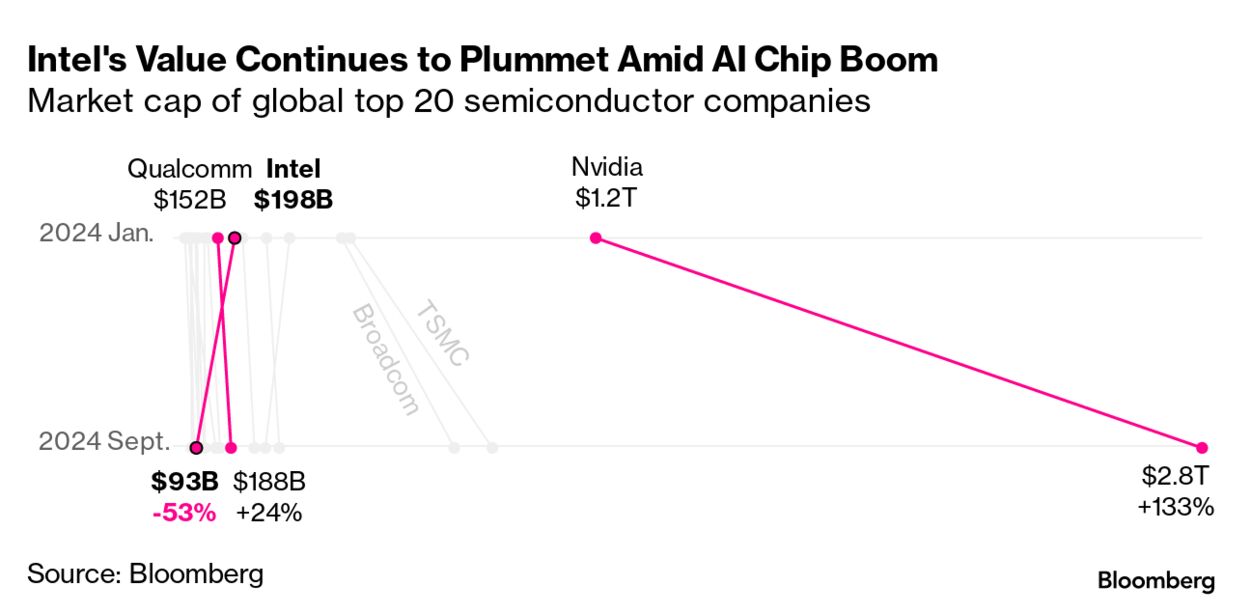

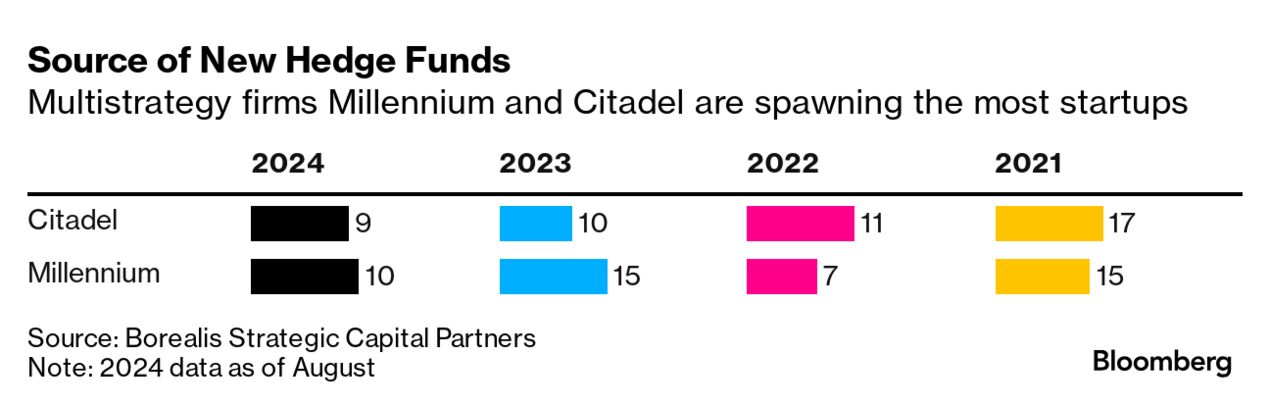

BlackRock is overhauling its private credit business as it races to catch up to competitors in the booming market. Apollo Global has offered to make a multibillion-dollar investment in Intel. The development came after Qualcomm floated a friendly takeover of the struggling chipmaker. Kamala Harris continues to build momentum against Donald Trump as early voting gets underway in several US states. But what would a Harris presidency mean for Wall Street, the economy and the world?  US Vice President Kamala Harris waves during a campaign event in Wisconsin. Photographer: Alex Wroblewski/Bloomberg China created a new class of white-collar workers in record time. Now, just as swiftly, many of their dreams are being crushed. Wizz Air tells long-haul passengers that nothing comes for free. Stanford took the top spot in Bloomberg Businessweek's rankings of the best business schools for the sixth straight year. Find out how schools across the world lined up. With hedge fund giants Citadel and Millennium closed to outside cash, some of the firms' traders are seizing the opportunity to go it alone. And investors are piling in: Startups run by alumni have raised some $14 billion in cash this year — a record according to research firm PivotalPath. But there's no guarantee these hedge fund cubs can replicate their parent firms' success. Gulf policymakers followed the US Federal Reserve's move to cut interest rates for the first time since the Covid-19 pandemic, giving the region some respite from the impact of lower oil prices. For the broader implications of a lower rate regime, it's over to my colleague Matthew Martin. Embarking on a multitrillion-dollar investment plan as interest rates spiraled upwards was never part of the economic masterplan for Saudi Arabia. Especially as it coincided with a period of budget deficits that threatens to stretch years into the future. So the Fed's decision to slash interest rates by 50 basis points, and the expectation of further cuts to come, will be a fillip for Saudi Arabia, and the Middle East's other dollar-pegged economies. Stock markets in the region bounced upwards on the news. But Saudi Arabia is perhaps the place that will most welcome an end to higher rates. The past few years have seen the kingdom wrestle with the impact of soaring inflation and higher financing costs on its investment plans. Cuts and delays to spending ambitions have had to be made. Looser monetary policy may help stimulate foreign investment, as well as lower borrowing costs for domestic investors. But it won't solve everything. The demand for cash to finance government investment projects (along with an explosion in mortgage lending) have hit liquidity in the banking system. Even during 2022 when money was flowing into state coffers from elevated oil prices, the local banking system wasn't reaping the benefits. Instead, Saudi lenders had to turn to the central bank for liquidity injections to stop lending rates spiraling upwards. While the central bank has not stopped making such direct injections, its helped out lenders by redirecting deposits from government controlled entities. The ratio of government and government-related entity deposits in the Saudi banks surged to an all-time high of over 30% this year. The spread between US interest rates and those in Saudi Arabia remains elevated, indicating banks still face a liquidity squeeze. That all points back to the recurring question around Crown Prince Mohammed Bin Salman's economic makeover plans: Where does the money come from? If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. You could also send us your feedback here. Thanks! |

No comments:

Post a Comment