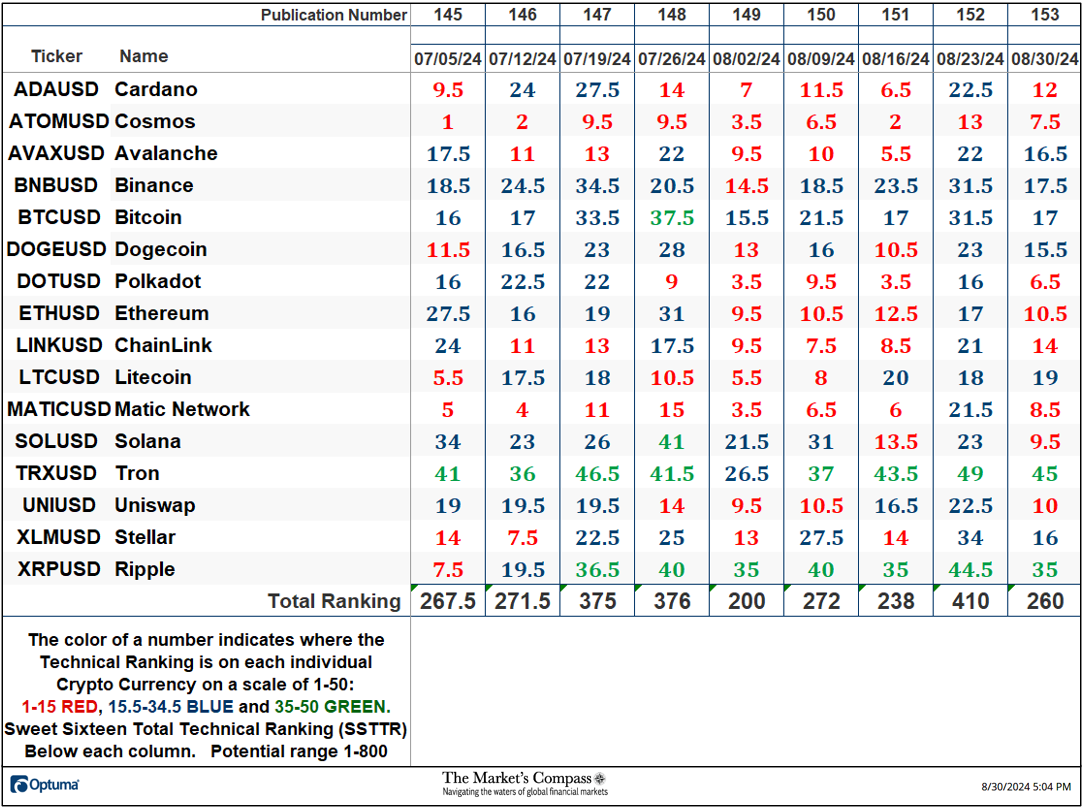

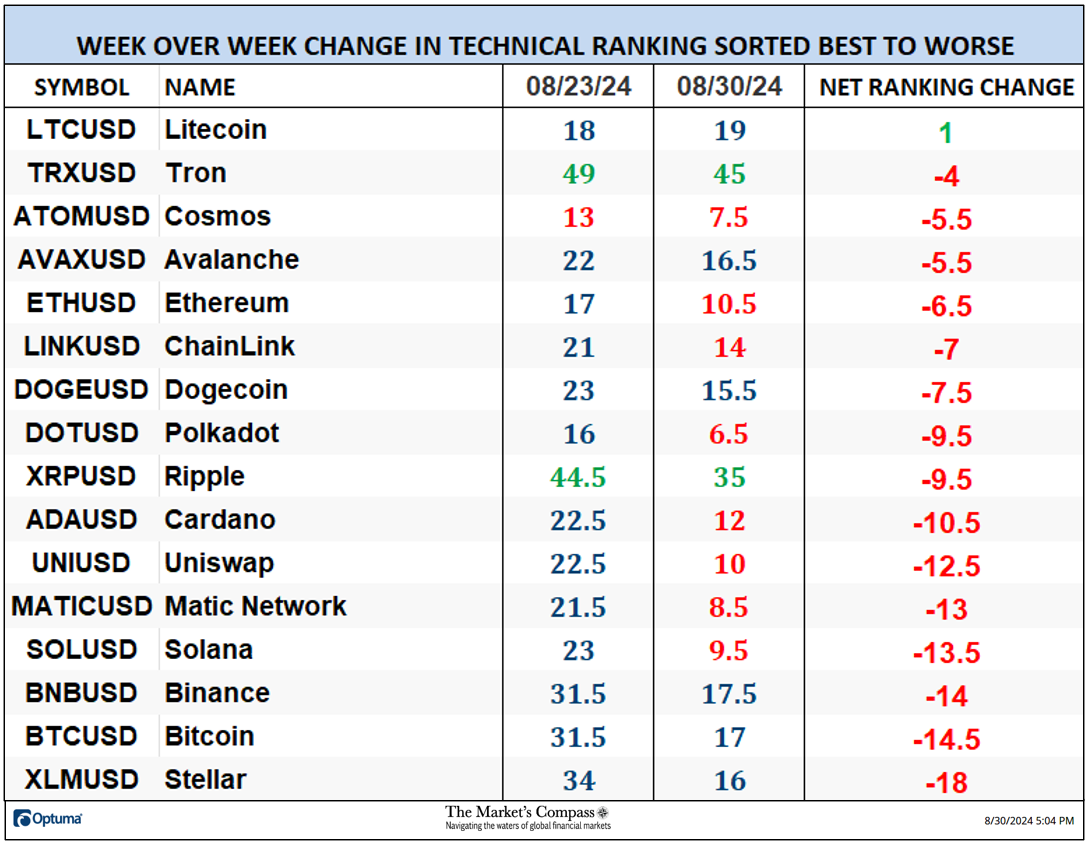

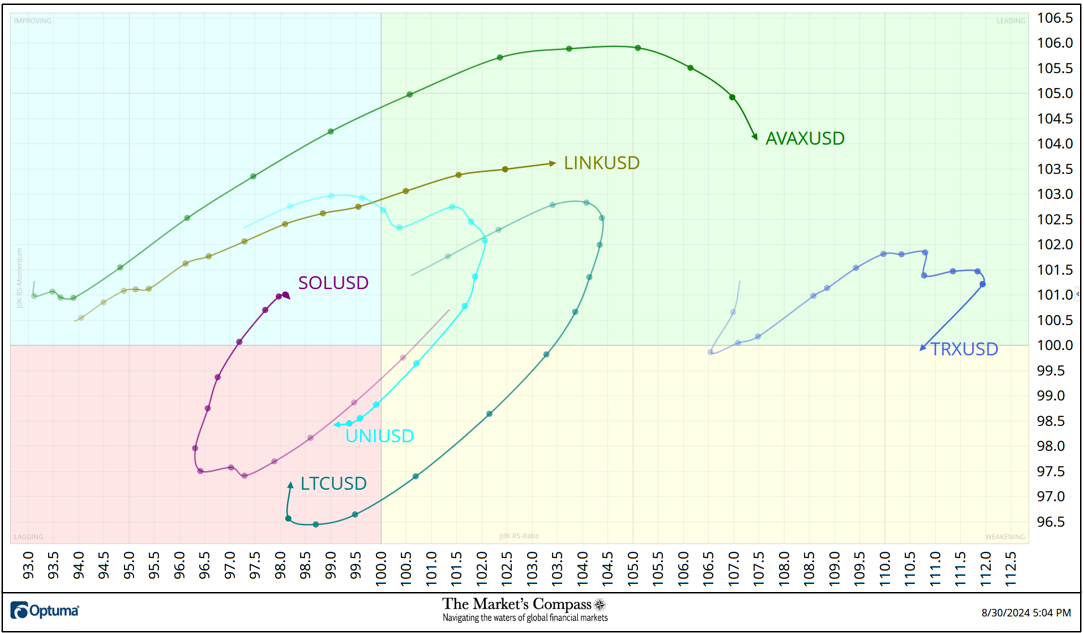

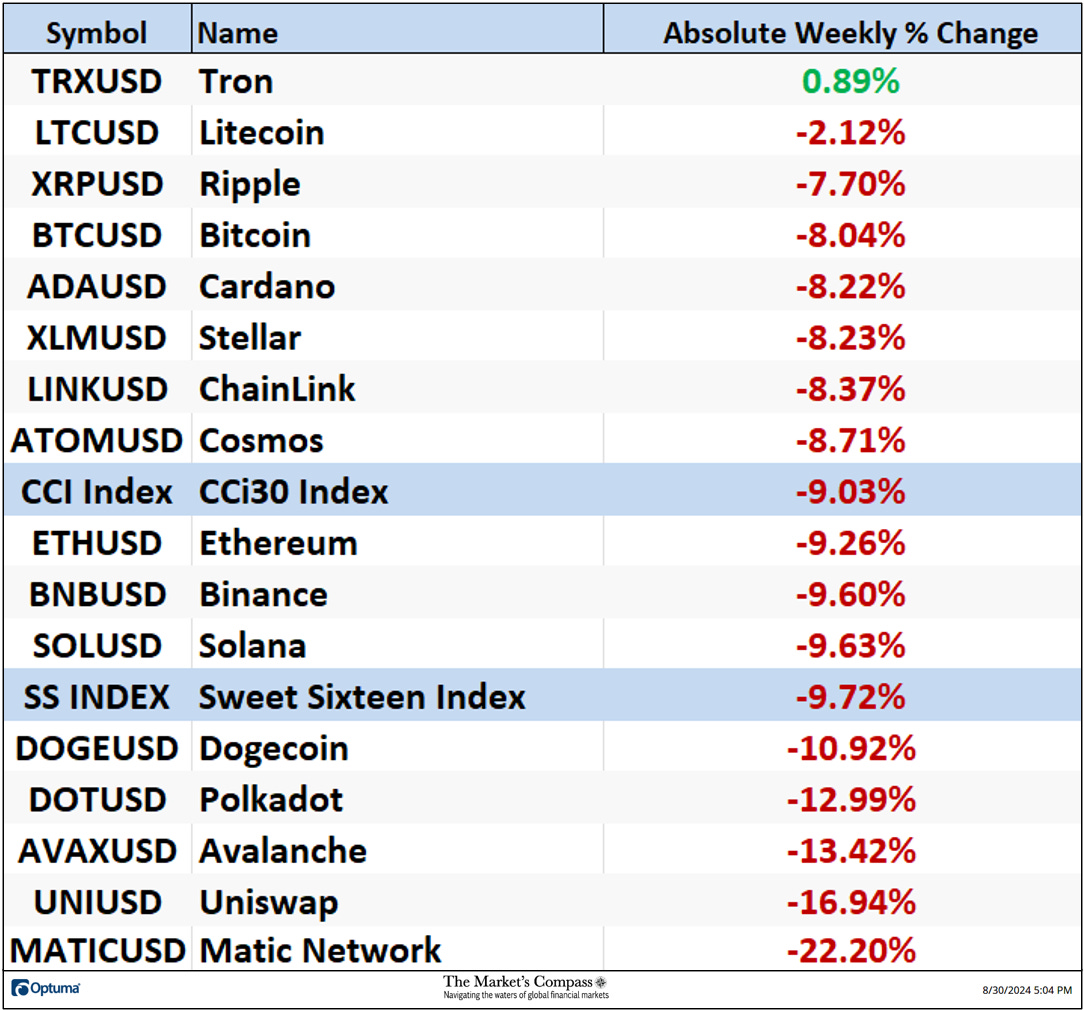

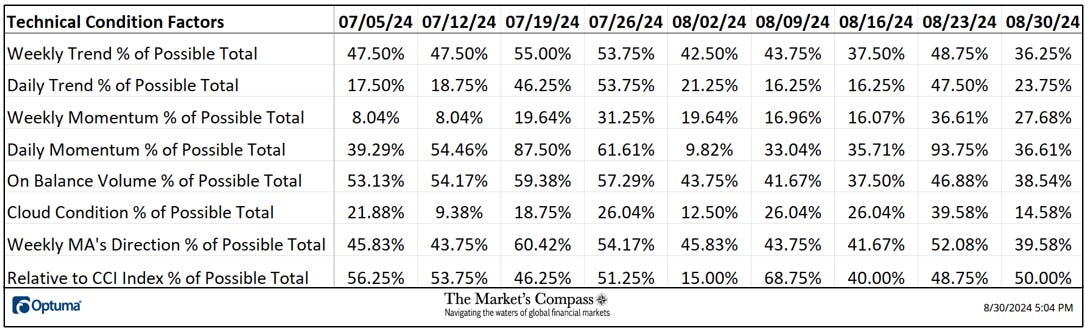

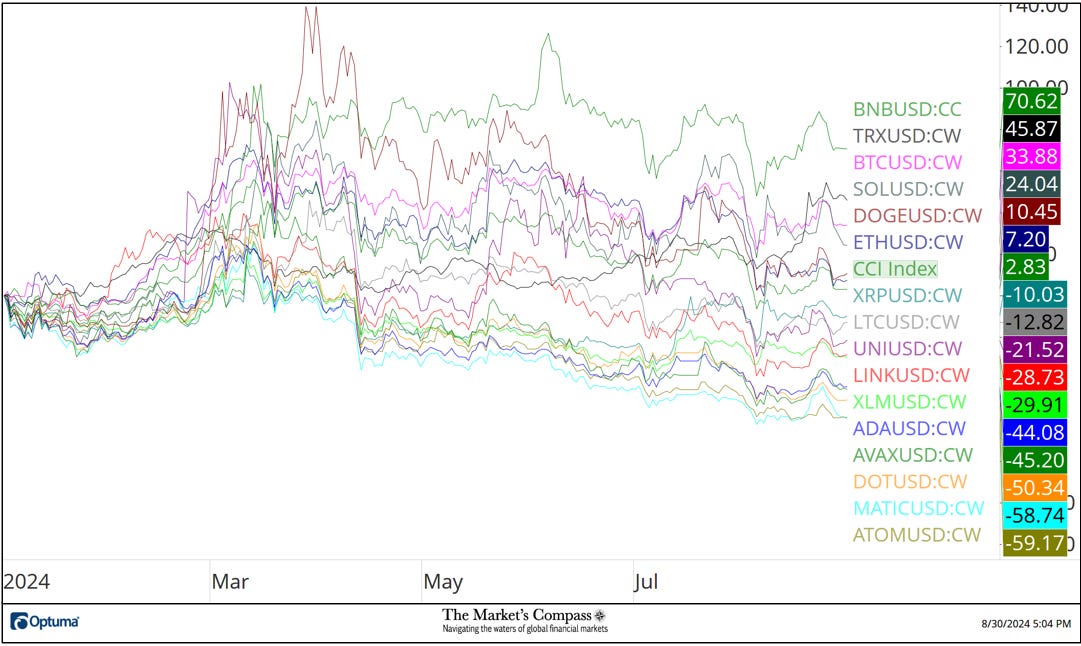

Happy Labor Day Weekend! In an unabashed attempt to lure you and other free subscribers to “pony up” and become paid subscribers I am sending you an unabridged version of today’s Market’s Compass Crypto Sweet Sixteen Study which paid subscribers receive every Sunday morning. For the cost of dinner and drinks with your friends at your local ($100 a year) you will be added to the list and have the Crypto Study plus the three weekly ETF Studies sent to your e-mail address every Sunday and Monday morning. Thank you for your consideration in becoming a paid “sub”. Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #153. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes. Paid subscribers will receive this week’s unabridged Market’s Compass Crypto Sweet Sixteen Study sent to their registered email. Past publications can be accessed by paid subscribers via The Market’s Compass Substack Blog along with the weekly ETF Studies. This Week’s and 8 Week Trailing Technical Rankings of the Sixteen Individual Cryptocurrencies*The Excel spreadsheet below indicates the weekly change in the objective Technical Ranking (“TR”) of each individual Cryptocurrency. The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. The TR of each individual Cryptocurrency can range from 0 to 50. The primary take-away from this spread sheet should be the trend of the individual TRs, either the continued improvement or deterioration, as well as a change in direction. Secondarily, a very low ranking can signal an oversold condition and very high number can be viewed as overbought. Thirdly, the weekly TRs are a valuable relative strength/weakness indicator vs. each other, in addition when the Sweet Sixteen Total Technical Ranking (“SSTTR”), that has a range of 0 to 800 is near the bottom of its range and an individual cryptocurrency has a TR that remains elevated, it speaks to relative strength and if the SSTTR is near the top of its recent range and an individual cryptocurrency has a TR that remains mired at low levels it speaks to relative weakness. Lastly, I view the objective Technical Rankings as a starting point in my analysis and not the entire “end game”. *Rankings are calculated up to the week ending Friday August 30th. Last week the SSTTR fell -36.59% to 260 from 410 the week before. That 410 reading marked the best level since the week ending March 24th at 420. Fifteen TRs fell last week and only one registered a small gain and that was Litecoin (LTC). That was vs. the week before when fifteen TRs gained ground and only one fell and that was Litecoin’s TR, which fell -2 to 18 from 20. The average TR loss was -9.39 vs. the previous week’s average gain of +10.75. Five weeks ago, the average loss was -11.20 when at that time the SSTTR fell to 200, which marked the lowest level since October 13th of last year. Two of the Sweet Sixteen TRs ended the week in the “green zone” (TRs between 35 and 50) one was Ripple (XRP) which has been in the “green zone” for seven weeks in a row and the other was Tron (TRX) which is charted below with a Relative Strength panel vs. the CCi30 Index below the Daily Candle Chart. A Linear Regression line in green highlights the superior relative performance vs. the Index since early June. Last week six TRs were in the “blue zone” (TRs between 15.5 and 34.5), and eight were in the “red zone” (TRs between 0 and 15). That was versus the previous week when two were in the “green zone, twelve were in the “blue zone”, and one was in the “red zone”. An obvious near across-the-board deterioration in the technical condition of the Sweet Sixteen and by proxy, most all Crypto Currencies. Relative Strength and Weakness in the Sweet Sixteen vs. The CCi30 Index* utilizing a Relative Rotation Graph*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com). The Relative Rotation Graph, commonly referred to as RRGs were developed in 2004-2005 by Julius de Kempenaer. These charts are a unique visualization tool for relative strength analysis. Chartists can use RRGs to analyze the relative strength trends of several securities against a common benchmark, (in this case the CCi30 Index over the past two weeks) and against each other over any given time period (in the case below, daily). The power of RRG is its ability to plot relative performance on one graph and show true rotation. All RRGs charts use four quadrants to define the four phases of a relative trend. The Optuma RRG charts uses, From Leading (in green) to Weakening (in yellow) to Lagging (in pink) to Improving (in blue) and back to Leading (in green). True rotations can be seen as securities move from one quadrant to the other over time. This is only a brief explanation of how to interpret RRG charts. To learn more, see the post scripts and links at the end of this Blog. Not all sixteen cryptocurrencies are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain. When I last published the Market’s Compass Crypto Sweet Sixteen Study on August 25th for the week ending August 23rd, Avalanche (AVAX) was rising sharply in the Improving Quadrant exhibiting positive Relative Strength Momentum and was poised to enter the Leading Quadrant. That positive Momentum continued until last Monday when it began to roll over, nonetheless Relative Strength continued to improve despite the loss in Momentum. ChainLink (LINK) was rising steadily in the Improving Quadrant and early last week that Relative Strength Momentum continued, and it is now climbing higher in the Leading Quadrant. After entering the Leading Quadrant Uniswap (UNI) has done an about face and has made a four Quadrant move, from the Improving Quadrant two weeks ago, to falling out of the Leading Quadrant last week, through the Weakening Quadrant and into the Lagging Quadrant. Solana (SOL) has also made a four Quadrant move but is ahead of UNI as it has entered the Improving Quadrant although it appears to be stalling. Litecoin (LTC) rolled over and fell out of the Leading Quadrant last weekend and Relative Strength momentum gathered a pace lower (notice the distance between the nodes or dots) as it traveled through the Weakening Quadrant. Although Tron (TRX) has lost a measure of Relative Strength and Relative Strength Momentum it still has exhibited superior Relative Strength vs. the CCi30 Index as can be seen earlier in this week’s Study. Seven Day Absolute % Price Change**Friday August 23rd to Friday August 30th. Fifteen of the Crypto Sweet Sixteen registered absolute price losses last week and only one gained ground (TRX) vs. the previous week when fifteen TRs gained ground and one fell (LTC). Of the fifteen absolute losers, Matic Network (MATIC) lost the most, down -22.20% after being up +34.01% the previous week. The average absolute price loss was -9.68%, from the previous week’s +13.33% average absolute gain. The Technical Condition Factor changes for the week ending August 9th with the trailing eight weeks added.There are eight Technical Condition Factors (“TCFs”) that determine individual TR scores (0-50). Each of these 8, ask objective technical questions (see the spreadsheet posted below). If a technical question is positive an additional point is added to the individual TR. Conversely if the technical question is negative, it receives a “0”. A few TCFs carry more weight than the others, such as the Weekly Trend Factor and the Weekly Momentum Factor in compiling each individual TR of each of the 16 Cryptocurrencies. Because of that, the excel sheet below calculates each factor’s weekly reading as a percent of the possible total. For example, there are 7 considerations (or questions) in the Daily Momentum Technical Condition Factor (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a possible range of 0-112 if all 16 had fulfilled the DMTCF criteria the reading would be 112 or 100%. A DMTCF reading at 85% and above suggests a short-term overbought condition is developing and a reading of 15% and below suggests a short-term oversold condition. Two weeks ago the DMTCF rose to an overbought reading of 93.75% or 105 out 112 from 35.71% or 40 out of a possible 112 which was a improvement from the deeply oversold reading of 9.82% or 11 out of 112 five weeks ago. Last week the DMTCF contracted sharply to 36.61% or 41 out of a possible 112. As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week seven TCFs fell and only one rose. The CCi30 Index with this week’s Sweet Sixteen Total Technical Ranking (“SSTTR”)The Sweet Sixteen Total Technical Ranking (“SSTTR”) Indicator (bottom panel in the chart below) is a total of all 16 Cryptocurrency Individual Technical Rankings and can be looked at as a confirmation/divergence indicator as well as an overbought / oversold indicator. As a confirmation/divergence tool: If the broader market as measured by the CCi30 Index continues to rally without a commensurate move or higher move in the SSTTR the continued rally in the CCi30 Index becomes increasingly in jeopardy. Conversely, if the CCi30 Index continues to print lower lows and there is little change or a building improvement in the SSTTR a positive divergence is registered. This is, in a fashion, is like a traditional A/D Line. As an overbought/oversold indicator: The closer the SSTTR gets to the 800 level (all 16 Cryptocurrencies having a TR of 50) “things can’t get much better technically” and a growing number individual Crypto’s have become “stretched” there is more of a chance of a pullback in the CCi30. On the flip side, the closer to an extreme low “things can’t get much worse technically” and a growing number of Crypto’s are “washed out technically” and an oversold rally may develop, or a measurable low is closer to being in place. The 13-week exponential moving average in red smooths the volatile SSTTR readings and analytically is a better indicator of trend in the indicator. At the close of last week’s trading the CCi30 Index held support at the overtaken Median Line (red dotted line) of the Schiff Modified Pitchfork (red P1 through P3) but almost all of the previous weeks price gains were wiped out. MACD continues to track lower below its signal line and has just entered negative territory. That said, the nine-week Stochastic Momentum Index has managed to hold above signal line. After briefly overtaking the ground above the 13-week Moving Average (red line) the Sweet Sixteen Total Technical Ranking has fallen back below the shorter-term moving average. If there is follow through to last week’s price weakness, then support at the Fibonacci 61.8% retracement level of the October to March rally and the upper price activity band (grey rectangle) at 11,840 will come quickly come into play. The CCi30 Index Daily Candlestick and Cloud ChartThe CCi30 Index rallied impulsively a week ago last Friday breaking out of the weeks long sideways trading pattern but failed to follow though and was capped at the Cloud model where there was a twist in the Cloud which should have been an easy hurdle to overtake. On Tuesday of last week, the index fell sharply back into the aformentioned trading range and has been trading sideways in a series of Doji. One positive technical feature is that the Kijun Plot (green at line 12,370) has not been violated. In concert with the price pulling back, MACD has rolled over and is back in negative territory along with a break lower in the Fisher Transform and the 10-Day Stochastic Momentum Index. Only the Short-Term KST has held above its signal line. Key support is at 12,370 needs to hold or a swift downdraft in price could unfold. Year to Date Comparitive Price Performance of the Sweet SixteenAll of the charts are courtesy of Optuma whose charting software enables users to visualize any data such as my Objective Technical Rankings. Cryptocurrency price data is courtesy of Kraken. The following links are an introduction and an in-depth tutorial on RRG Charts… https://www.optuma.com/videos/introduction-to-rrg/ https://www.optuma.com/videos/optuma-webinar-2-rrgs/ To receive a 30-day trial of Optuma charting software go to… A three part tutorial on Median Line Analysis AKA Andrews Pitchfork and a basic tutorial on the Tools Technical Analysis is available on my website… |

Sunday, September 1, 2024

The Market’s Compass Crypto Sweet Sixteen Study

Subscribe to:

Post Comments (Atom)

Silver Just Sent a Warning Shot

A 33% intraday crash in silver while stocks sit at all-time highs isn't normal. ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment