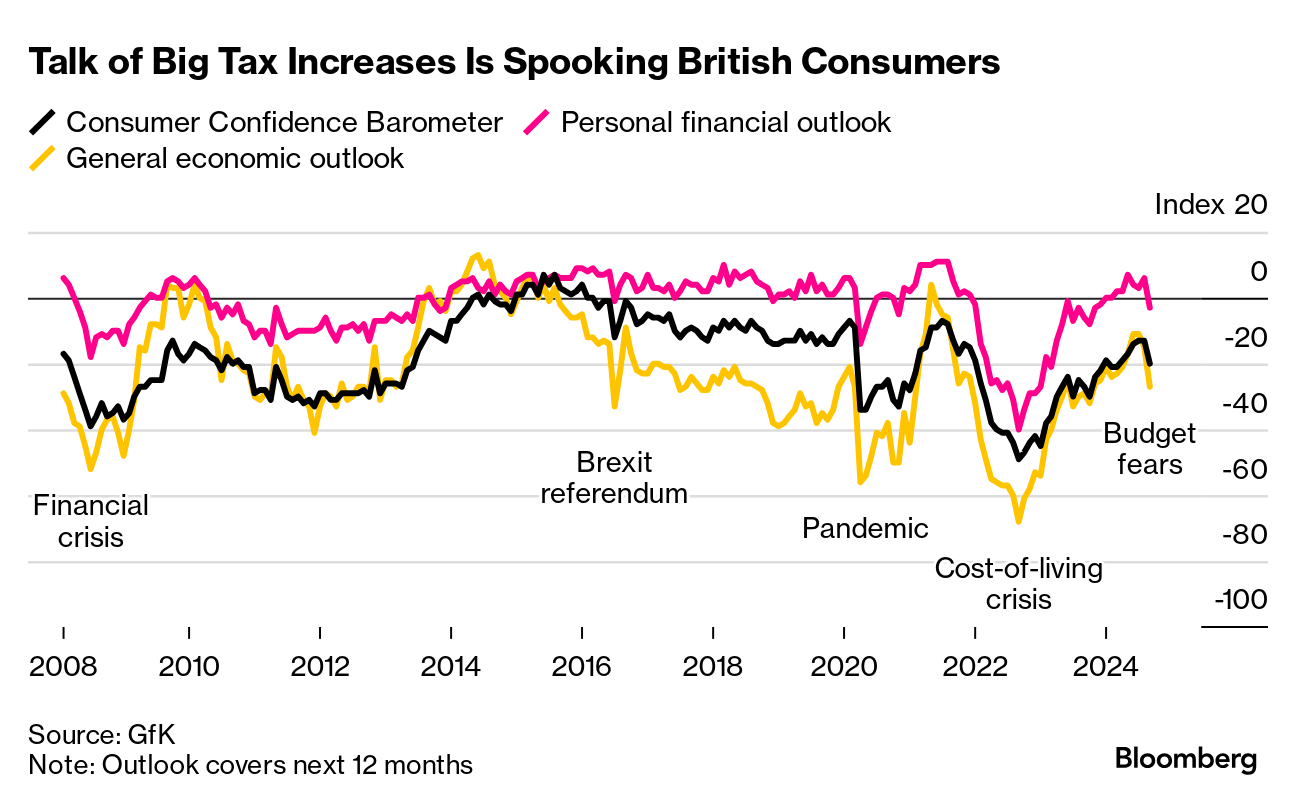

| Here's your daily snap analysis from Bloomberg UK's Markets Today blog: Retail sales in the UK were better than predicted in August and consumer confidence dived. Here's a few things to think about on that front. The warmer weather, or at least more seasonally-appropriate summer conditions, that appeared near the end of the summer months clearly helped retail sales. Rain is now forecast but it is hitting at the right time of year, in theory, so we'll have to see how well that's been planned for. End-of season sales also played a part. If those were successful, then that will reduce any issues of holding excess inventory for retailers. However, if there was more discounting by retailers over the period, that could show up in their margins. So keep an eye on that when the earnings season kicks back into gear. And consumer confidence slid. It's a notoriously volatile measure and, in the UK, very rarely turns positive. It's been blamed on pessimism about the upcoming budget but remember that interest rates are likely to keep coming down as the year goes on, which could help the mood on personal finances and bigger purchases. — Sam Unsted Check Bloomberg UK's Markets Today blog for updates all day. |

No comments:

Post a Comment