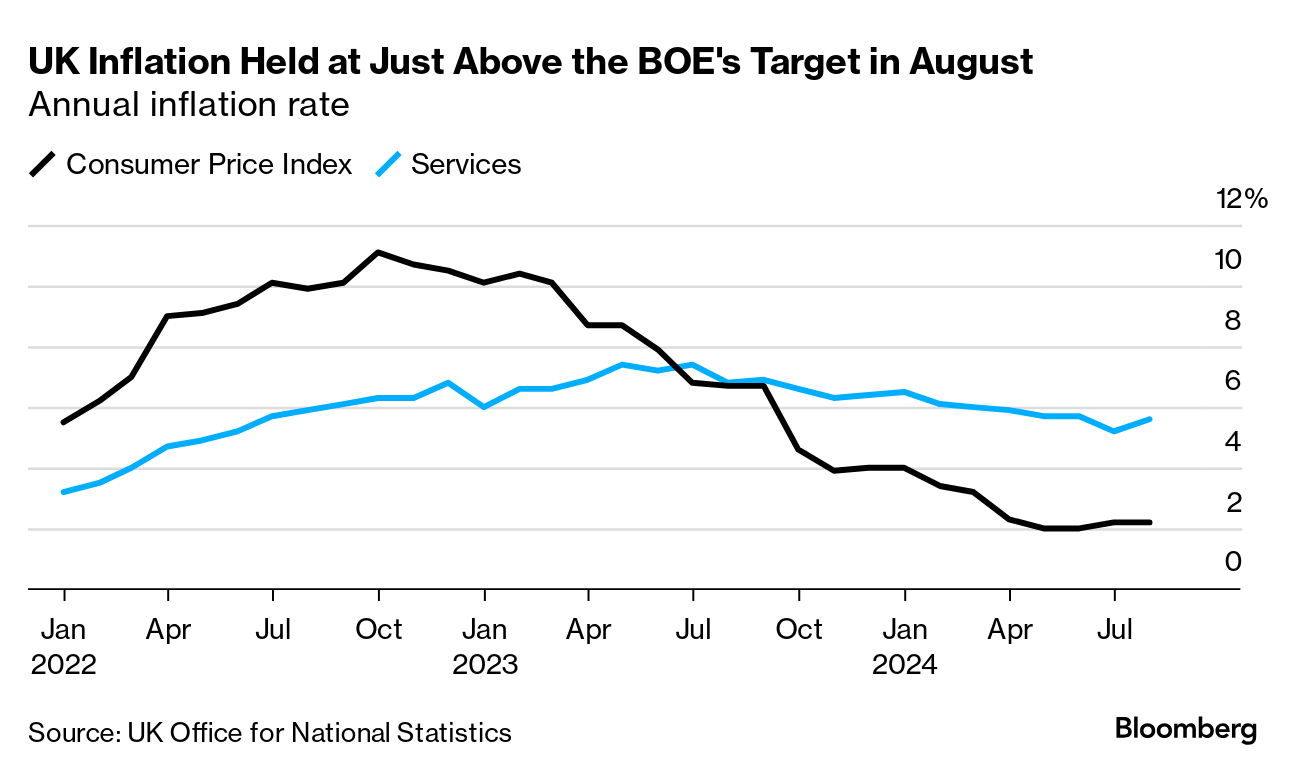

| Here's your daily snap analysis from Bloomberg UK's Markets Today blog: Today's inflation reading, at first glance, appeared to be a bit of a snoozer. All the key measures (headline CPI, core and services) were bang in line with forecasts, and the movement was mainly driven by technical or statistical quirks. But below the surface, something interesting was going on. That means producer prices, often the bridesmaid in these releases, deserve a moment the spotlight. Factory gate prices, paid by retailers rose by just 0.2% in August — below forecasts of a 0.5% gain. On the month, they unexpectedly fell. Meanwhile, input prices, paid by manufacturers for raw materials, fell 1.2% on the year thanks to a sharp drop in oil and fuel costs. Markets had expected a dip of 0.8%. Both provide further evidence that inflation pressures are receding, and will be welcomed by BOE policy makers nervously looking out for signs of resurgent price gains. — David Goodman Check Bloomberg UK's Markets Today blog for updates all day. |

No comments:

Post a Comment