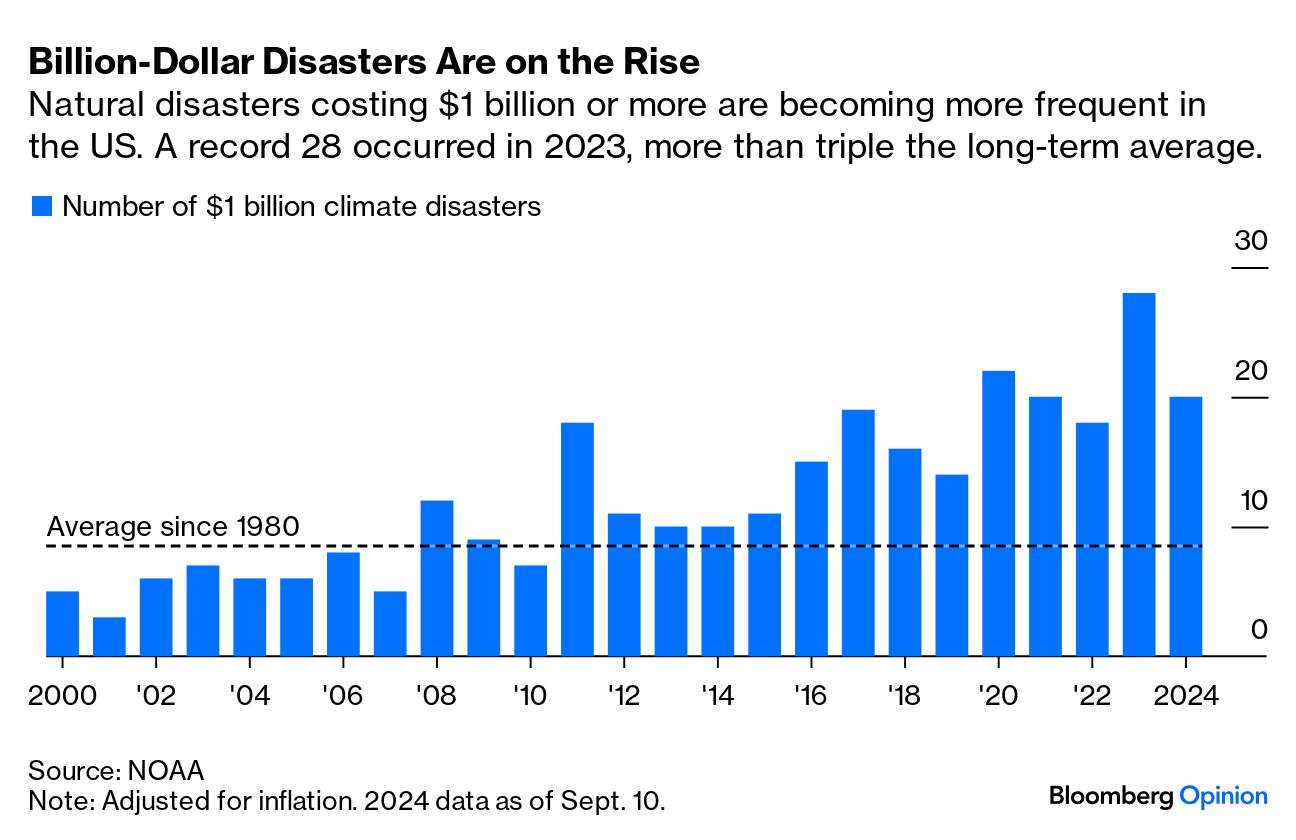

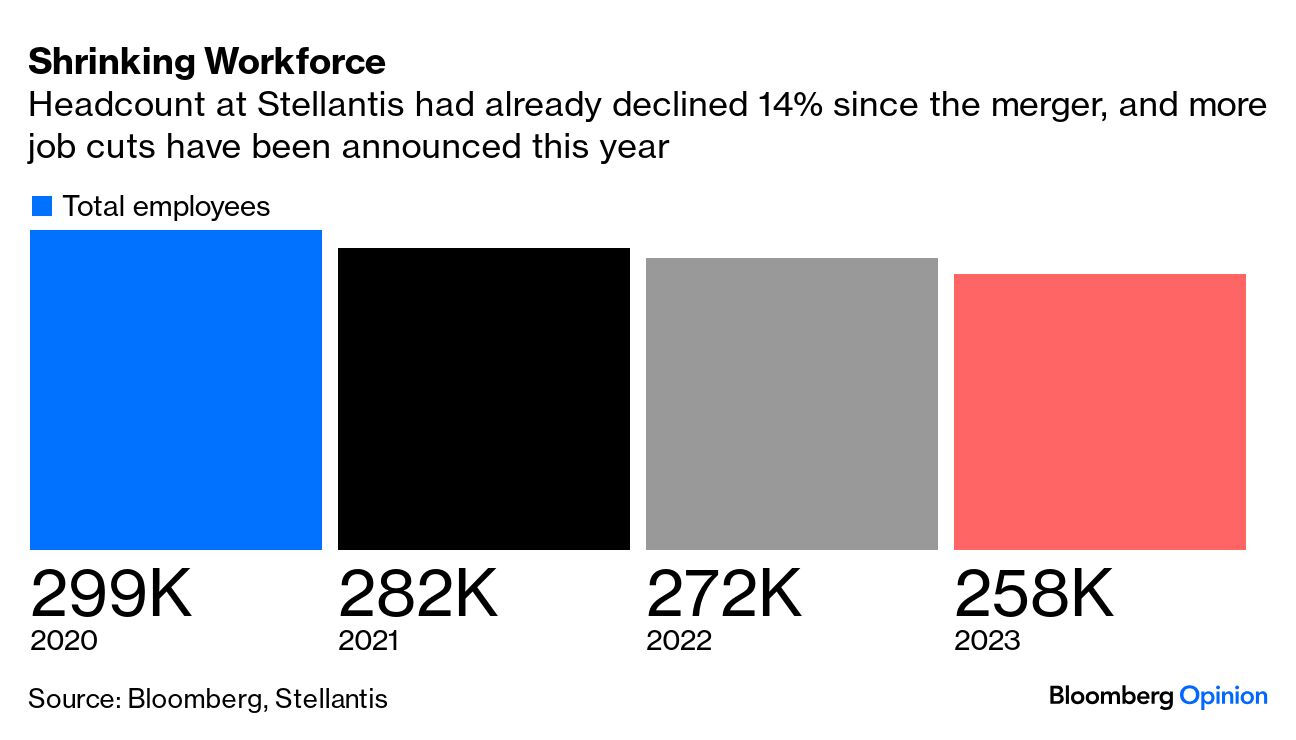

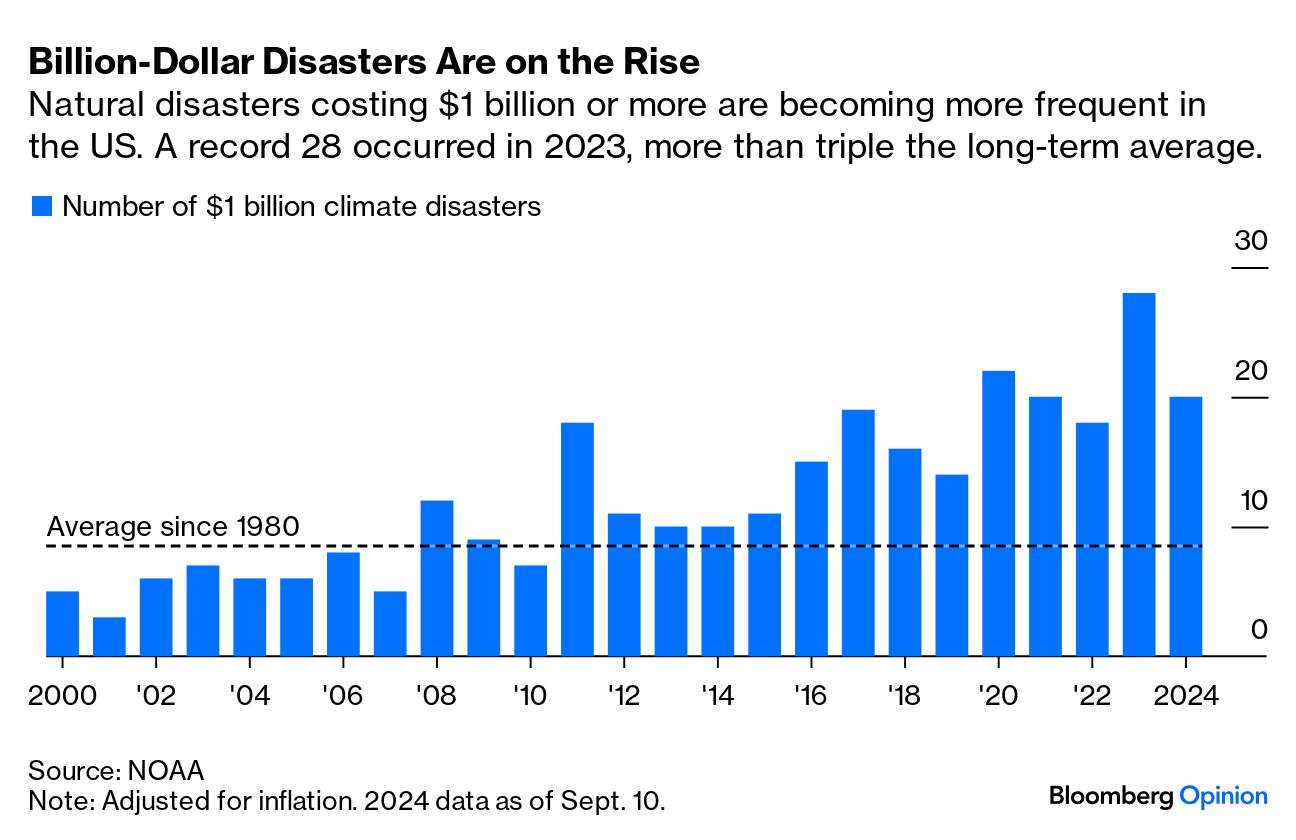

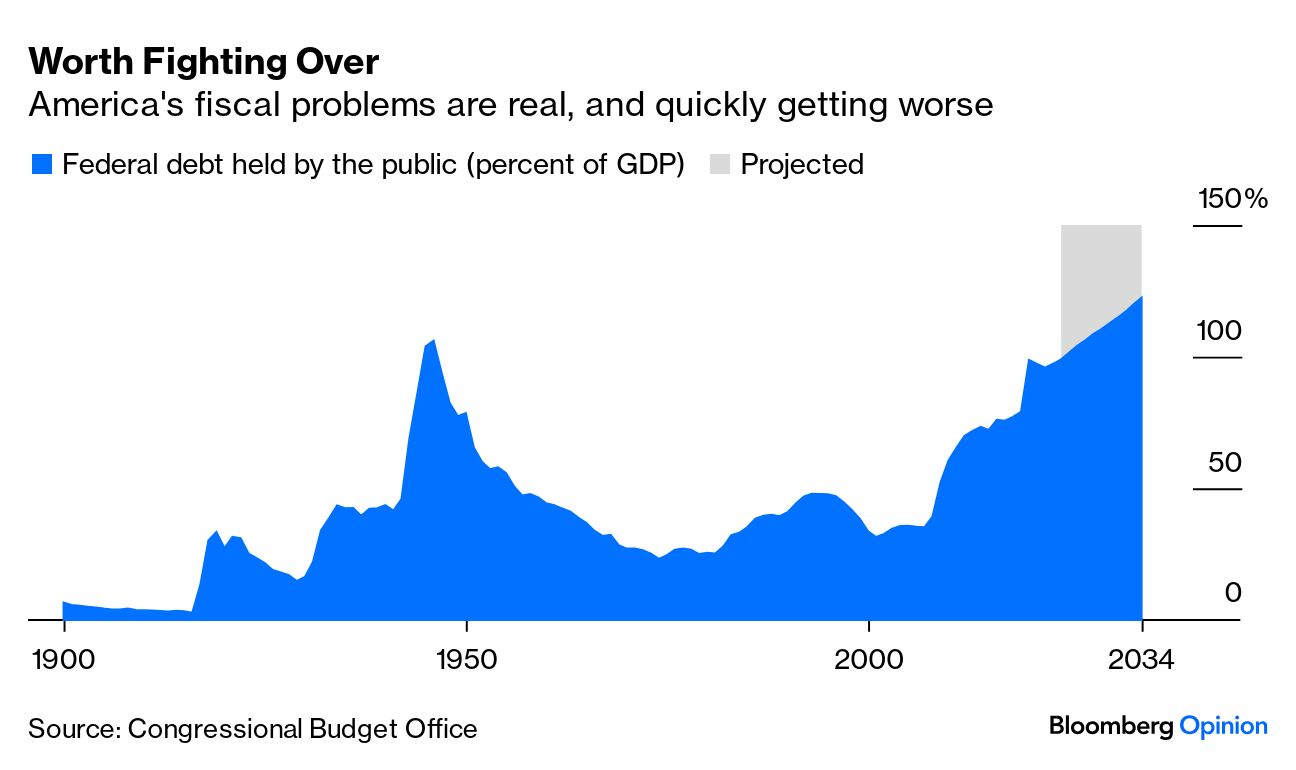

| This is Bloomberg Opinion Today, a benchmark of Bloomberg Opinion's opinions. Sign up here. The funny thing about Fed Day is that it's just a small group of humans gathering on the internet for one hour to tweet things like "we're so back" and "this is why we get up in the morning." And sure, maybe someone launches "the first nicotine pouch designed specifically to create shareholder value" during that one hour and people get a little excited. But then life kinda continues as normal and nobody really cares: And if you do still care, it's because you want to buy a house: Or you're going through some sort of midlife crisis: Or you're Bill Dudley, who is still riding the high of being right (as the youngest sibling, I can relate) about the Fed's jumbo rate cut. "I'm obviously pleased because it's always more fun to be right than wrong," he told Jonathan Levin and Allison Schrager during their live discussion this afternoon. Markets expect a reduction of at least 50 more basis points by the end of 2024, and John Authers says "confidence that the global economy is heading for a soft landing is now its greatest since BofA started asking the question in May last year." Although this rate cut was "priced in," as they say, it's the first time the Federal Reserve has cut rates in four years, so it's natural to have questions. Like, say: Where will rates land once all is said and done? "Nobody knows for sure, and Chair Jerome Powell injected enough uncertainty to ensure a choppy ride ahead," Jonathan writes. Fed watchers were surprised to see 10-year Treasury yields — a benchmark for mortgages — go up in response to the cuts. "Members of the Fed's rate-setting committee think that neutral interest rates are a bit higher than before, and that puts a floor under longer-term bond yields for the foreseeable future," he says. Another question: Where should I put my money? "Some investors will be tempted to chase stocks given the stubborn conventional wisdom that interest rates and stock prices move in opposite directions," Nir Kaissar writes, but the data doesn't always support that simple thesis, so investors should tread lightly. I hate to be the bearer of bad news, but a PlayStation now costs more than a purebred miniature goat: Gearoid Reidy says the souped-up version of the PS5 will retail for around $700 in the US and ¥120,000 in Japan — an outrageous price, considering you could buy the OG version of the console for about $300 in 2020, or ¥44,000. The average Japanese gamer in their 20s would need to fork over half of their monthly salary to afford the new model, and Gearoid suspects Sony "is in danger of forgetting its roots entirely." Earlier this year, Sony cut 900 employees from its PlayStation payroll, and an ex-Sony exec reportedly told laid off workers to "go to the beach for a year" or "drive an Uber" until the job market improves. Rich advice, given the gaming industry has shed an estimated 12,000 staffers this year alone — 2,550 of which came from Microsoft. But it's not just gaming giants lightening their load in the face of budget constraints. Automakers, too, are having a hard time managing the shift to electric vehicles. Look no further than Stellantis, the owner of Fiat, Jeep and Peugeot, which can't seem to stop firing people: Just six months ago, Chris Bryant said that Stellantis CEO Carlos Tavares deserved his $40 million pay package after the carmaker surpassed Volkswagen in market value. But the automaker's share price has fallen 50% since its peak in March, and Chris says "there's egg on my face, because those superficially impressive financial achievements weren't sustainable." Turns out, not enough people want to shell out $91,945 for a luxury Jeep with 24-way power seats that can give you a massage! And who can blame them? For $20K less, you could afford a personal masseuse for an entire year:  Then again, an in-house massage therapist might be overkill because most of us are spending less and less time at home these days. Amazon just mandated that employees must return to the office five days a week, and Lionel Laurent says it's part of a broader trend to "thin the ranks of middle managers and tighten the screws on remote work to strengthen the beloved trifecta of efficiency, productivity and collaboration after the pandemic." Trouble is, warm bodies loitering by the water-cooler won't magically increase output: "Dropping the hammer on remote work is probably more about making life easier for managers than it is about helping workers be more productive." Still, don't be surprised if Amazon eventually drops the L-word — that is, layoffs — on workers who fail to acquiesce. While Sean "Diddy" Combs' reservoir of baby oil is one of the details from the indictment of his alleged sex crimes that's grabbed headlines, it's far from the most important part of the story. According to the document, he forced women "to engage in frequent, days-long sexual activity with male commercial sex workers" in "Freak Offs," or "elaborate sex performances that Combs arranged, directed, and often electronically recorded." The music mogul's long list of purported sex crimes dates back to 2008, so you might think he'd have been put behind bars a long time ago. But Barbara L. McQuade says "sex rings can endure for years" because "bystanders fail to recognize what is occurring right before their eyes. The myopia is caused by common myths about sex trafficking. People imagine victims bound and gagged, in handcuffs and chains and held captive in a dungeon. Instead, the victims usually walk openly in public, side by side with their traffickers." Oftentimes, perpetrators will make themselves indispensable to their prey. They buy their victims fancy clothes. They help kickstart their careers. They get them hooked on addictive drugs and keep them pliant with IV fluids. "An indictment like this one can raise awareness of how sex trafficking really works, which, in turn, can help reduce this horrific crime," Barbara writes. Read the whole thing. "Can a flood be called a thousand-year flood if it happens every five years?" is the question on Mark Gongloff's mind after a tropical storm dumped 18 inches of rain in 12 hours on the southern coast of North Carolina. Mathematically speaking, the answer is no. You can't have 200 thousand-year floods in the span of a thousand years! And Mark agrees: "The moniker doesn't quite fit when you consider similar disasters also hit the area in 1984, 1999, 2010, 2015 and 2018. Along with the latest flood, that's five in just 25 years." And the costs of such storms add up quickly:  Is Mike Johnson ever gonna learn his lesson? We're less than two weeks out from another potential government shutdown, and the speaker of the House is in for a world of hurt if he can't get his party's act together. Bloomberg's editorial board says "Johnson won't win any good-faith concessions from Democrats by attaching a hopeless, unrelated citizenship measure to this bill." And yet that's exactly what Donald Trump is urging him to do: "If Republicans don't get the SAVE Act, and every ounce of it, they should not agree to a Continuing Resolution in any way, shape, or form," the former president wrote on Truth Social this afternoon. "Meanwhile, the country's real problems are getting worse," the editors say. Like, I dunno, this chart projecting net public debt will surpass 120% of gross domestic product by 2034: A TikTok ban may not be inevitable after all. — Stephen L. Carter Cornel West knows he can't win his quixotic quest for president. — Erika D. Smith Claudia Sheinbaum isn't going to thrive in AMLO's shadow. — Juan Pablo Spinetto Burberry desperately needs the return of Britpop. — Andrea Felsted Big polluters are trying to game hydrogen credits. — Fred Krupp Walkie-talkies exploded in Lebanon. We're living in a golden age of scams. Melania Trump defended her nude modeling. Robert Pattinson can't stop dying (and doing funny voices). (h/t Ale Lampietti) Ellen DeGeneres has a Netflix special about getting cancelled. Tupperware got real weird before it filed for bankruptcy. The grocery store is better at matchmaking than Tinder. Notes: Please send pineapples and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment