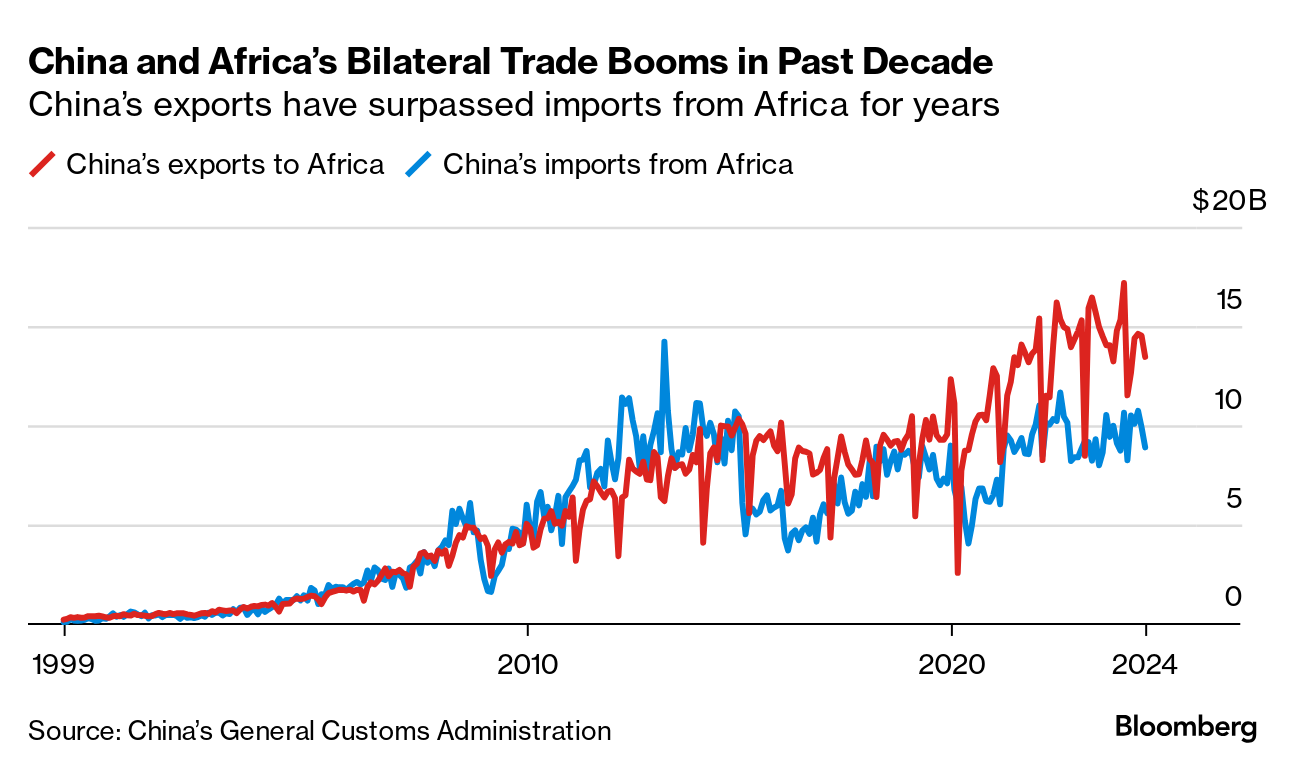

| China is stepping up its outreach to Africa, offering better trade terms, more investment and military training to a continent key to Beijing winning the geo-economic race against the US. President Xi Jinping laid out his vision in a speech to leaders from some 50 nations Thursday during the opening ceremony of the Forum on China-Africa Cooperation in Beijing. A gala dinner lavished African leaders with the red-carpet treatment. Among Xi's pledges: to unilaterally exempt import tariffs for products from 33 African countries deemed as least developed economies, as well as expanding market access to the world's second-largest economy. Over the past decade, China's lending fueled an infrastructure boom across Africa as part of Xi's flagship Belt and Road Initiative, but that slowed down during the pandemic before picking up again last year. Video: Xi Says China-Africa Relations at 'Best Period in History' African nations sound open to the renewed outreach and investment, but they want debt forgiveness and a more balanced trading relationship, too. China's trade surplus with Africa rose to a record $64 billion last year, with exports surging to a new high of $173 billion, while imports moderated from 2022. According to an action plan at this week's forum, China will waive unpaid interest-free debts due by the end of 2024 for the poorest African economies. Read More: Xi Wants Bigger Returns, Fewer Headaches in Africa Debt Deals Xi has traveled to the African continent five times since taking power — a record of visits that neither President Joe Biden nor Donald Trump managed to accomplish. New Energy China has also positioned itself as a trading partner on goods needed to expand renewable energy sources. That's fits well with economic development needs across Africa, which has struggled with reliable power and was fastest-growing region for Chinese exports of solar panels last year. Meanwhile, appearing via a video link at the Bund Summit in Shanghai, former US Treasury Secretary Robert Rubin said American politicians should be careful not to go too far with trade restrictions and tariffs on China while trying to safeguard national security. Tariffs should be limited and made difficult to apply to ensure they are used cautiously, Rubin said. "There are legitimate concerns about having secure supply chains," he added. "The question is where do you draw the line?" - Next Africa is a twice-weekly newsletter about the continent's present and future. Sign up here to have it delivered by email.

Related Content: (Editor's Note: Yesterday's edition incorrectly said talks were starting Wednesday between the US longshoremen's union and their port employers. The two-day talks are among union membership. Here's a link to the corrected version.) —Brendan Murray in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment