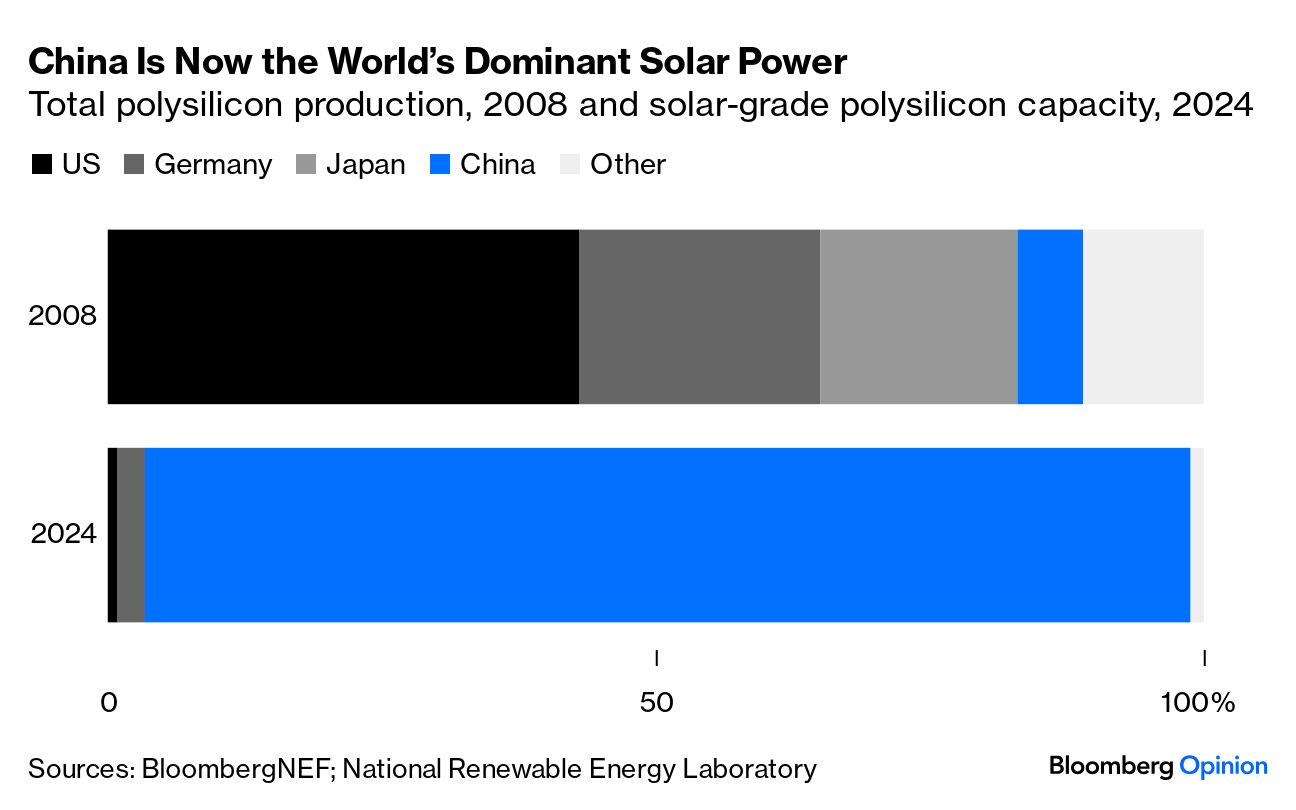

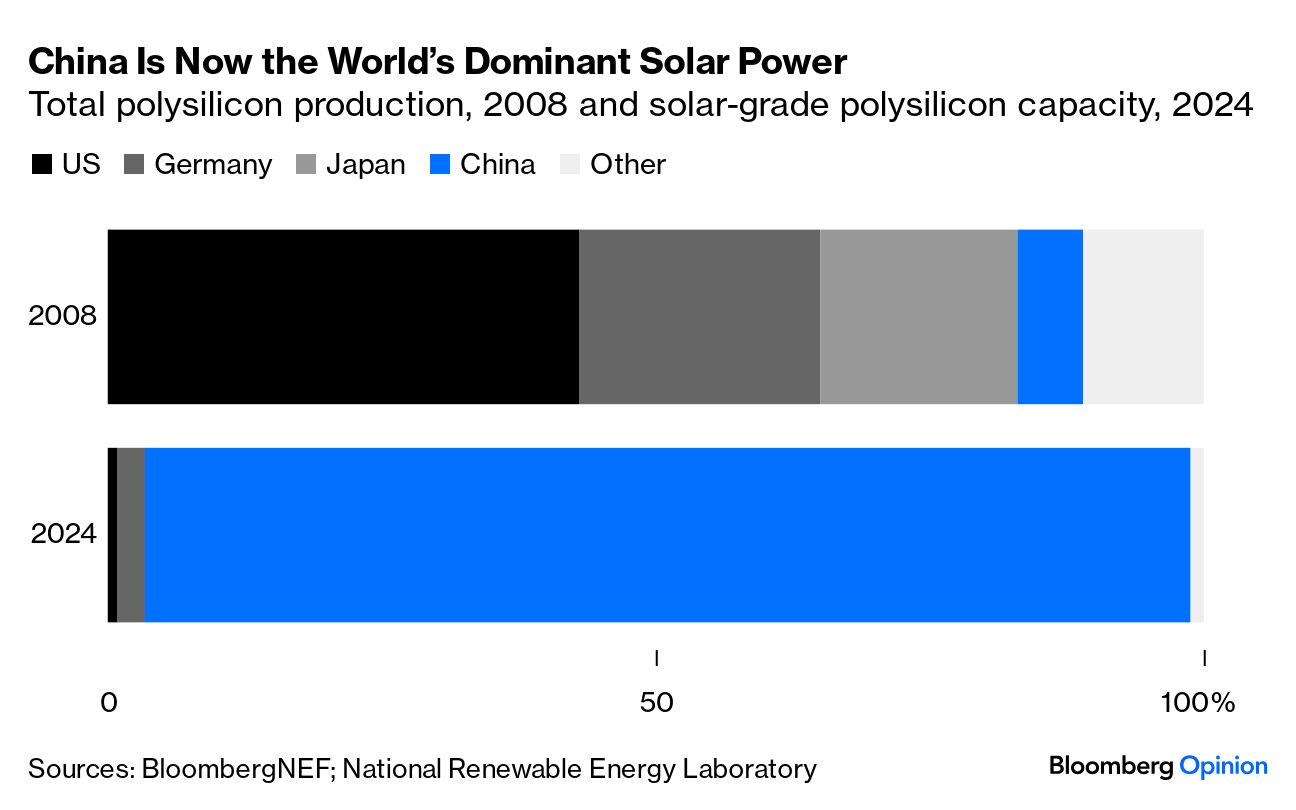

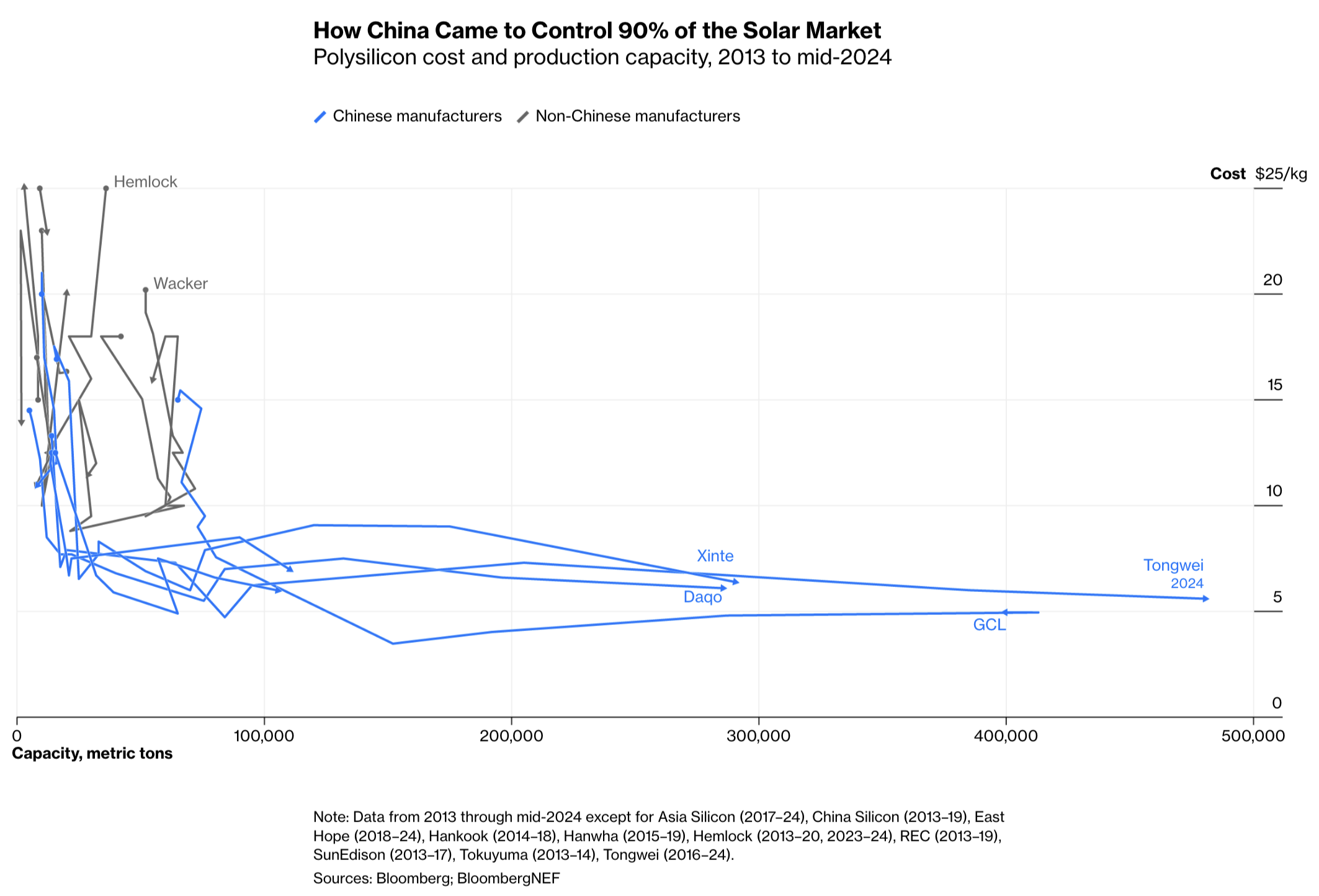

| This is Bloomberg Opinion Today, a valuable commodity of Bloomberg Opinion's opinions. Sign up here. Not that we needed any more Moo Deng or Chappell Roan analogies, but solar power is, in many ways, the baby hippo/midwest princess of the energy world. Seemingly overnight — well, 15 years, give or take — the power source went from "a backwater to a boom industry," David Fickling writes in a new free-to-read feature. In 2024 alone, he says "the capacity of new modules installed globally every three days is roughly equivalent to what existed in the entire world at the end of 2005." At the center of that domination is a five-letter word: China.  Beijing hasn't always gone hard on solar panels, though: As recently as 2010, a random town in Saginaw County, Michigan was the world's biggest producer of polysilicon, the main ingredient needed for solar. To find out why — and how — the US lost its initial foothold in the industry, David Fickling traveled about 7,500 miles, or 12,000 kilometers to two vastly different solar cell plants, one in the Great Lakes region and the other in China's Sichuan province. First up: Hemlock Semiconductor, low-profile, albeit historically significant polysilicon producer in remote Michigan. And I mean remote. To anyone who thinks journalism is a glamorous job, here's a photo David took while staking out in the woods — ever the dedicated columnist! — after the company turned down his requests to visit the facility:  At least it wasn't raining. Photographer: David Fickling/Bloomberg In 1954, some scientists figured out how to use silicon to power computer processors, and by 1961, Hemlock was born on this plot of isolated farmland. Although the plant excelled at making chip-grade polysilicon, which David says is in almost every electronic device on the planet, it took nearly 40 years for solar polysilicon — made from scraps rejected by chipmakers — to become a valuable commodity in its own right. "Hemlock initially surfed this wave," David writes, but wasn't able to keep up with demand. "Until the mid-2000s, the raw material for all the chips and solar panels on the planet was produced at just 10 facilities in the US, Europe and Japan," David explains. That oligopoly was extremely costly for solar panel manufacturers, and "Chinese rivals spied an opportunity to sell at half the costs of incumbents, sparking a trade war with the US." Fast-forward to now, and America is merely a footnote in solar history: China's Tongwei, the world's biggest solar power player today, has outposts throughout the country in energy-rich regions where power is cheap. The Sichuan-based site in Leshan, where David visited, "can produce about 120,000 tons, and Tongwei as a whole will have a capacity of 480,000 tons this year," an astonishing figure: "480,000 tons is enough to generate sufficient solar electricity to power Mexico for a year — or Indonesia, or the UK and Ireland put together." David spoke to the site's strategic development director over a lunch of chicken-feet skewers. "For Tongwei, everything is about the market," the executive said. "I don't think there will be a renaissance for the US, Europe and Japan … They cannot compete with the Chinese players any more." David mostly agrees. "The US solar industry that's left is moribund at best," he writes. "To have a functioning PV sector you need every piece of the supply chain — from polysilicon, ingot production and wafer slicing to cell manufacturing and finally module assembly. There's precious little sign that's going to emerge on a sufficient scale in the US," he writes, and levies won't help: "Successive waves of tariffs have done little more than create a Potemkin solar industry, while putting a tax on clean power as the climate crisis festers." As painful as it may be to admit defeat, US officials need to drop their protectionist act and make peace with China's solar panel supremacy. Read the whole thing. Bonus Energy Reading: Cobalt and lithium are essential to the energy transition. A slump in prices doesn't guarantee their security. — Javier Blas Speaking of everything revolving around the market, here's a devastating scene from the season finale of HBO's Industry:  Source: HBO Max And here's another one, for good measure:  Source: HBO Max A machine could do your job! Our partners can only be allayed by more automation!! Heavy sobbing!!! This is the stuff of TV dreams. It's also the subject of Allison Schrager's latest column on financial planning: The entire service sector is about to be transformed. Just as the industrial revolution changed the way goods are manufactured and consumed, so the technological revolution will do for services. Once something can be made at scale, the market for it can expand and be segmented; some people may want (and be able to afford) Birkin bags, while others will prefer canvas totes. The same goes for financial planning.

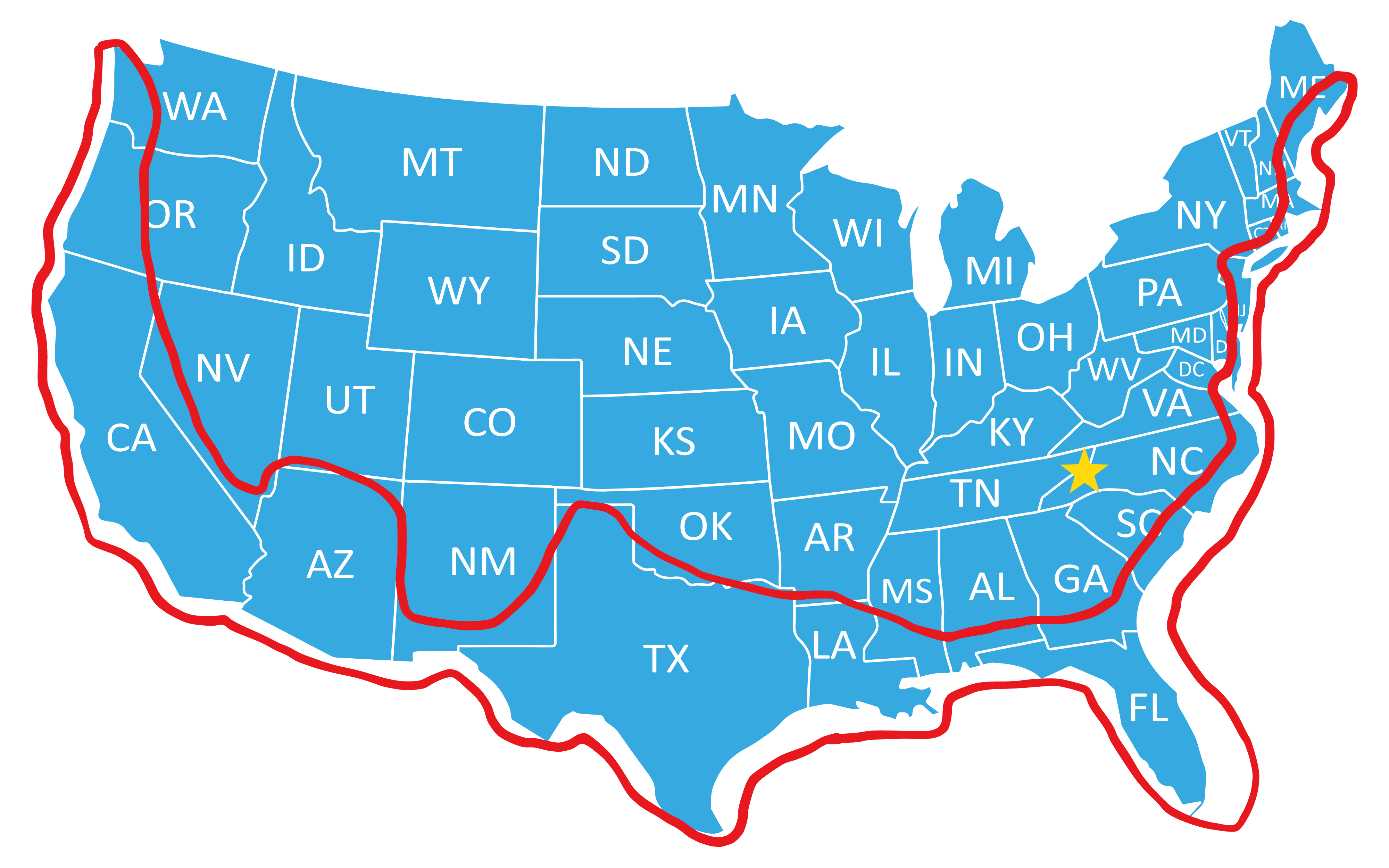

Sure, likening Eric Tao or Rishi Ramdani to a mass-produced tote bag might seem unfair. But an AI reckoning for their real-life Wall Street equivalents is coming, and those who are willing to pony up more money for a personalized human touch are gonna trust people like Sweetpea over Rishi any day of the week. Mark Gongloff asked me — well, really all of his readers — to draw areas vulnerable to climate change on a map of the US. Here's mine. Forewarning: It's pretty ugly. And by no means a reflection of the truly wonderful data visualization capabilities we have at our disposal at Bloomberg News: Predictably, I circled all of the coasts and a handful of troublesome states — Arizona, California, Texas, Louisiana and Florida — for good measure. But clearly I didn't go inland enough: That yellow star you see near the Appalachians — which I added after my initial doodle — is western North Carolina, a temperate, mountainous region that Mark says is the new poster-child for disaster preparedness. "Some places there received more than 2 feet of rain before and during [Hurricane Helene], causing biblical flooding that has taken at least 40 lives, wiped away towns and roads and lifted houses from their pilings to float away downstream," he writes. "It's stark evidence that no matter how insulated people might feel from the global heating humanity has caused by burning fossil fuels and otherwise generating planet-warming gases, there are no real safe havens." The widespread wreckage — 200-plus miles of closed roads and empty grocery store shelves — came as a major shock to even the most climate-aware. "If you had asked me a week ago, I would probably have recommended Asheville, North Carolina, as an ideal spot to ride out the climate emergency. It's a lovely, vibrant city far from the ocean, with plenty of fresh water and not so vulnerable to heat. I wasn't alone; Asheville often pops up on lists of possible climate havens. All of us were tragically wrong," Mark admits. Bonus Disaster Reading: -

People are still willing to pay a lot of money to live in Miami — oftentimes in cold hard cash. — Jonathan Levin -

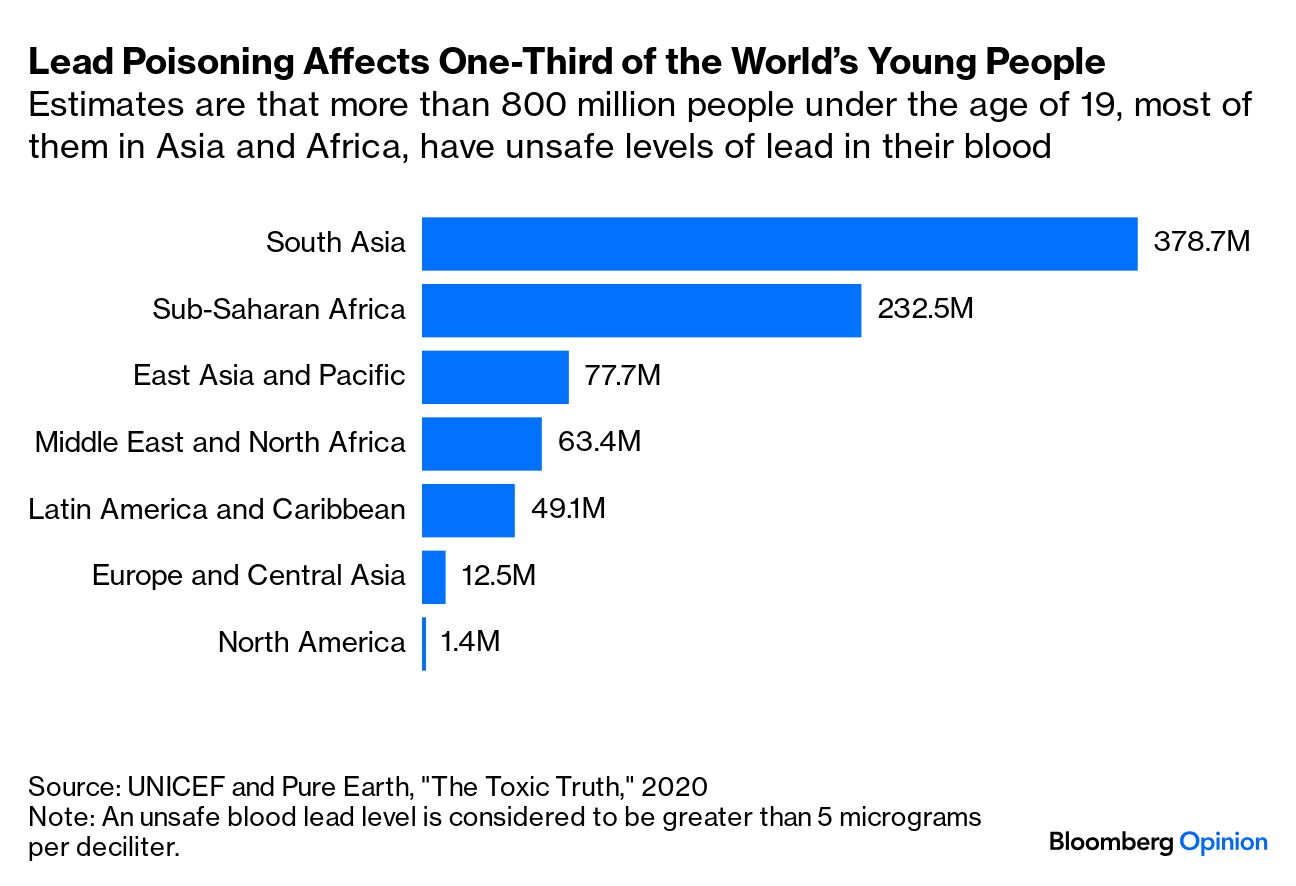

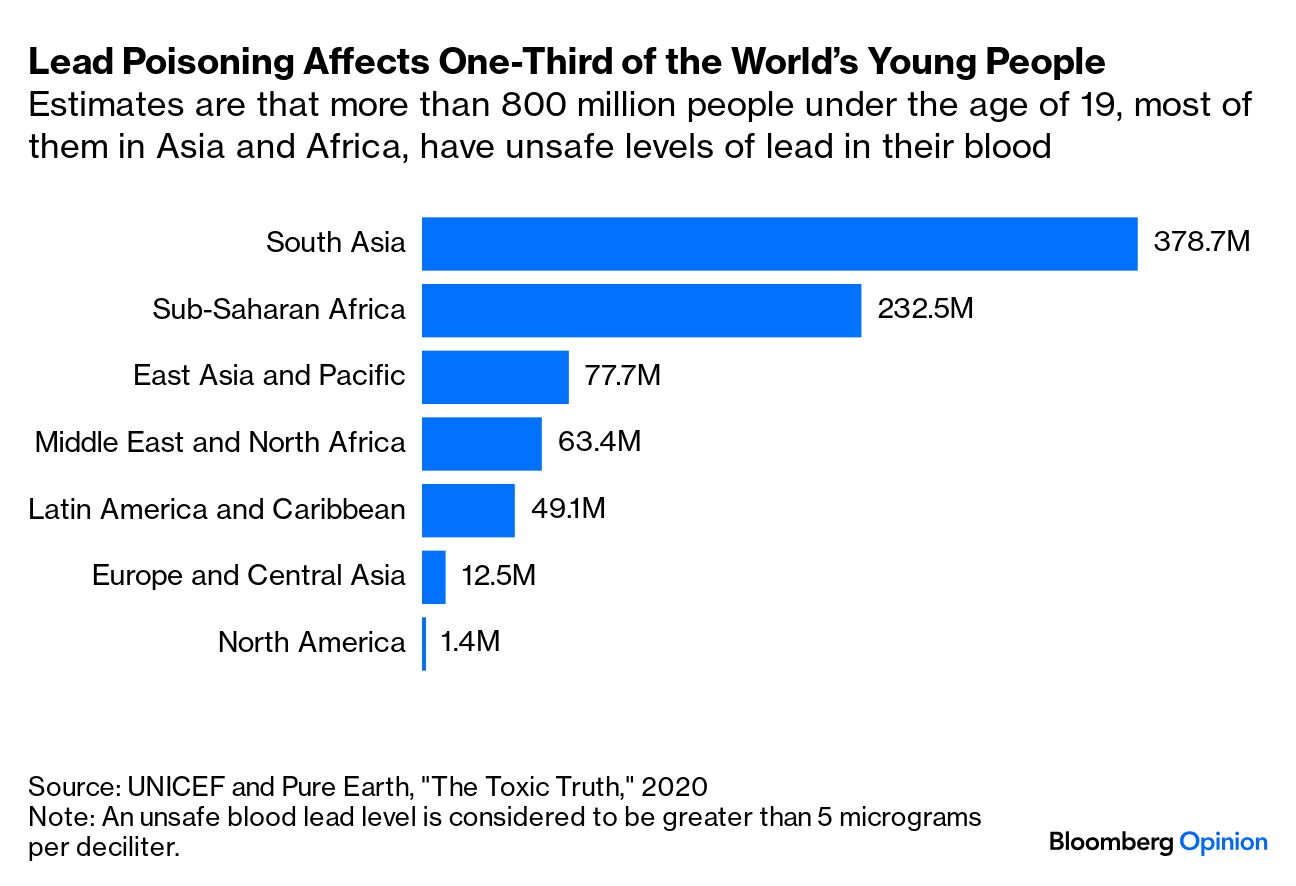

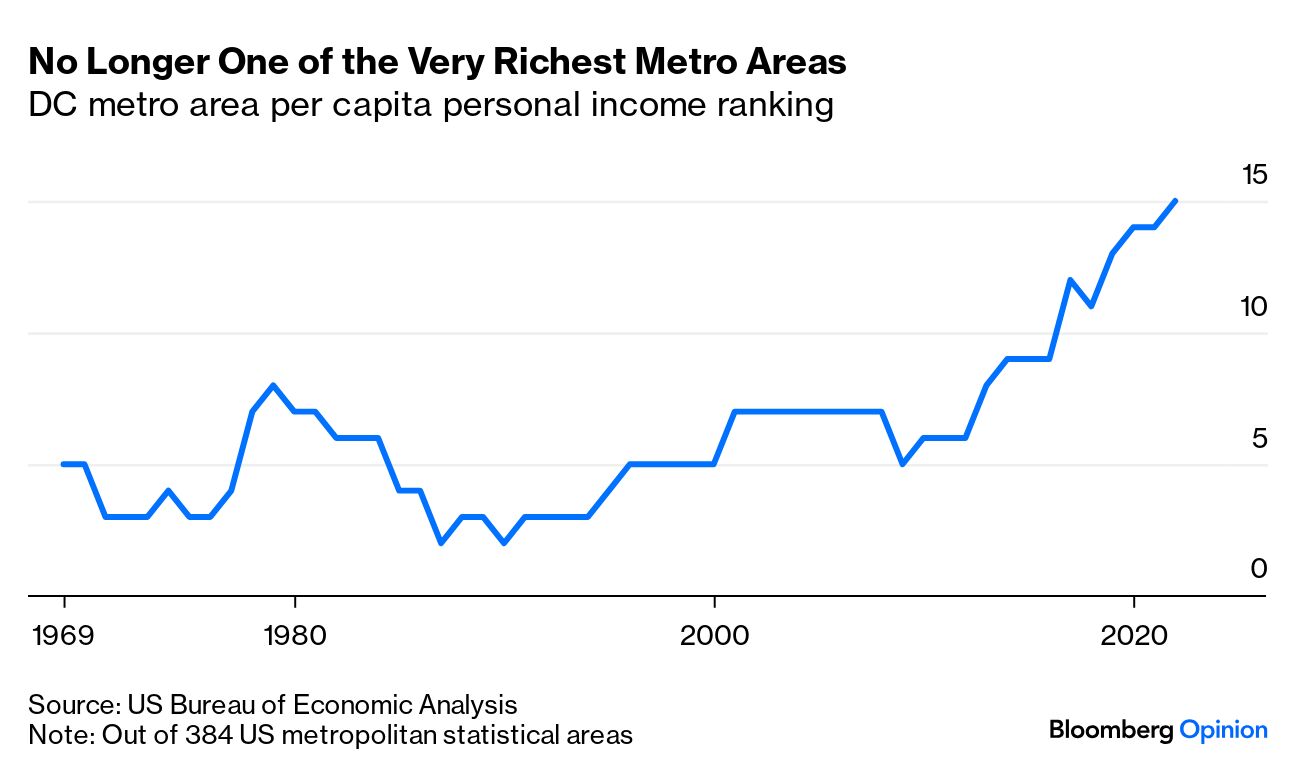

Scientists should issue hurricane-style warnings to save lives during disease outbreaks. — F.D. Flam Nobody's talking about how President Biden has a worldwide initiative to reduce lead poisoning, but we should be! Globally, lead poisoning is almost seven times more prevalent than it was in Flint, Michigan. Bangladesh has lead in its turmeric. Pakistan sells eye makeup with lead. Turkey enhances Henna with lead. Afghanistan cooks with aluminum coated in lead. Matthew Yglesias says Biden's little-known program to curb all that might end up being one of his "greatest legacies," but it likely won't be felt for decades.  Welp, looks like we don't need to worry about Washington, DC "becoming * the* imperial city of the United States" — a concern some people apparently share! — anytime soon. Justin Fox says "the area isn't all that rich, for one thing. And it has been losing ground to other regions in recent years," contrary to all those SoulCycle classes you hear about. "Unlike the UK, or France, or Japan, the US is not experiencing an ever-growing concentration of wealth and economic power in and around its capital," he writes. I suppose that's something to cheer! A Ukraine cease-fire deal might do more harm than good. — Bloomberg's editorial board Kari Lake has lost her luster and is trailing badly in Arizona's Senate race. — Erika D. Smith Even Ryan Reynolds couldn't fight Britain's bureaucratic blob. — Matthew Brooker After the Hezbollah leader's death, Netanyahu may choose more war. — Marc Champion A medicine linked to patient deaths has been abruptly pulled from shelves. — Lisa Jarvis Dropping thousands of voting registries is disenfranchisement in disguise. — Patricia Lopez Xi Jinping's latest stimulus signals a technocratic shift within China's government. — Shuli Ren A blank check started World War I. The US can't do the same with Israel. — Andreas Kluth Can Labour boost growth and productivity without angering its voters? — Martin Ivens California banned private legacy admissions. LVMH sold Virgil Abloh's Off-White. Beyoncé revived Levi's "Launderette" ad. Megalopolis is playing in near-empty theaters. Have we gotten Aubrey Plaza wrong this whole time? Timothée Chalamet got a nerd makeover. What happened to NYC's health inspectors? Notes: Please send sweater vests and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment