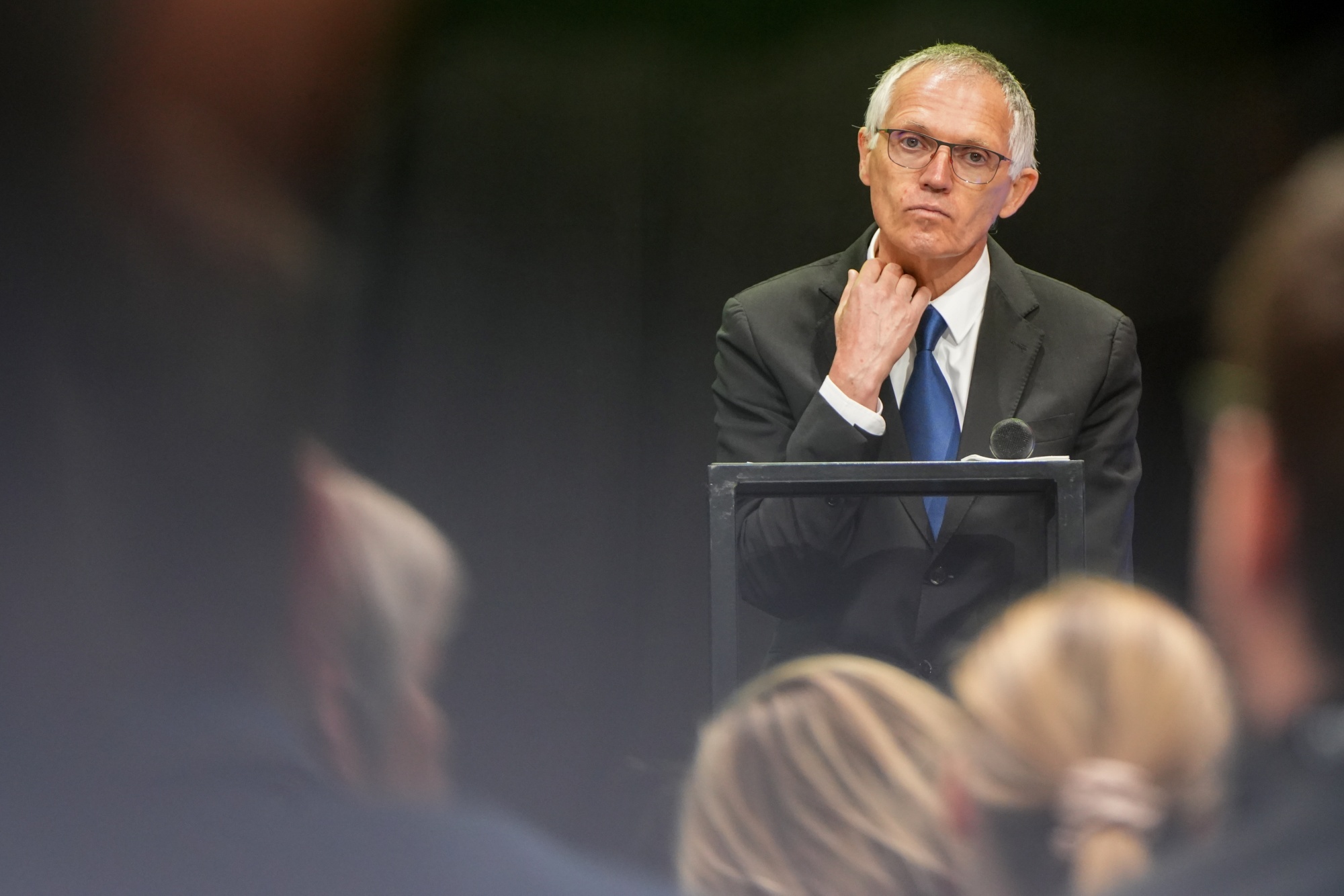

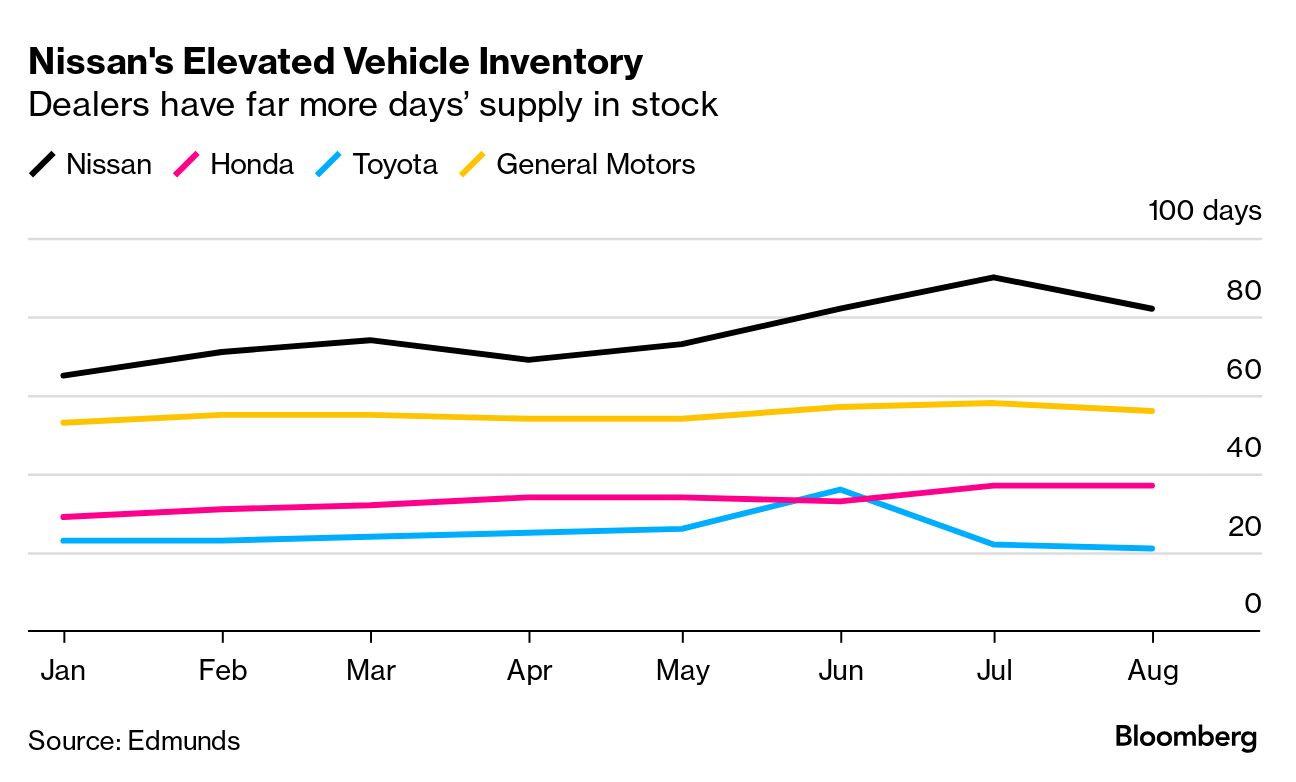

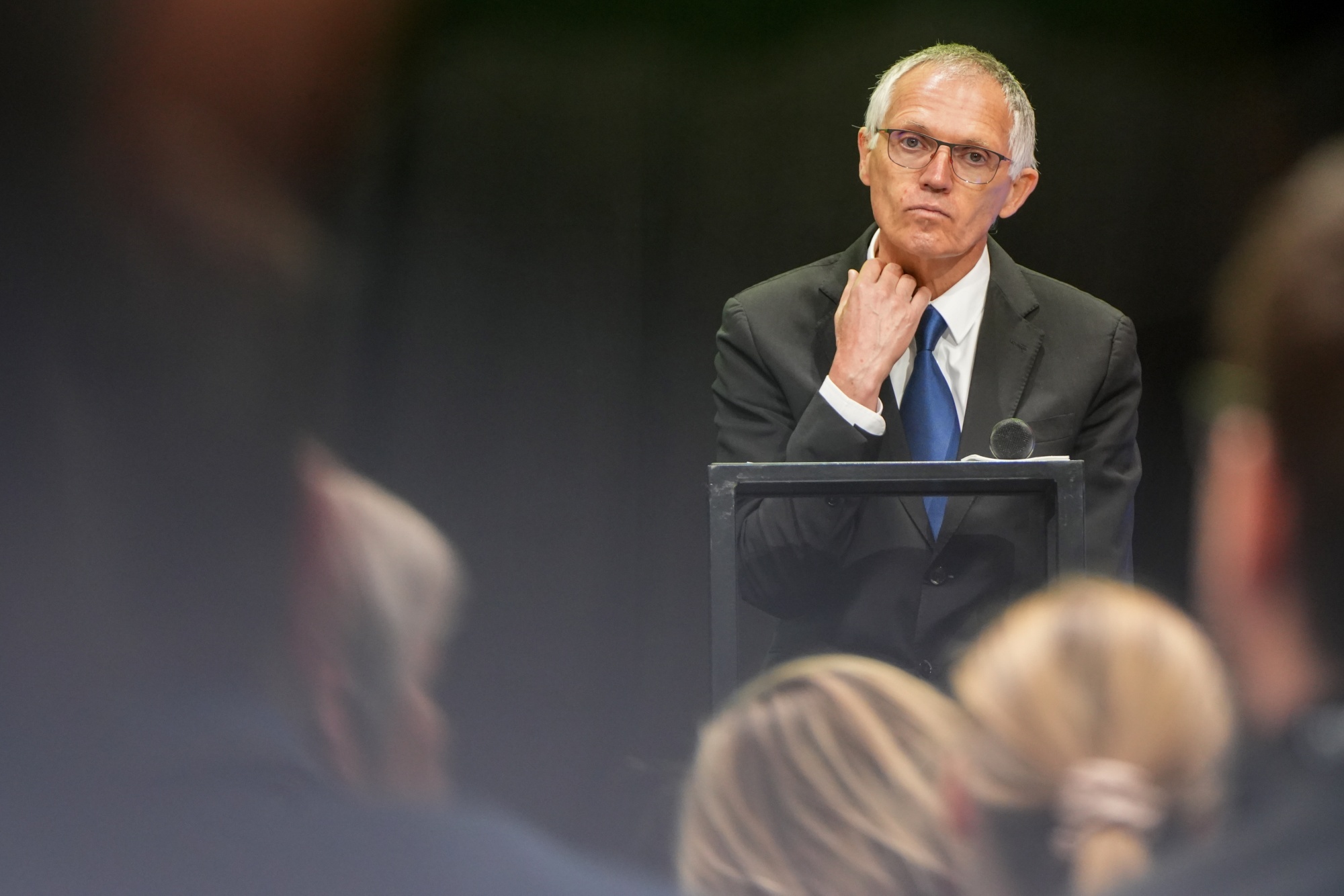

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Nissan is in trouble, and the global sales numbers the company put out late last week will do little to assuage investors. In fact, the figures may only escalate concerns the Japanese automaker will fall short of its profit forecast for this fiscal year, which management already slashed in July. Worldwide sales tumbled 5.5% in August, Nissan's fifth consecutive monthly decline. The manufacturer's biggest problem areas were China and the US, two markets Nissan relies on for roughly half its global volume. In China, sales slumped 24% — bad, but arguably not much of a surprise given Nissan is closing a plant and cutting production capacity after years of deteriorating performance. The company is having a hard time keeping up with local carmakers offering electric vehicles loaded with high-tech features that appeal to Chinese consumers. In the US — where Chinese cars are scarcely available due to tariffs — Nissan is facing an altogether different issue. The company doesn't have any hybrid models at a time gas-electric models are in vogue. Sales slipped 0.1%, the first monthly decrease since April. The dip came despite Nissan's efforts to tame inventory in North America by increasing incentive spending. CEO Makoto Uchida said in July his focus was on clearing the stock of cars on dealer lots, which doesn't seem to be going so well.  Nissan CEO Makoto Uchida. Photographer: Kiyoshi Ota/Bloomberg In the first half, the average Nissan dealership in the US earned 70% less than in the same period a year ago, Automotive News reported last month. Americans simply aren't buying Nissans like they used to, despite the company's splurging on advertising and incentives. Car lots are still stuffed with 2023 models even after new 2024 vehicles have been released. "To clear the inventory, Nissan will either have to bring in new models or cut prices," said James Hong, an analyst at Macquarie Securities Korea. While the carmaker recently launched the Infiniti QX80 sport utility vehicle and Nissan Kicks crossover, the two are lower-volume models and will do little to reduce the stockpile, he said.  A Nissan dealership in California. Photographer: David Paul Morris/Bloomberg Meanwhile, Nissan's top-selling EV in the US — the Ariya SUV — isn't eligible for the federal government's purchase tax credit of up to $7,500 because it's made in Japan. Nissan has gotten around this somewhat by taking advantage of credits available to leased vehicles. It's offering leases for as low as $199 a month, making the Ariya one of the better EV bargains around. Even so, data from car-shopping researcher Edmunds show Nissan still has among the highest levels of inventory in the country among major automakers. Nissan has pledged to launch seven new hybrids and EVs in the US by 2028. The question is whether consumers will wait around that long, or look elsewhere. The automaker's operating profit plunged last quarter by an alarming 99%, leading management to lower their outlook for the year ending in March by 12% to ¥500 billion ($3.5 billion). The company also trimmed its full-year sales target to 3.65 million units. Equity investors are clearly concerned — Nissan's shares are down 27% this year — and credit analysts are starting to pen reports with alarming headlines. S&P Global cut Nissan's credit rating to junk in March of last year. The automaker nevertheless plans to buy back ¥79.9 billion of its shares from Renault as part of an agreement to rebalance its alliance with the French carmaker. The repurchase will send funds Renault's way as it competes with Chinese automakers pushing into Europe. Nissan is looking closer to home for help, teaming with Honda on software and electric-car development. Aside from monthly sales reports, investors will get their next look at Nissan's results in November, when the company is due to report its earnings for the quarter ending this month. If sales in the US and China don't improve, those numbers are poised to disappoint. — By Supriya Singh  Stellantis CEO Carlos Tavares. Photographer: Nathan Laine/Bloomberg Stellantis and Aston Martin shares plunged Monday after the two issued profit warnings, taking after recent moves by Volkswagen, BMW, Mercedes-Benz and Volvo. Adjusted operating income margin will slump to 5.5% to 7% this year, down from a previous forecast for a double-digit percentage, Stellantis said. It's also now projecting industrial free cash flow will range from negative €5 billion ($5.6 billion) to negative €10 billion, versus prior guidance for positive cash generation. Aston Martin also lowered its earnings and cash flow projections, citing supply chain disruptions and weakness in China. - Volvo, Rivian, Uber urge EU to stick with combustion car phase-out.

- Major Japanese investors opposed Akio Toyoda's reappointment.

- Eastern US ports prepare to close as labor talks stall.

Spectators watch a street takeover in East Compton. Photographer: Myung J. Chun/Los Angeles Times California is cracking down on a surge in deadly street takeovers. Often organized through social media, these chaotic events — also known as sideshows — have transformed quiet streets into dangerous arenas where drivers race, spin out and burn rubber for cheering crowds. Over the weekend, two people were killed in separate homicides connected to sideshow events in Sacramento. Hundreds of people joined an illegal street takeover in South Los Angeles in June, when more than 50 participants looted a nearby auto-parts store, stealing an estimated $67,000 in merchandise, according to the Los Angeles Police. |

No comments:

Post a Comment