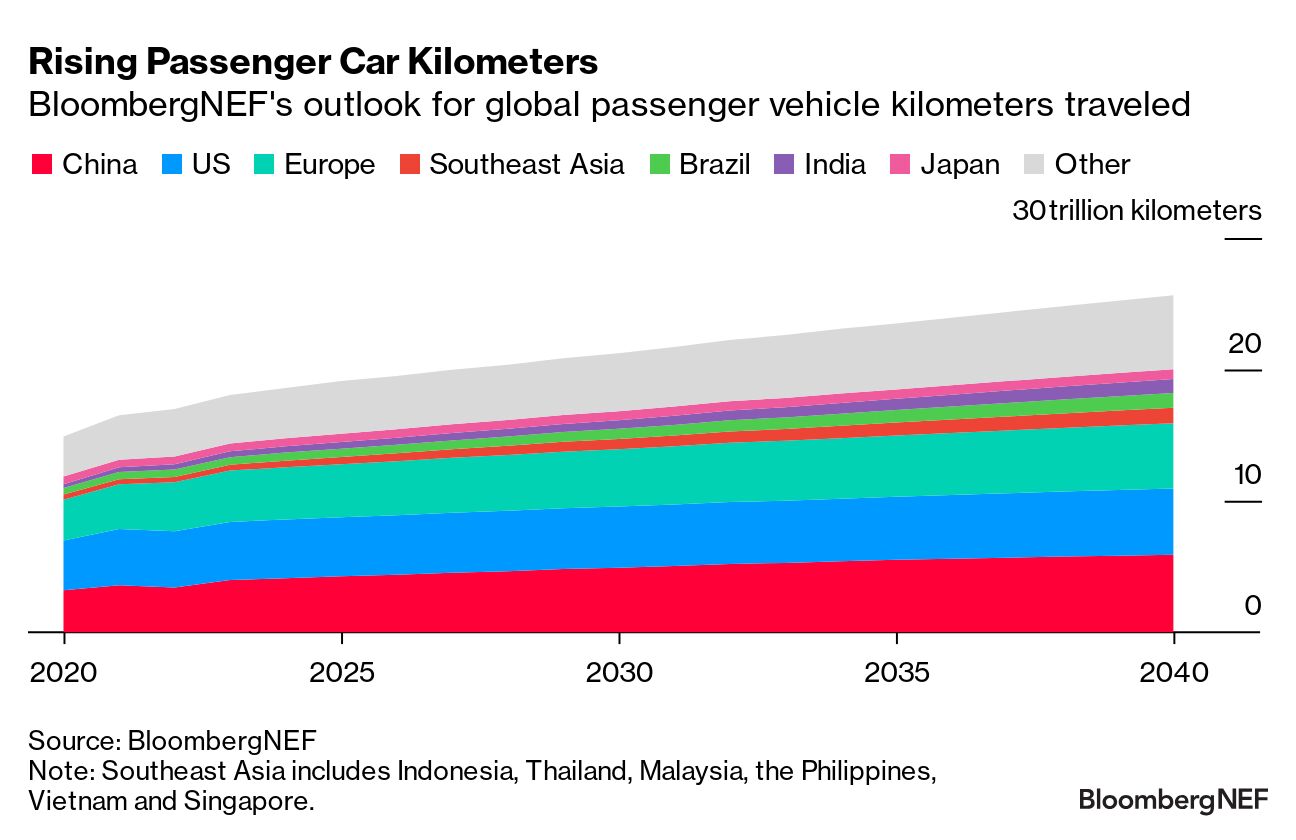

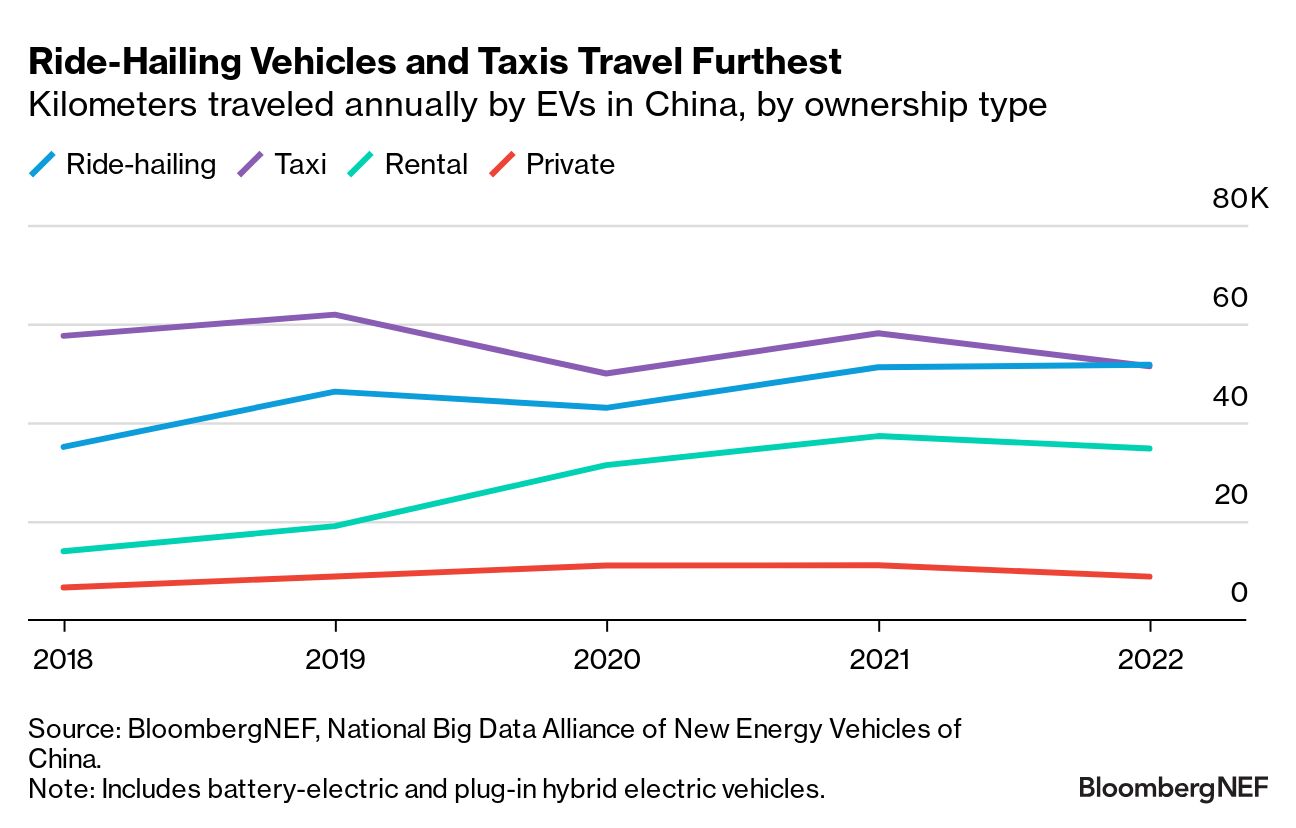

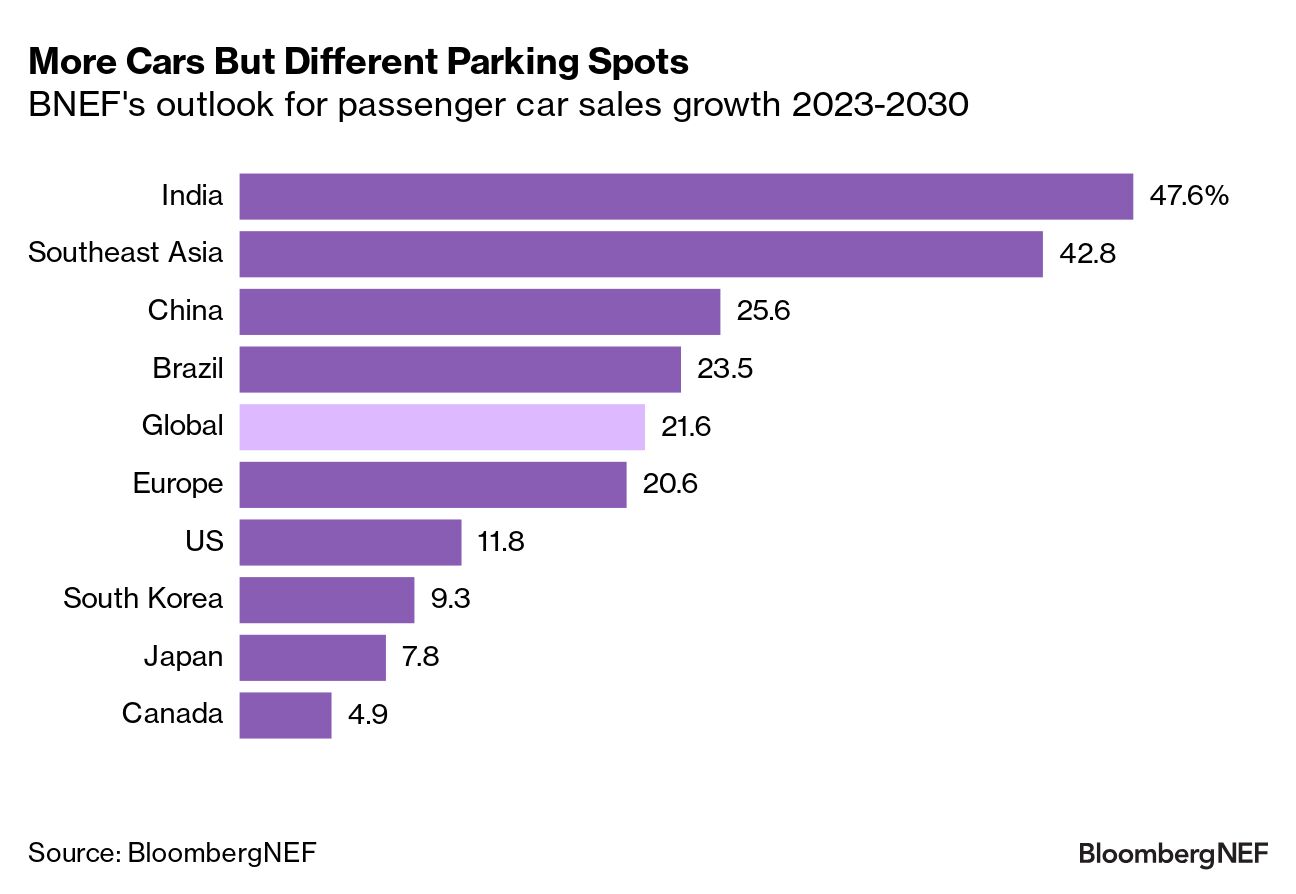

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. India, Brazil, China and countries in Southeast Asia are expected to fuel car-sales growth in the coming years as people there will be increasingly on the move, according to new analysis by BloombergNEF. As a population gets richer, it travels more — usually in the form of driving a passenger vehicle. The distance covered by cars could keep rising all the way through to 2040, according to BNEF's latest annual outlook for light-duty vehicles. Trips will grow fastest in emerging markets such as India, where annual vehicle miles traveled are expected to double by 2040. More vehicles will be needed to complete all those trips, so the size of the passenger-car fleet will expand — rising from 1.3 billion vehicles today to a record 1.62 billion in 2040. Again, most of the expansion is in India, Southeast Asia and Brazil, with China also still showing growth as motorization rates increase in the country's smaller cities. Mature markets like the US, UK, Germany and Japan will hit a peak in the mid-2030s. The size of the fleet will vary depending on the prevalence of shared mobility. Taxis and ride-hailing vehicles travel far further than the average private car. With more shared vehicles, a fleet is capable of providing the same amount of mobility with fewer cars on the roads. Shared and autonomous mobility services accounted for less than 4% of global passenger vehicle kilometers traveled last year, but BNEF's outlook sees this approaching 16% in 2040. The shared car fleet could reach 56 million, and the robotaxi fleet may exceed 23 million in 2040 — though there's a lot of uncertainty related to the timing and speed of autonomous vehicle deployment. Economic growth in emerging markets with low motorization rates does translate into higher demand for passenger cars. India and countries in Southeast Asia will see sales rise by 48% and 43%, respectively, until 2030. China — the world's largest auto market — will grow by over a quarter during the same period. The automotive industry has been on a wild ride this decade, with a global pandemic, semiconductor shortages and trade wars weighing on sales. Still, passenger cars are the most significant form of road transport and will remain vital to how people get around in the coming decades. Bloomberg Terminal subscribers can find BloombergNEF's annual outlook for light-duty vehicles here and BloombergNEF clients can find it here. — By Andrew Grant  Kevin Wood with his EV. Photographer: Alex Atack for Bloomberg Green Kevin Wood, who lives in Hampshire, UK, bought his first electric car last year, choosing an Atto 3 made by China's BYD. Ten months later, he remains impressed by the SUV's range, handling, comfortable seats, trunk space and voice-controlled sunroof. Wood had never heard of BYD before test-driving the Atto — but BYD has its sights set on drivers like him. Less than two years after entering the EU and UK markets, the carmaker is pursuing a rapid expansion in both, replete with TV and billboard spots, prime placement at auto shows, and sponsorship of the Euro 2024 football tournament. By the end of next year, BYD plans to double its UK sales and service locations from 60 to 120. |

No comments:

Post a Comment