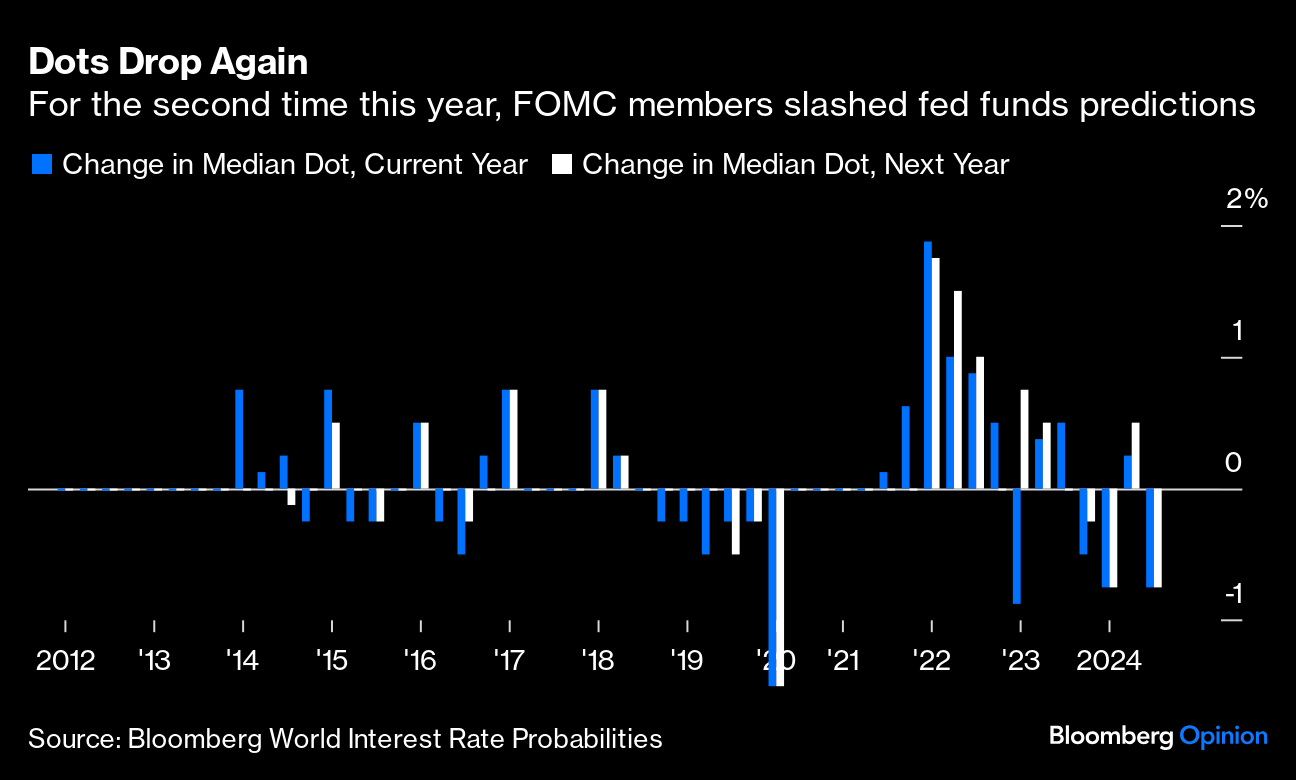

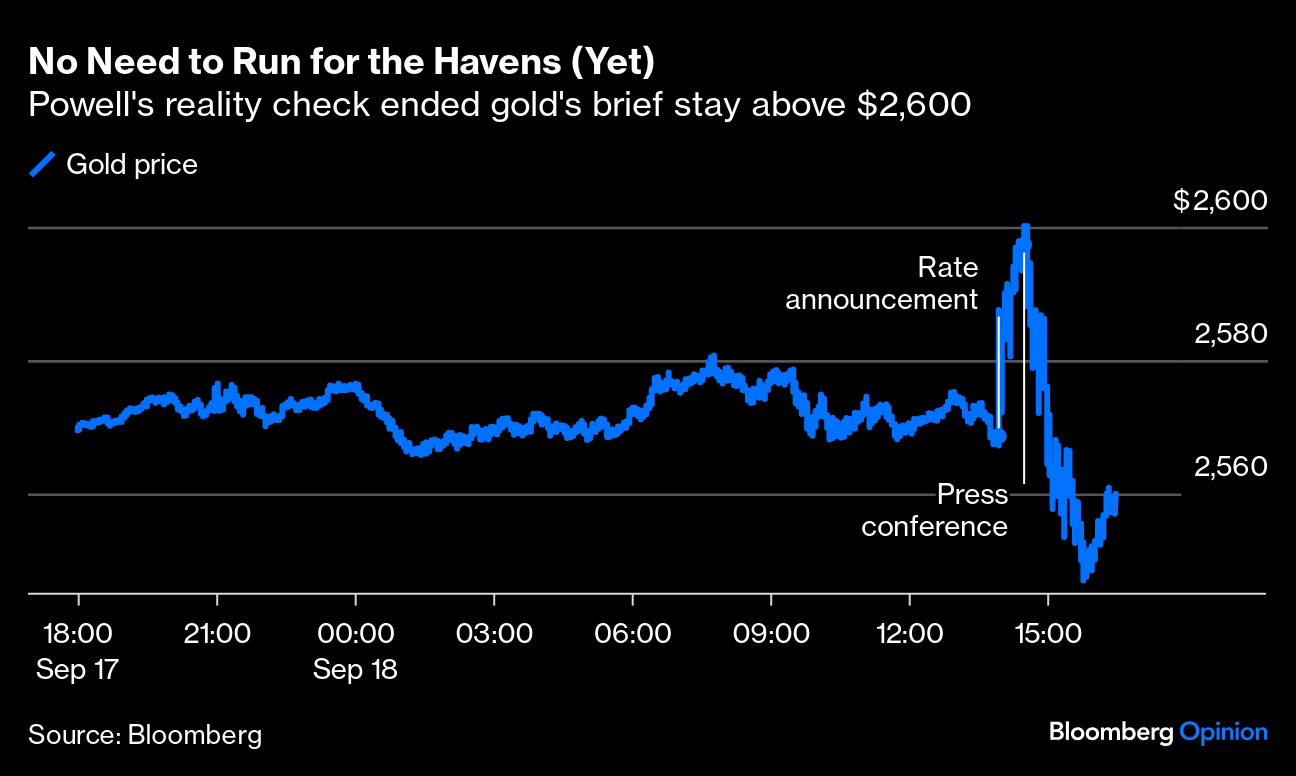

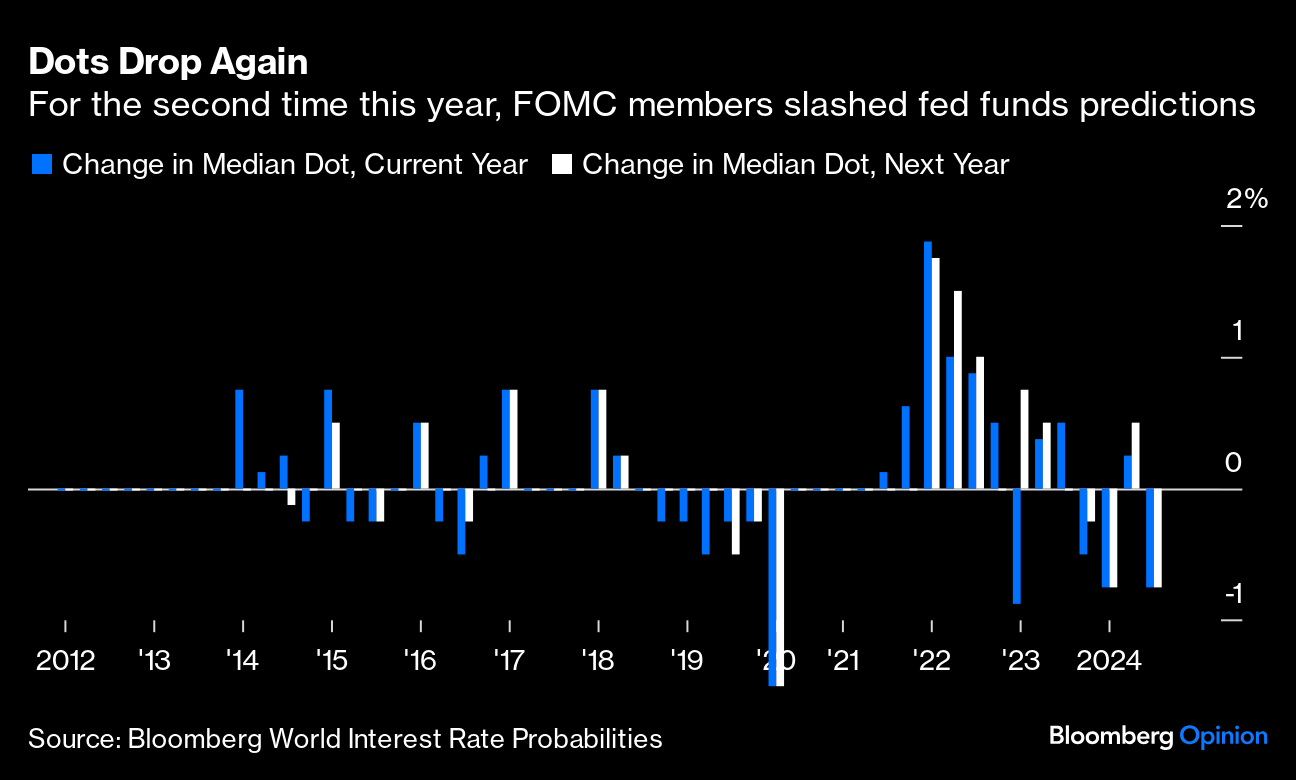

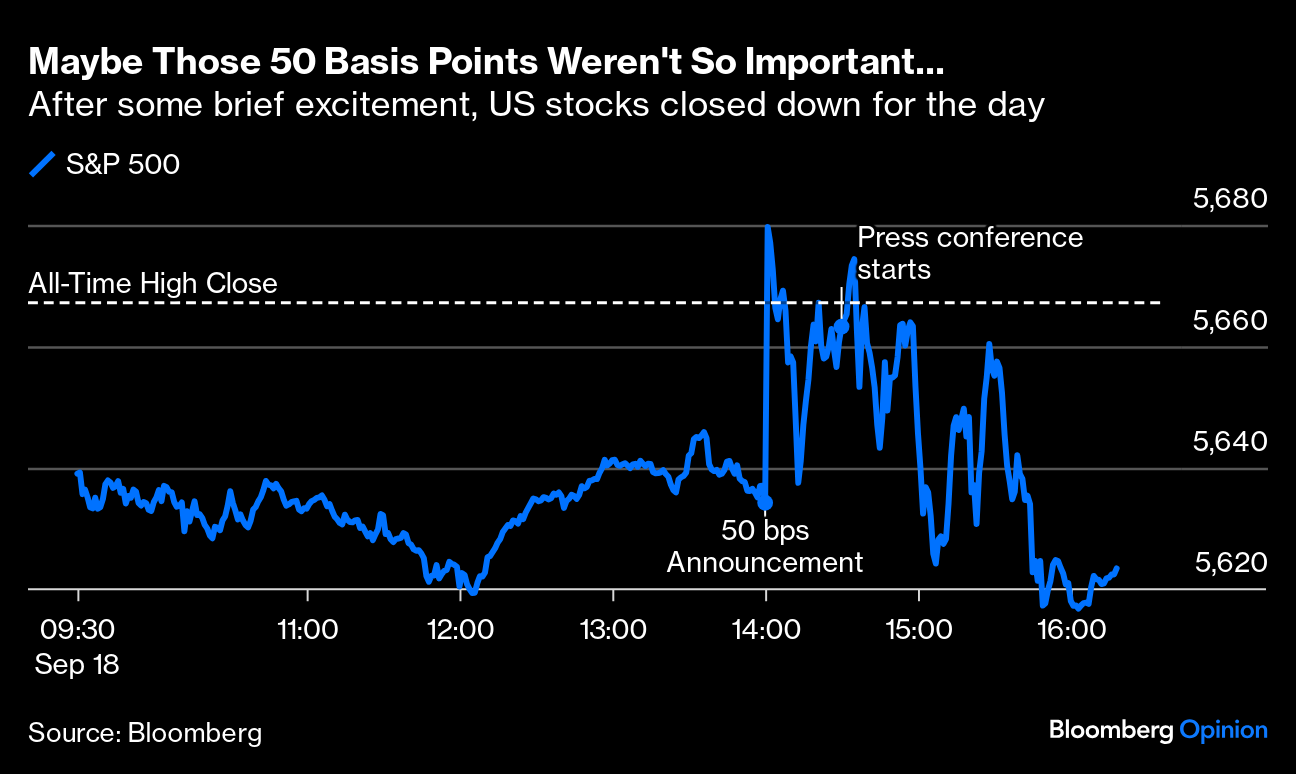

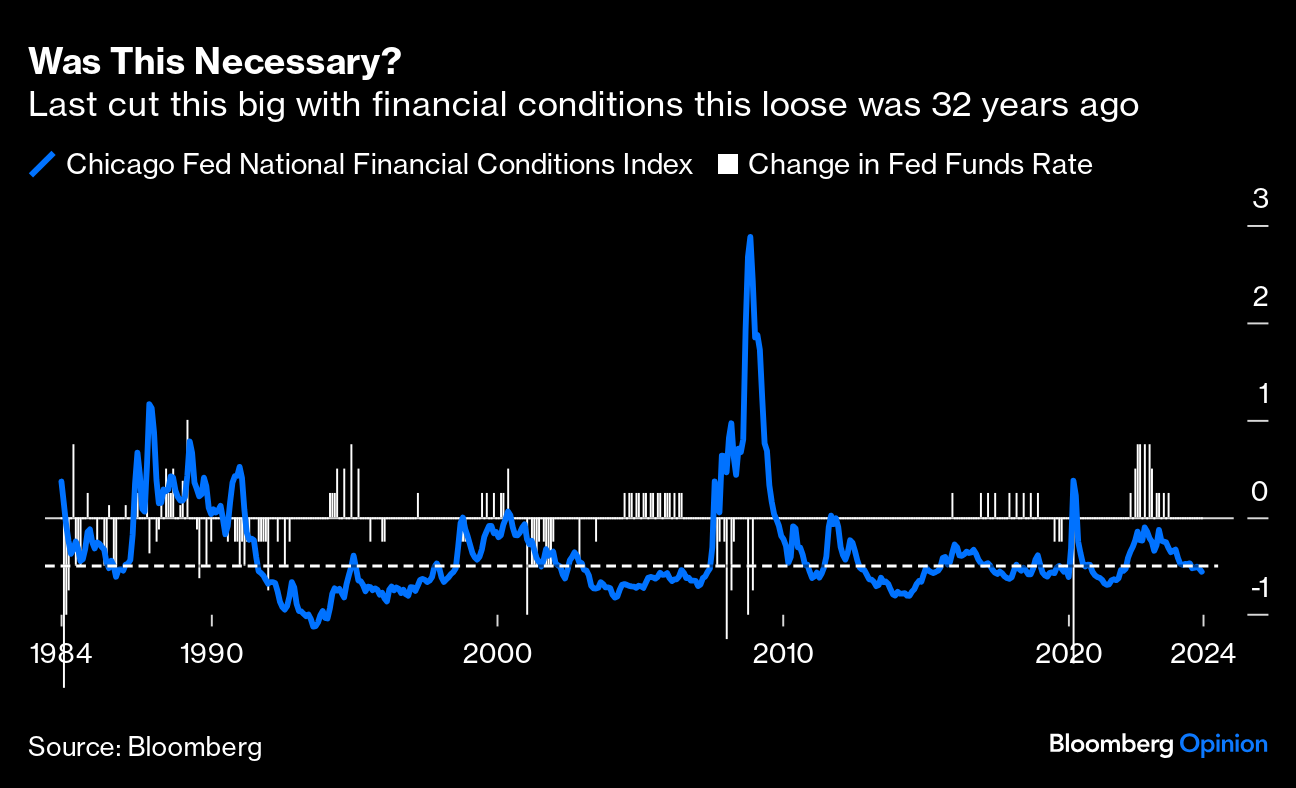

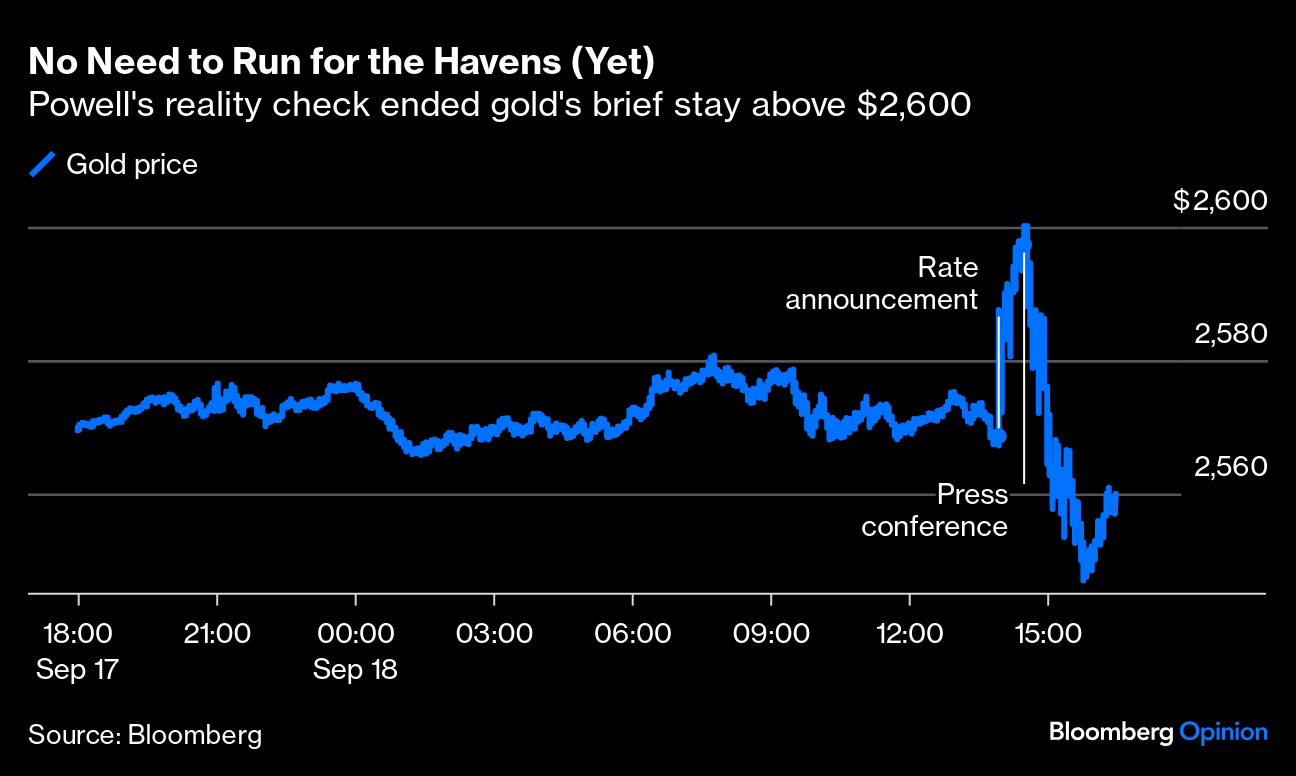

| The Fed went for it. The first cut to the benchmark fed funds rate in four years was a big one of 50 basis points. Market pricing had moved in the last few days to imply that there was a slightly better than 50-50 chance that this would happen, but the economists away from the trading floor largely weren't expecting it. Only nine out of 113 economists who responded to Bloomberg's survey expected a cut of this magnitude. The Federal Open Market Committee accompanied the jumbo move with a big shift in its predictions for where the rate will be at the end of this year and next, set out in the quarterly Summary of Economic Projections, commonly known as the dot plot. The median expectation for the end of both 2024 and 2025 dropped by 75 basis points. This isn't extraordinary, as they made exactly the same adjustment earlier this year. It would bring the effective rate to 3.4% by the end of 2025, compared to the 5.33% where it's been set for the last 14 months. But such a drop is unusual at a time when there's no obvious crisis to change the perceived balance of risks:  That makes it all the more intriguing that by the close of trading, after Federal Reserve Chair Jerome Powell had explained his thinking in his regular press conference, that markets had decided to treat the mega cut as a disappointment. The S&P 500 surged above its previous all-time closing high immediately after the announcement; two hours later, it ended down for the day. That's because of a turnaround in expectations for the future, which can be most easily gauged using the Bloomberg Terminal's World Interest Rate Probabilities function, derived from the futures market. The implicit rate expected for the December meeting dropped by 15 basis points on the announcement, but then rebounded, taking with it bond yields that had fallen dramatically over the last month. It finished the day almost exactly where it was Monday morning: Why the turnaround? First, there were the dots. You can debate how important they are, but when it comes to predicting where rates will be only three months from now, they should be taken seriously. FOMC members should have a good idea. The median dot suggests that there are only 50 basis points more in cuts to come this year. No more jumbos. Then Powell stated: "I do not think that anyone should look at this and say, 'Oh, this is the new pace.'" The initial move in fed funds futures suggested people had said exactly that. Asked whether it had been a mistake not to have cut at the last meeting in July, he admitted that the Fed probably would have moved if it had had access to the surprisingly good inflation numbers for June, which were published shortly afterward. In other words, Wednesday's cut should be seen as a "catch-up" and not a harbinger. That helped him tackle the greatest objection to such a steep cut, which is that it simply wasn't necessary. Big cuts generally happen at times of great stress — most recently the pandemic and the Global Financial Crisis. According to the Chicago Fed's index of financial conditions, things presently are about as lenient as they get. The last time the Fed cut this much when financial conditions were set this fair was way back in 1992: That might have made the cut look irresponsible. But Powell could present it as wholly good news, because it was so obviously unforced by circumstances. Big cuts in a crisis merely prove that things are tough. The key for Powell, to use the phrase of Goldman Sachs' Lindsay Rosner, was to convince his listeners that this was "a focused 50, and not a fearful 50." There's still a long way to go. Entering Wednesday, the Fed's estimate for fed funds at the end of next year was 120 basis points above the futures market's. By close of trade, that was down to 50 basis points — a big drop in eight hours, though still not on the same page. But for now, this was one case where words spoke much larger than actions. Powell managed to convince all and sundry that he was cutting from strength, not weakness, and narrowed the gap between him and the markets. And that led to... Gold's ascension to an all-time record on the Fed cut — just like that of the S&P 500 — was short-lived. Bullion had topped $2,600 an ounce for the first time ever in the minutes after the decision. The surge was typical of haven assets, which tend to gain on lower interest rates. However, the retreat from the peak appeared to be ignited by Powell's insistence that subsequent cuts won't be paced at 50 basis points. After all, he has consistently spoken of the Fed's data-dependent approach, which means playing by ear with no commitment to future actions. Perhaps reiterating his position reduced investors' optimism that gold should flourish as the easing cycle gets underway. The following chart tracks bullion's rise and fall during Powell's press conference:  Before the rate decision, gold had enjoyed a good run on the back of optimism for a cut and rising demand, shattering its record several times. It's up more than 24% for the year. An eventual policy easing should have provided more wind in the sails. Is it possible that rate cuts have already been priced in? TD Securities Bart Melek believes so: This is why we're seeing a bit of a relaxation in that upward momentum today. We have an outside long position among the discretionary trading community relative to open interest, which is priced for perfection. Now, my suspicion is that the gold market was a little bit more dovish about where the Fed is going than analysts or the bond market.

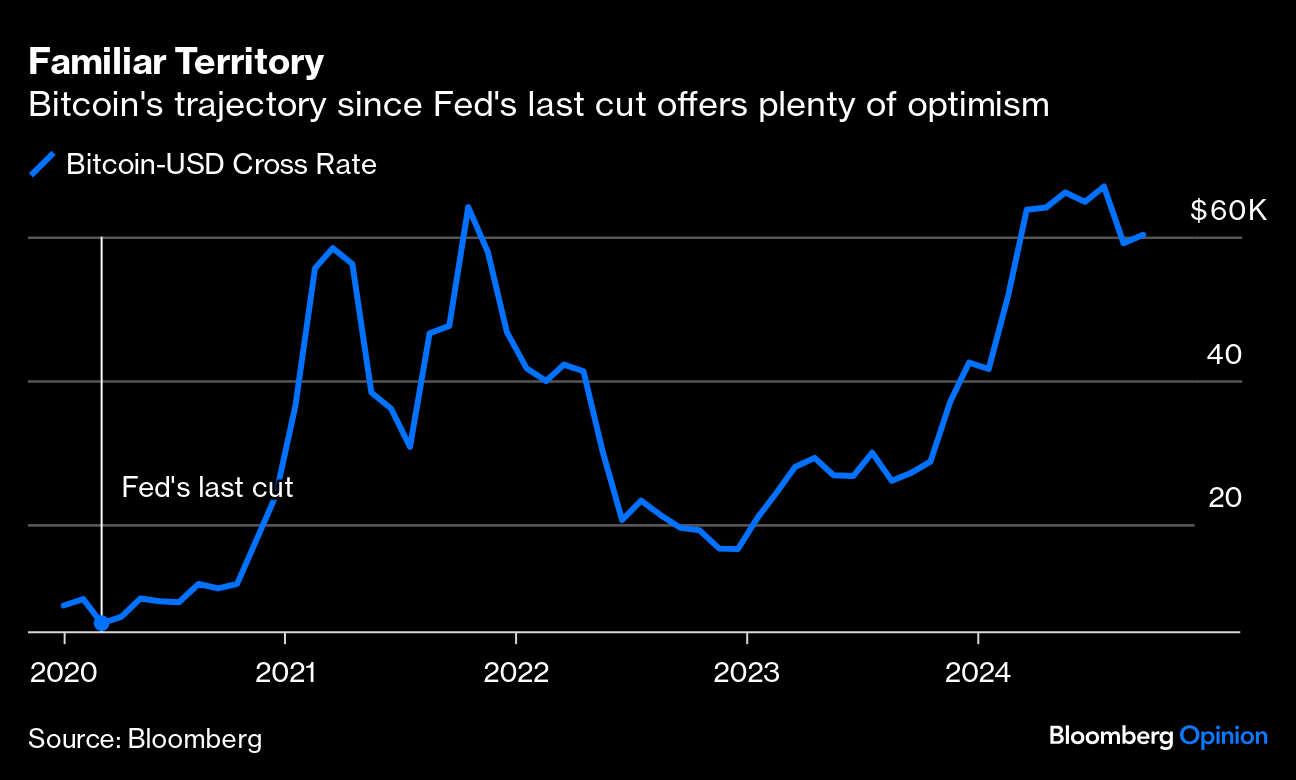

It's almost a no-brainer predicting where gold goes from here, as it surged in each of the last six easing cycles since 1989. Expecting investors to continue their flight to the safe haven asset is sensible. TD Securities sees bullion surpassing $2,700 in early 2025 on institutional and retail inflows into gold exchange-traded funds and derivatives, and continued strong central bank appetite for the physical metal as the dollar weakens and the risk rally ebbs. Bitcoin, also considered a haven asset these days, flattered to deceive. It gained about 2% before erasing all of that increase, while smaller tokens mostly declined. Bitcoin's trajectory since the Fed's last easing during the pandemic's initial panic had aligned with the notion it should appreciate when monetary policy gets loose: Frnt Financial's Stephane Ouellette expects Bitcoin to take off in the coming months. In 2020, it entered a full-blown bull market in early winter after emergency liquidity measures were announced in the summer: Market dynamics are incredibly benign at the moment. There is all but no leverage in the ecosystem, and it has received relatively little attention. It all speaks to early-market cycle dynamics as opposed to late-cycle, where leverage is high and attention is extreme. The fact that we're entering a liquidity cycle at a point with such benign market dynamics has us highly bullish on the asset over the next year.

Meanwhile, Donald Trump's newfound admiration for crypto makes the asset class interesting to watch even beyond the elections. Hedge fund manager Anthony Scaramucci sees Bitcoin reaching new record highs on the back of more regulatory clarity on the crypto industry from the US and a loose monetary policy. Whether these stars would align anytime soon for Bitcoin's breakout isn't certain. However, it makes sense to suspect that whoever wins the election will have something to do with how quickly the new clear rules for crypto become a reality. —Richard Abbey Some observations on politics are unavoidable these days. Former President Trump complained that the cut either meant a bad economy, or the Fed was playing politics. Other Republican politicians argued that the timing was suspicious. Why is this wrong? Let me count the ways: - Powell is a registered Republican, who served at the Treasury in Republican administrations. He was appointed by Trump.

- Monetary policy operates with a long lag — if the Fed really wanted to help the Democrats, they would have done this months ago.

- Inflation is a much hotter political issue than unemployment — so a cut shows complacency.

- Reputation matters to central bankers. They really want to avoid the humiliation of cuts that allow inflation to take off.

- A big cut now risks being taken as a sign of economic trouble, just before the election — which is a point Trump made himself.

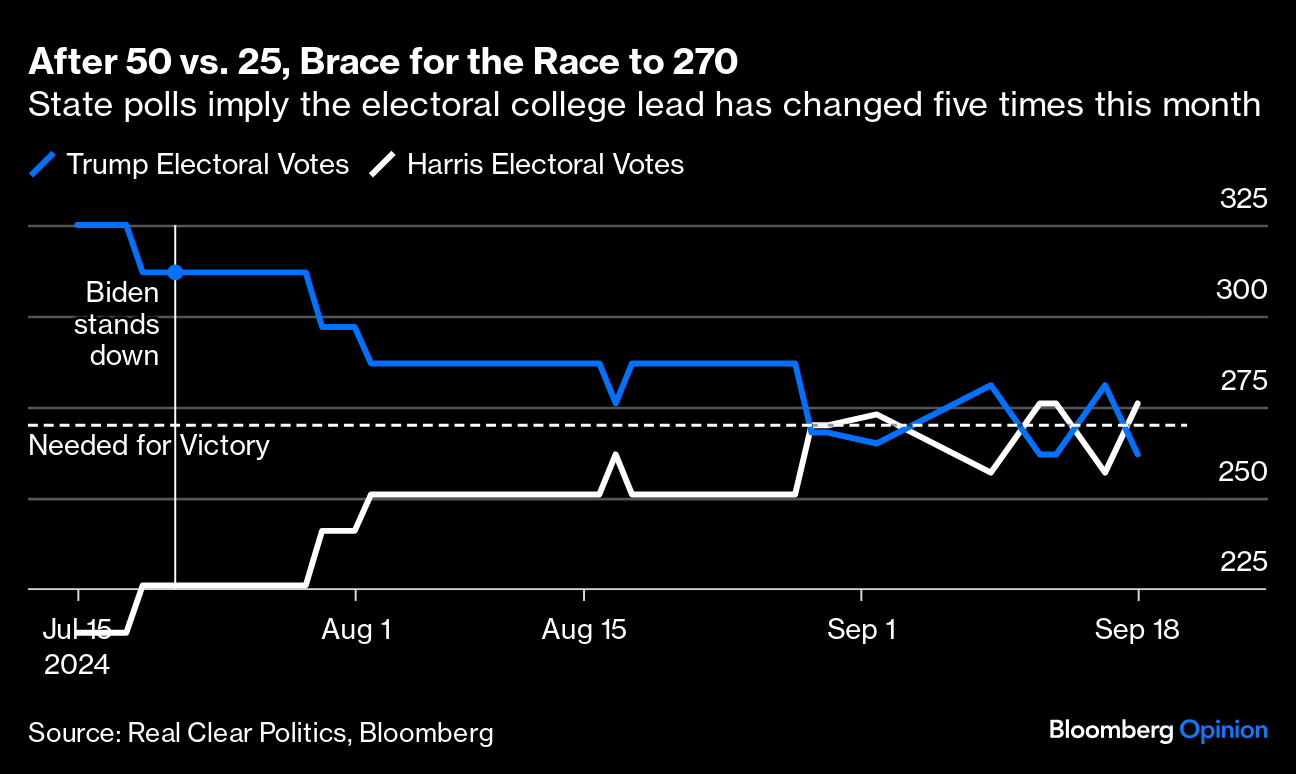

Conflict between presidents and the Fed has been going on for decades, but while in office Trump put particularly explicit pressure on the central bank to cut. He has promoted the idea that a future administation would reform the Fed's independence and allow for presidential input into rate decisions. That makes it difficult to see why he'd have a problem with the kind of politics he suggests are currently at work.  Trump wants his own input at the Fed. Photographer: Emily Elconin/Bloomberg If there is a sense that politics factored into the Fed's move, it centers on uncertainty. The election is two days before the FOMC next meets. That vote is consequential for markets if only because of the wide gap between the candidates on corporate taxes; and of course it matters for many more reasons beyond that. If gauging the size of this cut was a problem, working out who will win the Electoral College is a full-blown nightmare. The chart below, created using the WSL Election function on the terminal, is based on the assumption that each state is won by the candidate currently leading in the Real Clear Politics polling average on a "no toss-ups" basis. This involves awarding states and their electoral votes — the winning number is 270 — to whomever is in the lead, even if they're within the margin of error. Remarkably, the lead calculated this way has already changed hands five times this month: The next 50 days will be agonizing, and such uncertainty is bound to roil markets. To guard against that with a prophylactic cut of 50 basis points is a sensible insurance policy to limit the potential fallout, and that's responsible as far as it goes. Beyond that, the Fed is not playing politics. One problem on FOMC Day is to occupy yourself in the morning. But mighty Bloomberg Opinion colleague Jonathan Levin found a solution. He asked for songs to suit the occasion, starting off logically enough with The First Cut Is the Deepest. That led to a crowd-sourced playlist which you can find here on Spotify. Perhaps we could add the LA Untouchables' The Time Has Come. In the wake of the announcement, the mood was That's The Way I Like It, but after the press conference had shifted to Is This It? Any more suggestions out there?

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Nir Kaissar: The Fed Is a Poor Guide for Stock Investors

- Juan Pablo Spinetto: Claudia Sheinbaum Can't Thrive in AMLO's Shadow

- Marc Champion: Hezbollah Pager Attack Looks Like a Decapitation Strike

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment