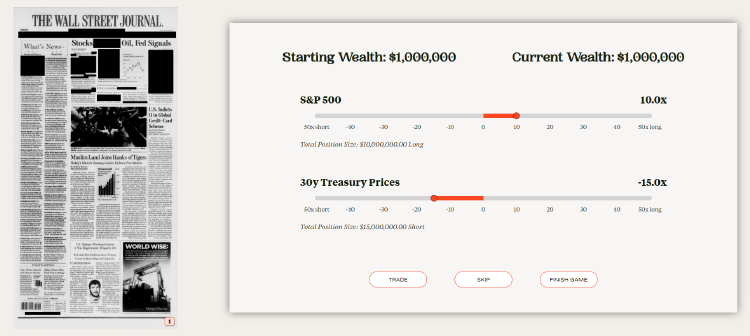

| Nobody in the world wants yesterday's papers. Within 24 hours, they're no use for anything more than wrapping fish and chips. But tomorrow's papers are no more useful if you're playing the stock market. In the short run, knowledge of the next day's news doesn't help you make money. This seems strange. In Back to the Future 2, Biff Tannen gets rich when he's gifted a sports almanac from the future that allows him to bet correctly on every sports event. But day-to-day and minute-to-minute, markets attempt to discount what's coming. Knowlege of what comes next isn't that helpful. Instead, the best route is a rigorous gamblers' approach, knowing when to stake a lot and when to be conservative. (A vital corollary of knowing when to hold 'em, etc.) These are the main conclusions from some fascinating research by Victor Haghani and James White of Elm Partners in London, which can be found here. They built a game in which traders were shown the front page of the Wall Street Journal (with market prices blacked out), and asked how much they would wager on the direction of the S&P 500 and the 30-year Treasury the day before. It looks like this:  Elm Partners Elm has put the game online, and you can play it for free here. It's great fun. Starting with a notional million dollars, a group of 118 experienced traders placed bets on 15 different days, taken by Elm Partners at random from the last 15 years. The results were almost comical: The players guessed the direction of stocks and bonds correctly on just 51.5% of the roughly 2,000 trades they made. They guessed the direction of bonds correctly 56% of the time, but bet less of their capital on bonds than on stocks (if you're planning a career as a proprietary macro trader, consider putting your focus on bonds).

Even with foreknowledge, you guess right only a bit more than half the time. The average return they made was only 3.2%, while half lost money and one in six went bust. What let them down wasn't lack of economic foreknowledge so much as "sizing" — the decision on how much to wager on each bet. Some of the calls were clearer than others, and a higher proportion of traders predicted the direction of stocks or bonds correctly — but they didn't take the chance to bet more money on these trades: On eight of the 30 trading opportunities, the players in aggregate displayed 2-to-1 odds of being correct in their bets, but they did not bet more heavily on those occasions. Overall, they did not display trade-sizing that bore any relation to their propensity to guess the price moves of stocks or bonds correctly.

Haghani and White also found evidence that people at the top of the trading profession did indeed make more money out of the same opportunities — driven more by savvier sizing than any better ability to predict the headlines. When five very senior traders played the game, all finished in the black with an average gain of 130%. Meanwhile, the 1,500 people who've played on the website lost 30% on average. If you actually knew the direction of prices in advance, rather than the news to which they were reacting, then the returns were infinite. That's why people try trading in the first place. Haghani describes an approach reminiscent of Bill Murray's weatherman caught in a time loop in the movie Groundhog Day: Six players devoted themselves to achieving the maximum possible payout, growing their initial wealth 70,575-fold. They did this by repeatedly playing the game to see what stocks and bonds did on each day, and then using that information to put up the perfect score by correctly betting the maximum size on each trade.

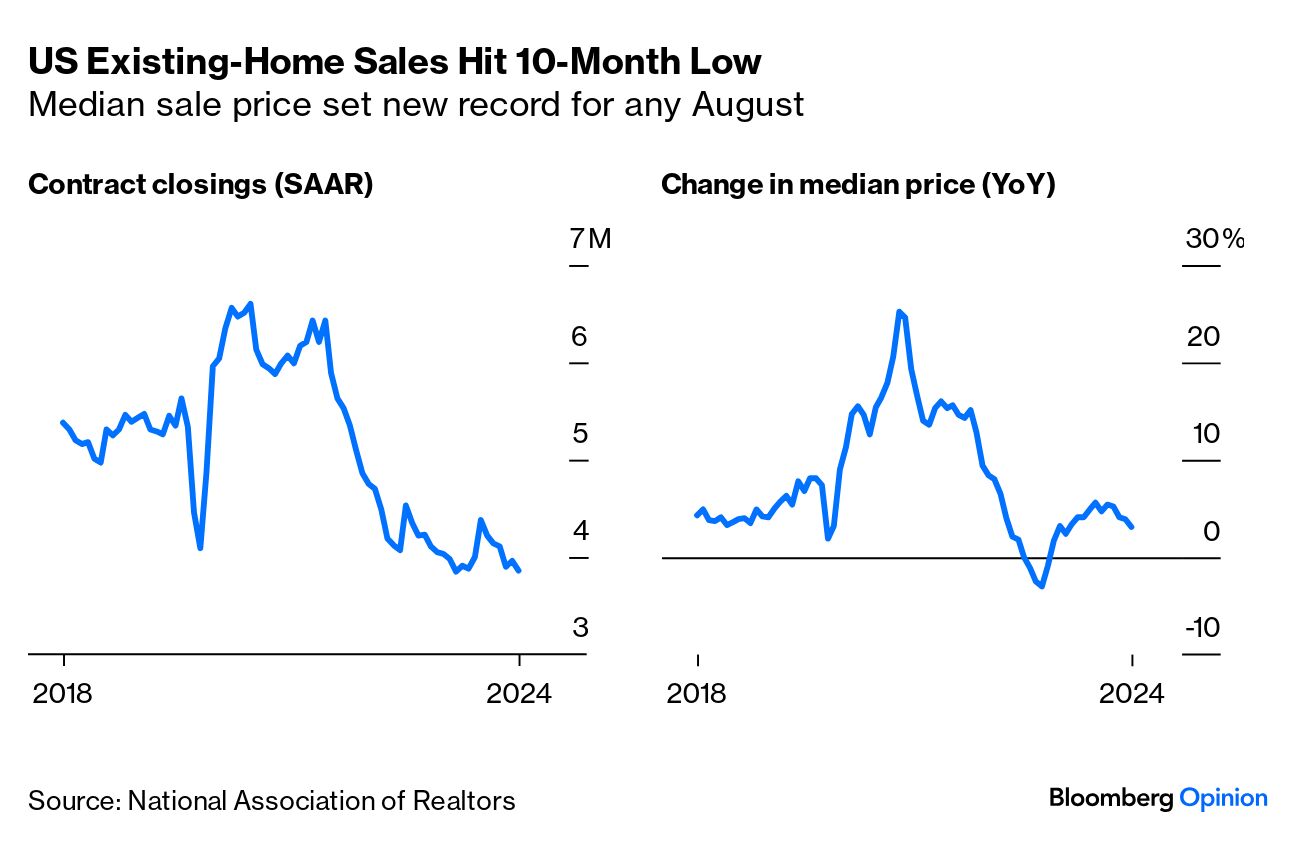

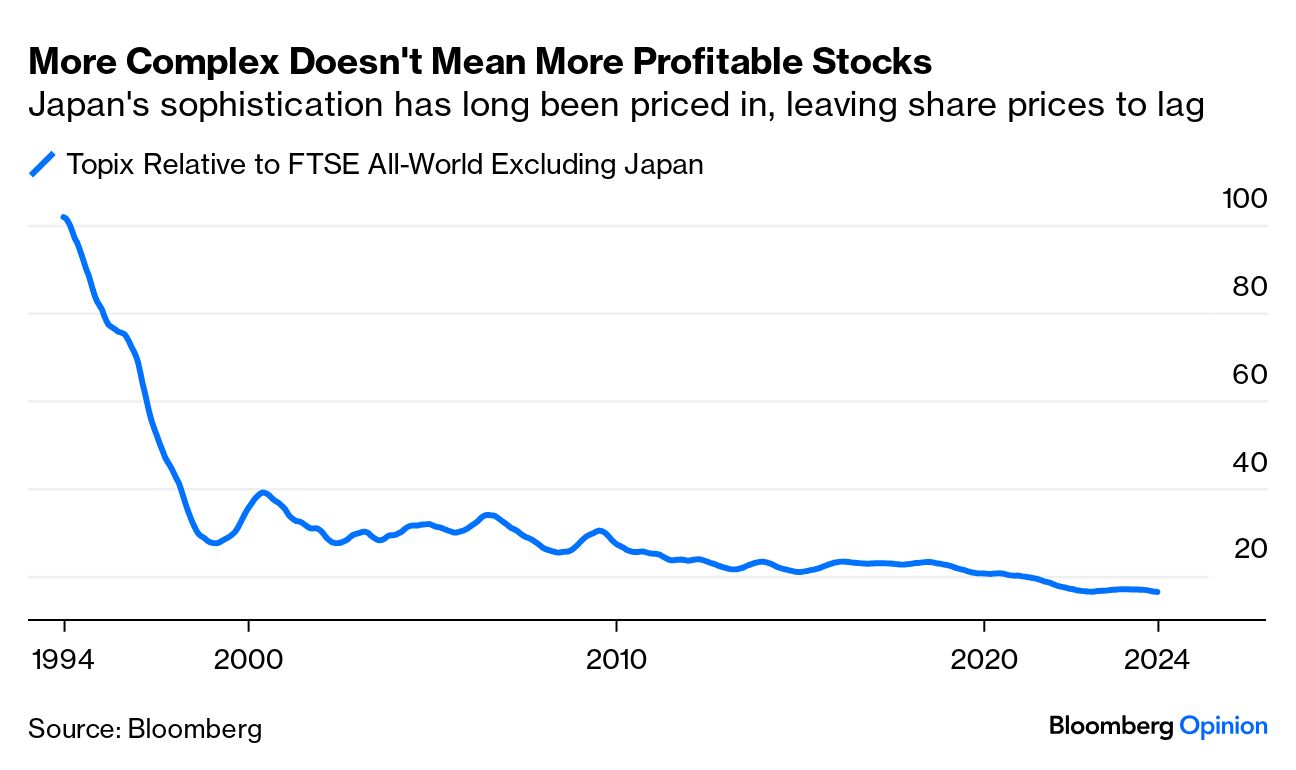

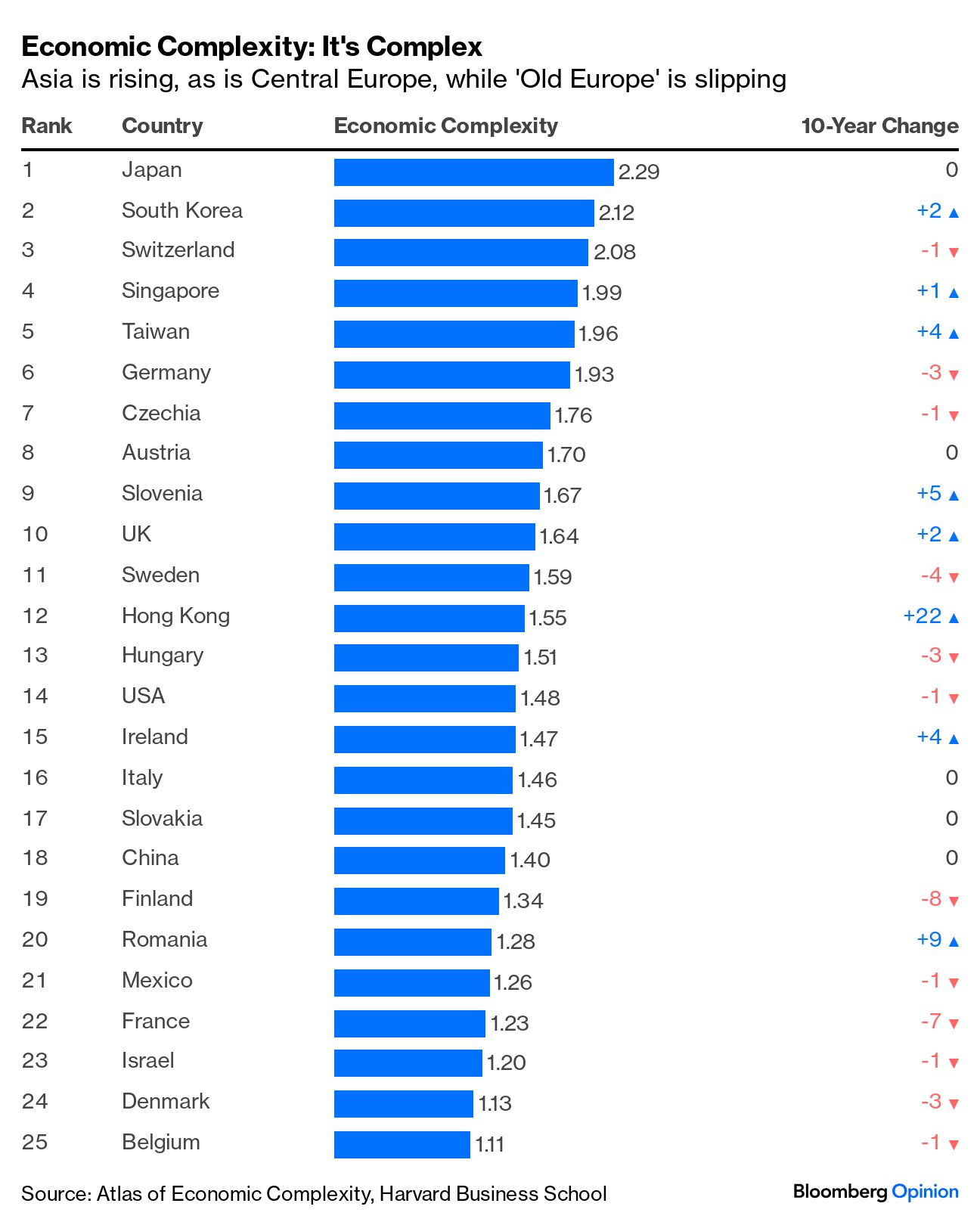

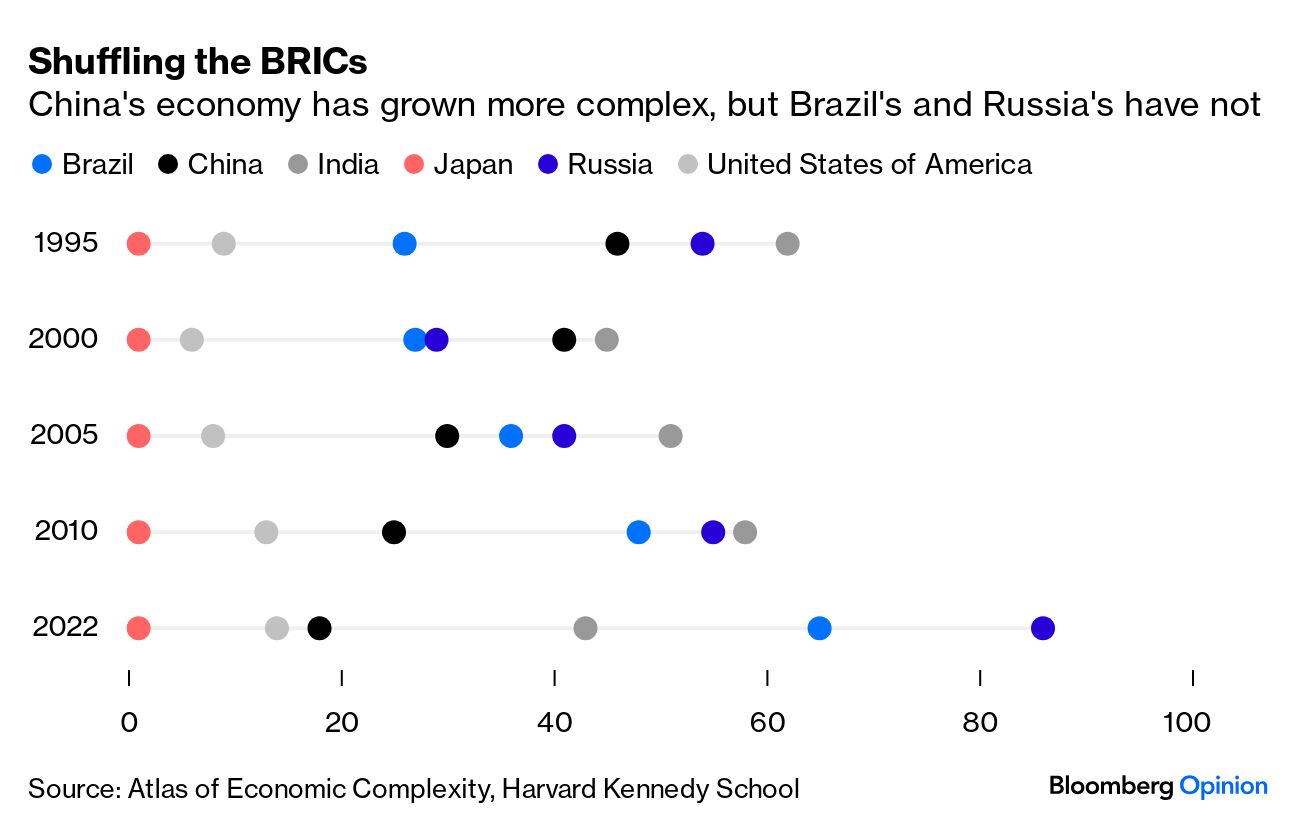

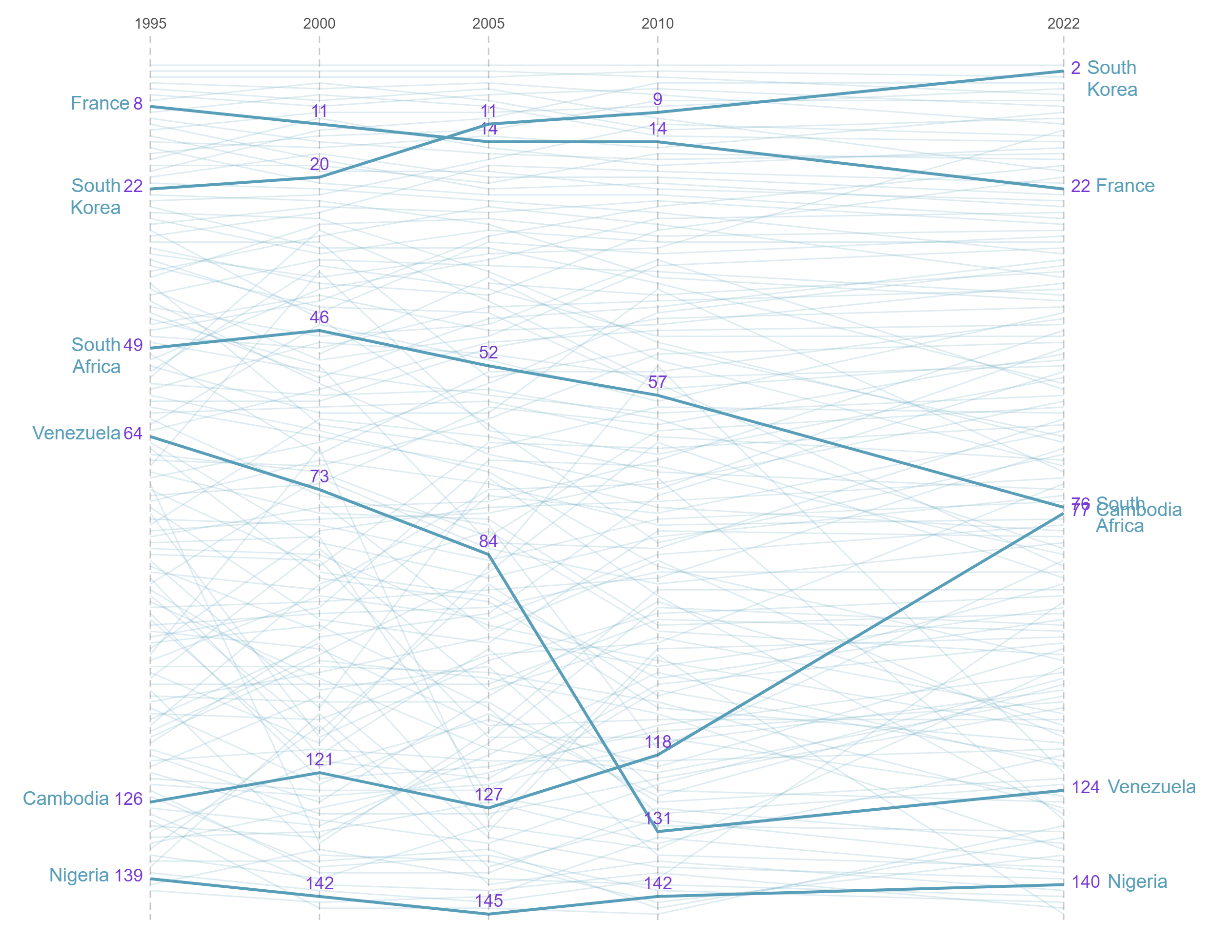

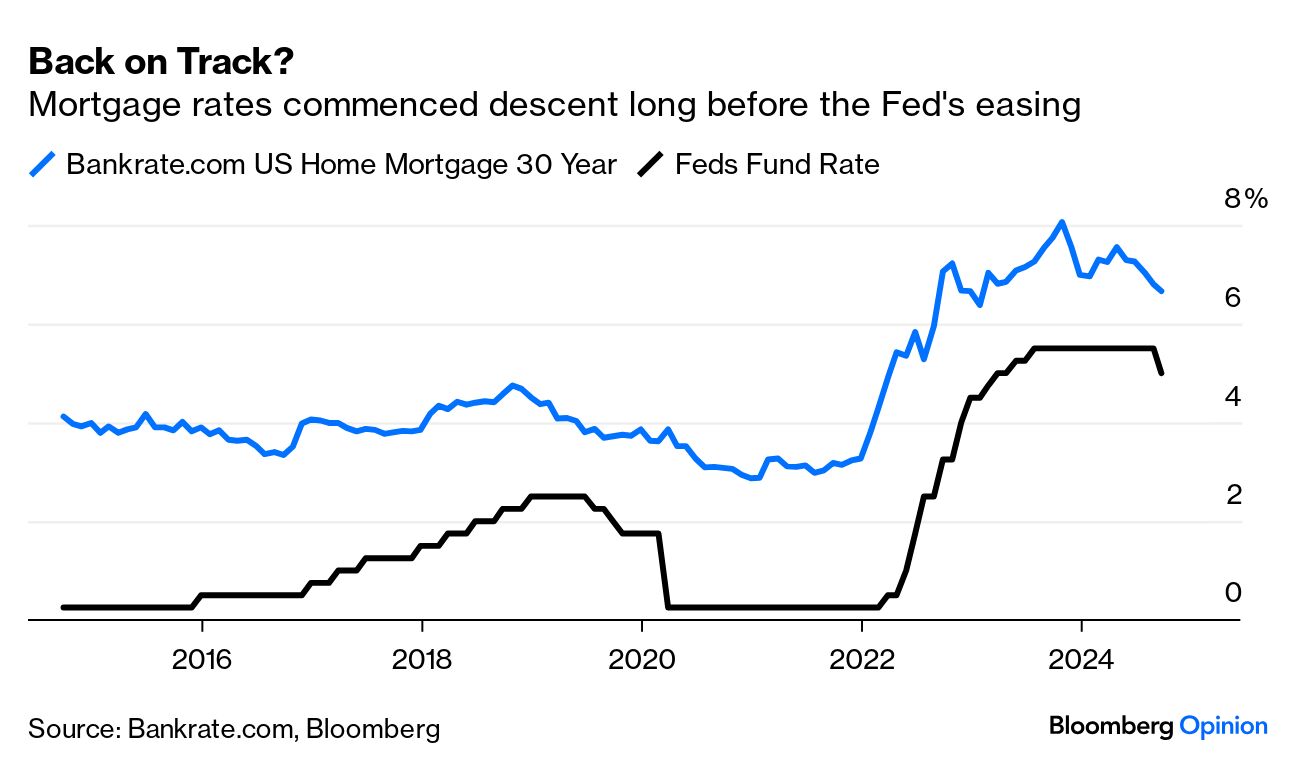

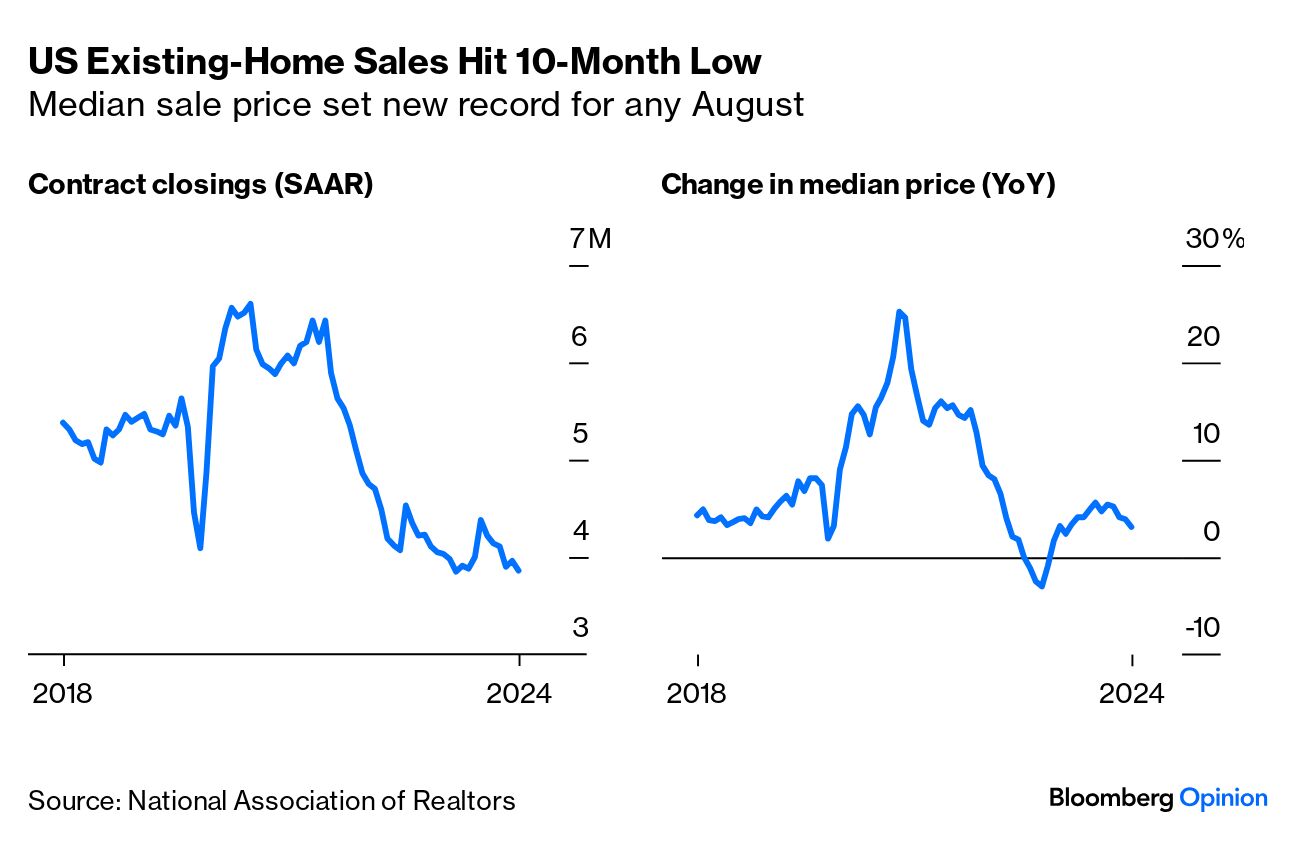

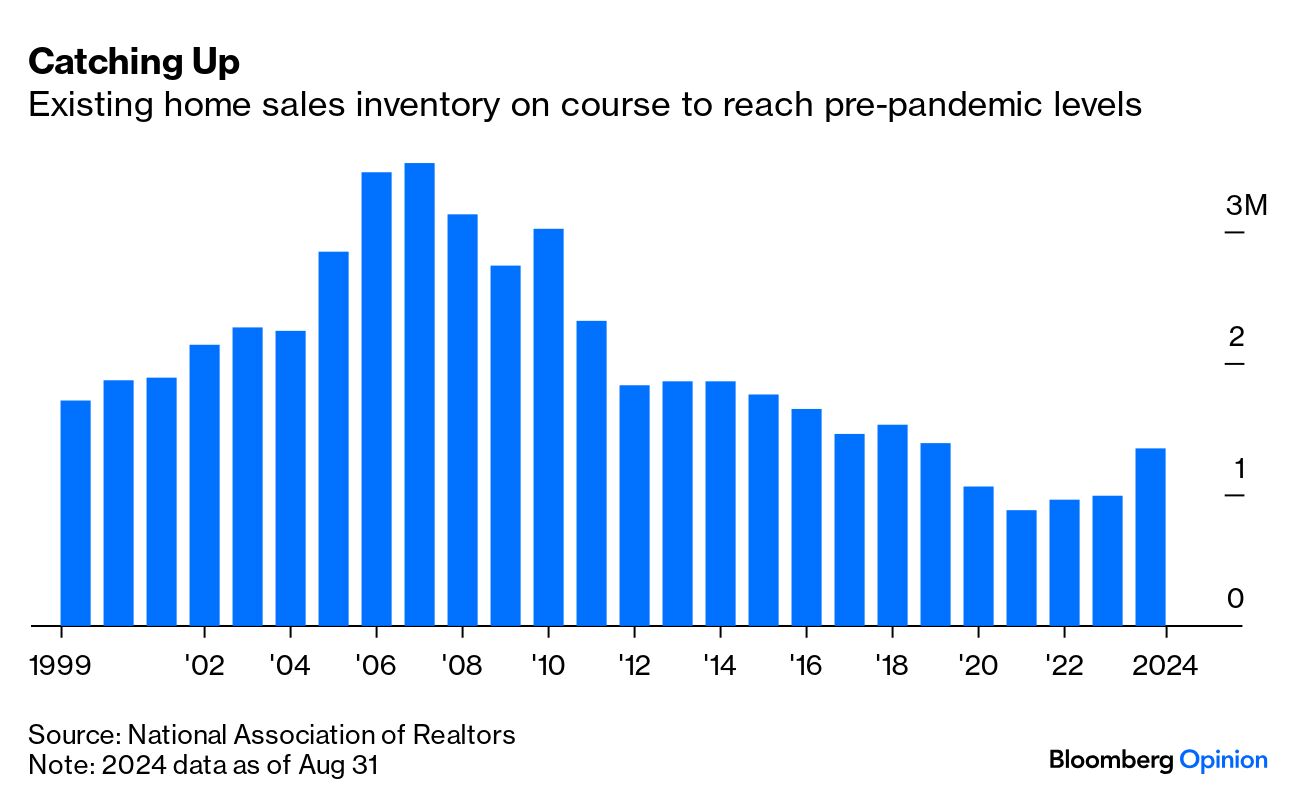

That's why people bet and bet big. But in the real world, to make money you need to acknowledge your limitations and stake less when you are less than certain. Add that to last week's excitement, when the Fed cut by 50 basis points only to be greeted by a fall in the stock market, and try to trade with humility. Or improve your poker. Or play Elm's game online. More fun on the internet. The Growth Lab at Harvard Kennedy School this week unveiled Atlas of Economic Complexity 10.0, the 10th edition of its massive empirical effort to gauge how countries develop and equip themselves to grow in the future. The dazzling array of information and non-intuitive insight is dazzling. It's best to explore the site yourself, but for examples, it can show you how Eastern Europe's share of world exports has grown, what Ghana exports, and the "product space" (the connectedness between products, based on the similarities of know-how required to produce them) for Mexico, revealing that its traditional oil industry doesn't lead to building other businesses, while its base in car manufacturing is producing much more transferable skills and infrastructure. The basic theory is that what drives growth is economic complexity, measured by the range of different businesses in a country and the ease with which their skills can be transferred to others. Mining doesn't go very far; training workers to assemble electronics likely inculcates skills that can be applied elsewhjere. (You can see the interview I did with Ricardo Hausmann, the economist who heads the project, for my old employers a decade ago here: I hope it's still worth watching.) Once a country has grown more complex, it is more resilient to shocks and better prepared to grow. To be clear, this doesn't help to call the stock market any more than tomorrow's headlines in the Wall Street Journal. Japan has been the world's most complex economy ever since the project started. That hasn't helped its stocks: The shifts over time, however, are fascinating. Hong Kong has grown more complex in the last decade. Nations in Central Europe (most spectacularly Romania) are now far more diverse, equipping them for growth. These are the 25 most complex economies, along with how their rank has changed over the last decade: Such analysis helps explain why the fashion two decades ago to invest in the BRICs (Brazil, Russia, India and China) hasn't delivered as hoped. This is how their complexity rankings, along with the US and Japan, have moved since 1995: Among the BRIC economies, only China has grown more complex and able to take on more challenges, while Russia and Brazil have regressed. The best explanation may well be the "natural resource curse," whereby resource-rich countries like South Africa, Venezuela or Nigeria fail to develop while those with no resources to speak of, such as South Korea or Cambodia, are forced to be entrepreneurial and innovative. Also, note that South Korea has risen from 22nd to second since 1995, while France has taken its place at 22nd, having dropped from eighth. With France's economy prompting growing concern, that's a data point hard to ignore. Housing affordability matters to American voters. It is the nerve of the proverbial American Dream. It's always been an issue, but easy money during the pandemic drove home prices to record highs, then was followed by a sharp rise in interest rates. The age-old problem is now acute. Ordinarily, the start of the Federal Reserve's easing cycle should bring homeownership within reach. Not quite. Lowering rates is just part of a complex equation encompassing decades of underbuilding, construction labor shortages, and costly inputs. Easing by the Fed is helpful, but other factors could counteract it. What informs this optimism of lower prices as interest rates fall? Confidence likely stems from a disconnect between housing prices and high interest rates, one of the confounding legacies of the pandemic on the economy. Price growth was slowing long before the Fed started to cut. This chart tracks the disconnect between Bankrate.com's average 30-year mortgage rate and the fed funds rate: Homeownership across the US became slightly more affordable by historical standards in the third quarter, according to ATTOM, a property data and real estate analytics company. But major expenses on median-priced homes currently consume 33.5% of the average national wage, virtually unchanged from a year ago — and still above the common 28% lending guideline. This comes as the national median home price has spiked to $365,000 while mortgage rates remain above 6%, keeping ownership expenses above what lenders prefer when issuing mortgages. Worse, ATTOM's latest data shows that the portion of average wages nationwide required for typical mortgage payments, property taxes, and insurance sits 12 points above a low reached early in 2021, right before mortgage rates shot up. The National Association of Realtors' index on homebuyer affordability currently sits near all-time lows:  Still, ATTOM's Rob Barber acknowledges the small wins, which he says "lightens the pressure on house hunters struggling to find a place that fits their budget. The cost of owning a home across much of the nation remains a tough go for average workers, exceeding levels preferred by banks and other lenders. But it is at least tracking in the right direction." Barber believes the half-point reduction "should brighten the prospects for buyers, as long as it doesn't spike demand too much and lead to even higher prices amid the ongoing tight supply of homes for sale around the US." August's sales of existing homes fell to a 10-month low, according to the NAR.  With the American Dream fast morphing into a nightmare, both presidential candidates have outlined housing policies. Vice President Kamala Harris' approach includes $25,000 downpayment subsidies for first-time homeowners while addressing supply with tax breaks. Former President Donald Trump believes opening federal land for housing and removing regulations should address the supply issues. Whoever wins, the NAR's measure of unsold home inventory shows they have a tough task: All else equal, anticipated lower rates could lure additional sellers. That would add to inventory, leading to price reductions. Should low rates also unlock pent-up demand, that would put upward pressure on prices. It's a complex equation requiring a lot of delicate balancing. For homeowners, what matters most is attaining the dream at the expense of an arm and a leg. —Richard Abbey OK, here's a fifth installment of songs about or inspired by the stars. Thanks for keeping them coming in: We Are All Made of Stars by Moby, When You Wish Upon a Star from Disney's Pinocchio, Stairway to the Stars by Sweet, Under the Milky Way by The Church, Smashing Pumpkins' By Starlight, Star and Lady Stardust by David Bowie, the "Imperial March" from Star Wars, Age of Aquarius by Fifth Dimension, Orion by Metallica, Orion's Belt by the Avett Brothers, Stars Out by Chance the Rapper, and Seeing Stars by Borns. For the classically minded, Mozart wrote a set of variations to Twinkle Twinkle Little Star, while Schubert wrote beautiful songs called Starry Night and The Stars, while Britten adapted Purcell's song I'll Sail Upon the Dog Star. Last call for more stars…

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

More From Bloomberg Opinion: - Marcus Ashworth: Fighting the Fed Would Be a Losing Battle for the BOE and ECB

- Beth Kowitt: How Americans' Trust in Big Business Went From Bad to Worse

- Marc Champion: In Lebanon, Israel Set a Trap for Iran and Itself

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. | .png)

No comments:

Post a Comment