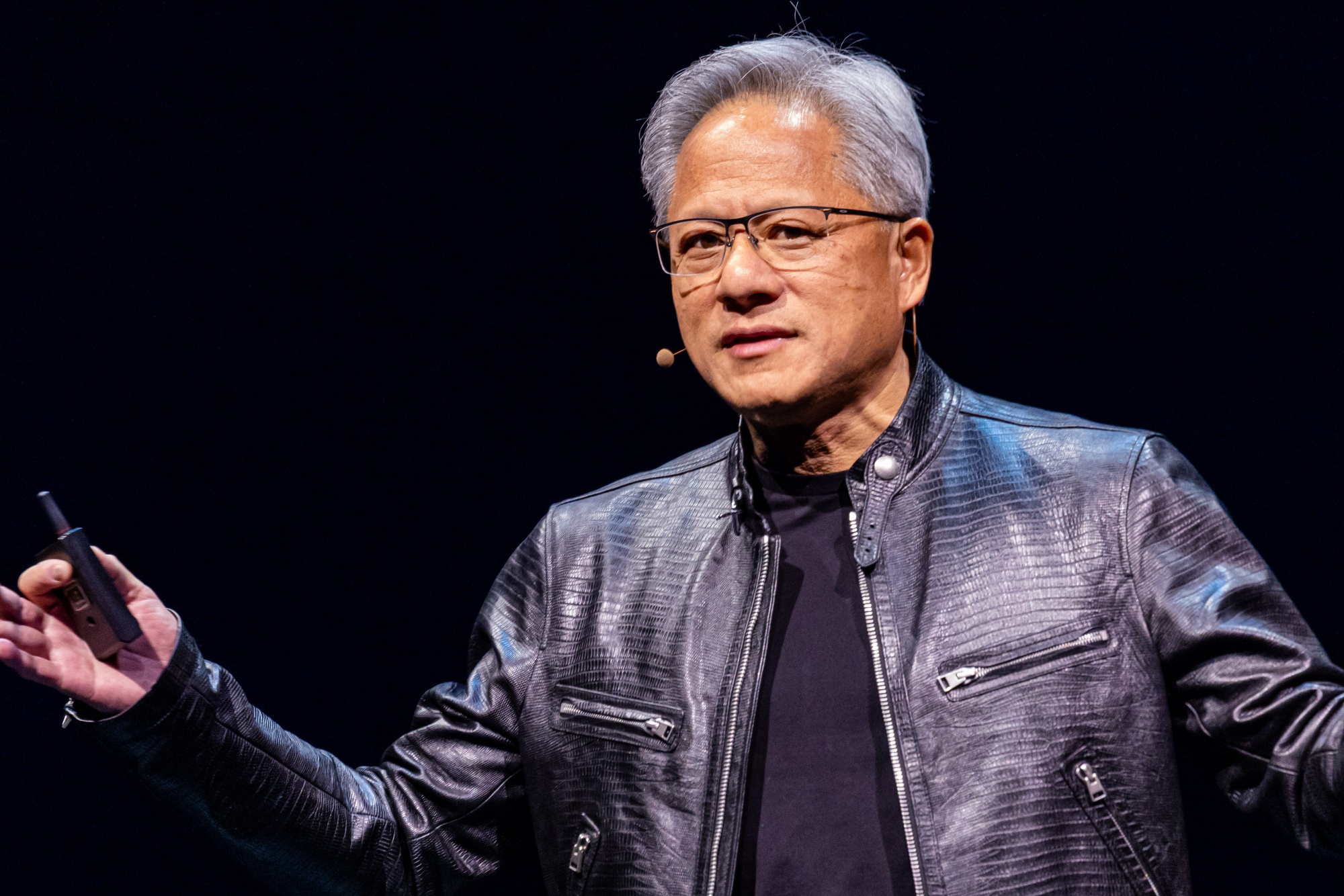

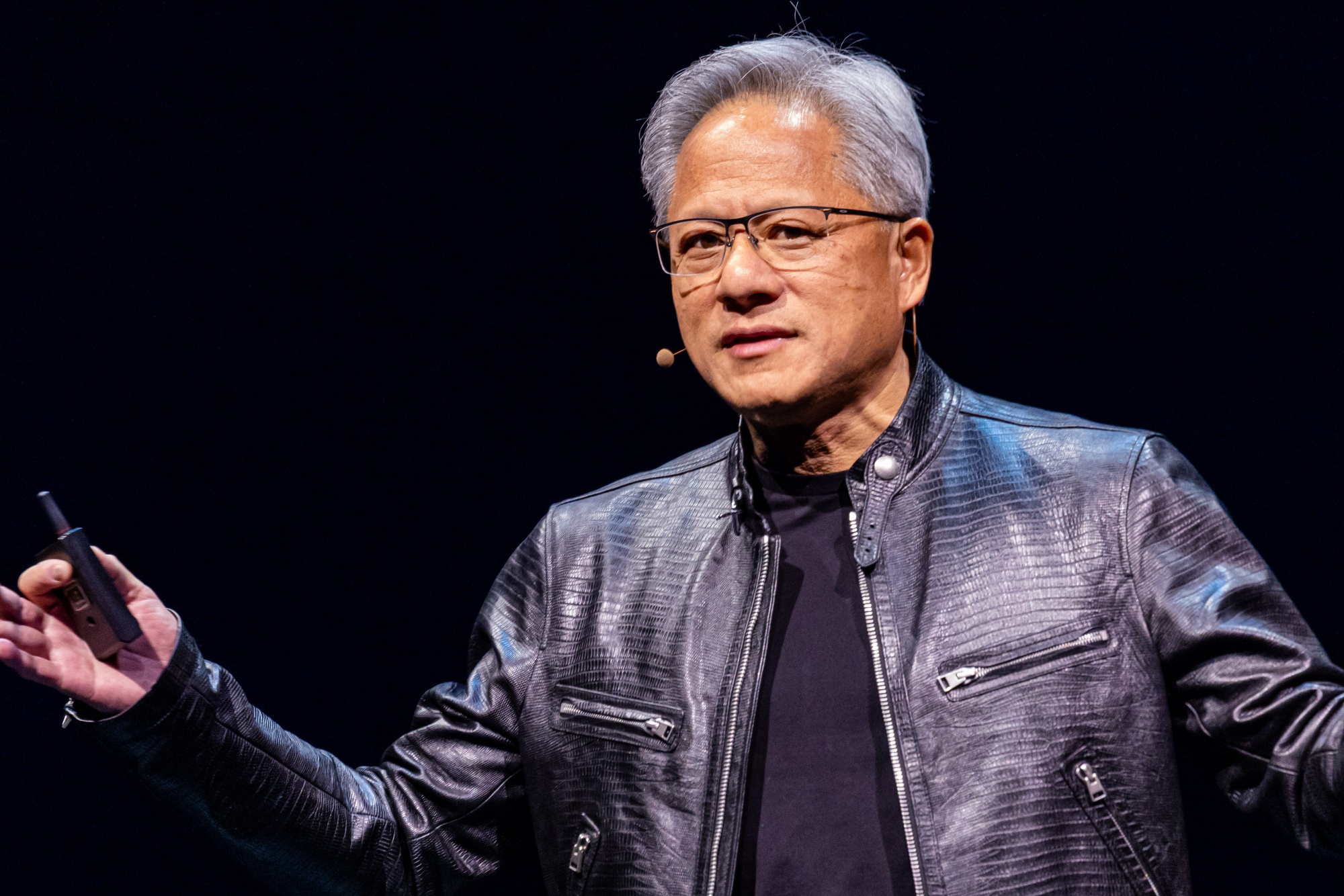

| I'm sure you're the same. Sometime in those painful first days back post-holiday, I started googling ahead of the impending new school term – about the weird things happening with one of my children's feet, that kind of thing – and a new sight greeted me. From late August, an "AI Overview" started appearing at the top of search results for the most complex Google queries, giving us a short-cut to information to help with our own, ahem, always flawless research. Why is this relevant today? Well, let's look at the slump in Nvidia stock, which fell by 9.5% yesterday, wiping out $279 billion in the largest loss of value ever recorded for a US company. All summer, the world of finance has been wrestling with whether it is overinvested in AI — and whether the tech giants have yet figured out a way to give some ROI for their AI. Even Google took a drop in July when parent company Alphabet Inc. showed an increase in spending on AI. Now the last few days shows that anxiety continuing, or as our reporters put it, there are "worries that the mania surrounding artificial intelligence had gone too far." And so Nvidia's chief executive — the world's 18th richest man — lost $10 billion yesterday, while Bloomberg revealed the US Department of Justice has sent subpoenas in an antitrust probe into the chipmaker. According to the reporters who broke the story, officials are concerned that "Nvidia is making it harder to switch to other suppliers and penalizes buyers that don't exclusively use its artificial intelligence chips.  Jensen Huang, chief executive officer of Nvidia, in June Of course, the drop is complicated. Our reporters here sum up the maelstrom of factors: "Worries about China's growth shook commodities markets from oil to copper. US manufacturing data came in light and showed an uptick in prices paid, a potentially worrying sign for inflation hawks. But most catalyzing for the tech rout were the fresh warnings that AI's promise to rewire global economies was far from being realized, making it hard to justify lofty valuations." But today too, Bloomberg reports UBS bailed on another chip manufacturer, ASML, warning that the earnings potential from AI is overhyped (though our reporters note it's still rated as a buy by more than three-quarters of Wall Street analysts tracking the firm). The general tenor is that big tech needs to find big uses. Bloomberg Opinion's Parmy Olson had a column last week making this point. For her, Meta is doing well in showing how exactly AI investment is boosting the business, but other firms less well. Equally, some are calling for investor patience as data centers are built and processing capacity is ramped up. I liked the line here from one market strategist: "If you go back to the dot-com era, the first winners of the internet weren't always the final winners." Perhaps AI will turn out not to have been "overhyped," but just "wrongly hyped" – there will be big winners, but we just don't know who they are yet. In government, something called Amara's Law was often quoted – that we tend to overestimate the effects of a new technology in the short-run but underestimate it in the long-run. Maybe. Which makes it very tough for the markets to price. Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment