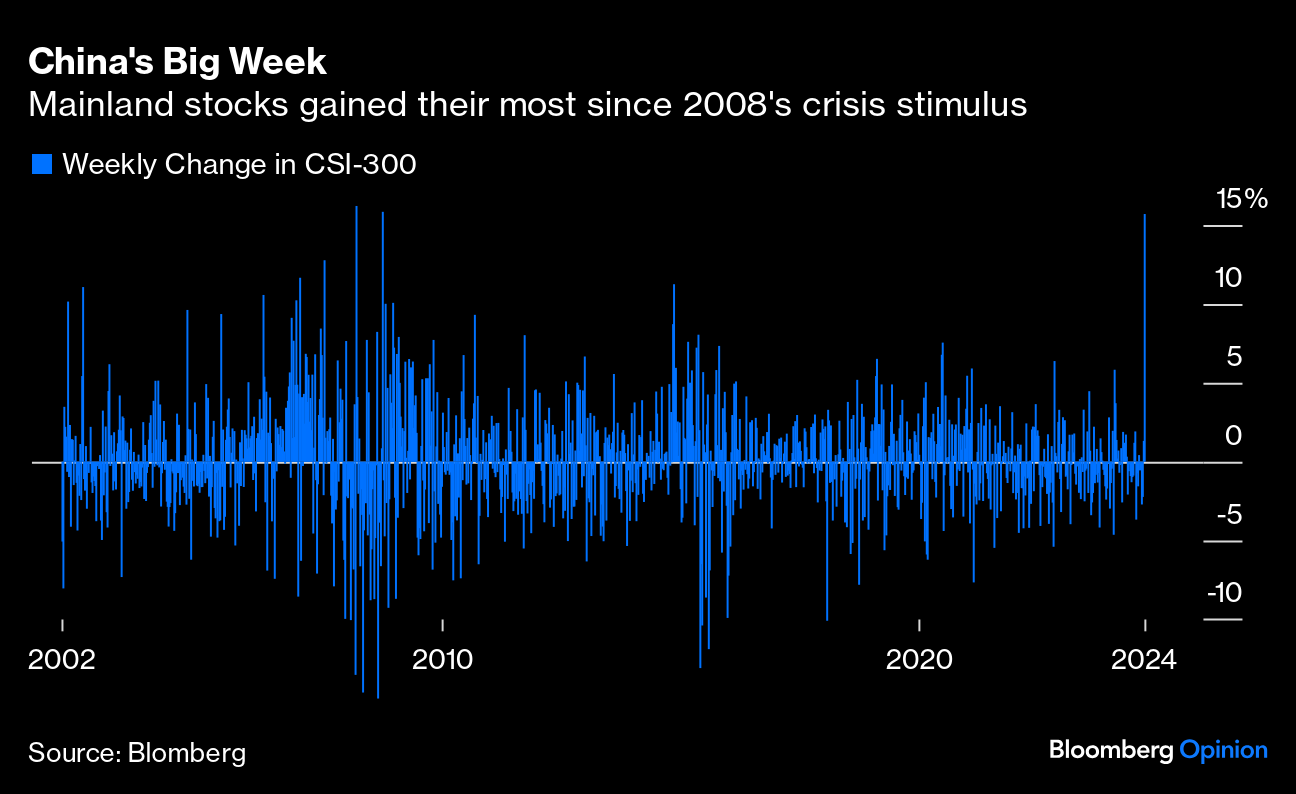

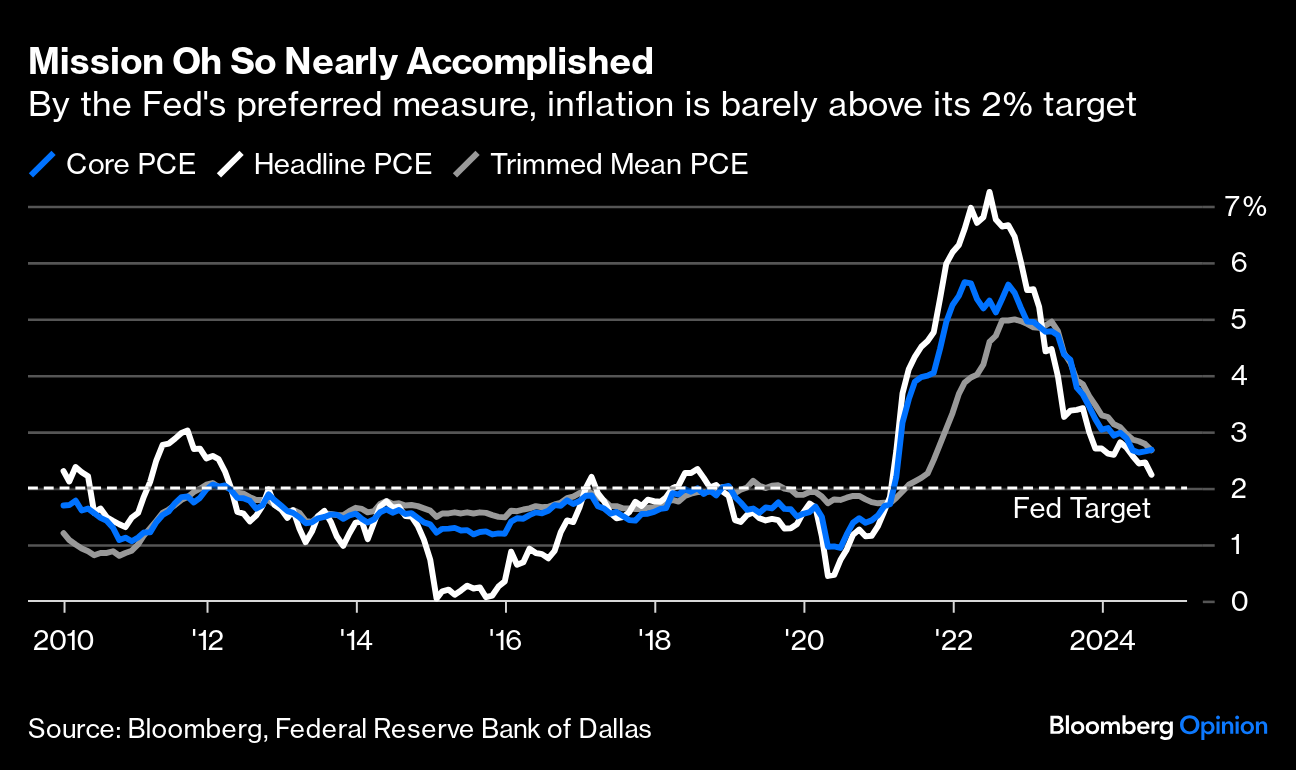

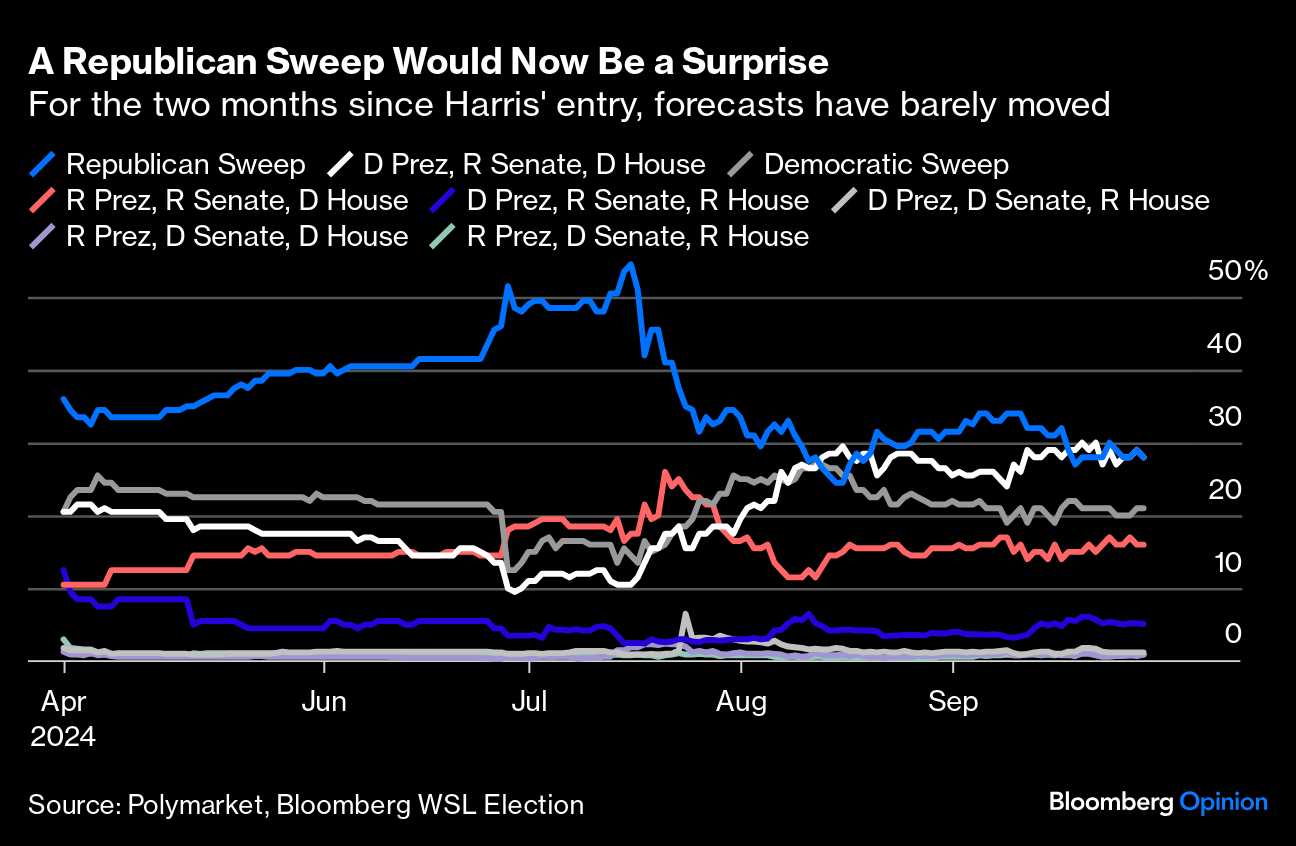

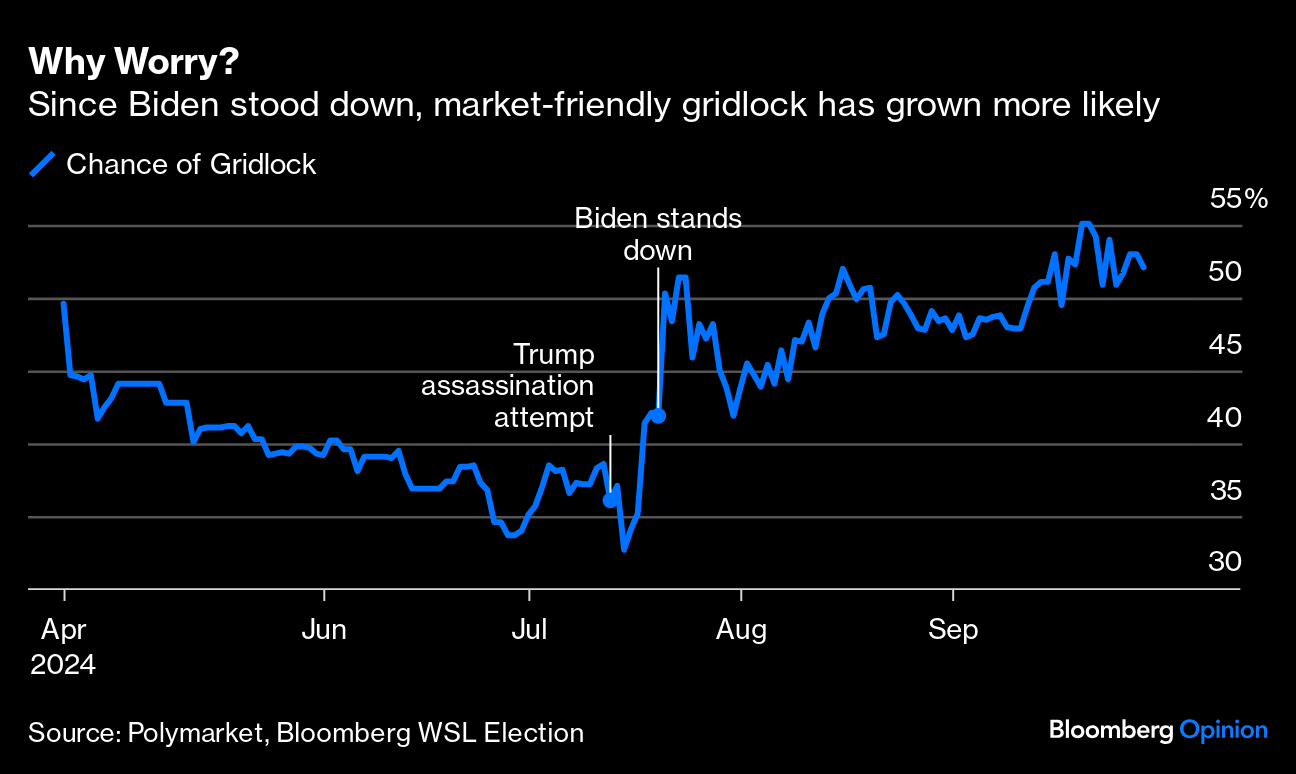

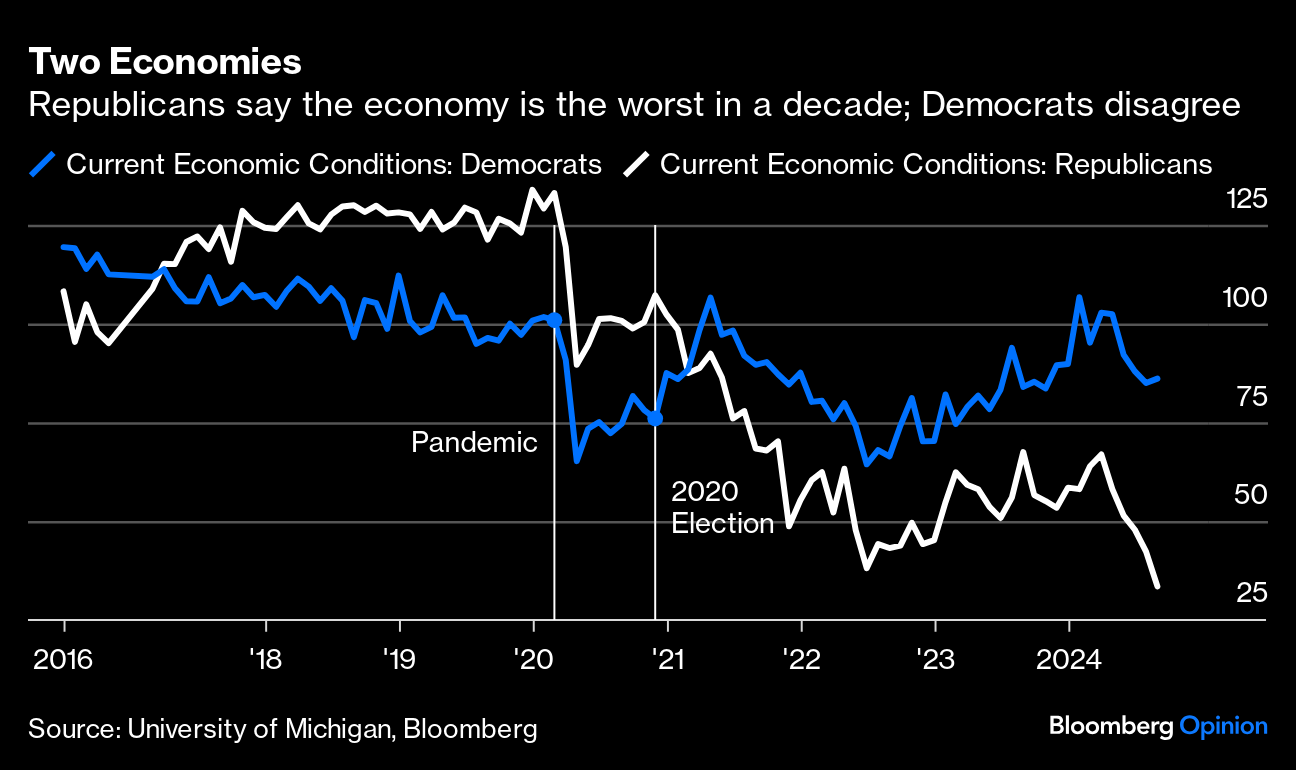

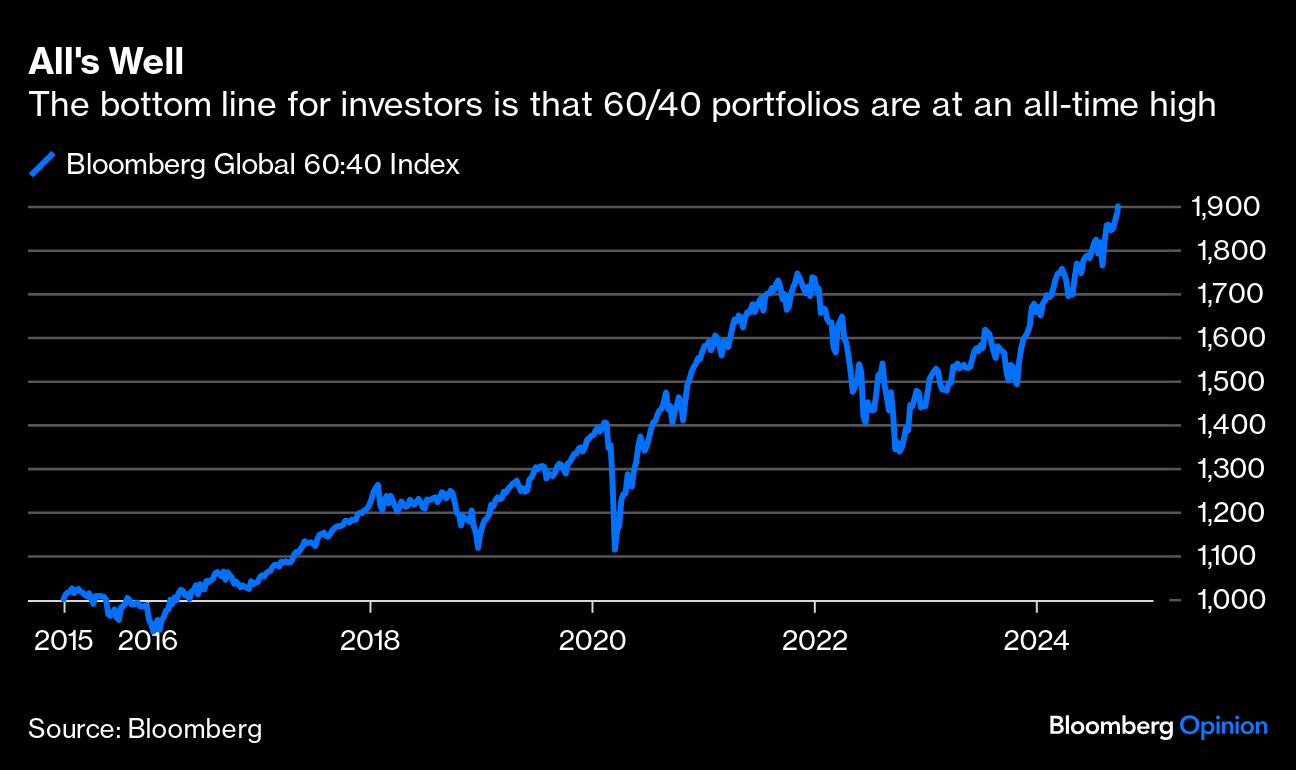

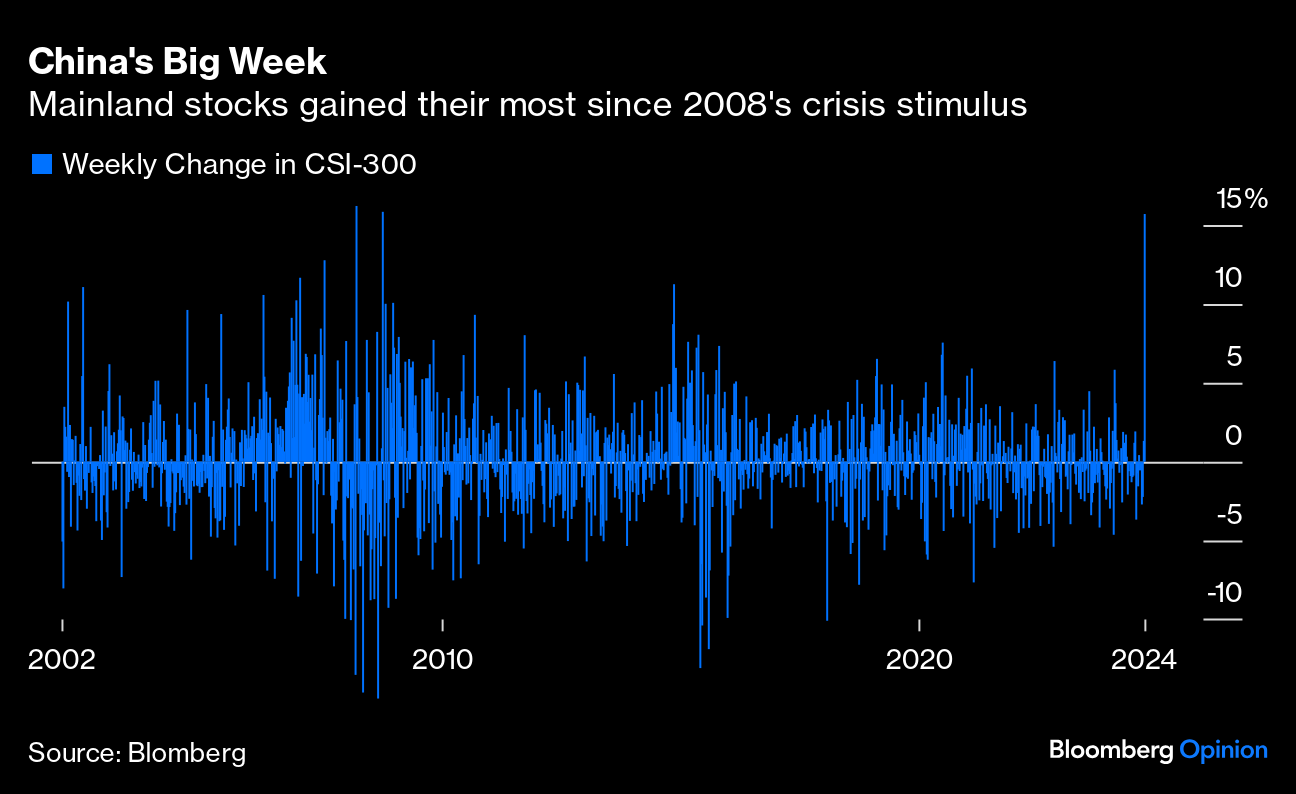

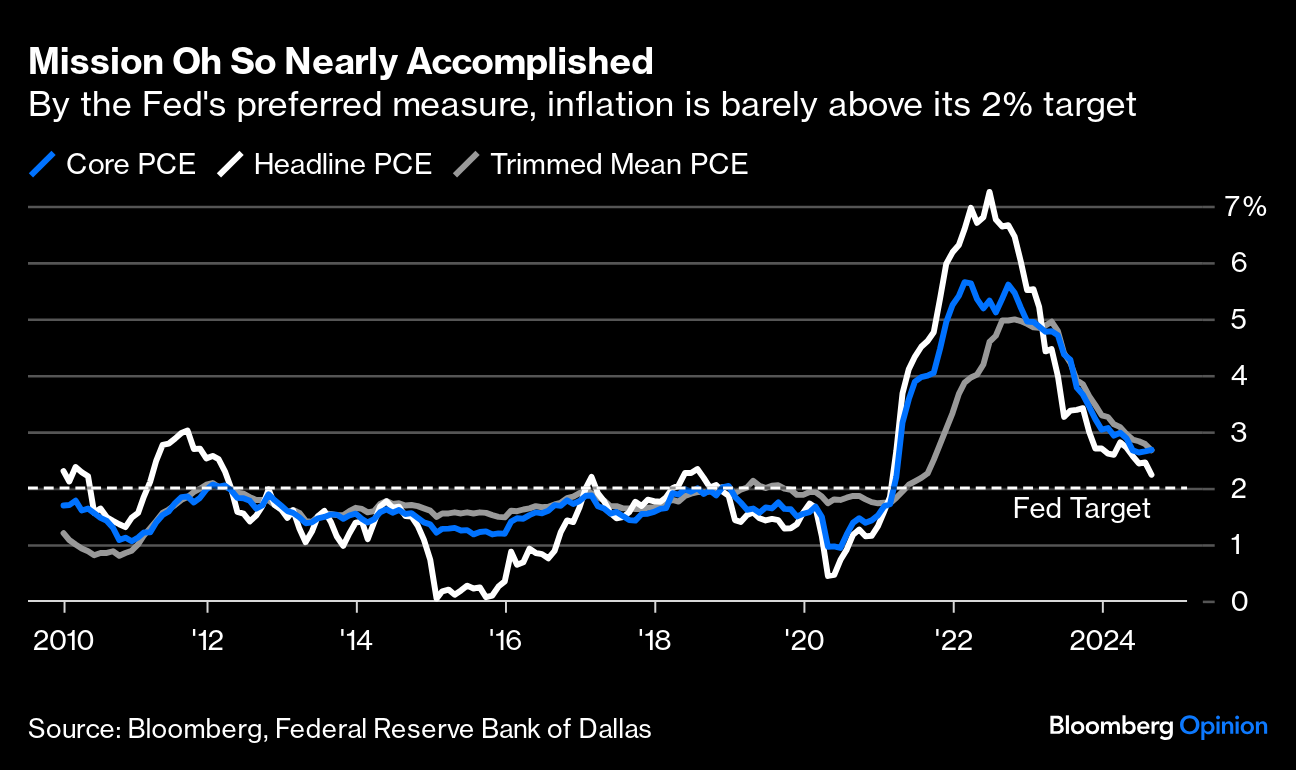

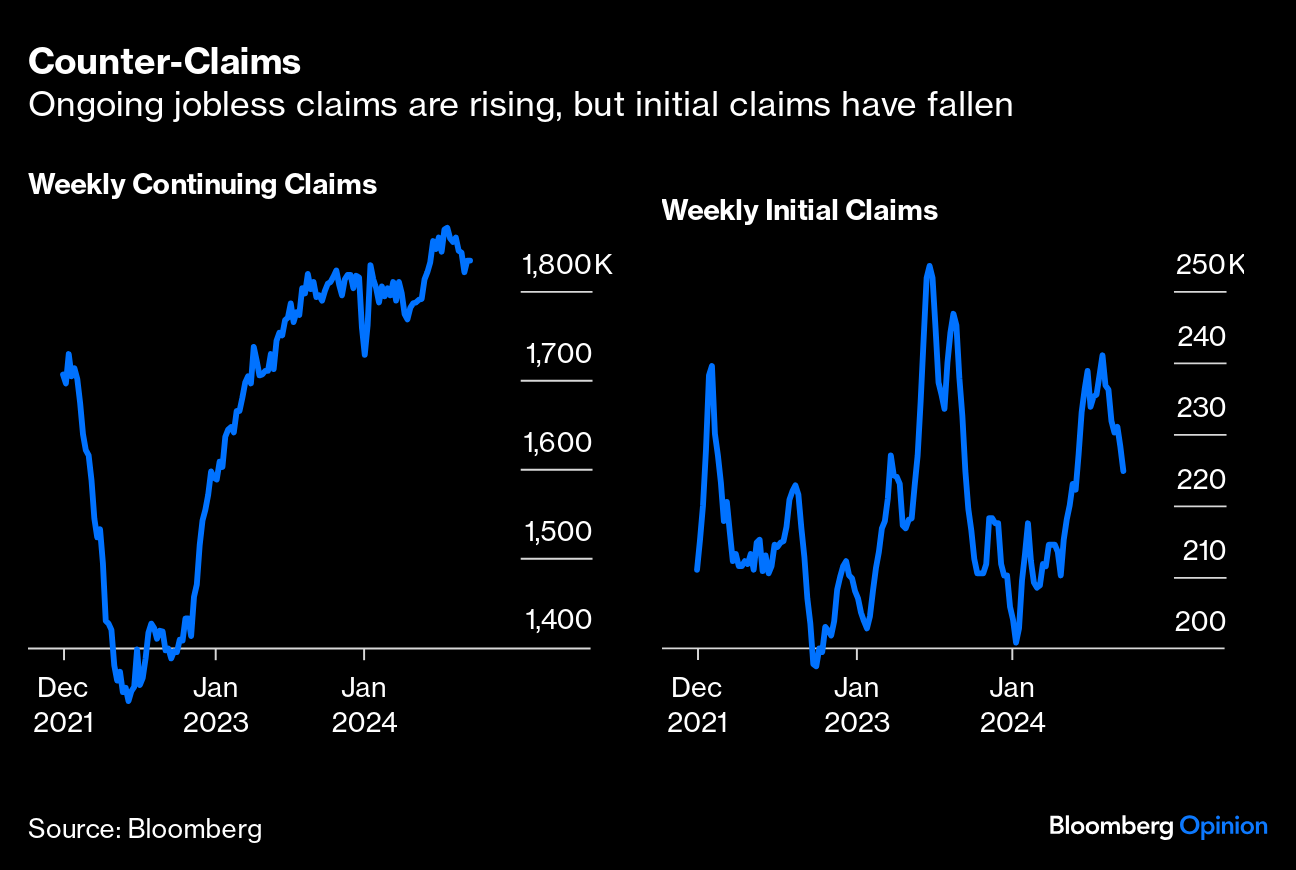

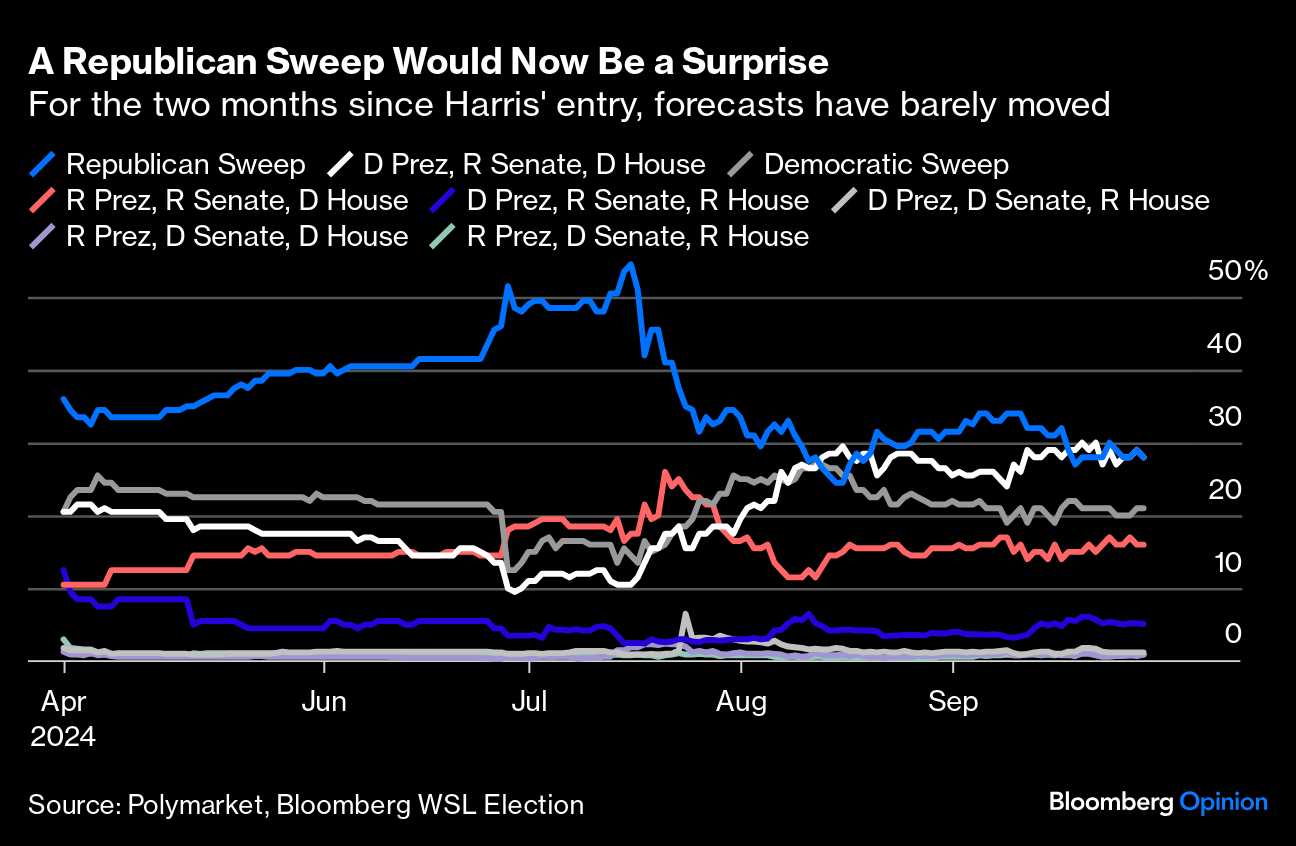

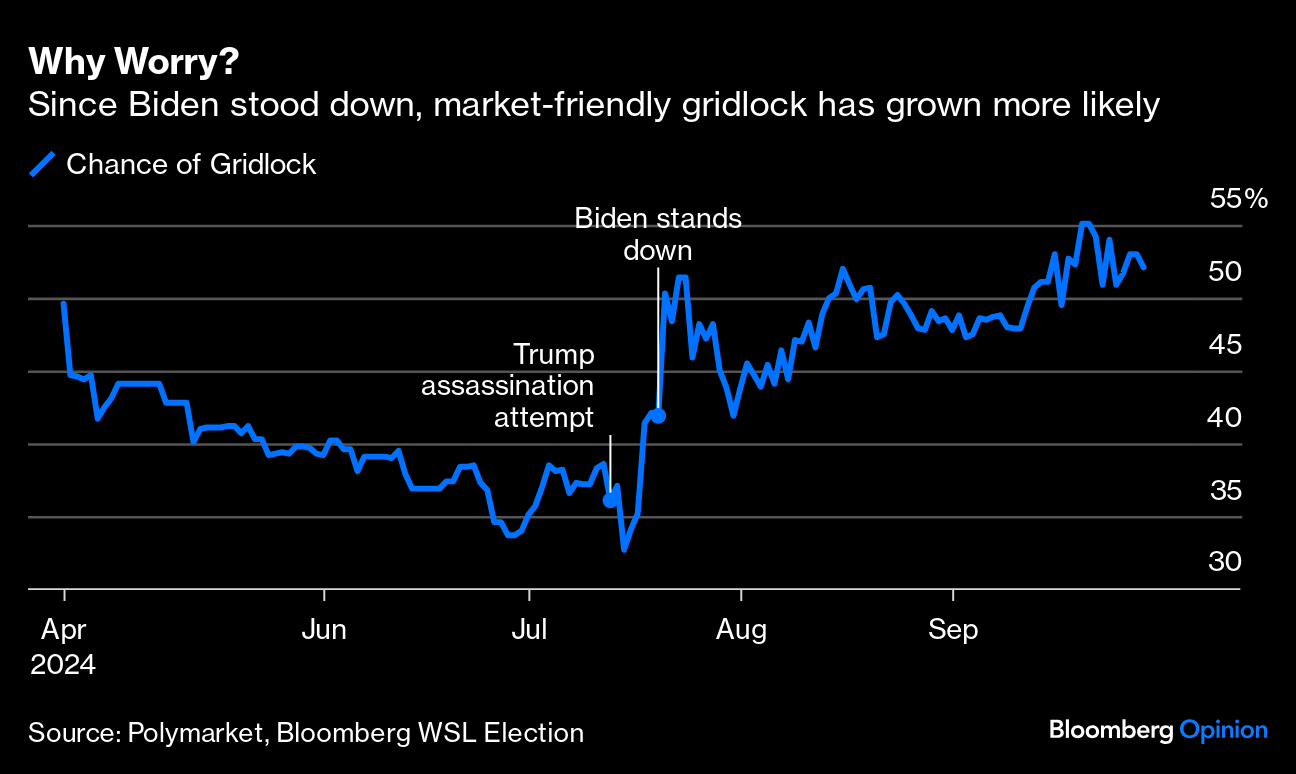

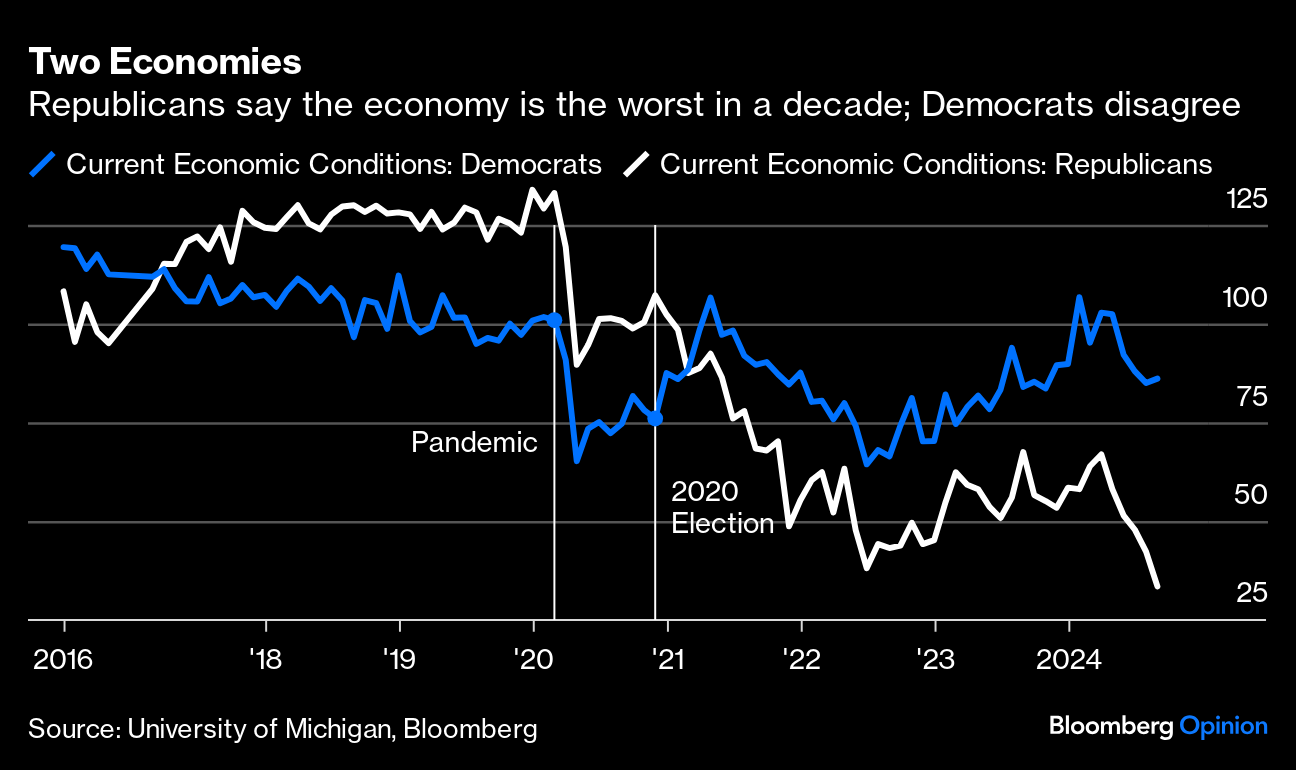

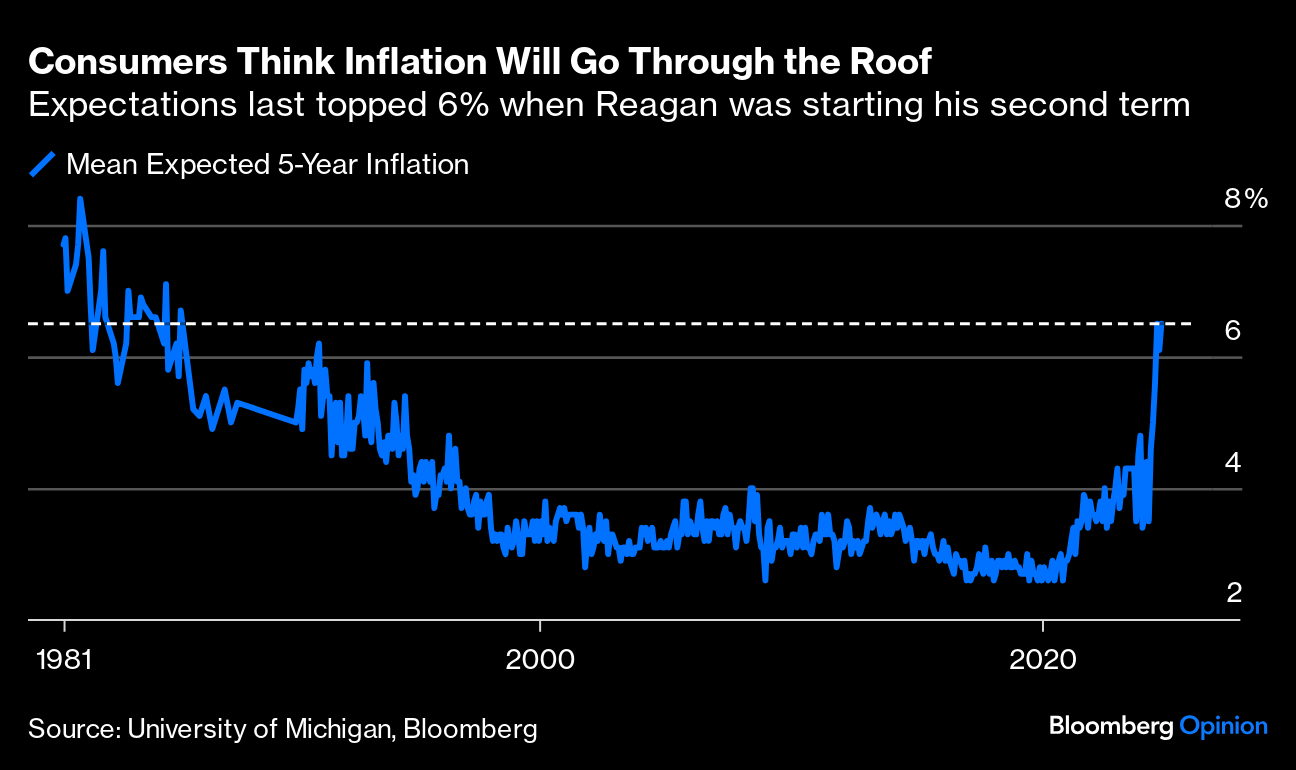

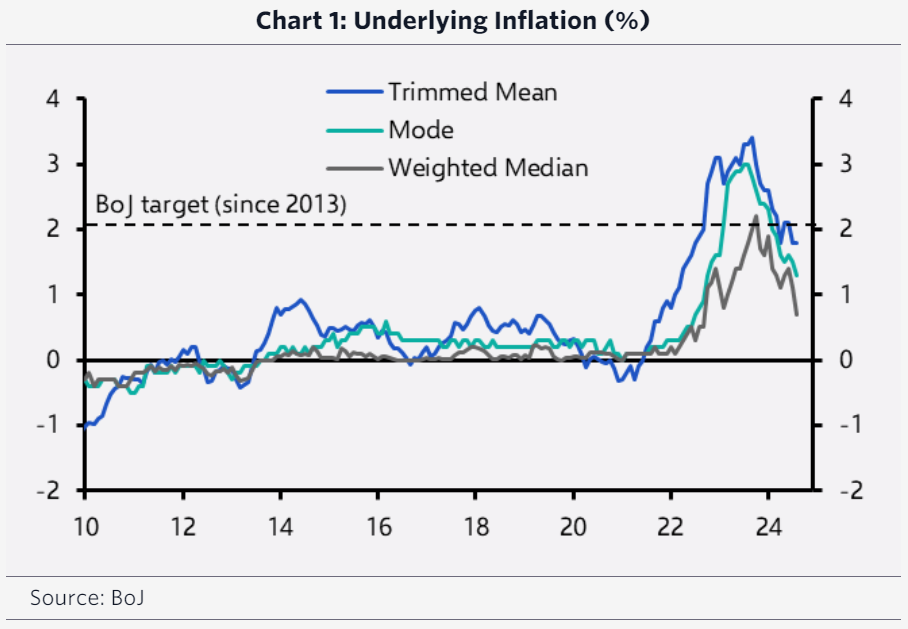

| Those with long memories will recall that September began with a menacing selloff for risk assets, just as August did before it. It's ending, also like August, with risk assets surging yet again, and the global economy apparently set fair for investors (even if electorates the world over feel very differently). The question is whether October will put us through the process again. It might well. First, the bottom line is that asset markets continue to thrive. Taking Bloomberg's global 60:40 index (with the classic 60% allocation to stocks and 40% to bonds) as a benchmark, we find that it's now at an all-time high; 60:40 hasn't died yet: Meanwhile, China's political establishment gave everyone a reason to be cheerful last week by unleashing what appears to be a determined plan to stimulate its economy back into life, using both fiscal and monetary policy. There are plenty of arguments about whether this will work, and whether the plans the Communist Party has in mind would be good or bad for the rest of the world. But the instant impact is undeniable, and so emphatic that it would be dangerous to ignore it. This is how last week's performance for the CSI-300, which covers the biggest stocks quoted in Shanghai and Shenzhen, stacks up compared to all previous weeks since its inception:  This was its first gain of more than 15% (and it's been followed by another 4% rise in Monday morning trading) since the week in late 2008 when another massive stimulus was announced to deal with the effects of the Global Financial Crisis. That turned out to be a hugely significant macroeconomic moment, and arguably more beneficial for the rest of the world than it was for China, which has been wrestling with debt problems ever since. But the old adage is that you should respect the price action, and if markets move as dramatically as this, they will have an effect and must be respected. Which is good for bulls. August and September both had bad starts due to disappointing macro data. At the beginning of this month, inflation appeared a little too sticky, and unemployment a little too low, to justify the Federal Reserve cutting by more than 25 basis points. It did anyway. In August, the data that regularly arrive at the beginning of the month (ISM surveys and unemployment numbers) appeared to portend genuine hard-landing risks for the economy. The latest numbers generally tend to assuage those fears. Friday brought Personal Consumption Expenditure (PCE) inflation data for August. This is the Fed's preferred measure, and it showed continued progress:  Whether gauged by excluding food and fuel, or by using the trimmed mean calculated by the Dallas Fed (stripping out outliers and taking the average of the rest), PCE inflation is very close to the 2% target and in a clear, steady marked declining trend. This is great for the Fed, and presents no obstacle to their cutting by another 50 basis points at their next meeting, due the week of the Nov. 5 election. However, the main reason for cutting would be the employment market. The latest data on claims for jobless insurance, as close to a good real-time indicator as we have, suggests the labor market is recovering, with layoffs reducing, and continuing claims aren't showing any great rise. While inflation may give no reason not to make another jumbo cut, then, the claims data give no reason to do so either: As it stands, there's little or nothing not to like. Inflation is licked and the employment market remains serene. Goldilocks is safe for now. But the week ahead brings a welter of unemployment data, with the JOLTS figures on layoffs and vacancies due before the non-farm payrolls on Friday. Could they trigger another market spasm like those that opened August and September? With markets surfing on good feeling, they certainly could. On the subject of the election, barely five weeks away, there's an ever-present risk that it will provoke volatility. A clean sweep for either party could portend significant policy changes, some of which (the proposed Trump corporate tax cuts) would be market-positive, while others, such as his tariff proposals, would not. If there isn't much election volatility showing up in markets to date, it's probably because the race is so wide open that it's impossible to bet with confidence on any outcome, a problem compounded by the bad failings of the polls in 2016 and 2020. There was a brief period in midsummer, between President Biden's disastrous debate performance and his decision to stand down, when a Republican sweep looked probable. Now, as this chart of the probabilities recorded on the Polymarket prediction market shows, it's up in the air:  This looks like an ungodly mess. But the market confidence seems reasonable if we look at the combined possibility of gridlock (any outcome in which neither party holds all of the presidency, Senate and House). There's a big variation between the different gridlock outcomes, particularly given the presidency's freedom to impose tariffs, but any split outcome would reduce the risk of fiscal over-expansion, which is what has investors most worried:  Meanwhile, gauging consumer sentiment is no easier than predicting the election. The University of Michigan consumer confidence numbers published Friday show a heartening improvement. But political perceptions warp responses so much that it's hard to know whether to take them seriously. When asked about current economic conditions, an empirical question about now that the election outcome can't affect, the gap between self-described Democrats and Republicans is the widest on record. Republicans think things are worse than when inflation was peaking in 2022, and far worse than the pandemic shutdowns. Democrats say the economy is almost back to where it was before Covid-19:  Republicans tend to be poorer than Democrats these days, which might explain some of the disparity thanks to inflation. But not all of it. For another illustration of the huge gap between what consumers and the markets perceive, this is the mean estimated inflation for five years' time, as reported to Michigan's researchers. If investors agreed, markets would be in a very different place now: A shift in methodology toward polling online has something to do with this. It's possible that people are accustomed to exaggerating when online. It's also possible that they're more likely to tell the truth. But a gap this wide is impossible to reconcile. For now, the market evidently thinks consumers are wrong, and in general agrees more with the Democrats. Continuing on the subject of elections: The big selloff that started August had much to do with a sudden strengthening of the yen. A big political surprise in Japan has just prompted another… Shigeru Ishiba is to be Japan's new prime minister, having won election as the ruling Liberal Democratic Party's leader. Very few people expected this, and it's a shock with market implications. As Gearoid Reidy explained for Bloomberg Opinion, he has carved out a career as the "anti-Abe," setting himself in opposition to the policies of the late Shinzo Abe, Japan's dominant premier of the last few decades. In matters of monetary policy, the candidate he beat, Sanae Takaichi, who would have been the first female prime minister, has called the Bank of Japan's rate hikes this year "silly." Ishiba thinks they were a great idea. A monetary hawk has taken control, and naturally that moved the currency. And how. These are the yen's movements against the dollar last week. The moment of Ishiba's election is marked, but it's not difficult to spot when the surprise must have happened:  The news broke just as the Tokyo stock market had stopped trading for the week, and it was a genuine surprise; Takaichi had led by 27 votes on the first round, only for Ishiba to win by 21 once others had been eliminated. But stock traders could do nothing all weekend except contemplate a sharp fall in equity futures, as a strong yen is almost axiomatically regarded as meaning a weaker Japanese stock market. At the time of writing, with the Nikkei 225 index down 4.3% in morning trading, the Ishiba surprise has been treated as a negative for stocks, but not a major turning point. The Nikkei 225 is still a little higher than its close on Wednesday, before it started to price in a Takaichi victory, and this shock isn't so big after several months of dramatic volatility:  How much does Ishiba's victory change things beyond that? Almost exactly 12 years ago, he suffered the same fate at the hands of Abe that he has now inflicted on Takaichi, winning on the first round but losing once other candidates had been eliminated. That election proved hugely consequential, and so Ishiba's surprising comeback is of at least highly symbolic significance. In general, he has staked out positions less in favor of an activist foreign policy than Abe, and more conservative on stimulating the economy. The key issue remains inflation. If the Bank of Japan has indeed managed to lift the country out of its deflationary slump, then more rate hikes will be needed. If not, not. There are various statistical ways to measure this, summarized by Capital Economics in this chart, but it's not yet clear that inflationary psychology has been brought back: If Japan's inflation continues to dwindle, then the BOJ will not be hiking rates much further, and Ishiba will have little effect on that. If it stays around 2%, the central bank will have that much more support for continuing its attempt at normalization. When it comes to the yen, his presence makes further strengthening (and hence further unwinding for the yen carry trade) that much more plausible at the margin. This was a major decision by the LDP. But as it stands, it looks as though the market has already accurately priced in the implications.  "Voice of the Red Sox" Joe Castiglione waves goodbye. Photographer: Billie Weiss/Boston Red Sox/Getty The baseball regular season is over, with the Red Sox on a perfectly mediocre and thoroughly deserved .500 record: 81 wins, 81 losses. It's still been a great ride to get there, in what turns out to have been the final season of radio commentary by Joe Castiglione, now 77, who has been the official Voice of the Red Sox for 42 years. More of these newsletters than I can count have been written to the accompaniment of his mellifluous voice. Thanks, Joe, and now it's time to end as he ended his seasons with a reading of Green Fields of the Mind, a wonderful essay on what baseball (or many other sports) mean to us by the Yale English professor and diehard Red Sox fan Bart Giamatti. Sports help us all survive. Have a great week everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Justin Fox: Biden's Economic Record Beats Trump's, With Some Caveats

- Howard Chua-Eoan: At a Critical Time, a Maverick Will Lead Japan

- Stephen Mihm: MAGA's Praise of 'Real Americans' Has a Dark History

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment