| I'm Shawn Donnan, a senior writer for economics in Washington. Today we're looking at Donald Trump's tariff math. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The Bank of Japan kept policy unchanged, while still keeping the ground prepared for a ramping up of borrowing costs in the coming months.

- China is considering removing more restrictions on home purchases after previous measures failed to revive a moribund housing market.

- The Big Take looks at Kamala Harris and her policies.

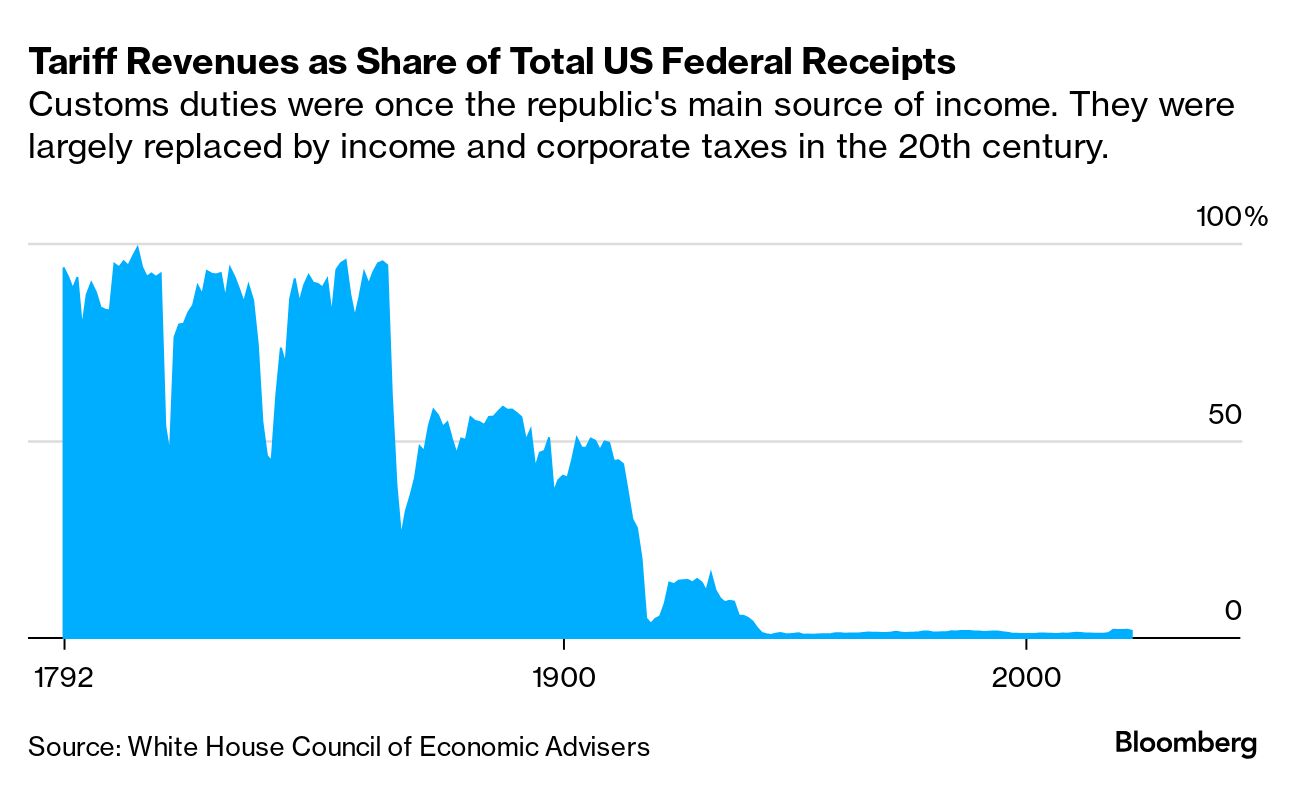

Donald Trump has a well-documented fascination with tariffs, but he's now making a new pitch on the campaign trail: using them as a source of revenues to pay for everything from tax cuts to childcare. There's a math problem, however. Even if the former president returns to office and rolls out a 10-20% tariff on all imports and higher levies still on Chinese imports, it won't be enough to pay for his plans, economists say. A new Bloomberg Economics study finds that a 20% universal tariff and a 60% tax on Chinese imports would bring in $300-$400 billion in revenues annually, up from the $83 billion duties collected in 2023. - Read the analysis on the Bloomberg terminal here.

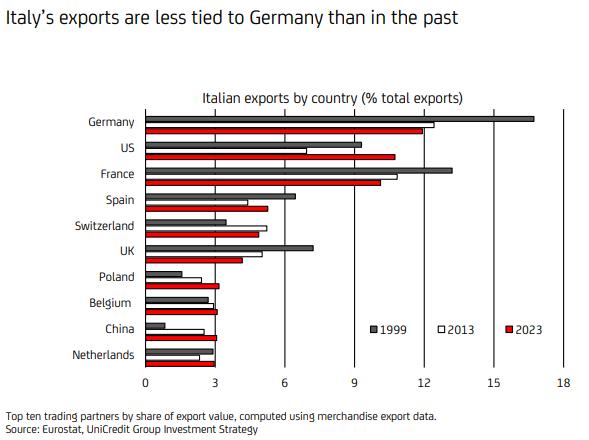

The Peterson Institute for International Economics separately puts likely revenues from a 10% tariff and higher China duties at around $225 billion. Neither estimate would be sufficient to match the as-much-as $6.9 trillion cost over a decade that the Penn Wharton Budget Model says Trump's fiscal promises would add to the US federal budget deficit. The Trump campaign says critics have it all wrong. His tariff plan, says Karoline Leavitt, national press secretary, "will result in millions of jobs and hundreds of billions of dollars returning home to American shores." Scott Bessent, a Trump adviser and the founder of hedge fund Key Square Group, also says critics miss an important point. While he agrees tariffs would likely fall short of filling the fiscal hole on their own, he says that as imports go down and production returns to the US, that will generate growth and jobs — and thus higher domestic tax revenues. Critics of Trump's plan dispute that last bit. They argue tariffs would actually lead to higher consumer prices, higher interest rates at the Federal Reserve and possibly a recession — something that would hurt revenues. There would also be retaliation from other countries. Just ask America's soybean farmers what happened when Trump imposed tariffs on China during his last presidency. Trump has plenty of arguments for tariffs, including that they provide leverage to negotiate with other countries. But the sales pitch that they'll lead to a transformative windfall for government coffers may not add up. For more, subscribe to Washington Edition, the newsletter about money, power and politics in the US capital. In another example of Germany's waning economic impetus, research shows that the euro region's No. 3 economy has diminishing trade links with the No. 1. "The share of Italy's merchandise exports going to Germany has declined since the launch of the euro and it is now less than 12%," Loredana Maria Federico, chief Italian economist at UniCredit (the bank that ironically has just expanded its stake in Germany's Commerzbank), wrote in a note earlier this month. Perhaps surprisingly given that the euro was aimed at breaking down internal European barriers, Italy's trade has reoriented somewhat away from the region, with more than half of its goods exports heading outside the EU. One increasingly important destination is the US, Italy's second-biggest trading partner, Federico wrote. |

No comments:

Post a Comment