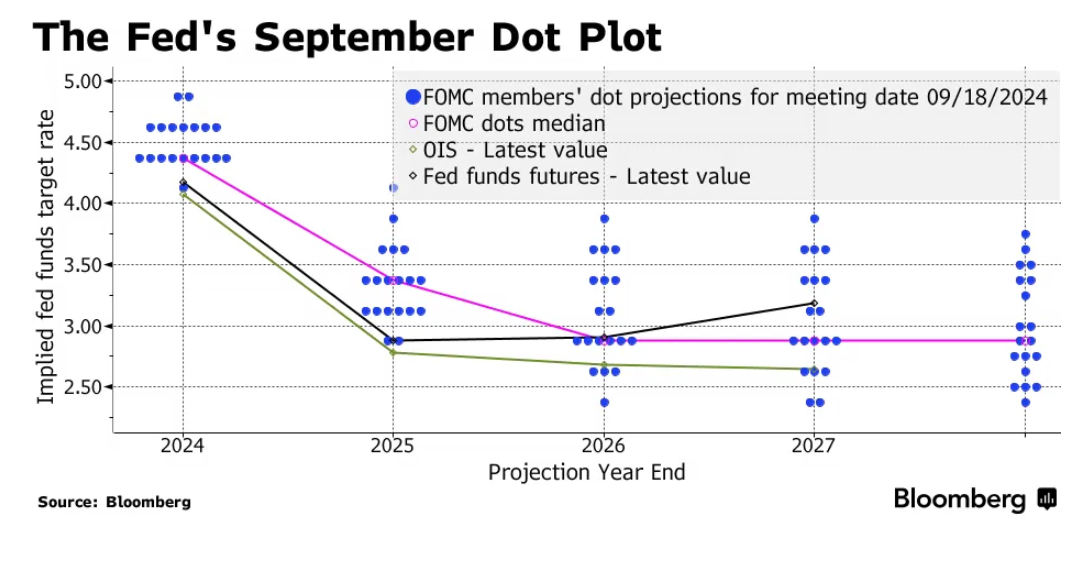

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the Fed's new policy stage. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. For the Federal Reserve Wednesday, it wasn't quite "Celebration Time," as Kool and the Gang put it in their hit song, but rather "recalibration" time. Chair Jerome Powell used the phrase about 10 times in his press briefing — in other words, policymakers had to start taking interest rates down to a "more neutral rather than restrictive" level. By cutting rates 50 basis points, Powell and all but one of his colleagues voted to go bigger than almost all economists forecast. The danger with that was that it might spook investors and the broader public into worrying that the US central bank was now worried about a looming recession. But Powell threaded that needle, according to former New York Fed President William Dudley. He did that by highlighting that the slowdown in inflation gave policymakers the space to kick off the normalization of interest-rate settings with a bigger move. While the Fed chief said officials in retrospect might have begun cutting rates on July 31 had they known about the weakness in the July jobs report that came out two days later, he underscored that being patient "has really paid dividends." The benefit is that policymakers now have greater confidence about whipping inflation, he said. Powell highlighted that — despite not having moved in July — "we don't think we're behind" the curve in easing policy. Wednesday's "strong move" showcased "our commitment not to get behind," he said. Financial markets fluctuated as traders sorted through positions and began placing new bets on where the Fed heads from here. But there was no big selloff in equities. The S&P 500 hit an all-time intraday high before closing down a modest 0.3%. Powell continued to refrain from offering much guidance, other than to caution against assuming that 50 is "the new pace" for cuts. Ultimately, it will be the job market that makes the call on whether the Fed does achieve the soft landing it's seeking. Dudley, a Bloomberg Opinion contributor, said if the employment data spark deeper concerns about downside risks, policymakers will "throw in a few 50s." - Millions of ambitious Chinese professionals have had their lives upended by President Xi Jinping's decision to reshape the world's second-largest economy. Read the Big Take.

- Australia's strong hiring extended into August. Meanwhile, efforts to fix the country's housing crisis are stuck in political gridlock.

- New Zealand faces another recession after the economy contracted in the second quarter. Germany may already be in one, the Bundesbank said.

- Economists are betting on more Indonesia easing after cut surprise.

- Europe is confronting the economic cost of devastating floods.

- A shadow network stretching from Dubai to China is involved in a multi-billion dollar effort to ship sanctioned gas from Russia.

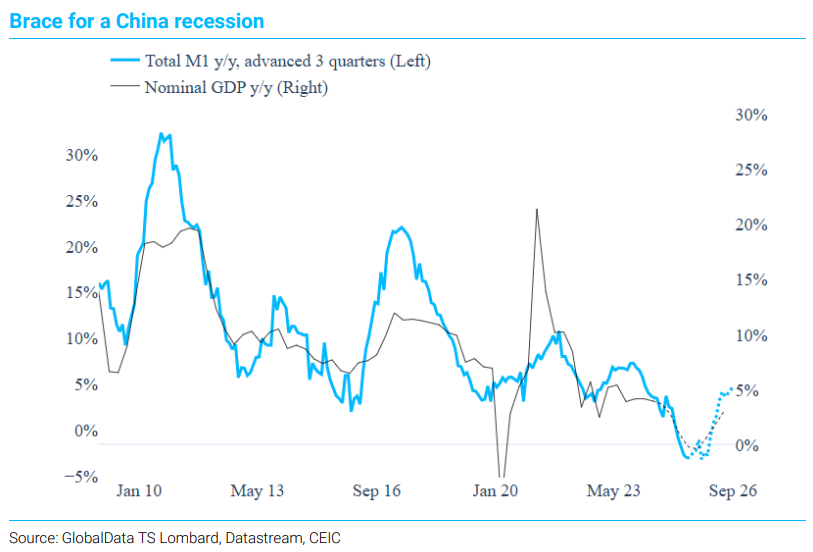

China's economic slowdown is set to get much worse, according to leading indicators highlighted by Freya Beamish and Rory Green at TS Lombard. "We've both covered the economy for our entire careers and we've never been more worried about Chinese growth," the duo wrote in a note Wednesday. They pointed to gauges including money supply, operating profits, the number of loss-making companies and a measure of labor costs — in other words income. Growth is likely to slump well below policymakers' 2024 target of 5%, they wrote. "The full-year picture for next year seems likely to be much worse, as low as 1-to-2%," they wrote, though this is "not something we will see flashing up on the Bloomberg terminal as an official number" as Chinese authorities aren't likely to allow revealing such a low figure. And nominal GDP "looks likely to contract." |

No comments:

Post a Comment