- The yield curve disinverted! That means the recession is about to start! Probably.

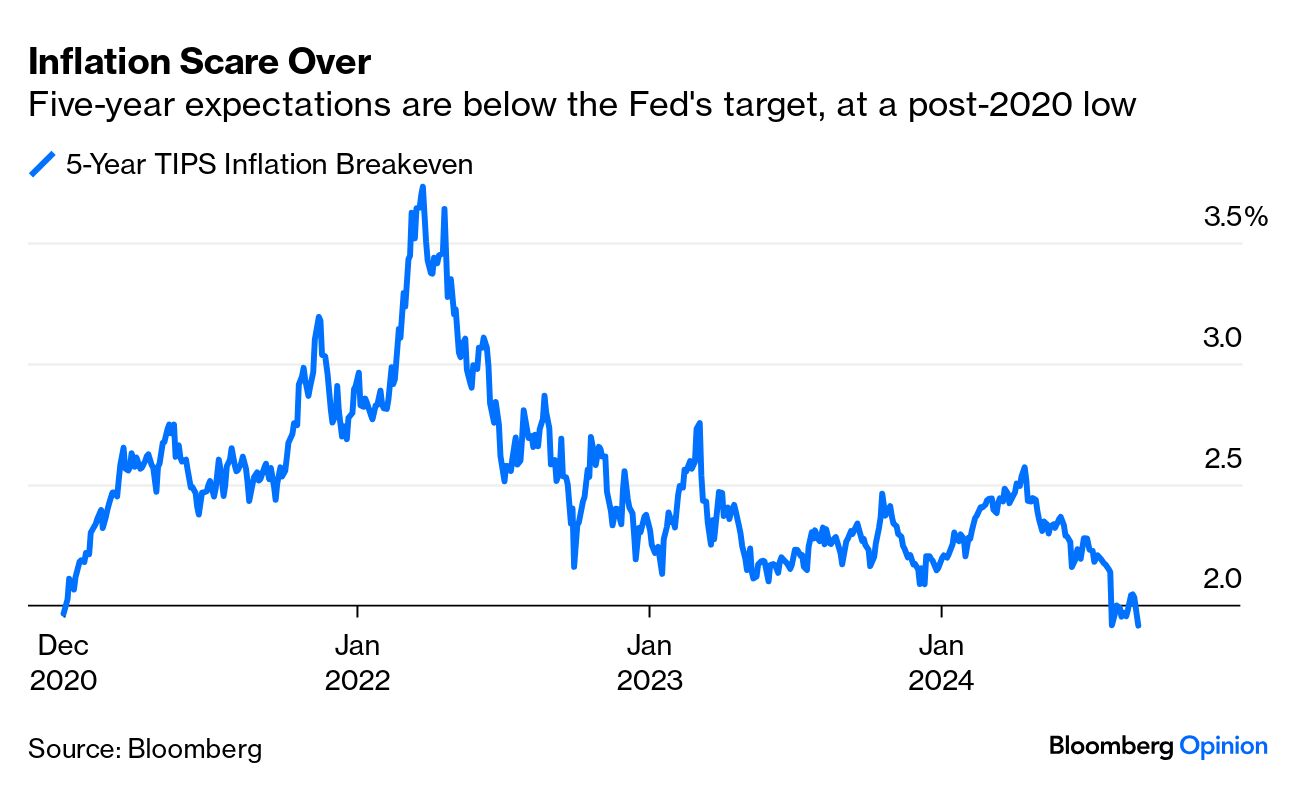

- The inflation scare is over; breakevens suggest it will be will be under 2% in the US for the next five years.

- On balance, the market is probably overestimating the number of rate cuts ahead. Let's hope so, anyway.

- Crude oil is now at its lowest since June 2023; fears about demand are driving it lower.

- AND all you need to know to drive yourself mad tracking the US election. You're welcome.

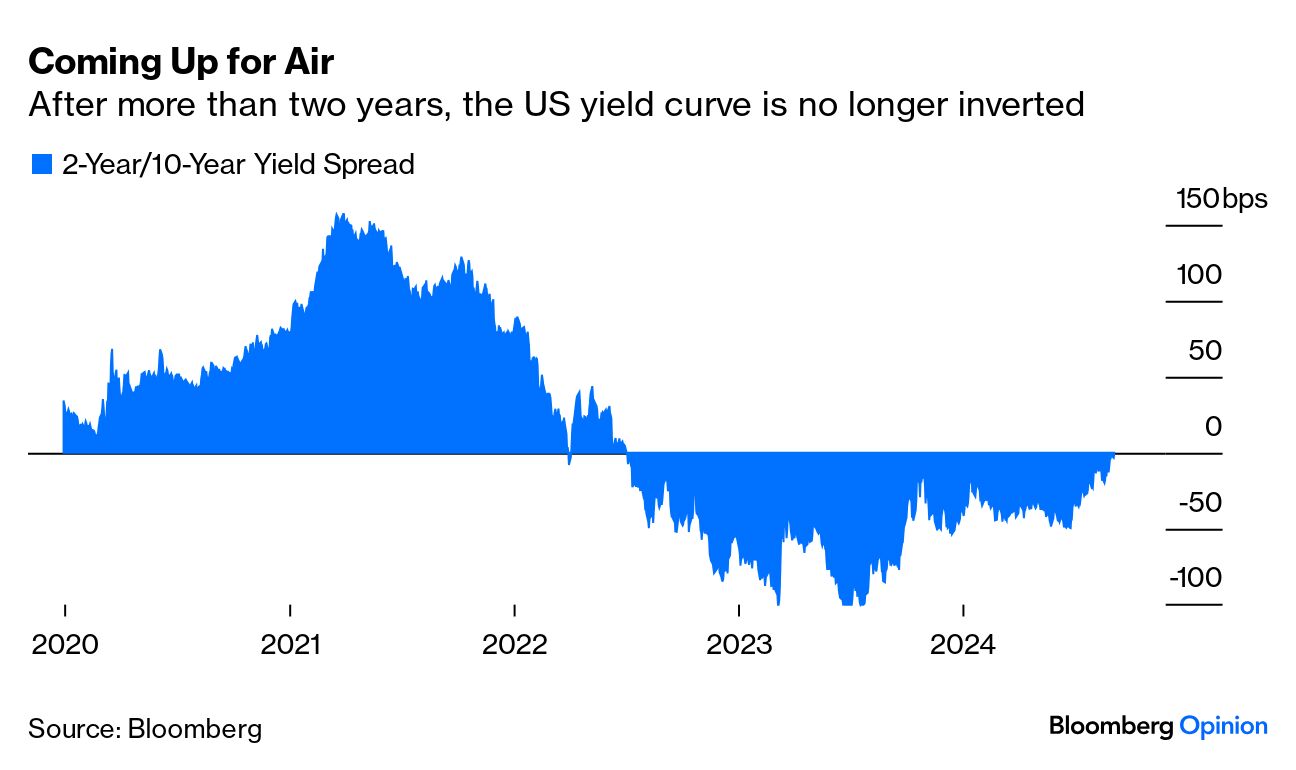

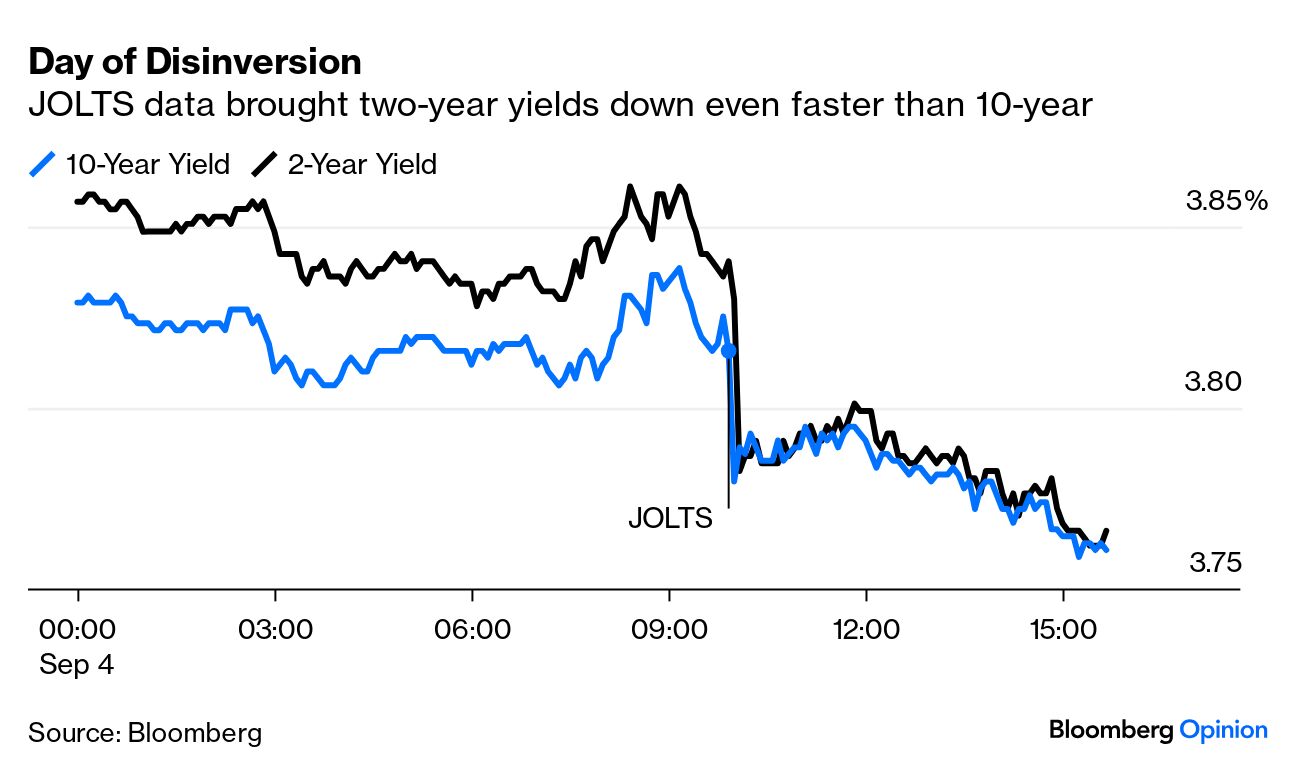

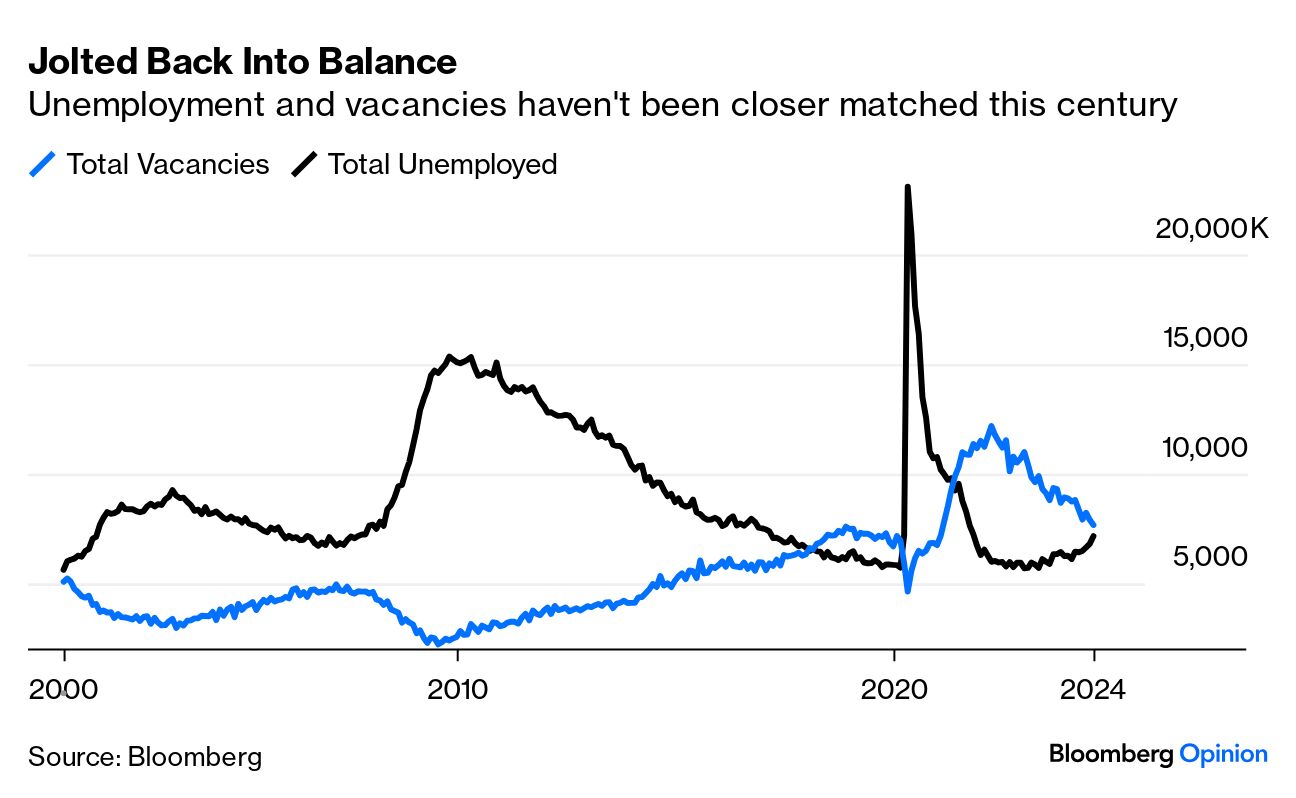

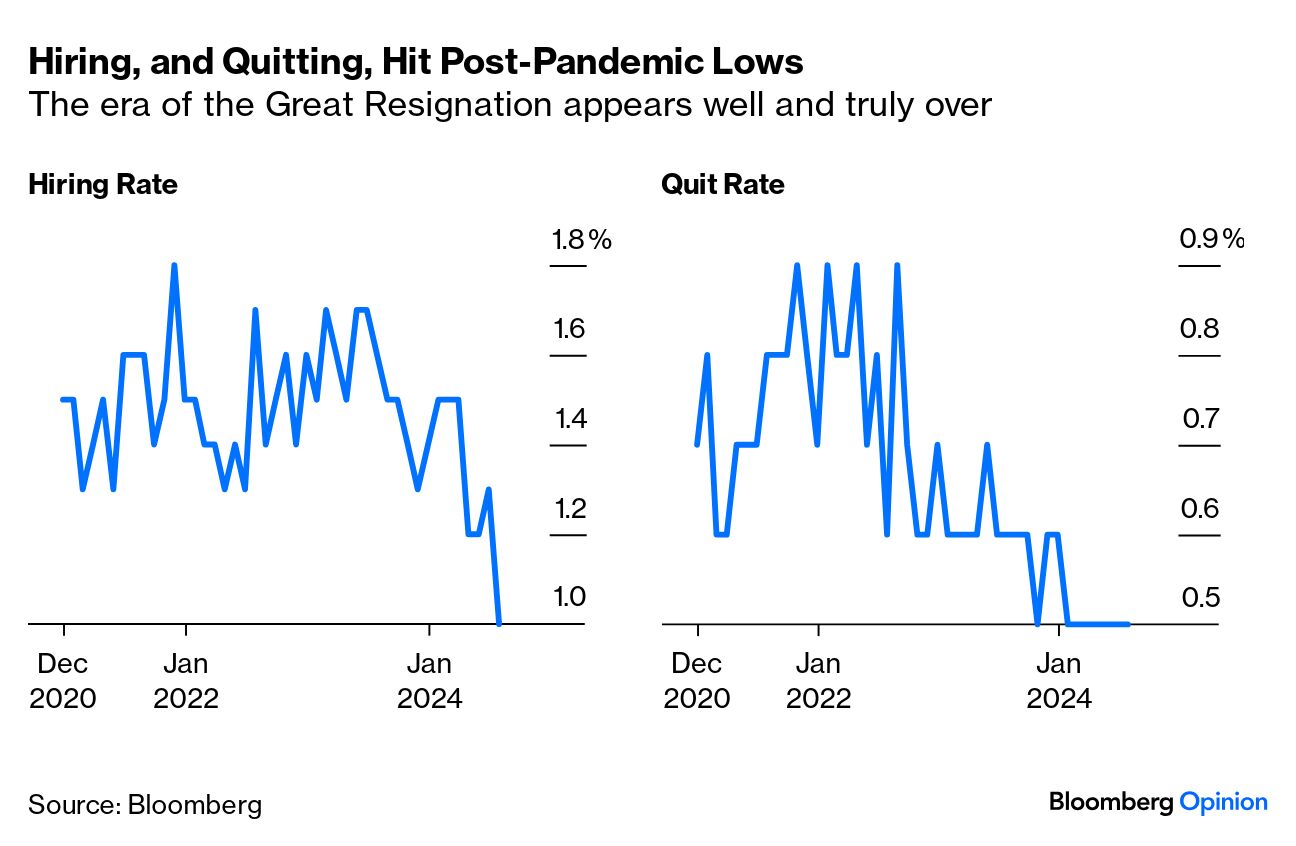

The moment many in the bond market had long awaited has finally come. The 10-year Treasury yield is ever so slightly higher than the two-year yield once more, so the infamous yield curve is no longer inverted. That ends 26 months of inversion: The yield curve is primarily known, outside the bond market, as possibly the best recession indicator there is. When the curve inverts, it suggests investors are convinced that inflation and growth will be down long into the future, so 10-year yields will have to be lower. That doesn't mean, however, that it's great news that the curve has disinverted. Rather, history suggests that this is a signal that a recession is now truly imminent. Rate cuts in the next two years will be enough to ensure that shorter rates are lower than long ones. And indeed, the moment of disinversion came on the publication of a data point that many thought recessionary, the latest numbers on the Jobs Openings and Labor Turnover Statistics (JOLTS), of which more later. This is how the two benchmark yields moved through Wednesday: Those JOLTS numbers flattened the curve by adding to traders' conviction about the scale of imminent fed funds cuts. In particular, the total number of vacancies dropped to its lowest since the pandemic year of 2020. Combining this with an ongoing increase in the number in the workforce but unemployed, there is now only about 1.1 vacancy per person looking for work. That's very close to balance: Meanwhile, the rate of quitting stayed at 0.5%, having spent much of 2022 at almost double that during the "Great Resignation," while the hiring rate dropped sharply: There are different ways to take this. The JOLTS survey has suffered more than most from falling response rates since the pandemic, so confidence in the numbers has reduced. Further, it refers to what was happening in the labor market in July. Joe Lavorgna of SMBC Nikko cautioned: The labor market was in balance two months ago. However, the downtrend in job openings is concerning and hints at the possibility that the hiring and separation rates will deteriorate in the months ahead. While these data support a 50-basis-point September rate cut, the upcoming employment report will supersede today's results.

It was possible to be more upbeat. Carl Weinberg and Rubeela Farooqi of High Frequency Economics attempted to calm everyone down: Job vacancies declined, hires rose and quits were steady. There is no signal here of any sudden collapse of the labor market or any imminent recession. Openings have come down significantly but remain higher than the 2019 average. Hires and quits moved up last month but current levels are below 2019 averages. Importantly, the vacancies-to-unemployed ratio has mostly normalized in recent months. Relax.

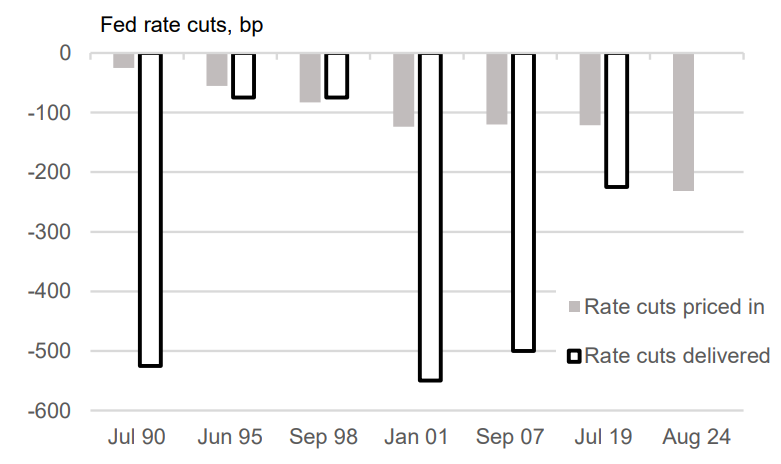

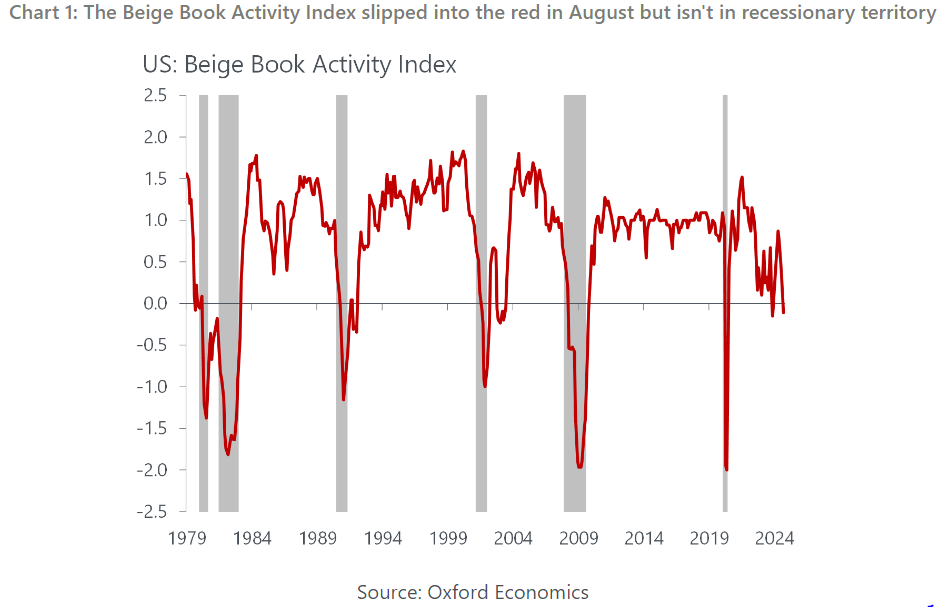

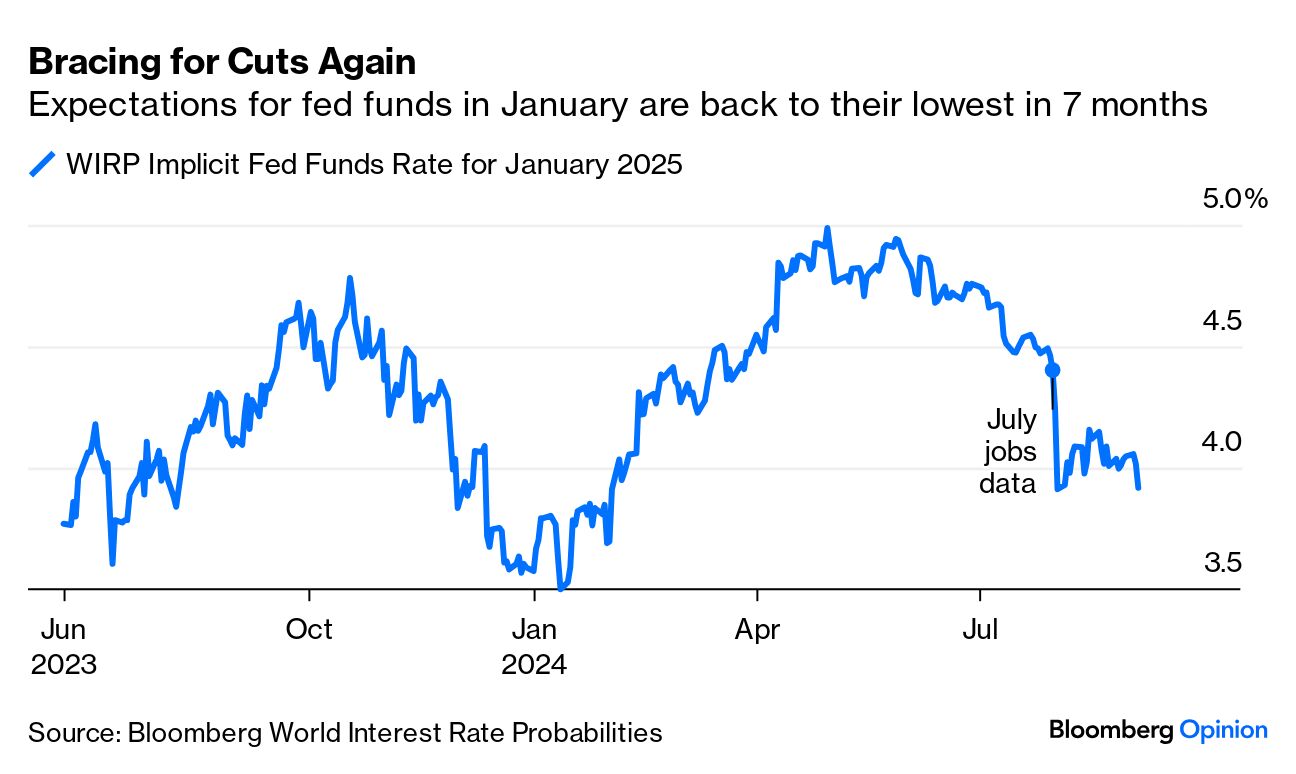

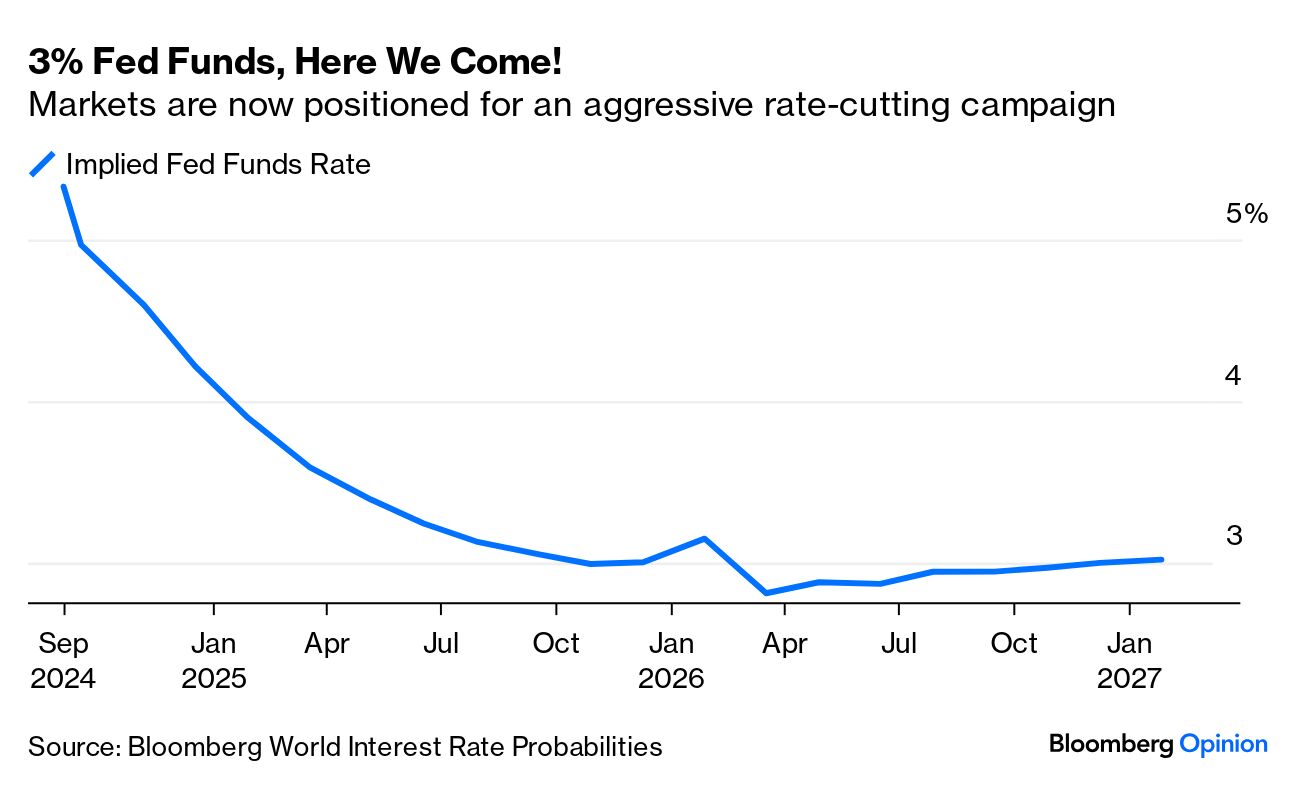

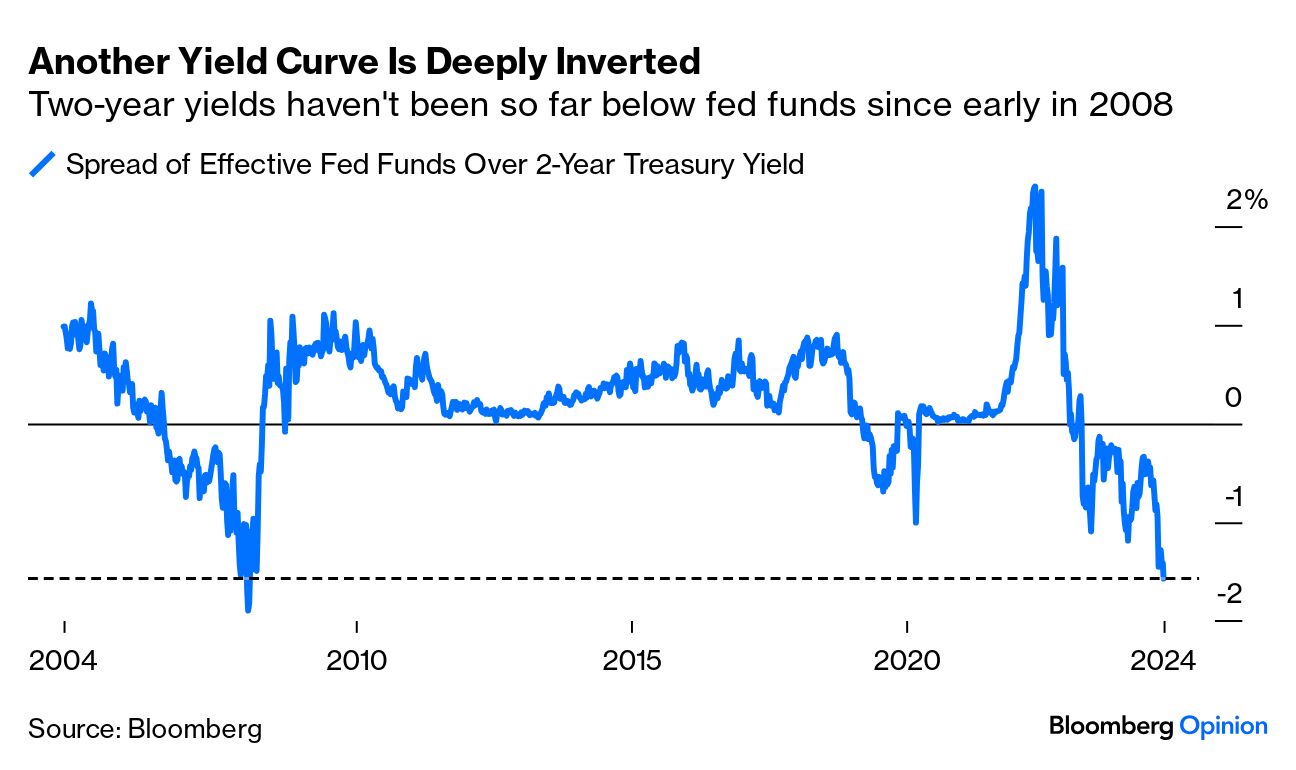

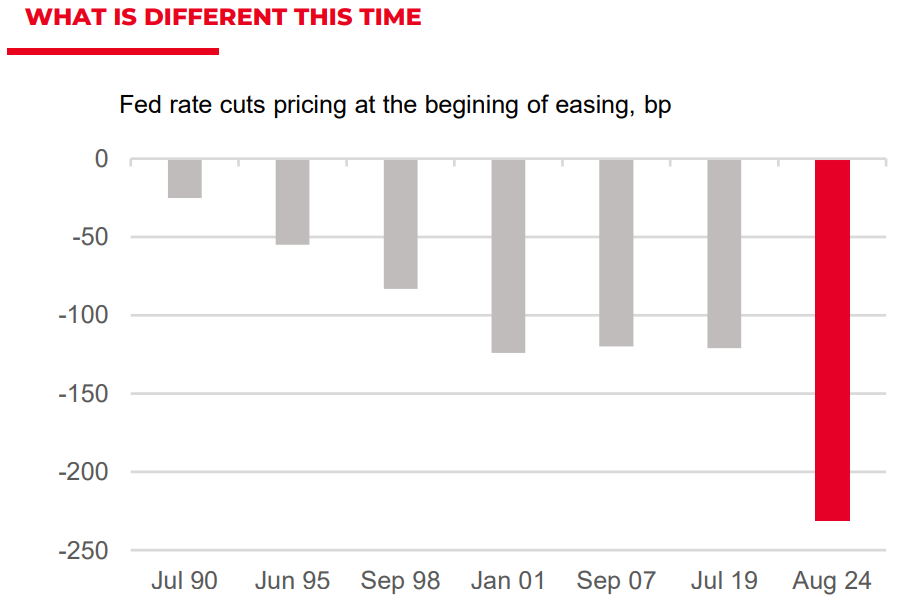

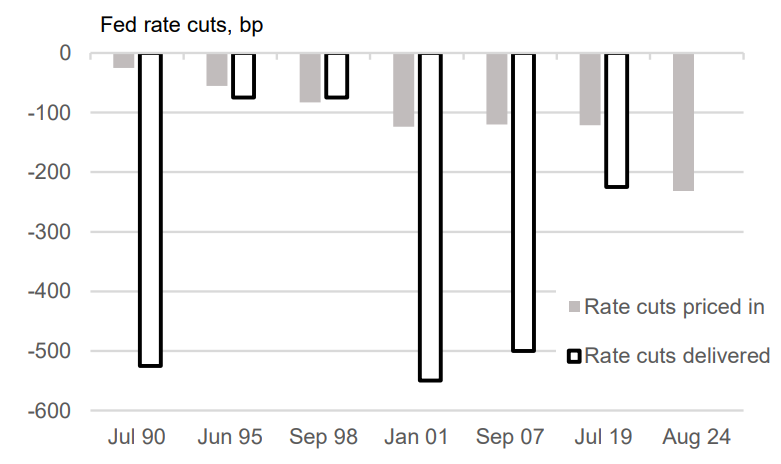

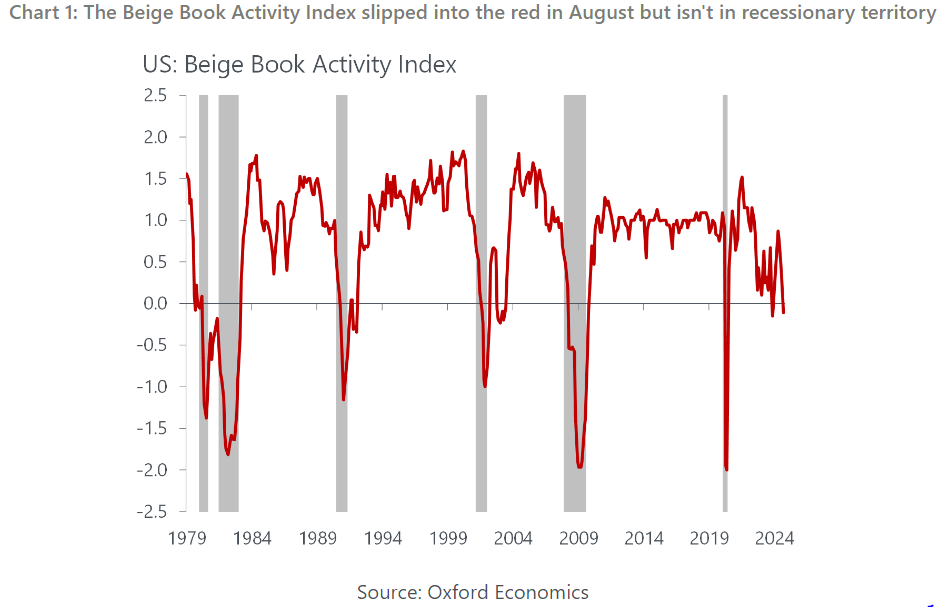

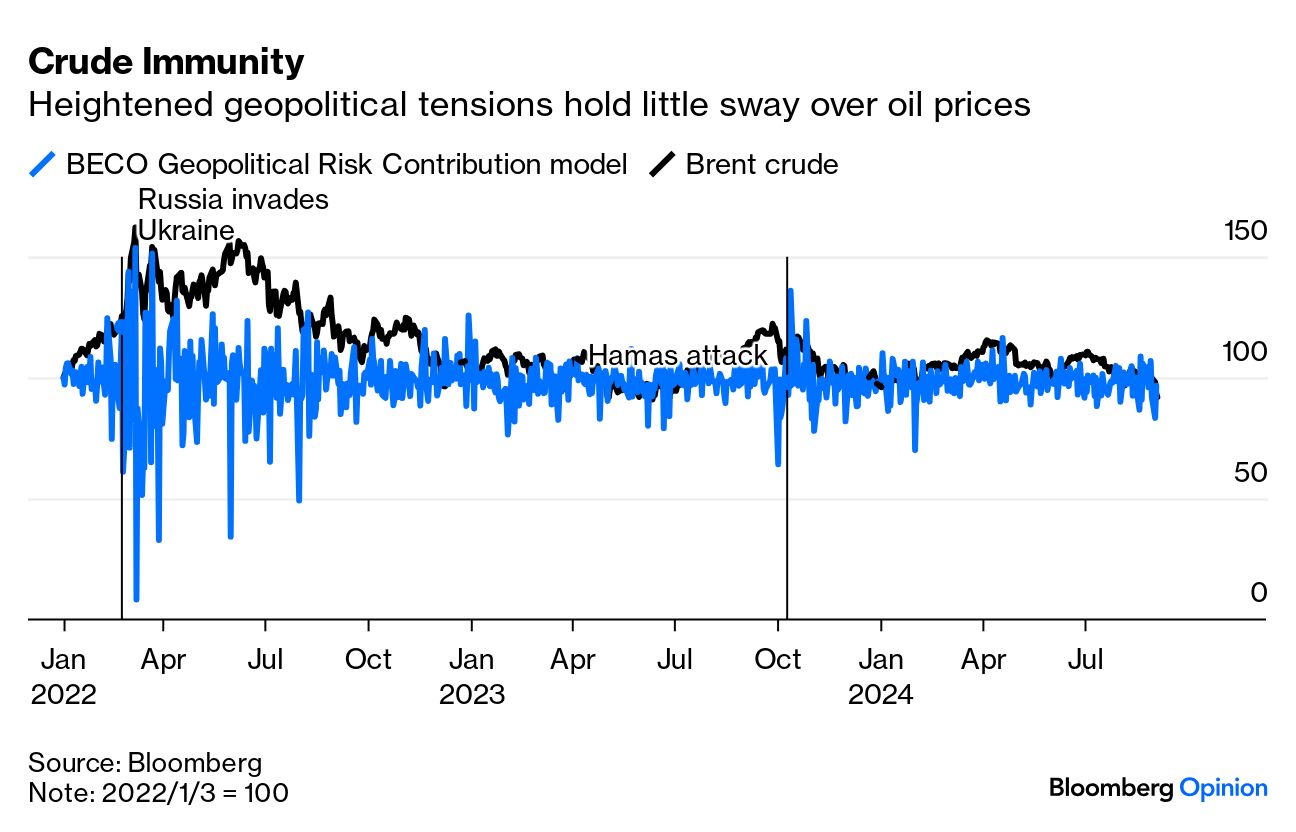

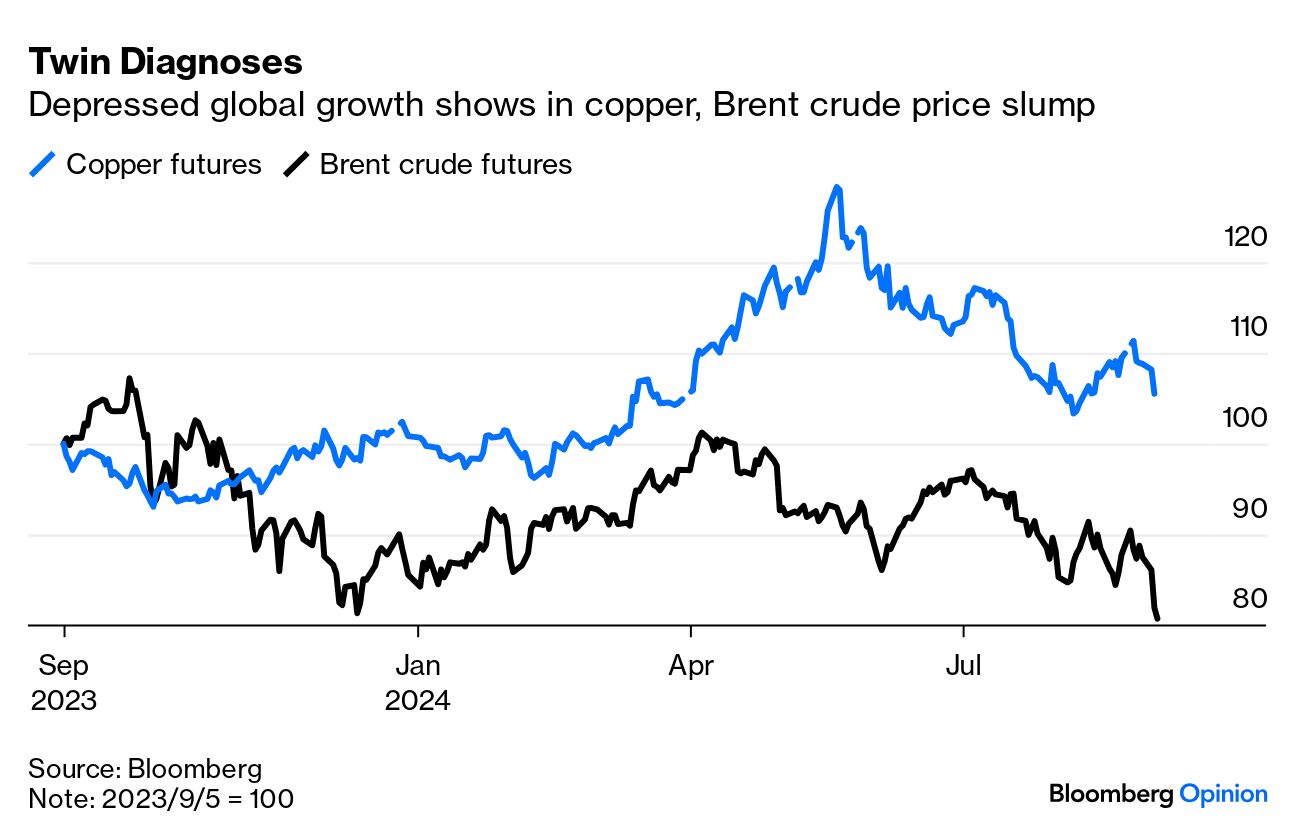

Few appear to have taken it that way. Bets on the Fed to cut rates aggressively grew in confidence. The projected fed funds rate for its January meeting is now back to its lowest since February, according to Bloomberg's World Interest Rate Probabilities function, which derives projected rates from the futures market. A month ago, the July non-farm payrolls number sparked a wave of bets that the Fed would have to cut repeatedly. Those bets have been reined in somewhat since, but the market is back to full confidence that fed funds will be below 4.0% next January: Looking longer into the future, the market now expects the Fed to cut at every meeting between now and the end of next year. Once the fed funds are down at about 3%, it's expected to leave it there for a while. That implies bad things about the economy: That confidence in imminent cuts means that another, less closely watched yield curve is now very deeply inverted. If we subtract the two-year Treasury yield, driven by Fed expectations more than anything else, from the effective fed funds rate, giving a spread from one day to two years, we find the curve is its most deeply inverted since the beginning of the crisis year of 2008. Back then, traders accurately thought that the deepening credit crisis would force the Fed into cutting many times. That's a very uncomfortable precedent: For another way to view exactly how confident the market is of rate cuts ahead, this chart from Adam Kurpiel of Societe Generale SA shows the amount of easing, in basis points, that was priced in by the market at the beginning of each easing since 1990. This one sticks out like a sore thumb: Typically, the error in the past has been to fail to see how much economic pain (and therefore easing) is coming down the pike. This was dramatically so in the cutting campaigns that followed Saddam Hussein's invasion of Kuwait in 1990, and the great implosions surrounding the dot-com bubble and the Global Financial Crisis. If the market is making a similarly large mistake this time, perhaps we should hope that it's overestimating cuts for a change:  All of this looks particularly overdone given that the Fed is still on balance unlikely to cut by 50 basis points this month. That will depend more than anything on Friday's unemployment report, which now looms as an unhealthily big event. Meanwhile, Wednesday's publication of the Beige Book, in which the Fed's regional branches offer an anecdotal picture of the economy, was in line with a soft landing rather than the kind of five-alarm fire that would necessitate the nine cuts that are currently priced in. This is Oxford Economics' regular gauge of the level of activity demonstrated in the book, derived from counting a number of cue words in the report. It suggests negativity (not for the first time in the last two years), but not a recession:  It's also noticeable, finally, that the market seems extremely confident that inflation is at last licked. Five-year inflation breakevens, derived from the bond market, now imply that prices will rise at an average of less than the Fed's target 2% per year for the next five years. The breakeven is its lowest since late 2020, and signaling that all need to worry about inflation is now over: The market might well be right about all of this, and this level of negativity suggests that people are primed for a major move lower for stocks and higher for bonds in the event of a disappointing payrolls number. But on balance, the risks are now skewed toward the negative positioning having been overdone, with another August-style rebound in prospect if the unemployment data allow it. Oil did a thing this week. It erased all of its 2024 gains despite heightened geopolitical risks. Brent crude, the global benchmark, fell below $73 a barrel, its lowest since June last year. While geopolitical risks haven't regained their peak after Hamas's Oct. 7 attacks on Israel, recent developments in the Middle East are stoking alarm. Ukraine's counteroffensive is raising the stakes in the war with Russia. Yet CFRA Research's Sam Stovall, shifting underweight on energy, sees no immediate avenue for oil prices to break above $80. This chart from Bloomberg Economics models the geopolitical risk contribution to changes in the oil price. While these risks remain ever-present, their drag on prices is waning, meaning other factors outweigh them: Obviously, the slump partly stems from weakening global growth. China's economy grew by 4.7% in the second quarter, below expectations. In the US, the Institute for Supply Management's manufacturing index rose to 47.2% from an eight-month low of 46.8%, but that remains within contraction territory. Pepperstone's head of research, Chris Weston, argues that the dull growth and a boost in supply make a "toxic mix" for a market that is already vulnerable: "Crude literally can't find a friend in this market. The buyers have simply walked away, seeing an ever-increasing probability of getting a fill at lower levels." The plunge is prompting members of the Organization of the Petroleum Exporting Countries+ to rethink their plan to raise production in October. Led by Saudi Arabia and Russia, OPEC+ had intended to add 180,000 barrels a day next month, restarting output halted since 2022 in a bid to shore up prices. With crude's latest fall, it's likely to shelve such plans, especially with Libya expected to restore nearly 500,000 barrels following a resolution to a power struggle that had disrupted flows. Will this have a lasting impact? Weston notes: Naturally, when we see this sort of volatility and reduced liquidity in top-of-order books, price can be prone to wild snapbacks on limited news flow — but for now, crude is telling a progressively harrowing story, and it is one that equity and rates traders are taking a steer from and increasing their need to hedge out risk.

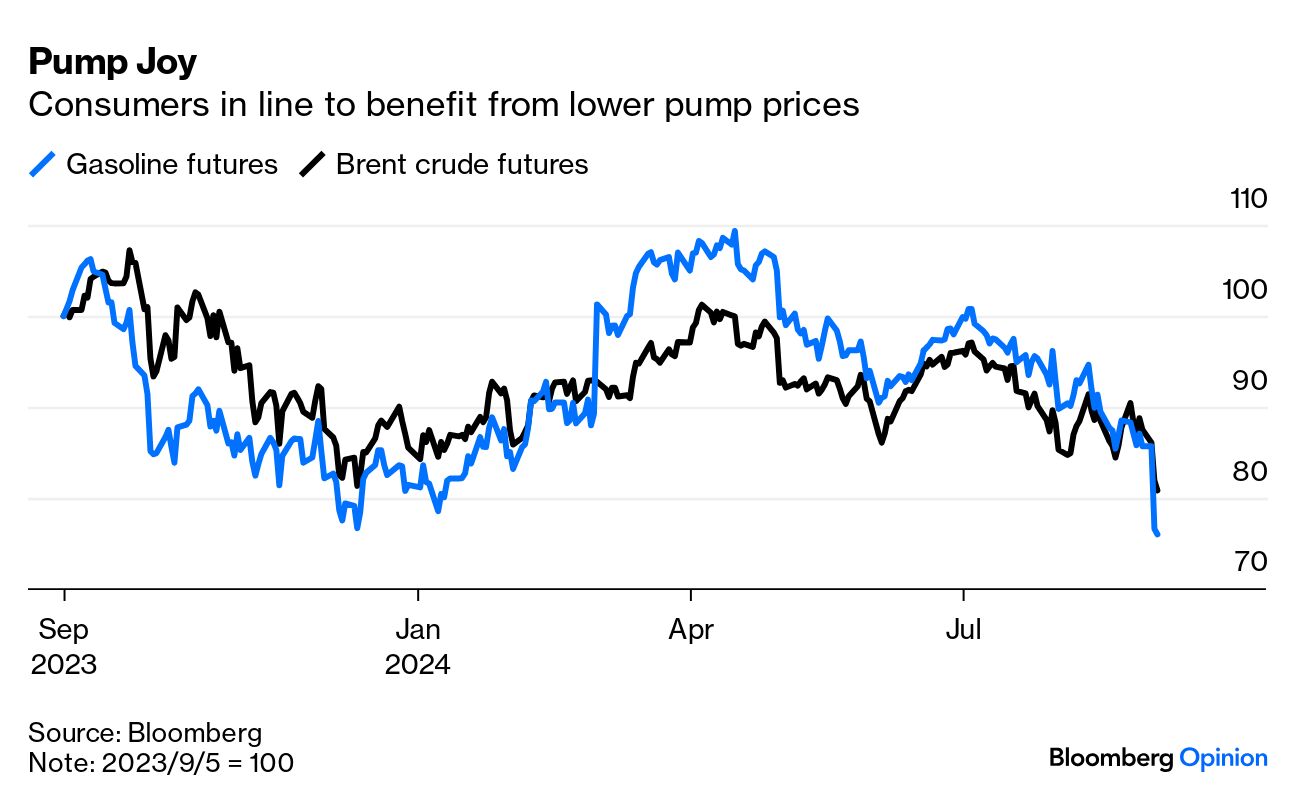

Like oil, copper — another proxy for global growth trends — has been faltering. It steadied near $9,000 a ton in Wednesday trading after a five-day run of losses fueled by an increasingly dim outlook for demand in China. This chart shows the correlation between the two commodities in the last year: The silver lining in oil's fall is the additional confidence added to expectations of monetary easing by the Fed. This is one less inflationary pressure to worry about. For consumers, the joy is almost instant, with gasoline futures in New York falling even faster than crude, and likely to translate into lower pump prices: Overall, cheaper gasoline, one of the most visible measures of inflation for voters, might just deliver a timely election boost for Vice President Kamala Harris. But both she and the oil price must contend with what shocks the geopolitical situation might create in the next two months. —Richard Abbey This is for those with a case of US election angst. You shouldn't treat politics as a horse race, but if you can't stop yourself, there's WSL ELECTION <GO> on the terminal, or you could go to realclearpolitics.com, fivethirtyeight.com or Nate Silver's latest venture Silver Bulletin for betting odds, the latest polls, and the opportunity to color in your own electoral maps. Using "no toss-up" polling results, in which whoever is 0.1% ahead (a statistical dead heat) is counted as a winner, you can see who's ahead. Just to whet your appetite for the way you can pummel your mental health: If Real Clear Politics' polling averages are right, then Harris was on course Tuesday to win the electoral college by a margin of two (270-268). Victory was wholly reliant on the electoral vote that goes with winning the congressional district that includes Omaha, Nebraska. On Wednesday, she slipped behind in Pennsylvania but took the lead in Georgia and Nevada, translating into an electoral majority of eight. This is meaningless, but does serve as a reminder that Donald Trump might win Pennsylvania and still lose the presidency if he falls short in Georgia and Nevada (doubtless after weeks-long recounts). That would be some scenario. To restore some sanity (particularly if you're a Republican), you could also check out this piece by Bloomberg Opinion colleague Aaron Brown. After stripping out the noise from Silver's forecast, and from the PredictIt prediction market, he arrives at a 70% chance of a Trump victory — but that's now. As Brown says: "There's a lot of campaigning to go, a lot of events that could turn the election into a landslide for either candidate."

Hold tight.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marcus Ashworth: The Vanishing Bull Case for Investing in France

- Aaron Brown: Election Predictions Are Too Noisy to Tell If Trump or Harris Wins

- Tyler Cowen: AI Culture Will Be Weirder Than You Can Imagine

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment