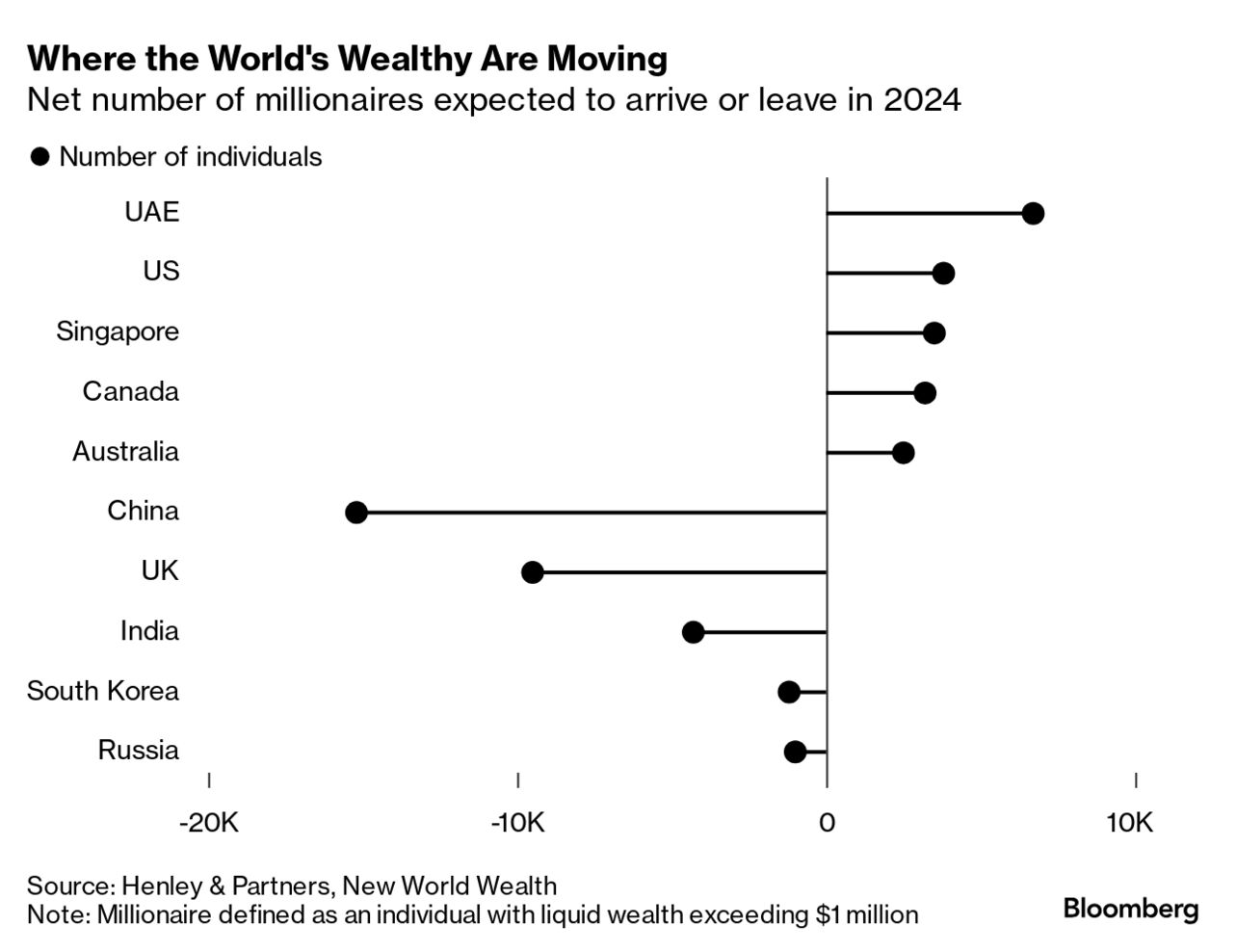

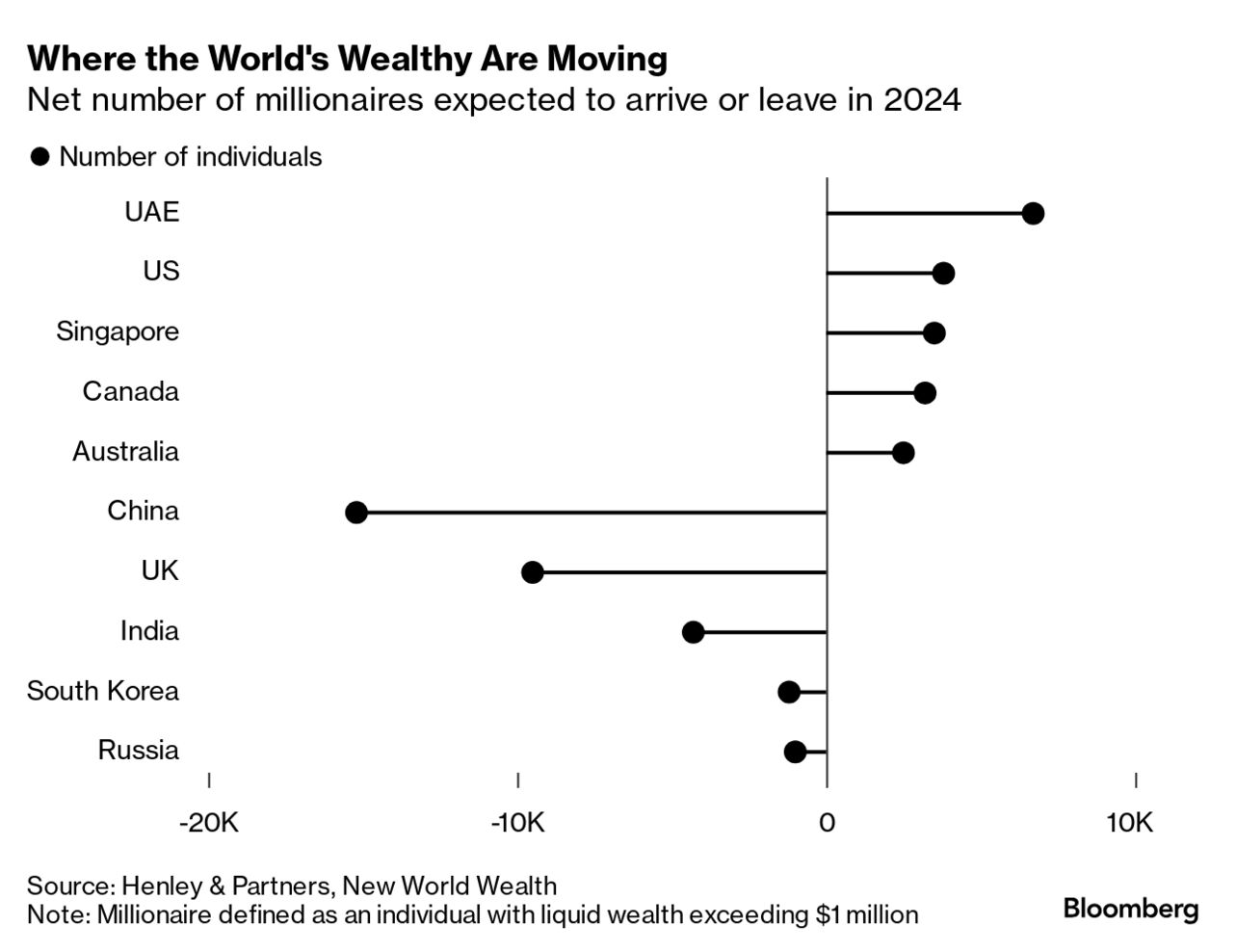

| Around 500 corporate leaders were at Labour Party conference in Liverpool for the £3,000 a pop "business day" – an event that we learn from Joe Mayes sold out in 24 hours. It feels as if what began as excitement to take Keir Starmer up on his offer to business leaders to "join the government of Britain" has morphed into CEOs waiting for morsels of information on what may be coming for corporate UK. In the end, the chancellor did manage to use her conference speech today to "project a positive vision for the country" even though the consensus was that she didn't say much that was new. It did not change the view that the next few weeks are critical – this morning the CEO of Lloyd's of London told Bloomberg Radio that getting the next six weeks right will be "really important to people interested in investing here." Our Andrew Atkinson and Irina Anghel also report that some businesses are adopting a "wait-and-see" approach until budget day. As the C-suite hits up Liverpool, the piece I found most interesting is counter-intuitively about Denmark. This Bloomberg TV interview with their prime minister sees her challenged on whether her country is more than just the giant Novo Nordisk, the creator of Ozempic, which is now worth more than Denmark's GDP. Her answer is — unsurprisingly — a yes, pointing to Lego, Carlsberg, wind turbine maker Vestas and shipping company Maersk.  The reason I found it so timely is that creating these sorts of companies was a major part of Rachel Reeves's pitch on wealth creation, before she went so big on expectation management that she plunged the UK into what City insiders are calling a "boom in gloom." Today Reeves tried to get back onto this more positive agenda, saying Oct. 30 will be a budget for investment, with a planning shakeup, and industries including carbon capture, gaming, onshore wind and data centers all ripe for investment. Philip Aldrick wonders whether the chancellor is gearing up for a change in the fiscal rules to see some borrowing for investment. But while the chancellor made a stab at course correction today, you can already see the boom in gloom writ large in our Big Take on the ultra-rich fleeing London. They cite a stat from Henley & Partners that the UK is on track to lose 9,500 millionaires this year. For most of the non-doms they interview, the chief threat is inheritance tax being applied to all their overseas wealth. If this all too much like "bleeding stumps" for you, Bloomberg Opinion's Matthew Brooker may offer the corrective you are looking for, as he predicts not as many will leave as are threatening to. He also suggests some kind of compromise on inheritance tax on non-dom earnings by "softening the inheritance tax measures — for example, by stepping up the rate gradually, to 10% in year 10, 15% in year 11, 20% in year 12 and so on." Because, as he goes on: "There's a lot riding on getting this right." Want this in your inbox each weekday? You can sign up here. |

No comments:

Post a Comment