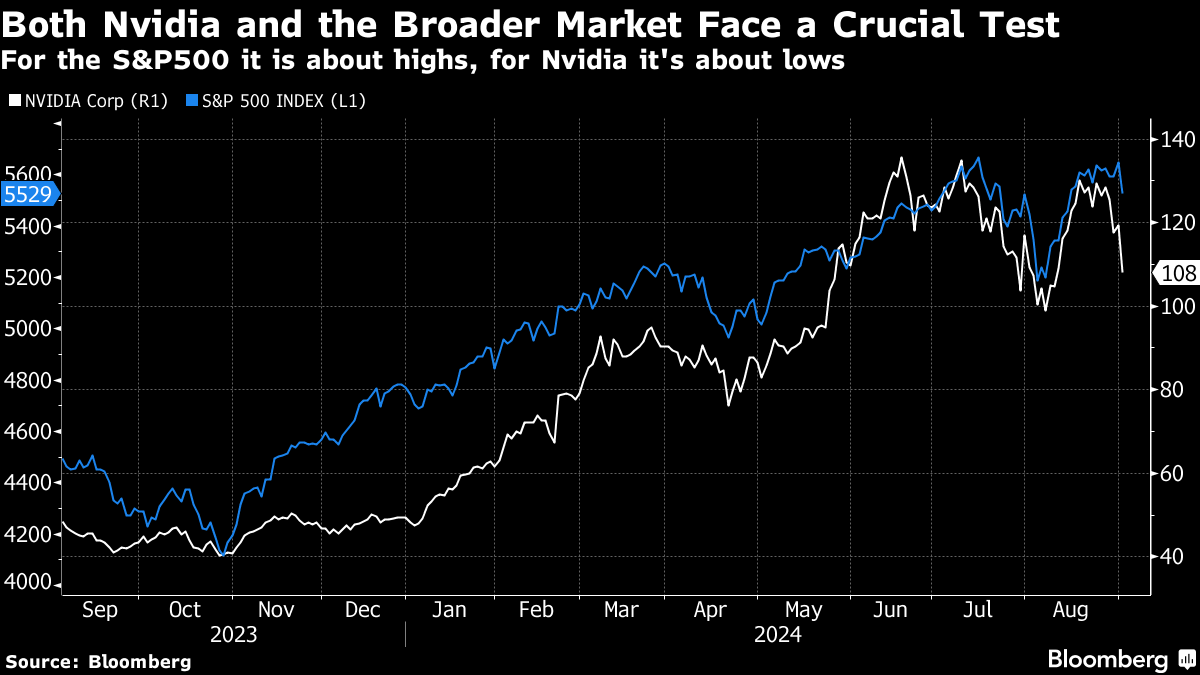

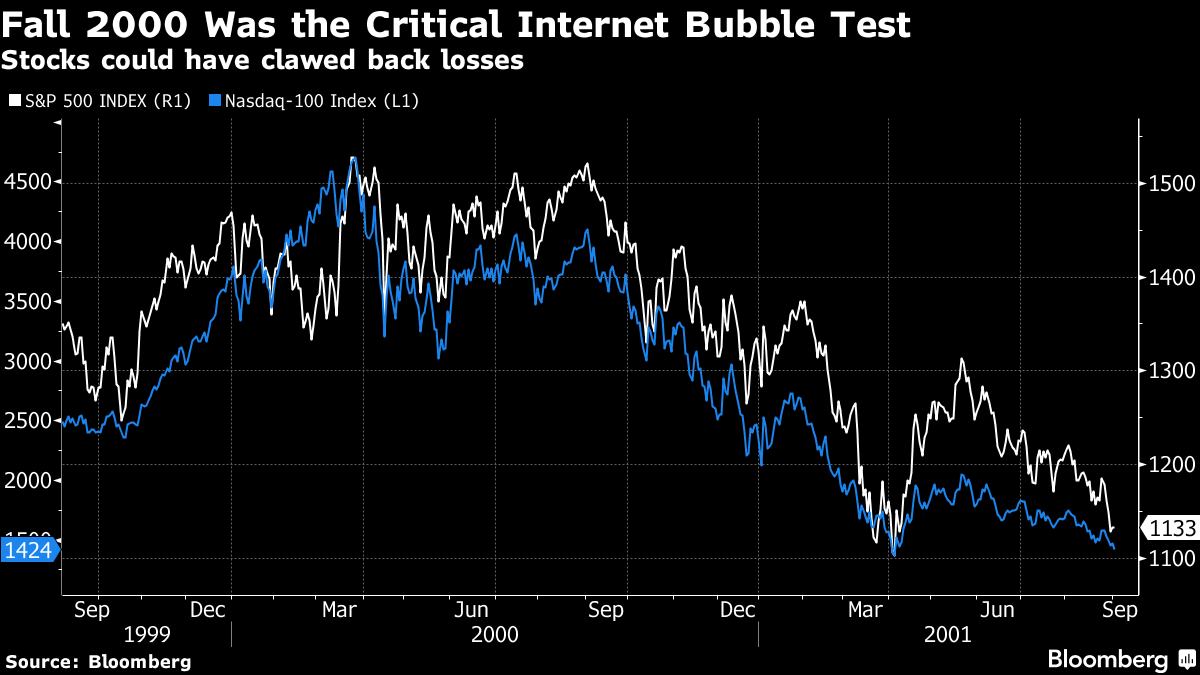

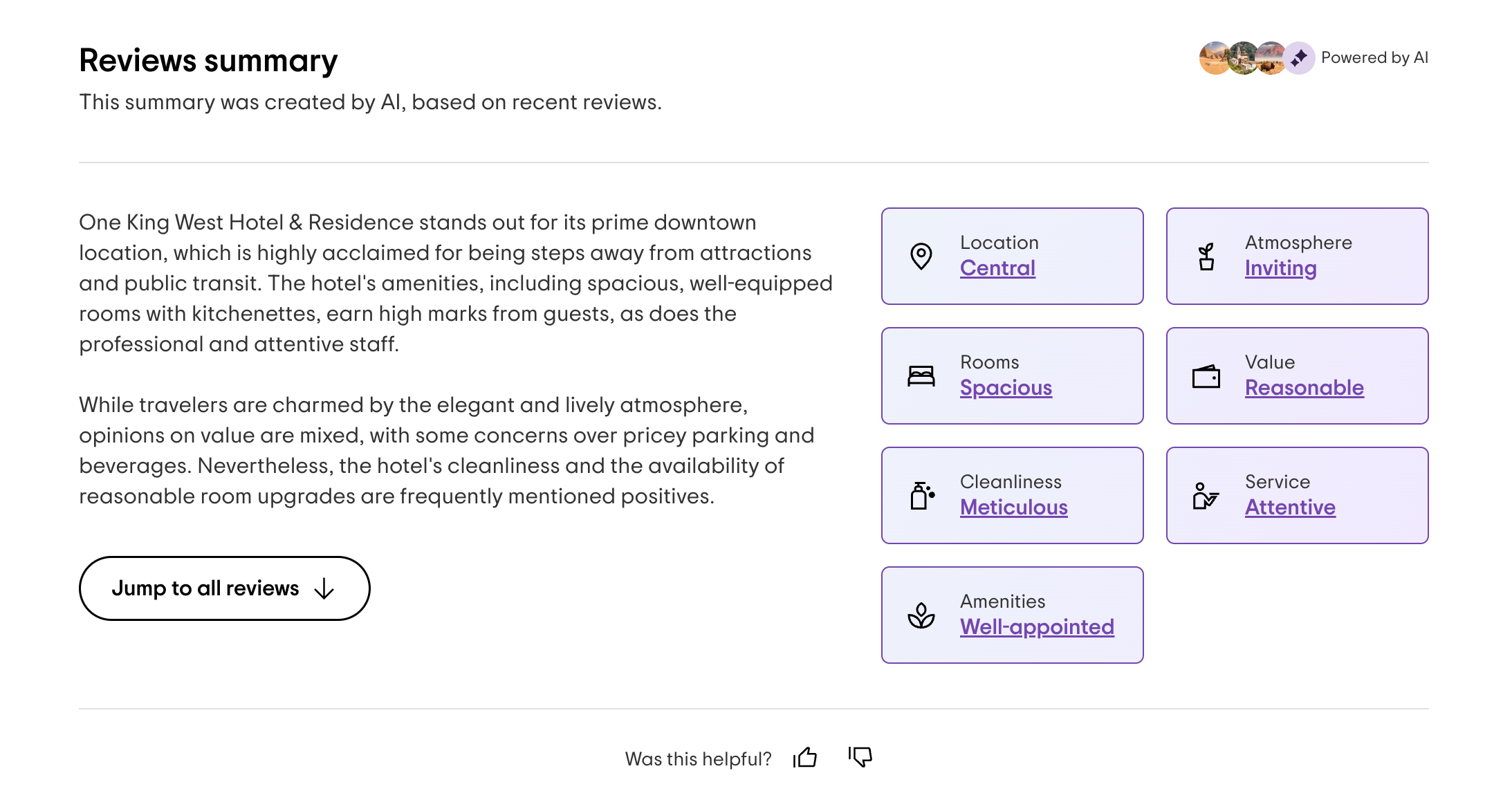

| If you look at the numbers — from jobless claims to consumption to GDP growth — they all tell a tale of decent if somewhat declining economic growth. Job openings in the most recent data released Wednesday showed more jobs in July than at the height of the pre-pandemic US economy. Given how juiced up growth was, and how the excess demand had led to inflation, one could argue this moderation is a good outcome. West Texas Intermediate Oil is trading for around $70 a barrel now, where it had seemed to flirt with $90 as recently as April. That's great for people's pocketbooks. So the Federal Reserve's rate hikes have done their job. If anything, rates are too high, with the upper bound of the fed funds rate, at 5.5% some 3% higher than the Fed's preferred measure of inflation. That gives the Fed ample opportunity to cut. Some economic forecasters are predicting jumbo rate cuts to match with the jumbo rate hikes we witnessed after the pandemic. In fact the swaps market that shows the market's collective thinking around rate cuts has over 100 basis points of cutting priced in until the end of the year. That would mean the Fed needs to cut at every meeting, with at least one of the three being a cut above 25 basis points. I think that's aggressive for a conservative institution not known for cutting interest rates at all except when recession is right around the corner. But that's at least what the market hopes and wants. The one thing that could help deliver those cuts is the labor market. If the US unemployment rate reading that comes out this Friday is higher, maybe the Fed would have room to cut rates 50 basis points when it decides on September 18. The swaps market hasn't bought into that outcome. But it does have 75 basis points priced in by November. So it's essentially saying the Fed goes big in either September or November. And increased unemployment is what would get it there since that's what would cause alarm about a recession. But if we got into a recession, so what? Stocks would fall, sure. But Treasury yields would cushion some of that. And because US households aren't over-leveraged as they were during the housing bubble, the impact of asset price declines should be manageable. Still, the Internet Bubble's collapse is a good lesson. It took years for the market to recover. And for the retiring Baby Boomers born in the early 1960s, most of whom do not have pensions, a similarly long equity market recovery is going to be a blow to their retirement. And we haven't even gotten into house prices yet. So, a recession would be a problem, not least for those who lose their employment. And for individual stocks, there's no escaping the downward pull. An obvious Internet winner like Amazon still went through a horrible time recouping the losses. Would you have stuck it out with a stock down about two-thirds from it's 1999 peak almost five years later? eBay, which got going just as the Internet Bubble popped, never had a chance to scale the same heights that Amazon did. So that stock was a relative winner. The share price was almost 50% higher than the 2000 peak by the fall of 2004. Still even there you had to wait a few years for the rebound to develop. I know Warren Buffet has been selling Apple shares. But I look at them as a potential winner when this is all said and done, if not in terms of share price, at least as a company. If you think about artificial intelligence and where it can be leveraged beyond just hardware — where Nvidia sits — a company with integrated software and hardware like Apple stands to benefit. A lot of the hype so far has been around the technology-enabling side of things so far, with Nvidia cleaning up as the only company ready to sell into this burgeoning market at scale. But for AI to have a real impact, applications that companies can monetize have to be built. And we simply haven't gotten to that phase yet. The megacap tech companies are busy working on AI, as are many others. But all we can visibly discern thus far after hundreds of billions of dollars of investment is marginal gains on digital product usability. For example, the internet travel website Trip Advisor prominently touts the use of artificial intelligence in its hotel reviews, putting a moniker "powered by AI" at the top of the synopsis for a hotel review. Basically, it finds commonalities across hundreds of reviews for a hotel or restaurant and comes up with highlights that stand out. And then it highlights the passages in the individual reviews that fit those characteristics. You can see an example here for one hotel in Toronto that I picked at random   That's a pretty nifty add-on. It definitely helps decide if a hotel is the right one and, therefore, ostensibly decreases the friction for a reservation that Trip Advisor can profit from. But these are not the kinds of incremental innovations on which hundreds of billions of dollars of investment are made. Apple, on the other hand, which makes the hardware we use, including the chips, and builds the software on top, doesn't have to buy AI products from anyone. It can make them itself. And if its chips and its AI integration into the software is good enough, it would be a game changer in terms of usability. Apple could even monetize that with the companies clamoring to get into Apple's App Store by promising to infuse their apps with some sort of AI. Against a competitor like Google in the mobile handset market and Microsoft in desktops, Apple is in a formidable position as it is more distinctly focused on a vertically-integrated suite of products that users buy than any of its competitors, who are basically technology conglomerates. And monetizing AI-powered handsets and laptops and desktop computers is a lot easier to do than getting additional ad spending out of better search results or better-targeting, as Google and Meta have to do respectively. Now, Apple's share price trades at more than 30 times earnings right now. And for the world's biggest company, that's pretty huge. But it's about as expensive as Coca Cola was when Warren Buffet was buying that company's shares 30 years ago. And Apple is far and away Buffet's biggest holding, with Coca Cola now fourth. So, in a market crash, Apple will get hurt. But it's stability as a brand and its unique AI opportunity will see it through on the other side more quickly. We're going to see this gold rush mentality come to an end soon. And that may turn some of these boomtown areas of the market into metaphorical ghost towns. But there's always an opportunity out there once the dust settles. With the likely end of the boom closer every day, now is the time to prepare to buy the winners when they hit bargain prices. |

No comments:

Post a Comment