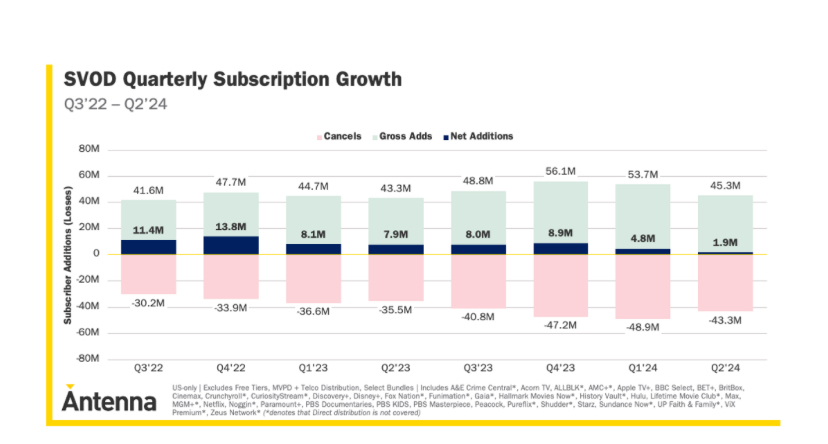

| David Zaslav, Brian Roberts and Shari Redstone have all grappled with the same problem: Their streaming services aren't big enough. Max, Peacock and Paramount+ all account for less than 2% of US TV viewing on average; combined, they're still smaller than Netflix. To solve this dilemma, executives from their companies — Warner Bros., Comcast and Paramount — have talked about joining forces. Earlier this year, Paramount, which Redstone is selling to David Ellison, spoke to NBC parent Comcast about partnerships between Paramount+ and Peacock. More recently, executives from Paramount have spoken with Zaslav and Warner Bros. about Max. These conversations have yet to produce any big deals because the negotiators all run into the same wall. Nobody wants to give up control. Zaslav, Roberts and Redstone/Ellison don't want to just hand their most valuable asset – their programming – to a competitor and surrender their relationship with the customer. These executives believe the streaming market has room for four or five players. They have to believe this because otherwise they would be admitting failure. Netflix, Amazon and Disney have already established themselves as the three leaders. Apple has more money than most small countries. That leaves room for one more mass-market player – at most — and every one of these folks believes (or hopes) theirs can be the one. But the sub-scale players also recognize that they need to do something to reach the hallowed ground of the fab five. There are three paths currently under consideration. The first and easiest option is to bundle. Packaging a bunch of networks worked in cable, why can't it work in streaming? There are already a few bundles in the marketplace. Disney sells all three of its streaming services together. It also sells a bundle with Max. Comcast sells one with Netflix, Peacock and Apple TV+. Bundling reduces the frequency of cancellation – or churn – one of the most expensive problems in streaming. Consider the below chart from Antenna. Streaming services signed up 45.3 million customers in the second quarter of this year — and lost 43.3 million — for net additions of just 1.9 million.

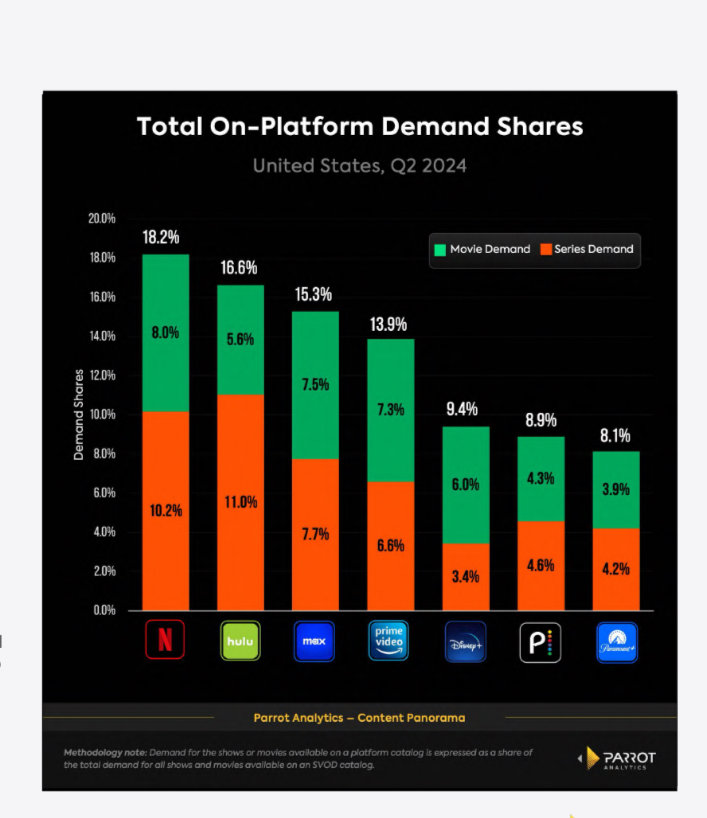

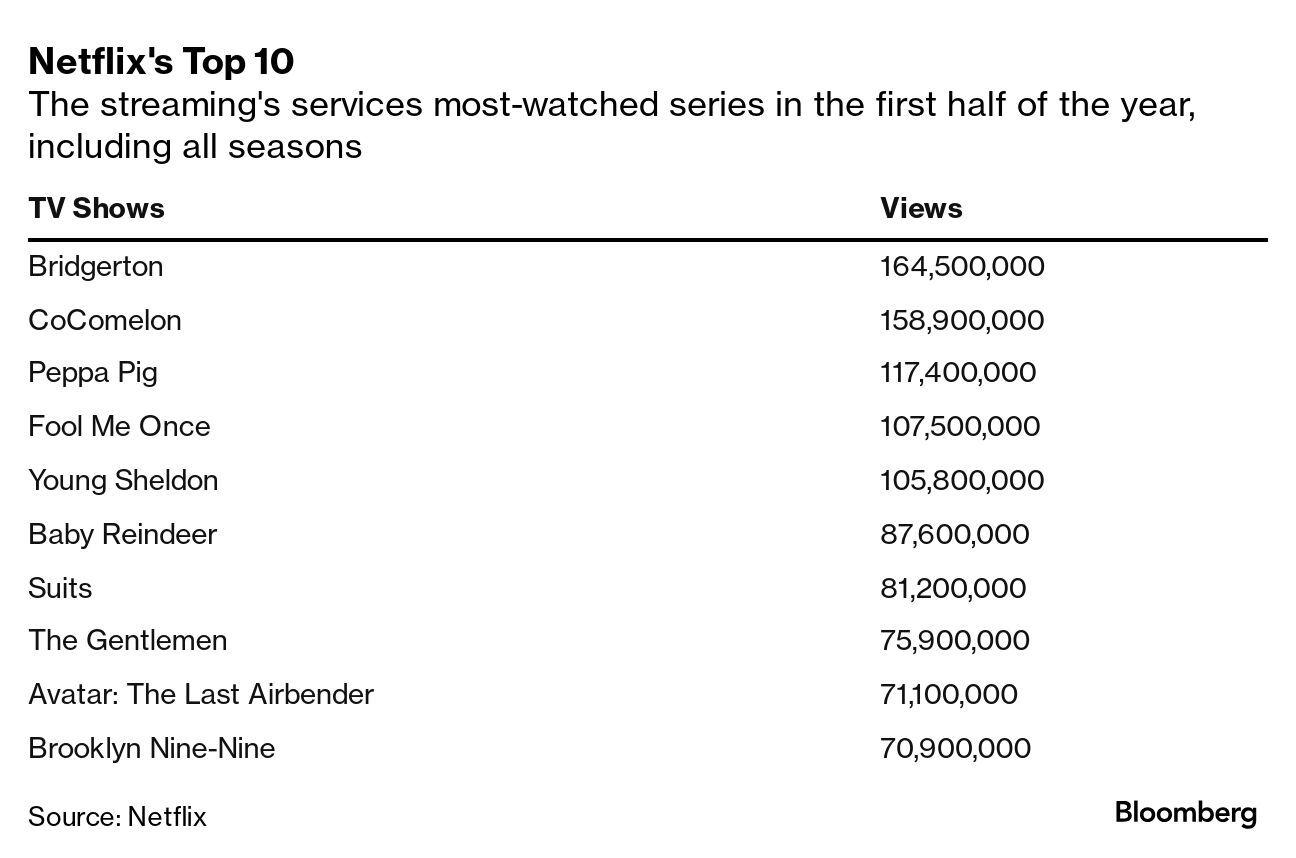

People who sign up for Peacock, Paramount+ and Max together are less likely to cancel than those who signed up for just one. Yet while bundling will reduce churn by a few points, even the biggest fans of bundles – like Zaslav – say they don't go far enough. Companies are selling their services at a slight discount to chase new customers. The current bundles don't really resemble cable, and customers still need to access multiple apps. (The Disney bundle may be the exception here.) It's possible that a third party emerges to package everything together (like a cable provider). Apple wanted to do this. Amazon wanted to do this. Charter and Comcast are trying to do this. Yet media companies have been unwilling to give up control of the customer experience. Netflix, the biggest player, is doing fine on its own and has the least incentive to help competitors mitigate churn. The second option is to integrate at a deeper level. Companies have discussed joint ventures where they establish a new company, commit their programming and create a new streaming service. Comcast and Paramount have already done a version of this in Europe and Max would like to ape this model with local players in many foreign territories. This is the high-risk, high-reward choice. Merging Peacock and Paramount+ would create one service with football all day long on Sunday and enough kids' programming to rival Disney. Max could provide award-winning dramas on TV and years of reality programming. If you combined Max with either Peacock or Paramount+, it would have a higher share of movies and TV shows that people want to watch than any other service, per Parrot Analytics. Executing such a transaction would be time-consuming and invite regulatory scrutiny. (Just look at what's happened with the sports streaming service Venu.) It would also require competitors to work together; they'd have to agree on ownership and what programming goes into the new service. Early on, shared resources made Hulu a legitimate competitor to Netflix and Amazon. But squabbles among the owners also prevented it from ever competing on a global basis. Will giving these companies two or three more years to merge and create a new product produce a better result? Or will it give Netflix and Amazon more time to consolidate their lead? That brings us to the last option: Stay the course and go it alone. Why spend a couple of years negotiating a deal, integrating staff, building technology and inviting regulatory scrutiny if you can do it yourself? Comcast is best-equipped in this scenario because it is a diversified company with plenty of resources. It generates sales of more than $80 billion a year selling broadband, cable and wireless services, or twice the revenue of its film, TV and theme-park business. Roberts could use that financial heft to invest in Peacock. To wit: He just committed almost $28 billion to take the NBA from Warner Bros. (We covered Peacock's larger strategy in this piece a couple months ago.) Paramount and Warner Bros. aren't going to rush into deals either. Paramount is changing hands so it's unlikely they do anything too dramatic in the next few months while Zaslav's greatest strength is his irrepressible confidence. (Some say it's also a weakness.) The argument against this approach is that these companies have been at it for four or five years now and have lost a lot of money. Too many people cancel every month, and none of these services has become a habit for consumer. (We wrote about Max's ups and downs here.) For there to be a big change in the current streaming landscape, one of these companies will need to feel desperate. Until then, they are just playing a high-stakes game of chicken. Bridgerton is the most popular show on Netflix so far this year, according to the company's latest data drop. Fool Me Once earned the most views of any one season, but Bridgerton had three seasons in the top 15. Here are the 10 most-watched shows, accounting for all seasons. (I didn't include spin-offs like Queen Charlotte or Little Angel.) There is a lot to unpack – maybe in a future post — but let's start with five immediate takeaways. - The UK is Netflix's best supplier. The UK produced the four most popular TV shows on Netflix in the first half of the year (Fool Me Once, Bridgerton, Baby Reindeer and The Gentlemen).

- Millie Bobby Brown has to be considered the most bankable star on Netflix. Her film Damsel was the most-watched in the first half of this year. Her earlier film, Enola Holmes, has become a franchise. And then there's that show Stranger Things.

- The most popular rerun is Young Sheldon, followed by Suits and Brooklyn Nine-Nine.

- Peppa Pig is challenging Cocomelon as the No. 1 kids property on Netflix. The average season of Peppa Pig has more viewers than the average season of CoComelon. But there are more seasons of CoComelon on Netflix — and thus more total viewership.

- Universal's animation studios produced five of the 13 most popular movies on Netflix, led by The Super Mario Bros. Movie.

One last point, for those of us who want more comedies: There are more foreign-language shows in the top 20 than comedies. Universal Music tries to reset the narrativeThe world's largest music company hosted a showcase for investors and analysts this week to reset the narrative around the company and the industry more broadly. Shares of Universal Music Group plunged more than 20% on July 25, the day after the company reported a drop in streaming revenue. Industry bodies have reported slowing growth in major markets like the US. Executives at Universal said that price increases, merchandise and physical products would sustain growth even as streaming services struggle to sign up customers. (Spotify and YouTube have defied gravity, continuing to grow at a double-digit clip.) While shares of Universal didn't react much to the presentation, analysts came away impressed. Ashley Carman has a good breakdown here. The Rock <3 grilled salmon stripsSean Evans has interviewed more than 300 celebrities over the last 10 years as the host of Hot Ones, the internet's favorite talk show. But there are several celebrities he's still chasing, including The Rock. "We've been pitching [The Rock] obviously for years and one time I got a note back that was like, 'would you be willing to do, instead of wings, grilled salmon strips?' And in my head I was like, that had to come from his mouth … that's as close as we've gotten. And then it fell through." You can read my profile of Evans in the latest issue of Bloomberg Businessweek. And a reminder that Evans is going to be interviewing Jason Blum at Screentime next month. The biggest winner of the Olympics is…

Peacock topped 2% of TV viewing for the first time in August thanks to the Olympics, according to Nielsen. Millions of people flocked to Peacock to watch the Olympics live, or catch up on events. They also went to YouTube, which accounted for 10.6% of all TV viewing, a new record. Do you think people under the age of 30 watched highlights on Peacock or YouTube? One other observation … notice the sudden drop in viewership for Hulu and increase for Disney+. Viewers are watching Hulu within Disney+, as entertainment Co-Chair Dana Walden told us last week. Deals, deals deals - Amazon is mandating employees return to the office five days a week. Experts say the policy has lots of loopholes.

- TelevisaUnivision, one of the largest Spanish-language media companies in the world, replaced its CEO.

- YouTube and Meta both cracked down on Russian media outlets.

- Social media stars MrBeast and Logan Paul have created a competitor to Lunchables that includes a bottle of Paul's low-sugar energy drink, MrBeast's milk chocolate bar and one of three food options: pizza, nachos or turkey and cheese with crackers.

The Marshall Project is hosting a film festival for criminal justice documentaries in a prison. Five people incarcerated in Sing Sing will pick the winner. Lastly, two indie rock recommendations: Seattle singer-songwriter Damien Jurado and North Carolina's MJ Lenderman. |

No comments:

Post a Comment