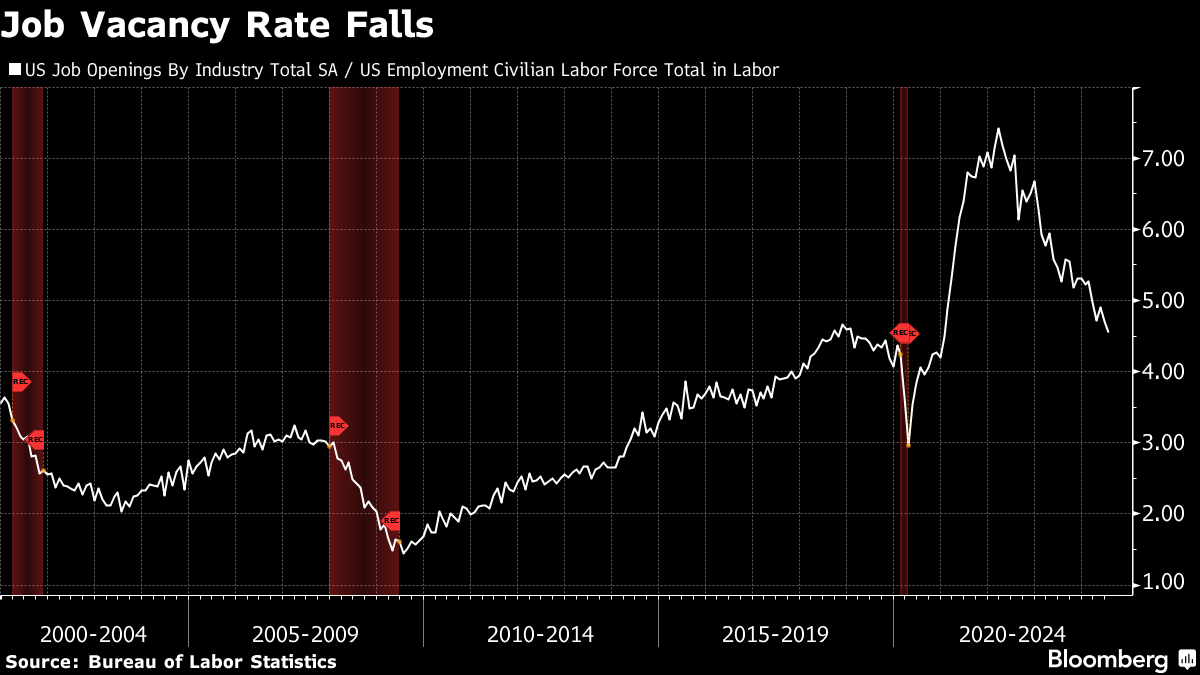

| Good morning. US job market shows some cracks. Dollar's pain is yen's gain. Wall Street is souring on China. Here's what's moving markets. — Kristine Aquino Treasuries led a global decline in bond yields after a report on Wednesday showed US job openings fell in July to their lowest since the start of 2021. That led to the yield curve briefly turn positive, with traders adding to bets for a larger, half-point interest-rate cut by the Federal Reserve this month. Friday's payroll report is expected to show hiring and wage growth picked up in August. If, however, the data come in weaker than expected, stocks could be heading for a correction, according to Goldman Sachs's Scott Rubner. The dollar fell for the first time in more than a week, propelling the Japanese yen up by more than 1%. The yen, typically sought as a haven when risk assets retreat, added to gains prompted by comments from Bank of Japan Governor Kazuo Ueda on Tuesday. He affirmed that the central bank will keep raising borrowing costs should the economy and prices perform as policymakers expect. "The market is trading more traditional risk-off this week. That has seen safe-haven currencies rally, with the yen favored given the expected divergence between the Bank of Japan and developed-markets policy," said Skylar Montgomery Koning, a foreign-exchange strategist at Barclays in New York. The chorus of Wall Street banks critiquing China is growing louder. JPMorgan strategists downgraded Chinese stocks to neutral from overweight, citing a challenging outlook and heightened volatility around the US election. Meanwhile, Bank of America's economists joined their counterparts at Goldman Sachs and JPMorgan in predicting China's economy will grow less than 5% this year. "We find both the fiscal and monetary policy stance less accommodative than desired and insufficient to revive domestic demand growth," BofA economists including Helen Qiao wrote in a note dated Sept. 2. Investors from New York to London to Tokyo are piling into investment-grade bonds, with 81 deals emerging in 48 hours. Uber is among companies selling debt, with its first offering as a high-grade company. Corporate finance chiefs are happy to borrow now because yields are relatively low. Meanwhile, money managers are eager to buy bonds before the Fed starts cutting rates potentially as soon as this month, which could pull bond yields lower. "For issuers that are looking to print a low coupon, you could clearly see why they would be hitting the market at this point," PGIM Fixed Income's Robert Tipp said. US President Joe Biden is preparing to block Nippon Steel's $14.1 billion takeover of United States Steel, according to people familiar with the matter. The proposed deal has been subject to a review by the Committee on Foreign Investment in the United States, and Biden plans to kill it as soon as the CFIUS decision lands on his desk, the people said. A decision could be made as soon as this week, they added. Blocking the sale would cloud the outlook for US Steel, whose shares plunged 17% in New York. Here's what caught our eye over the past 24 hours: A key job market gauge has reached an inflection point that may lead to a faster rise in the unemployment rate, based on Federal Reserve Governor Chris Waller's research. That adds to the market's perception that the bar for a 50-basis-point rate cut has been lowered. Over the past two years, Waller has been arguing that the Fed could curb inflation without a recession. His main thesis is that the Fed's tightening can rebalance the labor market by reducing job openings without a significant rise in the unemployment rate. So far, he's been right, defying many who considered such an outcome is unlikely. But his research paper with Andrew Figura, published in 2022, also showed that once the job vacancy rate falls to the pre-pandemic level of 4.6%, the unemployment rate would rise to 4.5%. (The jobless rate was 4.3% in July.) That line was crossed on Wednesday, when the JOLTS report showed the vacancy rate declining to 4.56% in July, from a peak of 7.4% in March 2022. At Jackson Hole, Fed Chair Jerome Powell said further cooling of the labor market would be "unwelcome," suggesting the central bank's focus has now shifted to keeping a lid on the unemployment rate. All that has prompted traders to add a few more basis points to their bets for a September rate cut, as Kristine Aquino notes above. Waller will speak about the economic outlook on Sept. 6, just after the payrolls report. That may offer him a chance to set market expectations for the size of the cut before the Fed's blackout period ahead of the September policy decision. Ye Xie is a New York-based currency and rates reporter for Bloomberg. Sign up for Hong Kong Edition newsletter to get an insider's guide to the money and people shaking up the Asian finance hub. |

No comments:

Post a Comment