| Good morning. US stocks just keep on climbing. Boeing increases its wage offer. And traders are keeping a close eye on the RBA. Here's what's moving markets. —Isabelle Lee US equities eked out gains Monday as traders parsed commentary from Federal Reserve policymakers and saw scope for further easing after last week's half a percentage point interest-rate cut. The S&P 500 advanced 0.3%, a whisker away from last week's intraday record while an equal-weighted version of the benchmark hit a new high, a sign that gains are broadening out. Data showing US business activity is robust even as growth moderates stoked confidence the world's largest economy can nail a soft landing. US business activity expanded at a slightly slower pace in early September, while expectations deteriorated and a gauge of prices received climbed to a six-month high. The US should emulate China to meet the surging demand for electricity to run artificial intelligence, according to Constellation Energy, a power firm that just inked a deal with Microsoft to reopen the shuttered Three Mile Island nuclear plant. Big tech companies are proposing data centers so massive that they could only function if they're built alongside power plants, said its CEO Joe Dominguez, adding that China is already taking that approach. That's a significant shift from the current models that rely on miles of long-distance transmission lines to carry electricity. A few years ago, experts thought that solar and wind output would be sufficient to meet additional power needs. Boeing offered its largest union a larger pay bump as it tries to overcome a debilitating strike that has shut down its aircraft manufacturing across the Pacific Northwest. The planemaker offered striking Seattle factory workers a 30% wage increase over four years, up from the 25% increase turned down this month by 33,000 members of the International Association of Machinists And Aerospace Workers. Boeing said the terms are final and only valid until the end of Sept. 27, as it seeks to raise pressure on the other side to accept. Meanwhile, the broader crisis that has engulfed Boeing since one of its jets suffered a mid-air blowout in January has helped prompt the US Federal Aviation Administration to overhaul its internal processes for identifying and addressing aviation safety risks. The changes underway are intended to strengthen oversight across the agency, FAA Administrator Michael Whitaker plans to tell members of the House Transportation and Infrastructure Committee's aviation panel on Tuesday. UniCredit Chief Executive Officer Andrea Orcel moved to more than double the lender's stake in Commerzbank, a move condemned by German Chancellor Olaf Scholz. "Unfriendly attacks, hostile takeovers are not a good thing for banks, which is why the German government has taken a clear position here and made it very clear that we do not consider this to be an appropriate course of action," Scholz told reporters. The statement came hours after UniCredit disclosed it had entered into derivative contracts that would allow it to raise its Commerzbank stake to around 21%, from 9% previously. The Italian lender used Barclays and Bank of America to help it quietly build up a stake in its German peer, according to people familiar with the matter. The Reserve Bank of Australia looks set to hold fire on any policy change when officials hand down their next interest-rate decision on Tuesday, keeping their benchmark uncharged even after the US central bank's supersized reduction last week. Other key events on the radar on Tuesday for Asia-focused macro traders include Japanese purchasing manager indexes and South Korean retail sales. Here's what caught our eye over the past 24 hours: - Merrill's former market expert says this is different from 1999

- Israel strikes in Lebanon kill hundreds as conflict spirals

- Rate cut kickoff sparks rush to emerging market bond ETFs

- Palantir's CEO spars with Wall Street as shares keep rising

- Goldman's old HQ turned into $4,000-a-month apartments

- Iran's president says he's prepared to ease tensions with Israel

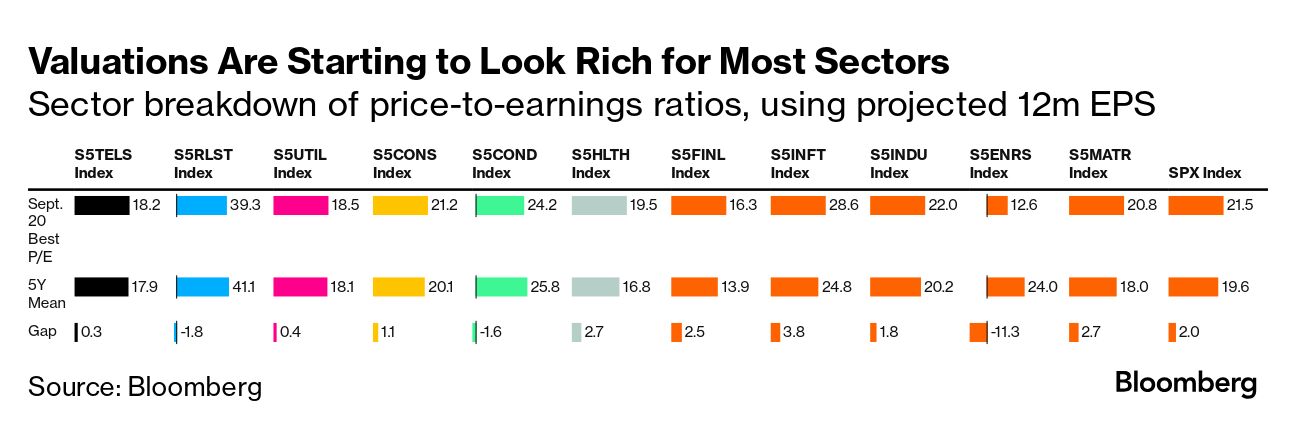

Valuations across most sectors of the US stock market are broadly starting to look lofty after the Fed's interest-rate cut last week propelled the majority above their five-year averages. Tech is perceived to be the biggest culprit for the S&P 500's elevated price-to-earnings ratio, and while that's still true on an absolute basis, it's not the only one. Sectors such as health care and materials now command the second largest premiums versus their own five-year means, as you can see below: It's unlikely that valuations stand in the way of investors betting on a soft landing, especially with fundamentals still looking solid. But some sectors are starting to look overbought and may have little upside left. Tatiana Darie writes for Bloomberg's Markets Live blog in New York. Follow her on X at @tatianadariee. |

No comments:

Post a Comment