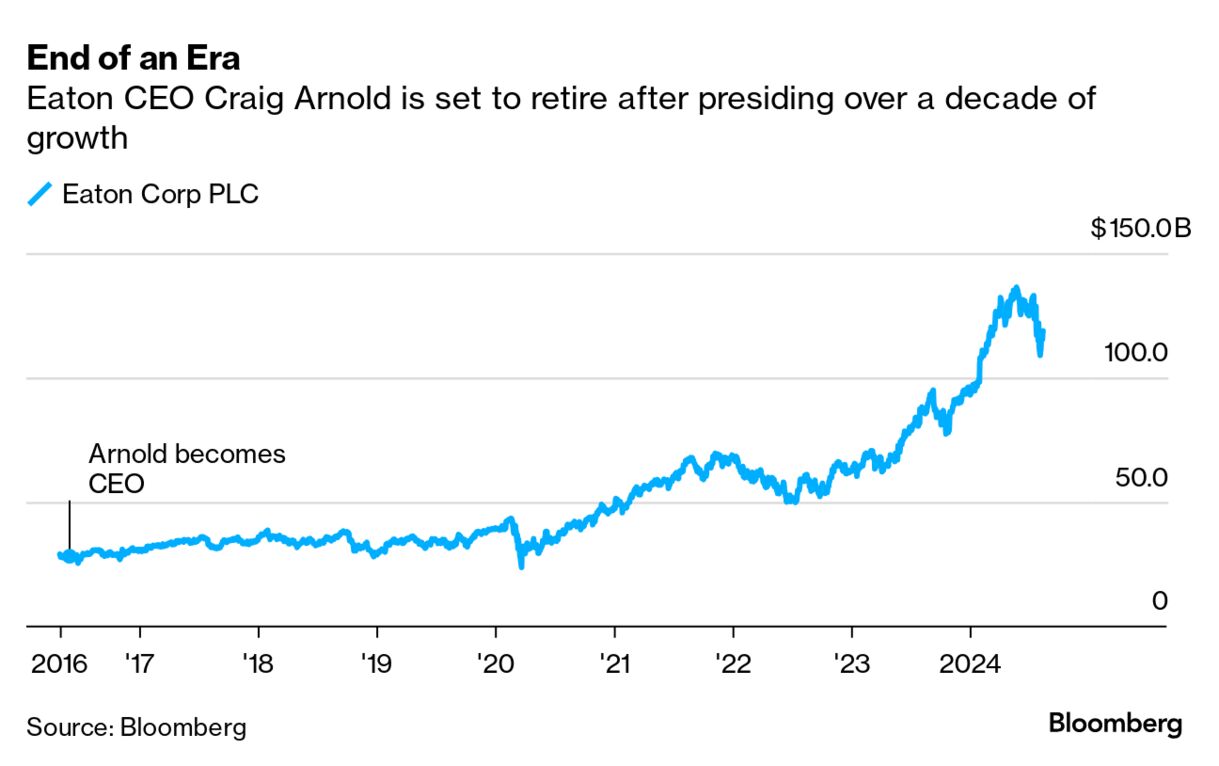

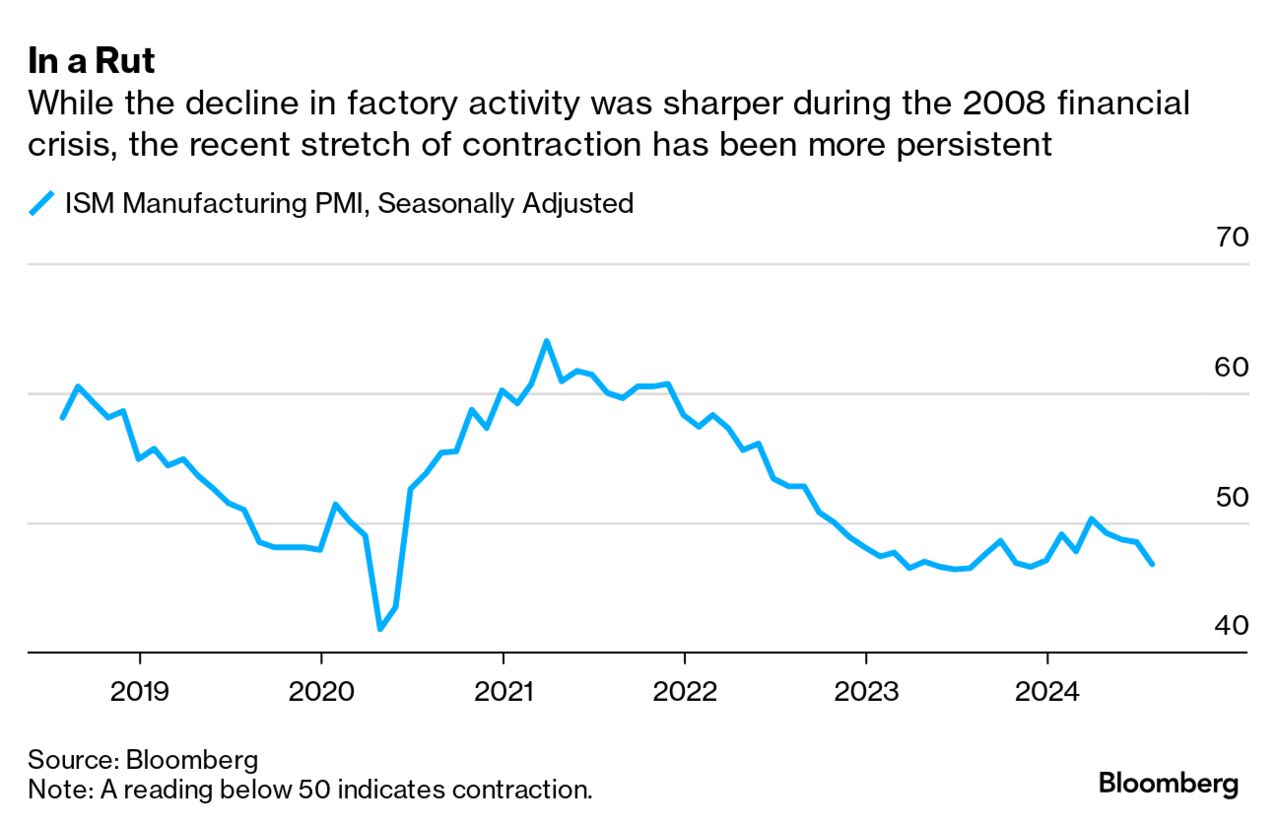

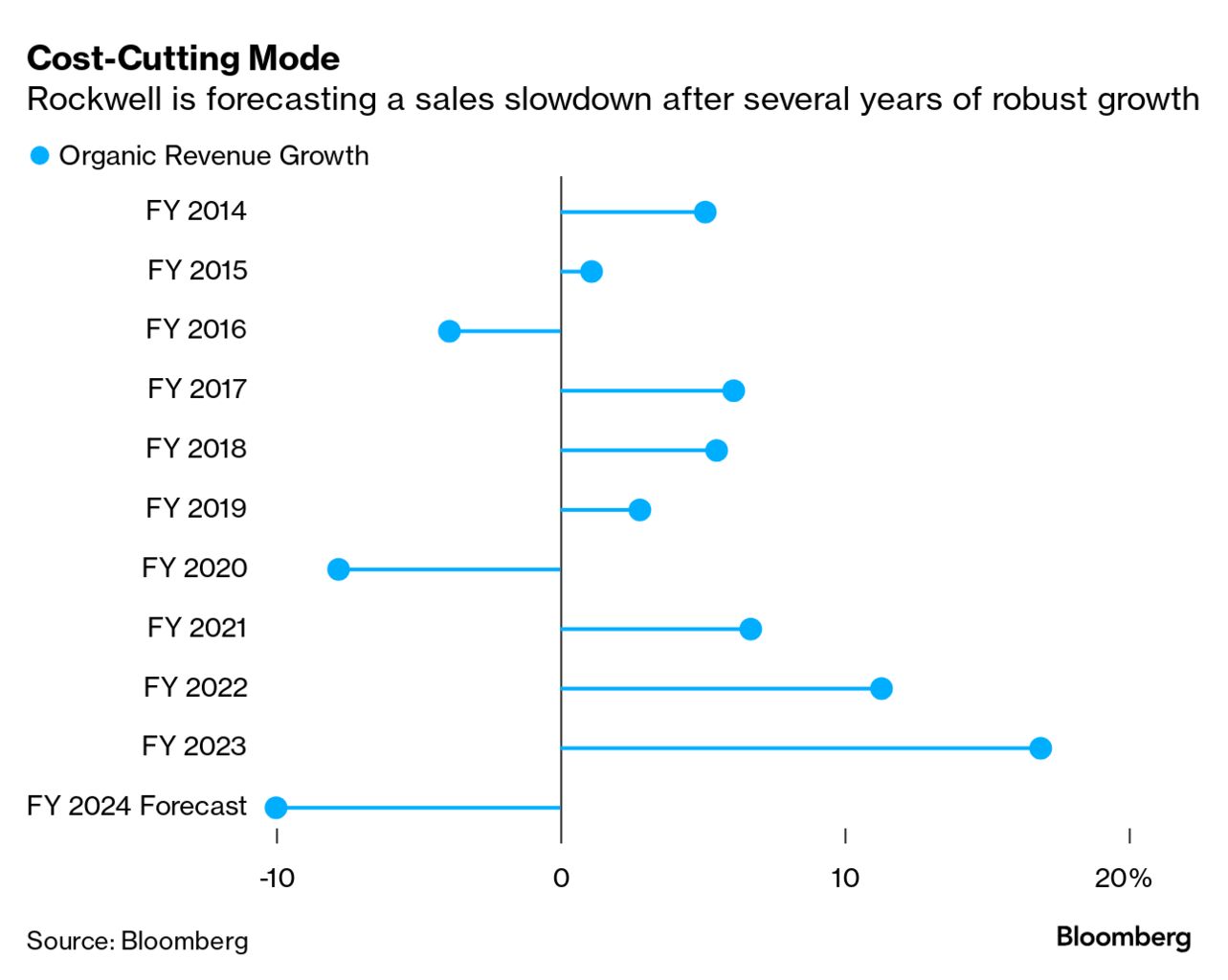

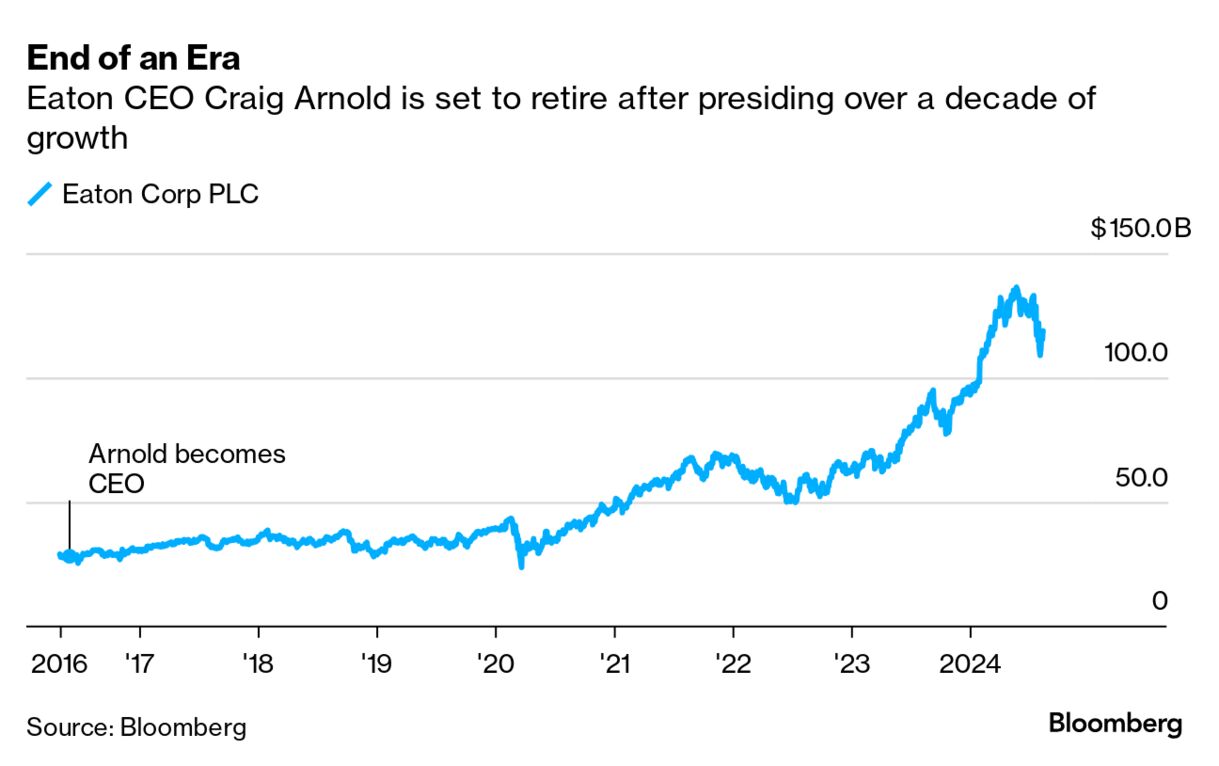

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Manufacturers are making too much stuff. Companies including Rockwell Automation Inc., pool-pump maker Pentair Plc, water-technologies giant Xylem Inc. and electrical equipment manufacturer Hubbell Inc. are culling product lines as they lean into variations of the operating principle known as "80/20." The idea is that 80% of a company's profits can often be traced back to just 20% of its products or customers, meaning that a considerable amount of any particular manufacturer's output simply isn't worth the added cost and complexity. Thinning out less-desirable product lines can help companies focus on the parts of their business that make most of their money and avoid time-consuming distractions. The operating ethos isn't new. The 80/20 rule, also known as the Pareto principle, traces its roots to the work of early 20th century Italian economist Vilfredo Pareto. Illinois Tool Works Inc. and Idex Corp., among others, have championed this philosophy for years. But the strategy's productivity benefits have taken on new relevance as manufacturers contend with a period of prolonged sluggishness. The second-half sales recovery that many industrial companies factored into their earnings guidance for 2024 is failing to materialize. A growing number of manufacturers are instead warning of weakening demand and mounting project delays, as high interest rates and political uncertainty take their toll. "The projects aren't going away, but people are saying, 'Hey, let's hold off for now," said Mark Sheahan, chief executive officer of Graco Inc., whose fluid-management technologies are used to spray finishes on cars and pump peanut butter into jars. "It's kind of a general slow, sluggish environment that we're operating in." The economy is at the "edge of a significant slowdown," Antonio Pietri, CEO of industrial software company Aspen Technology Inc., said in an interview. "Everyone is being a bit more cautious." A gauge of US factory activity fell deeper into contraction territory in July, extending the most prolonged period of weakness since the dot-com bubble burst in the early 2000s. Industrial conglomerate Idex last month lowered its full-year revenue and earnings guidance, citing a more cautious stance among its customers and a stubborn inventory glut after a surge of orders during the pandemic supply crunch. Even so, Idex, which makes everything from metering technologies, fire safety products and custom-molded thermoplastic components, was able to improve its profit margins from the first quarter to the second quarter. That was an accomplishment that management attributed to its continued push to root out operational complexity, and focus on the highest-return products. Rockwell also cut its full-year earnings outlook when it reported results earlier this month, and now anticipates sales will decline about 10% on an organic basis in fiscal 2024. Automakers and food and beverage companies already had a weaker appetite for capital spending as consumers facing high interest rates and continued inflationary pressures dial back their purchases. That's now spreading to other industries, including semiconductors and energy-transition related projects, as companies wait to see the outcome of various stimulus initiatives after the US election, Rockwell CEO Blake Moret said in an interview. The company is aiming to wring out $250 million of cost savings, in part by consolidating its supply chain, shifting some of its shipping needs to cheaper ocean freight options and shrinking its real estate footprint. It's also getting rid of lower-volume and lower-margin products. Rockwell offers a "really long list" of products, Moret said. "Do we need to offer those or can we improve customer service by reducing that long tail of seldom-used items and free up capacity for more frequent fliers?" The cost-cutting push in part reflects a need to align the company's spending with the current business environment, but Rockwell could do with some streamlining after a string of acquisitions and pandemic-related disruptions, Moret said. "The attention is turning to integrating all the parts, all the capabilities we didn't have six or seven years ago and getting rid of inefficiencies that inevitability built up over years of volatility," he said. It's not the only one: Hubbell makes about 100,000 different electrical products. In those categories where it both doesn't sell that many units and doesn't command a high margin, the connector and enclosure manufacturer is either looking to raise prices, cut costs or stop production. "It helps our factories by not distracting them," Mark Mikes, the president of Hubbell's electrical solutions segment, said at the company's investor day in June. Read More: Industrial Outlook Is a Mixed Bag for 2024 For Xylem, 90% of sales in its applied water technologies unit come from top quartile customers, while a full half of the products that the business manufactures account for just 5% of revenue combined. "For years, we have added new and better products to our lineup. And frankly, in many cases, we have not had the discipline to sunset other older products," Franz Cerwinka, who oversees the applied water systems business and Xylem's broader business transformation efforts, said at the company's investor day in May. Pentair early this year committed to applying an 80/20 operating philosophy across many of its businesses. Asked why the company didn't so this sooner, CEO John Stauch said that in recent years, "the burning platform for us was more about the supply chain difficulties we were having and how do we meet that growth" in demand. But Pentair realized the complexity built into its business was actually making its supply-chain challenges worse because factories were expected to meet on-time delivery commitments for every single product, even the ones that aren't as important. Read More: Pool Slowdown Throws Cold Water on Recovery One convenient way to get rid of a lot of products and manufacturing needs in one slug is to simply sell businesses. That's what Johnson Controls International Plc did when it struck a deal for its air distribution technologies division in June. That unit accounted for about 30% of Johnson Controls' factory operations but only about 3% of its sales, TD Cowen analyst Gautam Khanna estimated. The dollar value of the transaction wasn't material enough for Johnson Controls to disclose it — which is another way of saying nearly a third of its factories were focused on products that weren't all that valuable to the company.  Eaton Corp. this week announced that Paulo Ruiz will become the company's next CEO in June 2025, succeeding Craig Arnold, who has held the top job for nearly a decade. Ruiz will serve as president and chief operating officer in the interim starting in September; he currently oversees Eaton's industrial businesses, including its aerospace, vehicle and golf-grip operations. Arnold, who took on the CEO role in 2016, is approaching the company's mandatory retirement age of 65. Eaton shares had surged to a record high in May amid enthusiasm about the demand for its electrical equipment from data center customers. The stock has since slid amid broader volatility and concerns among investors that artificial intelligence investments aren't yet living up to the hype. But Eaton earlier this month raised its full-year earnings and sales guidance, citing strong demand driven by electrification and reindustrialization investments. The company is tracking $1.4 trillion worth of megaprojects — defined as construction blueprints valued at more than $1 billion — that have been announced in North America since the beginning of 2021. Only 15% have started construction. Read More: Power-Hungry Data Centers Are Gobbling Up Texas Amid AI Boom "Operationally, there is not much for the new CEO to 'fix,'" Barclays Plc analyst Julian Mitchell wrote in a report. But Ruiz may look to strike more takeover deals, of which Eaton has done relatively few under Arnold, and could also seek to reduce the company's dependence on the Americas, Mitchell said. Heath Monesmith, the current head of Eaton's electrical business, and Matt Hockman, who oversees the global energy infrastructure solutions arm, were also considered contenders for the CEO job. There's a risk that they now decide to pursue leadership opportunities elsewhere, RBC analyst Deane Dray said, pointing out that Johnson Controls is looking for a CEO after George Oliver announced his plans to retire. Eaton's Chief Financial Officer Olivier Leonetti previously held the same role at Johnson Controls. Southwest Airlines Co. says it had sought a collaborative solution to Elliott Investment Management's push for an overhaul but the activist investor instead "unilaterally" decided to announce a competing slate of board directors. Elliott this week announced plans to nominate 10 candidates to Southwest's board, including former Ryanair Holdings Plc executive Michael Cawley, former Virgin America CEO David Cush and former Air Canada CEO Robert Milton. Southwest said it remains open to conversations with Elliott and would evaluate the investor's proposed nominees. Like most companies, Southwest typically holds its annual meeting in the spring and investors vote then on board nominees. Investors with a 10% stake can force the airline to call a special vote earlier. Elliott has an 8.2% stake in Southwest, according to a filing this week. Recent actions by Southwest — including plans to offer assigned seating and new premium options — "strike at the heart of Elliott's criticism and demonstrate a willingness to adapt," Jefferies analyst Sheila Kahyaoglu wrote in a note this week. That may make shareholders less willing to vote out current leadership, she said.

Rheinmetall AG, the German defense giant, agreed to buy Loc Performance Products, a Michigan-based manufacturer of tracks, wheels and armor for military tanks, for $950 million. The acquisition expands Rheinmetall's business in the US, where the company is working on the military's XM30 combat vehicle and common tactical truck programs. Rheinmetall sized the total potential order volume for the US army vehicle programs at $60 billion. A surge in military investment across Europe in response to Russia's invasion of Ukraine has put Rheinmetall on track for record growth, with CEO Armin Papperger forecasting roughly €2 billion ($2.2 billion) in annual sales additions in the coming years.

Carrier Global Corp. agreed to sell its commercial and residential fire safety business to an affiliate of private equity firm Lone Star Funds for about $3 billion. The deal, which is expected to close by the end of the year, completes a transformation of Carrier under CEO Dave Gitlin. Since spinning off from the former United Technologies Corp. in 2020, Carrier has acquired heat-pump manufacturer Viessmann Climate Solutions for €12 billion ($13.2 billion) and struck deals for its security access, industrial fire alarms and commercial refrigeration arms, as well as the Chubb fire and security business. Roper Technologies Inc. agreed to buy Transact Campus Inc., a provider of campus ID and higher education payment software, for about $1.5 billion. The Transact business will be combined with Roper's existing CBORD operations, which provide food service management software and commerce platforms to health care and senior living facilities, as well as corporate and college campuses. Roper has systematically transformed itself from a pump-and-valve maker into a software specialist through a string of acquisitions and divestitures. It prefers to focus on niche applications where there's little competition and high profit margins. The Transact business checks these boxes. Roper also doesn't like to pay up for deals: The Transact purchase price implies a very reasonable multiple of 14 times the company's expected 2025 earnings before interest, taxes, depreciation and amortization. Roper earlier this year agreed to buy child-care services software provider Procare Solutions for $1.75 billion. |

No comments:

Post a Comment