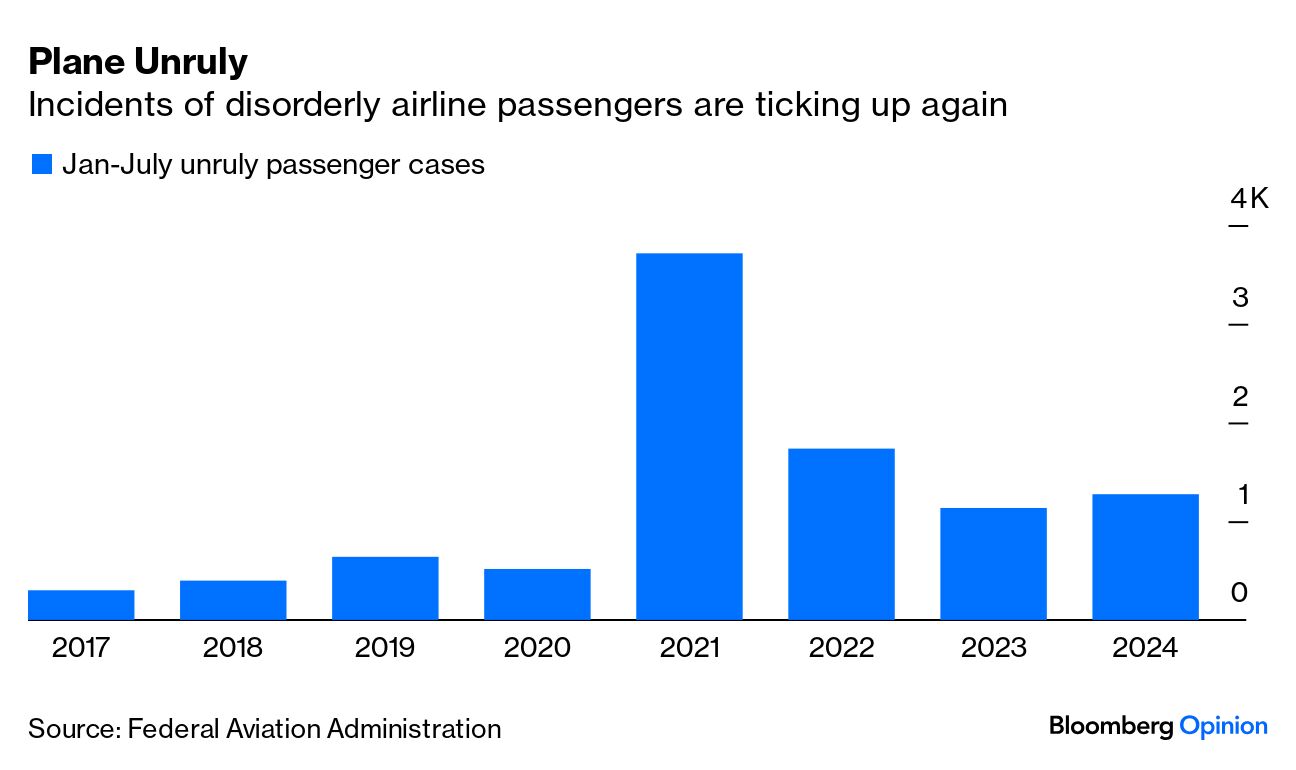

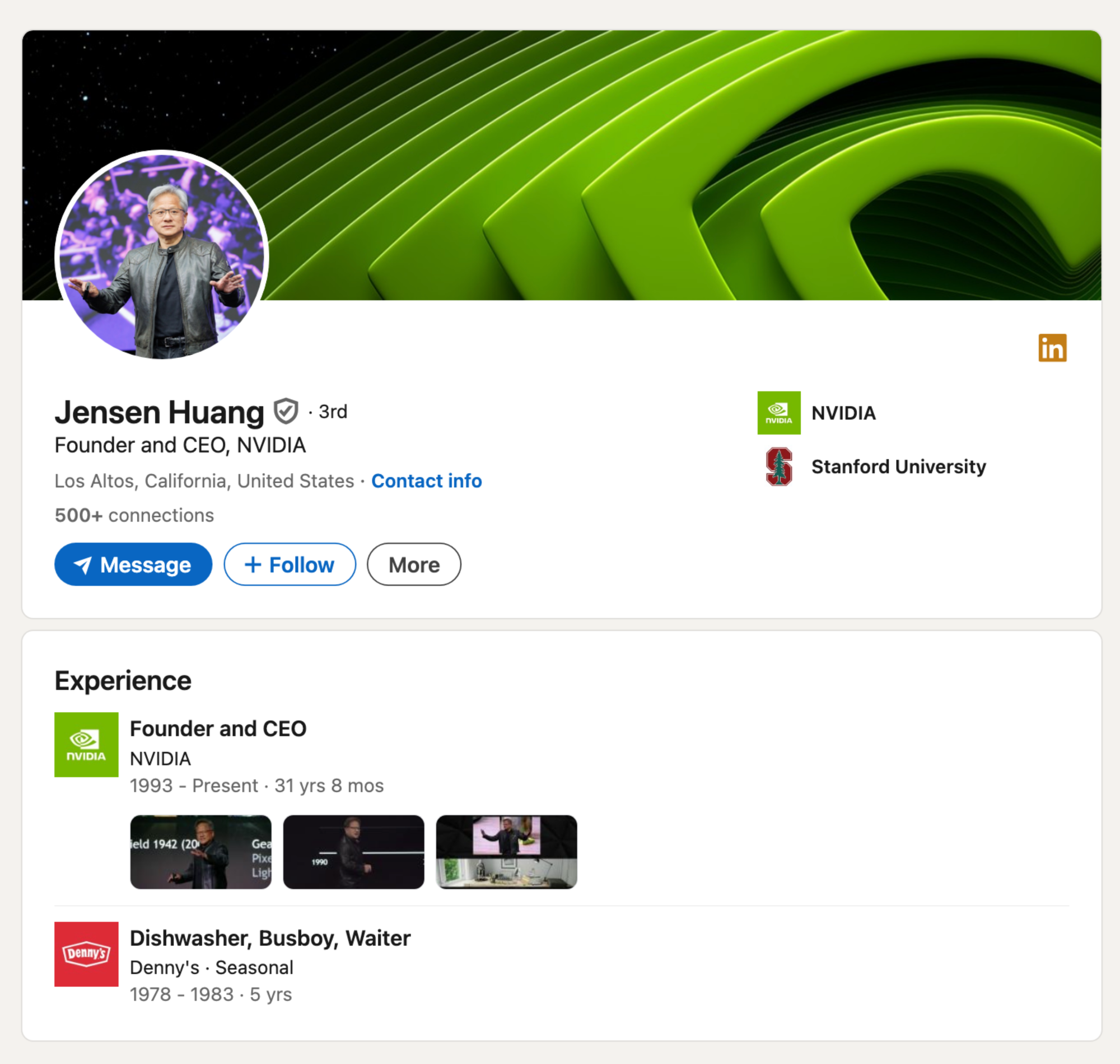

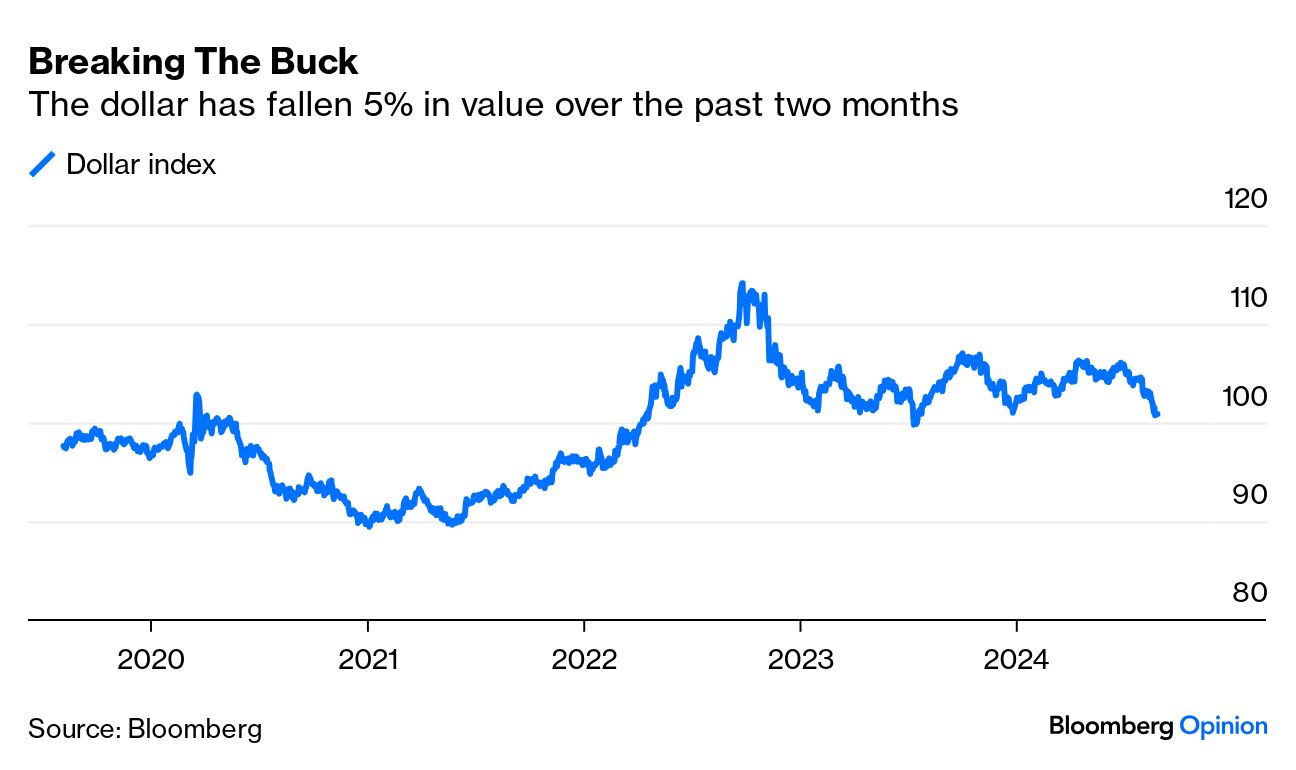

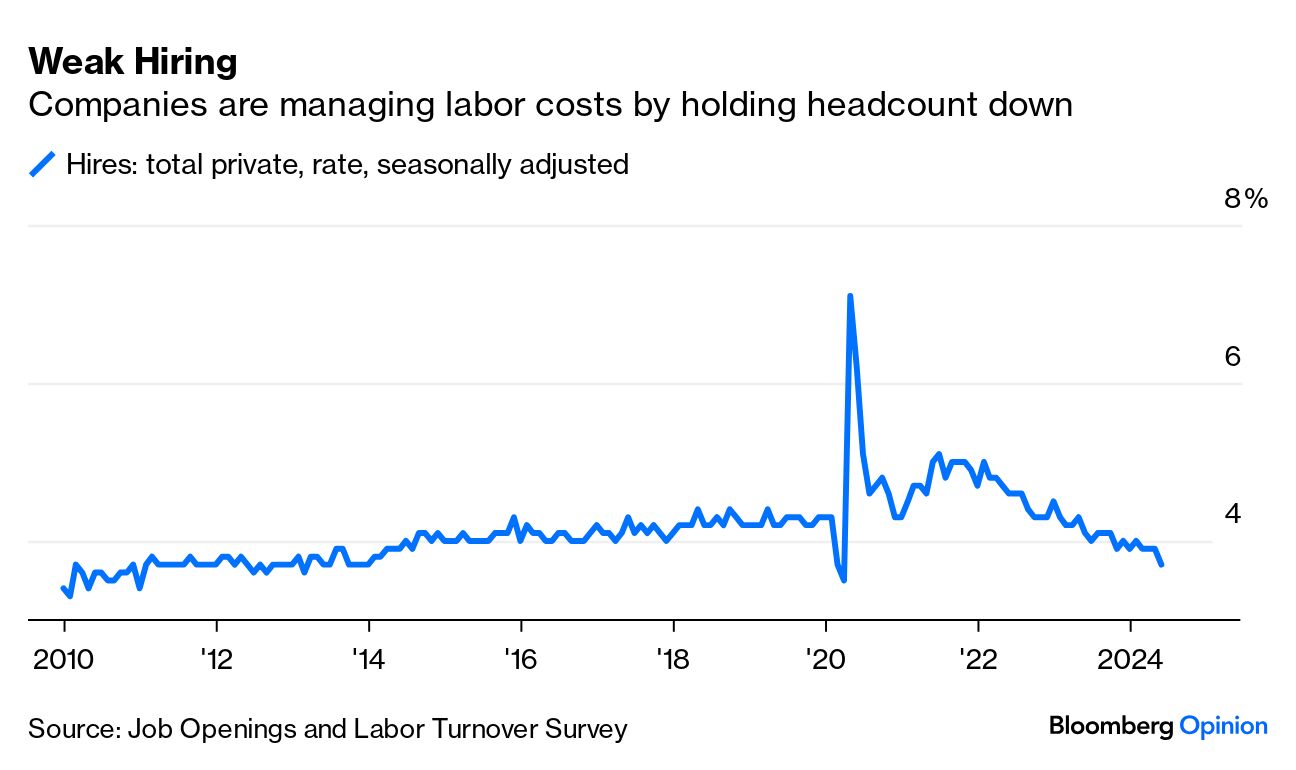

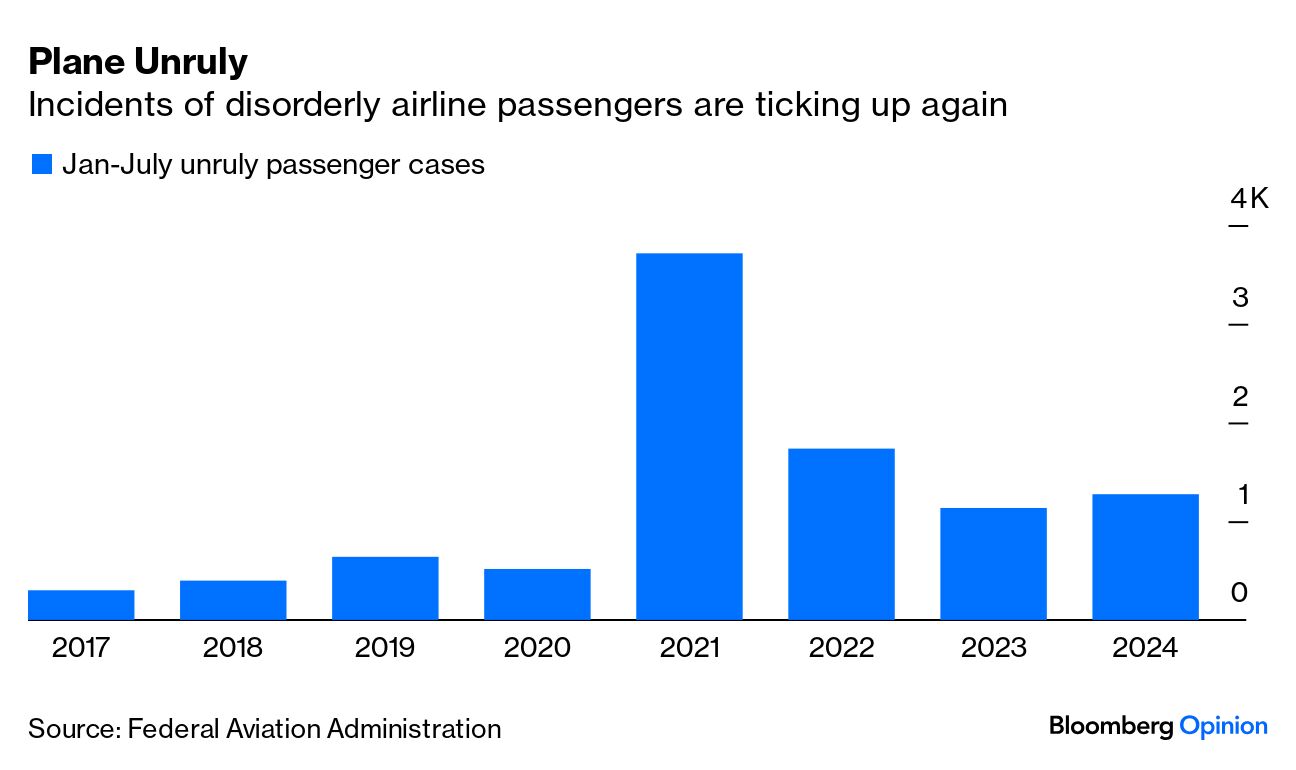

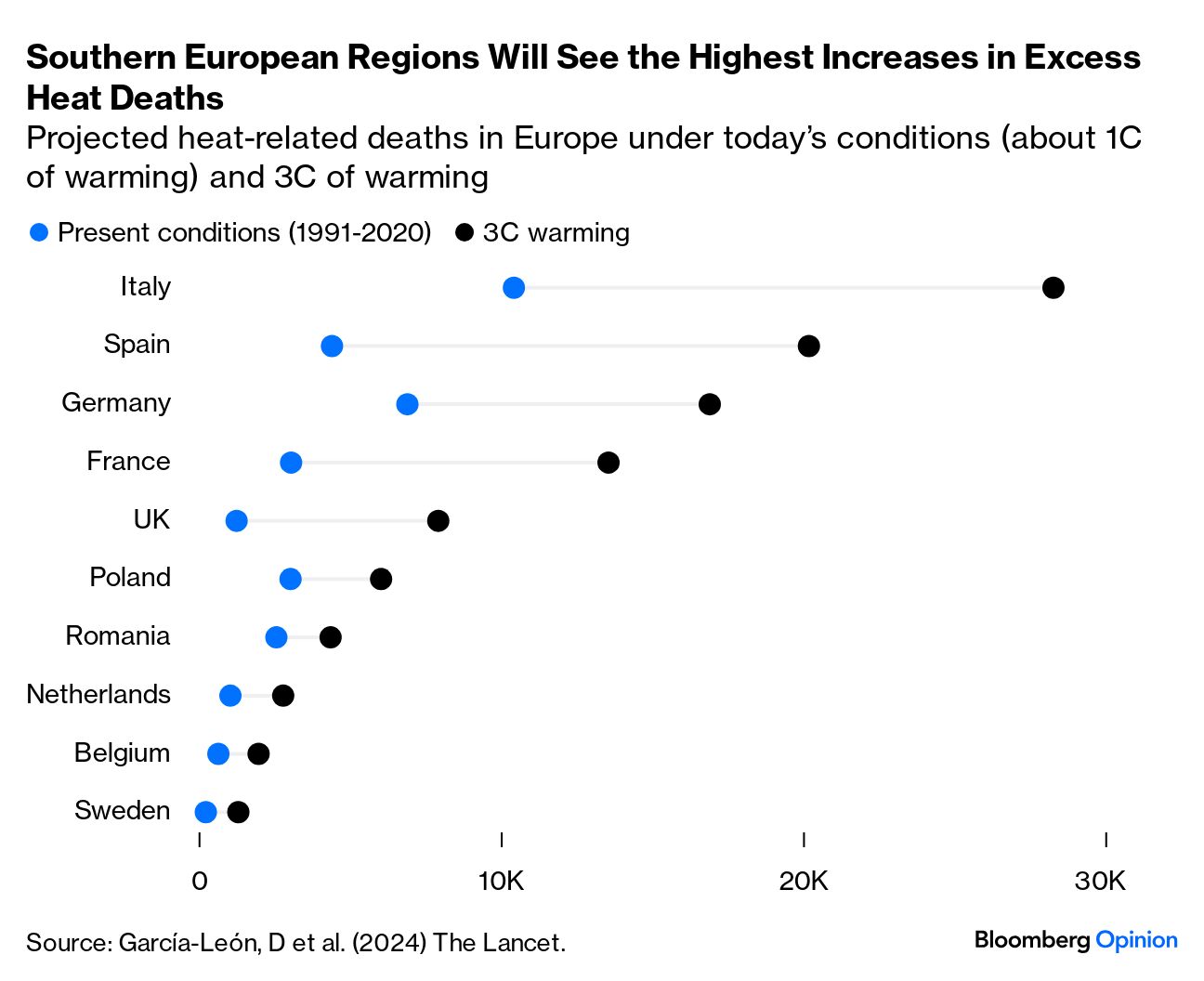

| This is Bloomberg Opinion Today, a highly caloric breakfast of Bloomberg Opinion's opinions. Sign up here. Every time I go to Denny's for breakfast — reader, let's be real, I've been there a grand total of three times, but one of them was last week! — I order an ungodly amount of food, not because I'm particularly hungry, but because it feels like the appropriate thing to do at Denny's. During my latest trip, I ordered the French Toast Slam, which involved three buttered-up hockey pucks of French toast, two slices of bacon, two links of sausage and two eggs over easy. For good measure, I also ordered some hash browns. This highly caloric breakfast was served on not one, not two, but three plates — an affront to tapas establishments everywhere: Needless to say, I felt slightly ill after consuming it all, and as I sat there contemplating the empty plates and pools of syrup spread out before me, I got to wondering: Who's gonna clean all this up? Denny's is open 24/7 — that's a lot of dirty dishes. Well, reader, I have an answer for you. His name is Jensen Huang: OK, it's not Jensen Huang anymore. But for five years, from 1978 to 1983, the man who would later found the most valuable company on earth was a dishwasher at Denny's, as evidenced by his LinkedIn profile. Years later, he'd come back to that same Denny's and sit at a booth with his buddies Chris Malachowsky and Curtis Priem and decide to start Nvidia. What began at Denny's is now one of the most important economic influences in America. Nvidia's market cap has risen by more than $3 trillion since the ChatGPT craze began in 2022. It has a more than 6% share in the the S&P 500, and the Patagonia-vested brethren of Wall Street treat the chipmaker's quarterly earnings like a biblical event. But Mr. Huang is not God, and therein lies the problem. When Nvidia's results hit the wire last night, people anticipated nothing less than perfection after a slate of extraordinary earnings beats. And it was perfect, for the most part. But Nvidia's 122% year-on-year revenue growth wasn't enough to please the masses: "Investors disliked that forecasts for the current quarter weren't raised much, and didn't hear enough reassurance on how quickly the company's next-generation Blackwell chip will roll out," John Authers writes. After the call, its shares were down more than 8% after-hours, and almost 12% for the week. "There's no pleasing some people," says John. But more than that, some people seem to be forgetting what Nvidia actually does: Build computer chips for artificial intelligence. "There's an adage in Silicon Valley," Dave Lee writes: "Hardware is hard. And expensive. And time-consuming. That's the case even when you're a company that's really good at it." Traders stunned by the fact that Nvidia's new chip hit some production hiccups clearly missed that memo. "It's become a little silly. Bloomberg Intelligence analysts have it right when they say Nvidia is up against 'lofty and unsustainable expectations.' The Blackwell delay is a temporary blip, and the company's overall margins are still enormous," Dave says. Just like the portions at Denny's! Between Dollar General shares sliding as much as 29% today and the greenback anticipating its biggest monthly loss of the year, it's safe to say that the paper note with George Washington's face on it is NOT having a good go of it lately: Marcus Ashworth isn't sweating, though. "This is not a King Dollar being toppled from its throne story," he writes. Instead, it's a story about bringing some sense of normalcy back into currency markets. The US has enjoyed a rich premium over the last three years; a series of rate cuts by the Fed — which are expected to begin mid-September — will pour cold water on that, to the much-needed benefit of everyone else. Economies in Europe will breathe easier. Emerging markets will enjoy lower import costs from commodities priced in dollars. Asia, too, stands to make gains: Andy Mukherjee says lower interest rates could help landlords in Singapore outshine banks. But not everyone is in a celebratory mood. Conor Sen says the Fed's actions in September won't be a magic fix for job seekers. "We are in a 'low hiring, low firing' labor market regime," he explains. "Even a meaningful pickup in economic activity and interest rate-sensitive industries next year won't guarantee an increase in hiring." I am but one of the 17 million passengers that will have to cram onto an airplane over Labor Day weekend, which makes me feel tiny and insignificant. But each one of us has a role to play, Thomas Black says: Stay calm. Practice patience. And be on your best behavior. It's as simple as that! "Maybe we can get through this Labor Day weekend without yet another viral video of an unruly passenger," he writes. A girl can dream.  The 81st Venice Film Festival kicked off this week, and the celebrities look hot! Like, sweaty hot and hot hot. Whoever thought it was a good idea to host a recurring event in Venice, Italy, in the last week of August was an actual idiot (sorry, Giuseppe). By the start of the next century, the floating city will either be underwater or unbearably hot. I doubt it makes it to the 150th anniversary. I wish I was kidding: Lara Williams says "heat-related deaths could triple from existing levels by 2100 if temperatures rise by 3C (5.4F) — which the world is on track for under current climate policies — to nearly 129,000 a year from about 44,000 a year." And guess what country will bear the brunt of it all? Oh, madone: Trump and Harris talk a lot but say nothing. — Bloomberg's editorial board Delaying Covid shots until October could protect us through the winter. — Lisa Jarvis If South Korea builds its own nuclear weapons, so will the world. — Hal Brands Free trade helps put less efficient producers out of business. — Tyler Cowen Wukong makes equal rights for women a taboo topic. — Catherine Thorbecke Germany can't afford to turn its back on migrants. — Chris Bryant Housing is a top issue for voters in Arizona and Nevada. — Erika D. Smith Elon Musk's free speech absolutism is super flawed. — Adrian Wooldridge A demure and mindful trademark investigation. America's "chocolate oligopoly" is under scrutiny. The Boar's Head listeria outbreak is not improving. Is pandan New York City's next matcha? Yolanda Hadid has a honey bar in her house. When birds build nests, they're also building a culture. Range Rover hanky panky goes terribly awry. Notes: Please send strawberry pandan cronuts and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Threads, TikTok, Twitter, Instagram and Facebook. |

No comments:

Post a Comment