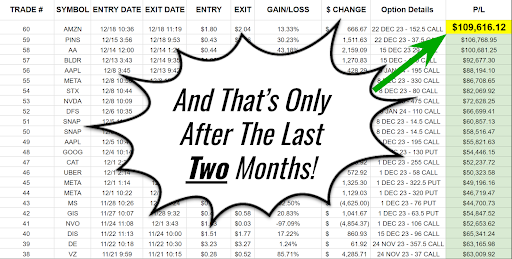

| This P/L chart will make your eyes pop (ad) |

Today I want to show you how our research shows you could've grown a $25,000 account into $109,616.12 within the last TWO months.

You see, former multi-million dollar hedge fund manager Roger Scott spent the better half of 2023 developing what might be the most advanced trading tool that exists…

It's a revolutionary software system that tracks the moves of institutional investors…. in real time…

Go here to watch the most recent trading workshop video at no charge. |

|

| [Revealed] How savvy traders are "flipping" options (ad) |

Did you know there's a way to flip options and target big potential paydays?

Seriously.

Using one little-known trading technique…

I've discovered a way to determine which options contracts are undervalued…

Then "flip" them back a few hours later for what could be absurd profits.

These trades take a few hours at most…

And there's usually 3-4 of them per week.

The next trade could be coming as soon as tomorrow. |

|

You have not added any stocks to your watchlist.Click here to add stocks to your watchlist. - AFC Gamma (NASDAQ:AFCG) was upgraded by analysts at Compass Point from a "sell" rating to a "neutral" rating. They now have a $9.00 price target on the stock, down previously from $10.00. This represents a 9.2% downside from the current price of $9.91.

- Alnylam Pharmaceuticals (NASDAQ:ALNY) was upgraded by analysts at The Goldman Sachs Group, Inc. from a "neutral" rating to a "buy" rating. They now have a $370.00 price target on the stock, up previously from $198.00. This represents a 37.3% upside from the current price of $269.42.

- CF Industries (NYSE:CF) was upgraded by analysts at Barclays PLC from an "equal weight" rating to an "overweight" rating. They now have a $90.00 price target on the stock, up previously from $80.00. This represents a 12.5% upside from the current price of $80.02.

- Cisco Systems (NASDAQ:CSCO) was upgraded by analysts at HSBC Holdings plc from a "hold" rating to a "buy" rating. They now have a $58.00 price target on the stock, up previously from $46.00. This represents a 17.6% upside from the current price of $49.33.

- EnLink Midstream (NYSE:ENLC) was upgraded by analysts at Tudor, Pickering, Holt & Co. from a "hold" rating to a "buy" rating. They now have a $15.00 price target on the stock. This represents a 14.3% upside from the current price of $13.12.

- FOX (NASDAQ:FOXA) was upgraded by analysts at Wells Fargo & Company from an "underweight" rating to an "overweight" rating. They now have a $46.00 price target on the stock, up previously from $29.00. This represents a 15.9% upside from the current price of $39.69.

- Illumina (NASDAQ:ILMN) was upgraded by analysts at Daiwa Capital Markets from a "neutral" rating to a "buy" rating. They now have a $154.00 price target on the stock, up previously from $120.00. This represents a 18.8% upside from the current price of $129.63.

- JD.com (NASDAQ:JD) was upgraded by analysts at JPMorgan Chase & Co. from a "neutral" rating to an "overweight" rating. They now have a $36.00 price target on the stock, up previously from $33.00. This represents a 26.2% upside from the current price of $28.52.

- Kimco Realty (NYSE:KIM) was upgraded by analysts at Raymond James from a "market perform" rating to a "strong-buy" rating. They now have a $25.00 price target on the stock. This represents a 12.1% upside from the current price of $22.31.

- Kite Realty Group Trust (NYSE:KRG) was upgraded by analysts at Raymond James from a "market perform" rating to a "strong-buy" rating. They now have a $28.00 price target on the stock. This represents a 12.0% upside from the current price of $25.00.

- Microchip Technology (NASDAQ:MCHP) was upgraded by analysts at Piper Sandler from a "neutral" rating to an "overweight" rating. They now have a $100.00 price target on the stock, up previously from $90.00. This represents a 23.1% upside from the current price of $81.24.

- NIKE (NYSE:NKE) was upgraded by analysts at Williams Trading from a "sell" rating to a "buy" rating. They now have a $93.00 price target on the stock, up previously from $67.00. This represents a 11.8% upside from the current price of $83.17.

- Newmark Group (NASDAQ:NMRK) was upgraded by analysts at Wolfe Research from a "peer perform" rating to an "outperform" rating. They now have a $15.00 price target on the stock. This represents a 17.1% upside from the current price of $12.81.

- Origin Materials (NASDAQ:ORGN) was upgraded by analysts at Bank of America Co. from a "neutral" rating to a "buy" rating. They now have a $3.00 price target on the stock, up previously from $1.35. This represents a 119.0% upside from the current price of $1.37.

- Sphere Entertainment (NYSE:SPHR) was upgraded by analysts at JPMorgan Chase & Co. from a "neutral" rating to an "overweight" rating. They now have a $57.00 price target on the stock, up previously from $37.00. This represents a 16.2% upside from the current price of $49.05.

- Teradyne (NASDAQ:TER) was upgraded by analysts at Cantor Fitzgerald from a "neutral" rating to an "overweight" rating. They now have a $16.00 price target on the stock. This represents a 87.9% downside from the current price of $132.43.

- View today's most recent analysts' upgrades at MarketBeat.com

Ready to discover the standout stock of 2024? We've identified a single buy & hold gem that's poised to redefine your portfolio. Download our exclusive report now and dive into the Insights. Click below to opt-in and receive up to two additional free bonus subscriptions. Unsubscribe at any time.

Get Your Free Report |

|

- Bumble (NASDAQ:BMBL) was downgraded by analysts at TD Cowen from a "buy" rating to a "hold" rating. They now have a $7.50 price target on the stock, down previously from $22.00. This represents a 24.0% upside from the current price of $6.05.

- CAE (NYSE:CAE) (TSE:CAE) was downgraded by analysts at Morgan Stanley from an "overweight" rating to an "equal weight" rating.The current price is $17.30.

- Cardlytics (NASDAQ:CDLX) was downgraded by analysts at Northland Securities from an "outperform" rating to a "market perform" rating. They now have a $5.00 price target on the stock, down previously from $7.00. This represents a 36.6% upside from the current price of $3.66.

- Coherus BioSciences (NASDAQ:CHRS) was downgraded by analysts at UBS Group AG from a "buy" rating to a "neutral" rating. They now have a $1.50 price target on the stock, down previously from $4.00. This represents a 4.9% upside from the current price of $1.43.

- Estée Lauder Companies (NYSE:EL) was downgraded by analysts at Bank of America Co. from a "buy" rating to a "neutral" rating. They now have a $100.00 price target on the stock, down previously from $140.00. This represents a 5.7% upside from the current price of $94.65.

- Lumen Technologies (NYSE:LUMN) was downgraded by analysts at Wells Fargo & Company from an "equal weight" rating to an "underweight" rating. They now have a $4.00 price target on the stock, up previously from $1.75. This represents a 26.3% downside from the current price of $5.43.

- Silicon Motion Technology (NASDAQ:SIMO) was downgraded by analysts at Bank of America Co. from a "buy" rating to an "underperform" rating. They now have a $60.00 price target on the stock, down previously from $90.00. This represents a 6.6% downside from the current price of $64.21.

- Viracta Therapeutics (NASDAQ:VIRX) was downgraded by analysts at SVB Leerink LLC from an "outperform" rating to a "market perform" rating. They now have a $3.00 price target on the stock, down previously from $5.00. This represents a 760.3% upside from the current price of $0.35.

- Vital Energy (NYSE:VTLE) was downgraded by analysts at KeyCorp from an "overweight" rating to a "sector weight" rating.The current price is $37.02.

- XOS (NASDAQ:XOS) was downgraded by analysts at DA Davidson from a "buy" rating to a "neutral" rating. They now have a $9.00 price target on the stock, down previously from $17.00. This represents a 71.4% upside from the current price of $5.25.

- View today's most recent analysts' downgrades at MarketBeat.com

| Survive Biden's Tax Attack with Gold! (ad) |

|

- Couchbase (NASDAQ:BASE) is now covered by analysts at Piper Sandler Companies. They set an "overweight" rating and a $22.00 price target on the stock. This represents a 21.1% upside from the current price of $18.17.

- Couchbase (NASDAQ:BASE) is now covered by analysts at Piper Sandler. They set an "overweight" rating and a $22.00 price target on the stock. This represents a 21.1% upside from the current price of $18.17.

- Liquidia (NASDAQ:LQDA) is now covered by analysts at Raymond James. They set an "outperform" rating and a $27.00 price target on the stock. This represents a 90.7% upside from the current price of $14.16.

- Two Harbors Investment (NYSE:TWO) is now covered by analysts at Janney Montgomery Scott. They set a "buy" rating and a $15.00 price target on the stock. This represents a 10.1% upside from the current price of $13.63.

- Y-mAbs Therapeutics (NASDAQ:YMAB) is now covered by analysts at Cantor Fitzgerald. They set an "overweight" rating and a $20.00 price target on the stock. This represents a 62.1% upside from the current price of $12.34.

- View today's most recent analysts' new coverage at MarketBeat.com

| Get 30 Days of MarketBeat All Access Free | | Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: |

| - Best-in-Class Portfolio Monitoring

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. - Stock Ideas and Recommendations

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report. - Advanced Stock Screeners and Research Tools

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

| START YOUR 30-DAY FREE TRIAL  |

|

| Upgrade Your Subscription |

Upgrade to MarketBeat All Access and receive your premium edition of MarketBeat Daily at 9:00 AM ET. UPGRADE NOW  |

|

View and add up to five holdings to your watchlist.

VIEW MY PORTFOLIO  |

|

Join MarketBeat's free stock discussion and trading idea group on Facebook.

JOIN NOW  |

|

|

Thank you for subscribing to MarketBeat! We empower individual investors to make better trading decisions by providing real-time financial information and objective market research. MarketBeat is a small business and email is a crucial tool for us to share information, news, trading ideas and financial products and services with our subscribers (that's you!). If you have questions about your subscription, feel free to contact our U.S. based support team via email at contact@marketbeat.com. If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribe from these emails. © 2006-2024 MarketBeat Media, LLC. 345 N Reid Place, Suite 620, Sioux Falls, SD 57103 . United States. Today's Bonus Content: Protect Your Investments: Download Your Free Guide from Colonial Metals Group! |

![image for [Revealed] How savvy traders are](https://www.marketbeat.com/images/webpush/files/thumb_2059push_webinar_02_720x480.jpg)

No comments:

Post a Comment