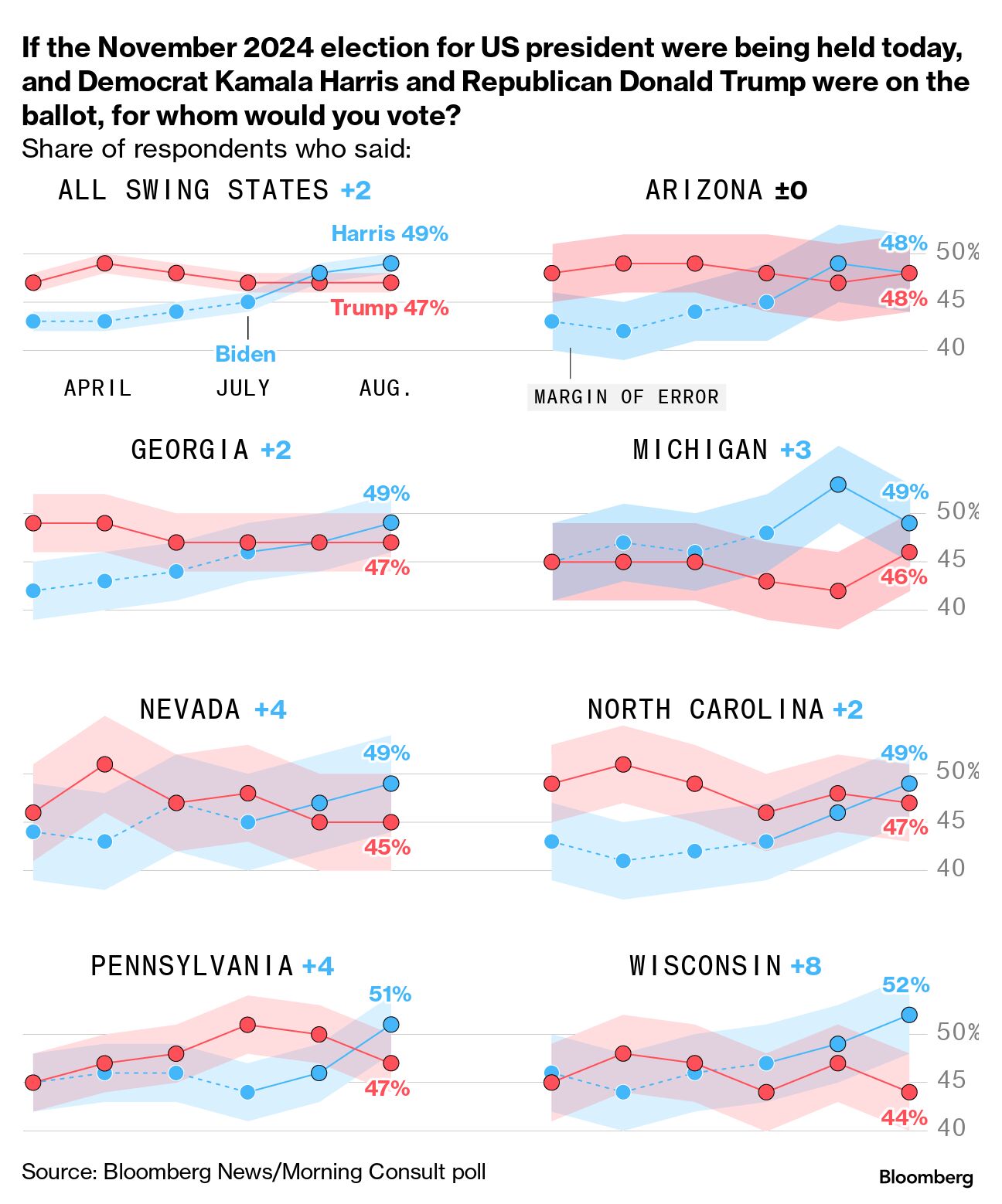

| College football superfan (and Bloomberg Businessweek writer) Amanda Mull explains why this season promises a peek into the game's uncertain future (spoiler alert: It's mostly about money). Plus: New polls from Bloomberg-Morning Consult show Democrats are putting more states into play. If this email was forwarded to you, click here to sign up. And a programming note: Businessweek Daily will be off for Labor Day. See you Tuesday. Yesterday marked the opening of the 2024 college football season—sort of, at least. Officially this is Week One, according to the various conference governing bodies, oversight organizations and selection committees that make up the loose confederation of American college football. But a handful of teams broke the seal and played their first game last weekend, including Georgia Tech's upset of Florida State (in Ireland, for some reason). That was Week Zero. No one can really pinpoint when Week Zero became a thing, or why the NCAA, which governs college football in many (but not all) respects, allows a handful of teams to play a week early and bars others from doing so. The main exception is the University of Hawaii, or its opponents for home games; Hawaii is very far away, so those teams can get things started early if they want. If you nodded along to the previous paragraph, then you're well equipped to digest the season to come, which will be the most uncertain in the recent history of the fantastically popular sport. A number of college football's fundamental structures have changed: For the past few seasons, student athletes have been freer to move among schools during the offseason and accept sponsorship money, which has produced a transfer market that scrambles rosters. Conferences, too, are engaged in a grand, ongoing game of musical chairs. This year, that includes the consequences of the once-robust PAC12's collapse, which, among other uncanny results, has landed Stanford and Cal in the Atlantic Coast Conference. How the sport determines a champion is changing as well, with an expansion of the playoffs from four teams to 12. Matchups, though, will still be determined largely in closed meetings by a cabal of football-adjacent bigwigs. Even in America's most fractious major sport, some things are sacred.

These changes are fueled mainly by the sport's expansive business interests—those of schools, conferences, broadcasters, coaches, big-money boosters, agents and, much to the chagrin of some traditionalists, occasionally even the athletes. College football has long been a cash cow cloaked in the (now mostly abandoned) charade of amateurism, and there's never been as much money sloshing around as there is now. Schools defect from conferences for richer media deals; unlike in college basketball, which bundles its broadcast rights into one contract managed by the NCAA, college football sells its rights by conference. The conferences then make annual payouts to schools, with the Big Ten and SEC at the top of the financial heap, paying out more than $50 million to each of their member institutions for the 2023 season. The Big Ten's new deal—the all-time richest in the sport—is worth $7 billion over seven years. Playoff expansion, too, is a tried-and-true way to goose revenue—just ask the NFL. ESPN functionally controls the College Football Playoff as its sole broadcast partner, and more games mean more broadcasts. The first round of the new playoff will be played on campuses, which also means more revenue for home teams. Universities say they need the cash to prepare for another change: To settle an antitrust case earlier this year, the major conferences have agreed to share the spoils of their athletic departments with athletes. The NCAA expects schools to pay players a total of more than $1 billion a year if the courts approve the proposed settlement, according to documents obtained by the Associated Press.  Cheerleaders at the Florida International University stadium, now named for the rapper Pitbull. Photographer: Ivan Apfel/Getty Images

Schools and conferences with less lucrative broadcast deals have begun to look elsewhere for money, including contracts that would let private equity firms get a piece of college football for the first time. The Big 12, which distributed nearly $40 million to its member schools in 2024, has been the most aggressive. It's currently considering a pact with as-yet-unnamed private equity partners, as well as a naming rights deal with Allstate Insurance.

College football, of course, is well acquainted with nontraditional cash flow, so some schools with smaller audiences and less interest from big money are finding even more creative revenue sources. Florida International University in Miami, for example, just sold its stadium's naming rights to the rapper Pitbull. |

No comments:

Post a Comment