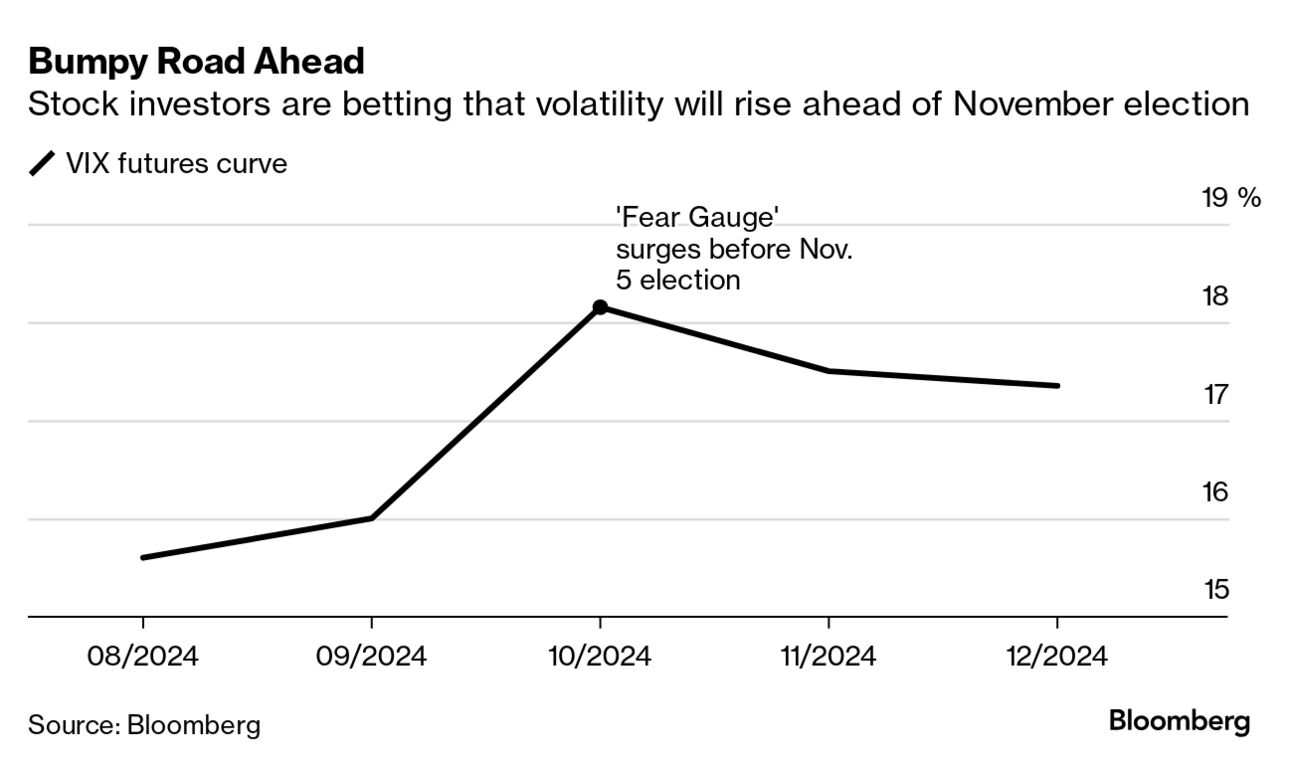

| Welcome to the Year of the Elections, Bloomberg's newsletter on the votes that matter to markets, business, and policy amid the most fragmented geo-economic landscape in decades. The result of one of the most frenetic two months in US political history is a race — and nation — transformed. The political landscape was capsized by Joe Biden's disastrous debate performance, a shocking assassination attempt on rival Republican presidential nominee Donald Trump, and the president's subsequent decision — as he was isolating with Covid — to drop out of the race and endorse his vice president, Kamala Harris.  Harris at a campaign event in Arizona this month. Photographer: Rebecca Noble/Bloomberg There's a palpable excitement gathering behind the Democratic nominee, who has quickly rallied not only her party but also voters dispirited by their original choice between two well-trodden geriatric candidates. The Democrat has opened a small but steady lead in public opinion polls, turning around a race that seemed unwinnable for her party just weeks ago. Harris can expect a boost from the Democratic convention next week in Chicago, where three presidents — Biden, Barack Obama and Bill Clinton — will fête her alongside some of the party's rising stars. But she needs to navigate some important challenges across the three-month sprint until Election Day and identify areas where she'll break from her boss. That's particularly important on the economy. Voters remain skeptical of Democratic leadership thanks to spiking post-pandemic inflation that only lately cooled. Recent market instability has only underscored the fragility of the recovery. Rising unemployment and discouraging sales data could prove the harbingers of a dreaded recession. Trump in the meantime is still adjusting to a new opponent. He stumbled through some high-profile events — including an appearance at a conference for Black journalists where he questioned Harris' ethnicity, and a live broadcast with Elon Musk marred by technical glitches. And while that has reminded voters of the chaotic lows of his presidency, his base remains as fervent as ever. He's trying out different nicknames on her (none are sticking) when hammering away at inflation and cost of living would be more effective. After the convention in Chicago, Harris will need to avoid the type of pitfalls that doomed her first presidential campaign. She has pledged to sit for at least one interview before attention shifts rapidly to her Sept. 10 debate with Trump. On that stage is where the stakes are highest. Trump is looking to land a second knockout blow. She needs to appear calm and in control, and to keep needling a thin-skinned rival already chafing at being called "weird." And to add even more drama to the moment, the two have never met. America and the world will be tuning in. — Justin Sink  Trump during a news conference yesterday. Photographer: Bing Guan/Bloomberg |

No comments:

Post a Comment