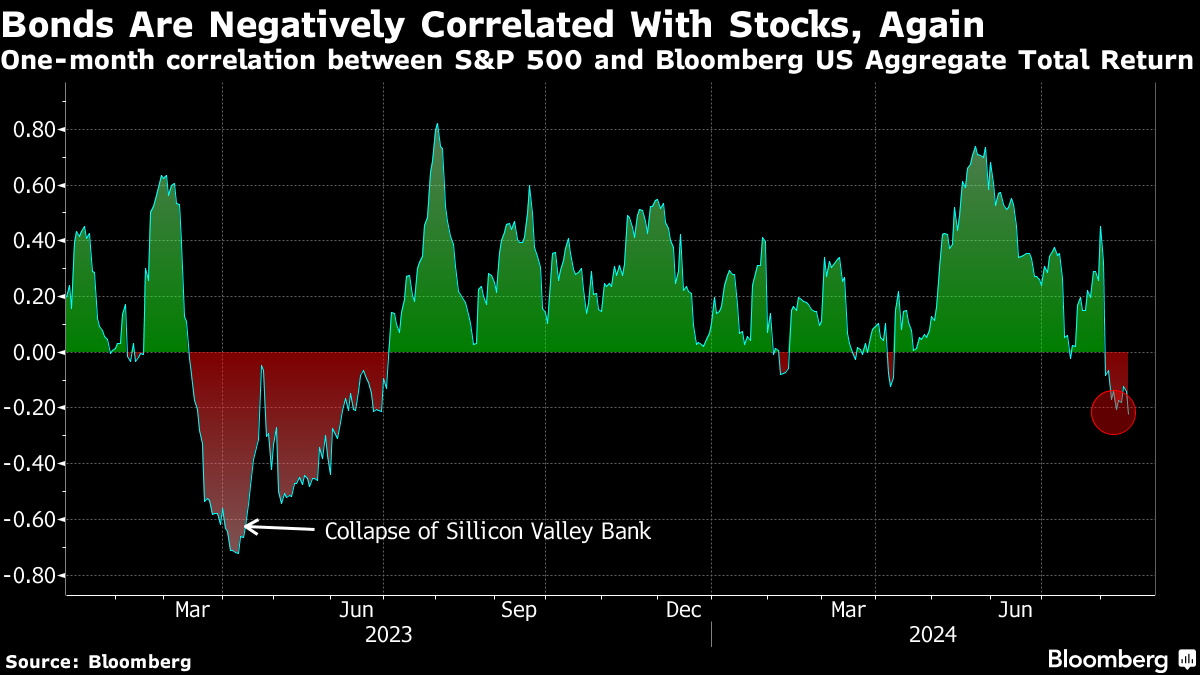

| This newsletter has discussed before the idea that buffer ETFs are being employed as bond replacements. The funds use options to limit downside stock risk while capping upside, a proposition that resembles a fixed-income security that pays interest and can be redeemed at maturity for face value. But for anyone who bought these ETFs to replace their bond allocation, the cross-asset volatility of the past couple weeks has been an interesting test of that logic. A key point is that the ETFs limit but don't completely eradicate the potential for losses, and when the S&P 500 skidded, they took lumps as well. Contrast that with the experience of Treasuries holders who benefited from that market's surge. That doesn't mean they aren't useful bond replacements, according to Allianz Investment Management's head ETF market strategist Johan Grahn. "Yes, they are correlated to equities and we want them to be, because keep in mind, if you're investing over time — decades, even — seven out of 10 times, the equity market is going up. So you're tilting the odds in your favor," Grahn said in a phone interview. "It's a different way of thinking about what you're looking for." Besides, there's no guarantee that bonds will save you anyway, Grahn said — and it's true, Treasuries have been a very unreliable hedge over the past few years. Those haven properties were nowhere to be found in 2022, when the Bloomberg US Treasury Total Return Index dropped 12.5% as the S&P 500 spiraled 19% lower. And how did the AllianzIM US Large Cap Buffer20 Jan ETF fare amid 2022's mayhem? Just 0.6% lower on the year. |

No comments:

Post a Comment