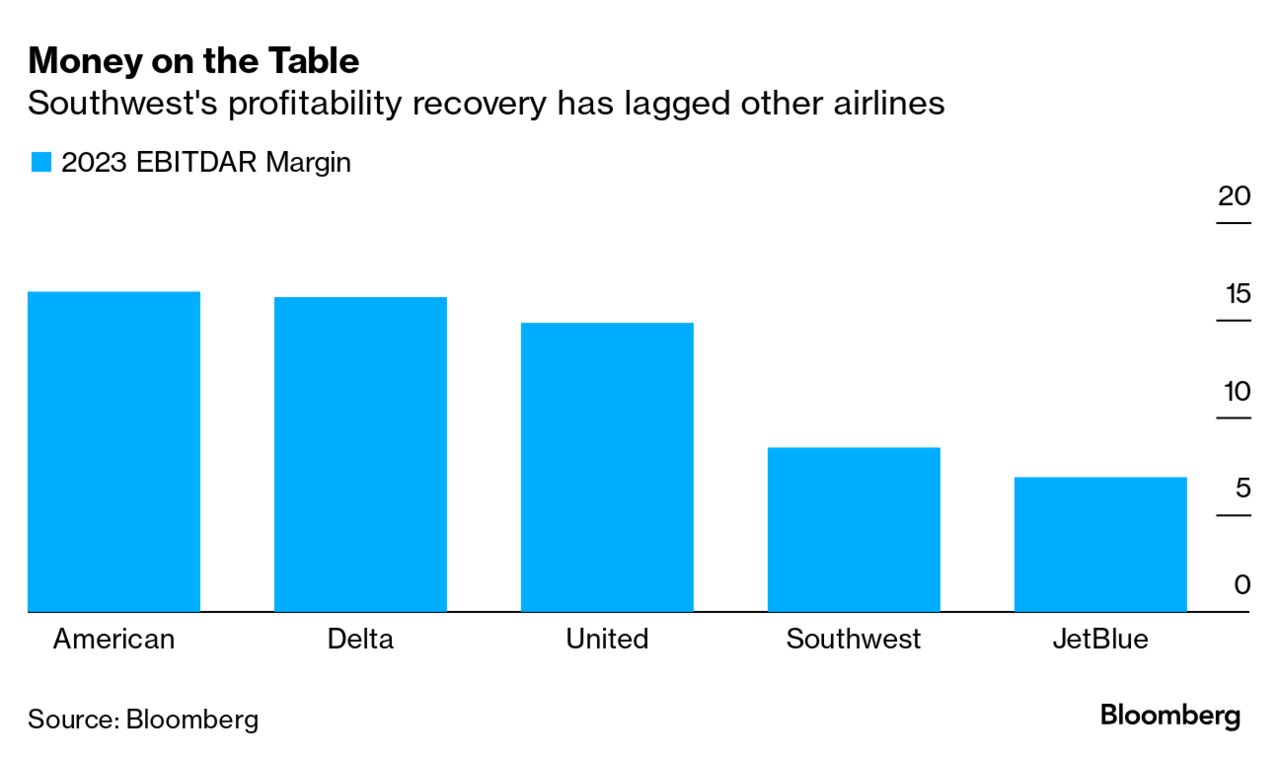

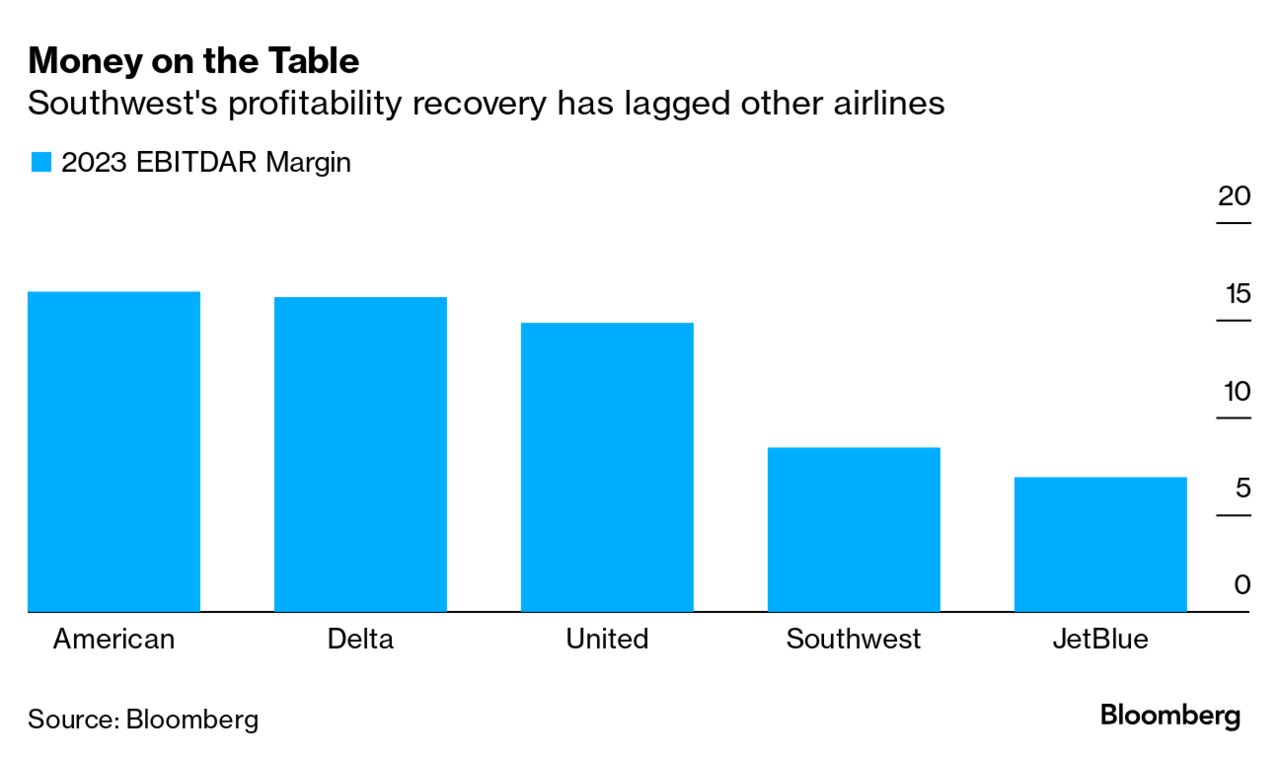

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Elliott Investment Management is inching closer to forcing a shareholder referendum on the current leadership at Southwest Airlines Co. The last time a corporate standoff with the investor reached a similar make-or-break point, it resulted in one of the most dramatic (and bizarre) activist battles that the industrial sector has ever seen — and Elliott walked away victorious. Elliott this week announced it's increased its direct position in Southwest to 9.7%. That's just shy of the 10% holding the activist needs to call a special shareholder vote over its push to replace two-thirds of the airline's board and oust Chief Executive Officer Bob Jordan and Chairman Gary Kelly. Elliott has said the leaders have been slow to update antiquated aspects of Southwest's business model and lack the credibility to improve its operations and stock price from here. Southwest has repeatedly backed its existing management team, while also announcing updates like assigned seating and expressing an interest in collaborating with Elliott on ways to improve the business. The two sides are set to meet on Sept. 9.  Source: Bloomberg If Jordan's and Kelly's jobs remain "sacrosanct" and not up for debate with the board, then it's "preferable to give shareholders a direct say on the question of who should be leading Southwest," Elliott partner John Pike and portfolio manager Bobby Xu wrote in a letter to the airline this week. "If we end up having to nominate directors to the board of Southwest and take this contest all the way to a special meeting, then it will be the first time we have had to conduct such a contest in the United States in more than seven years." They're referring to Elliott's 2017 showdown with metal-parts maker Arconic, the company now known as Howmet Aerospace Inc. That's not the last activist campaign Elliott launched — far from it. But it's the last time that a company board dug in its heels and fought the famously persistent activist investor into a full-blown proxy fight, rather than striking an earlier settlement. With Southwest CEO Jordan telling employees that "if it's a fight they want, it's a fight they will get," it's worth looking back at how the Arconic situation played out — for the management team, for Elliott and for other shareholders.

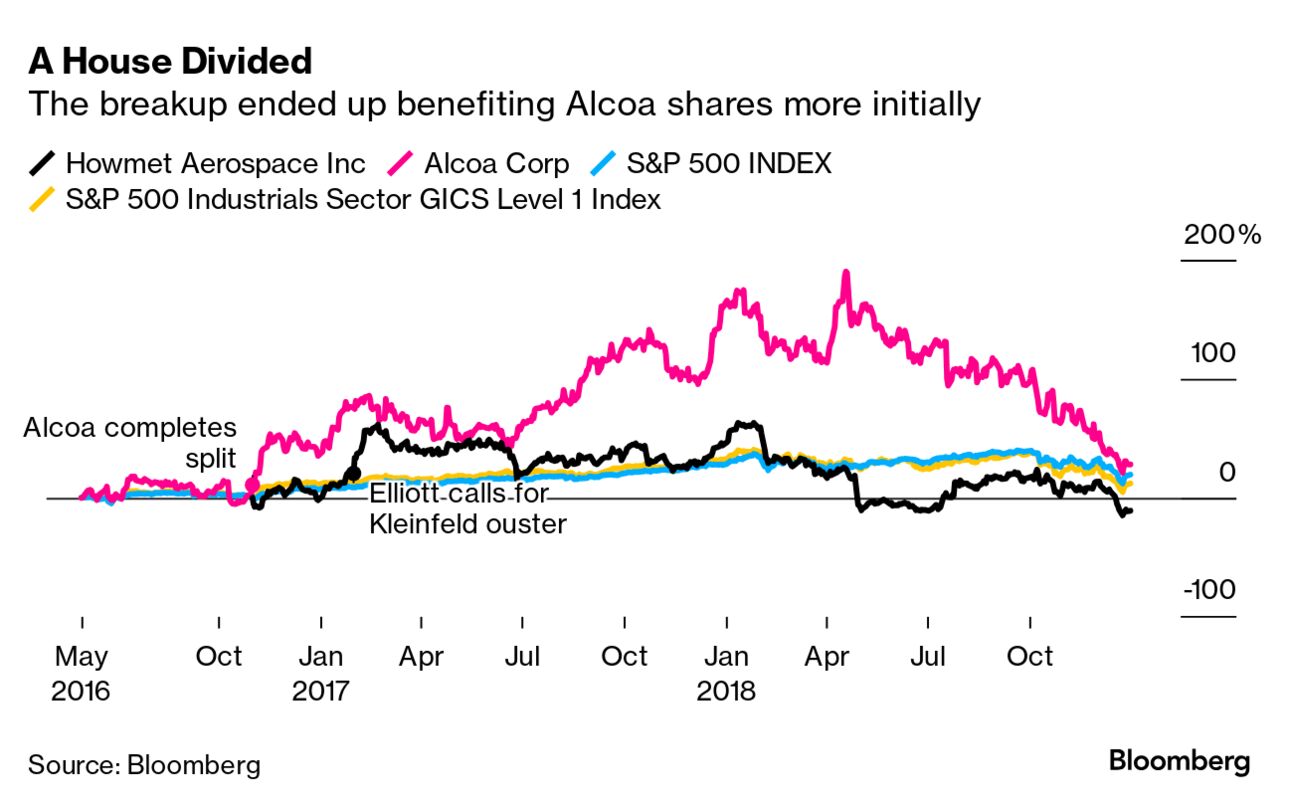

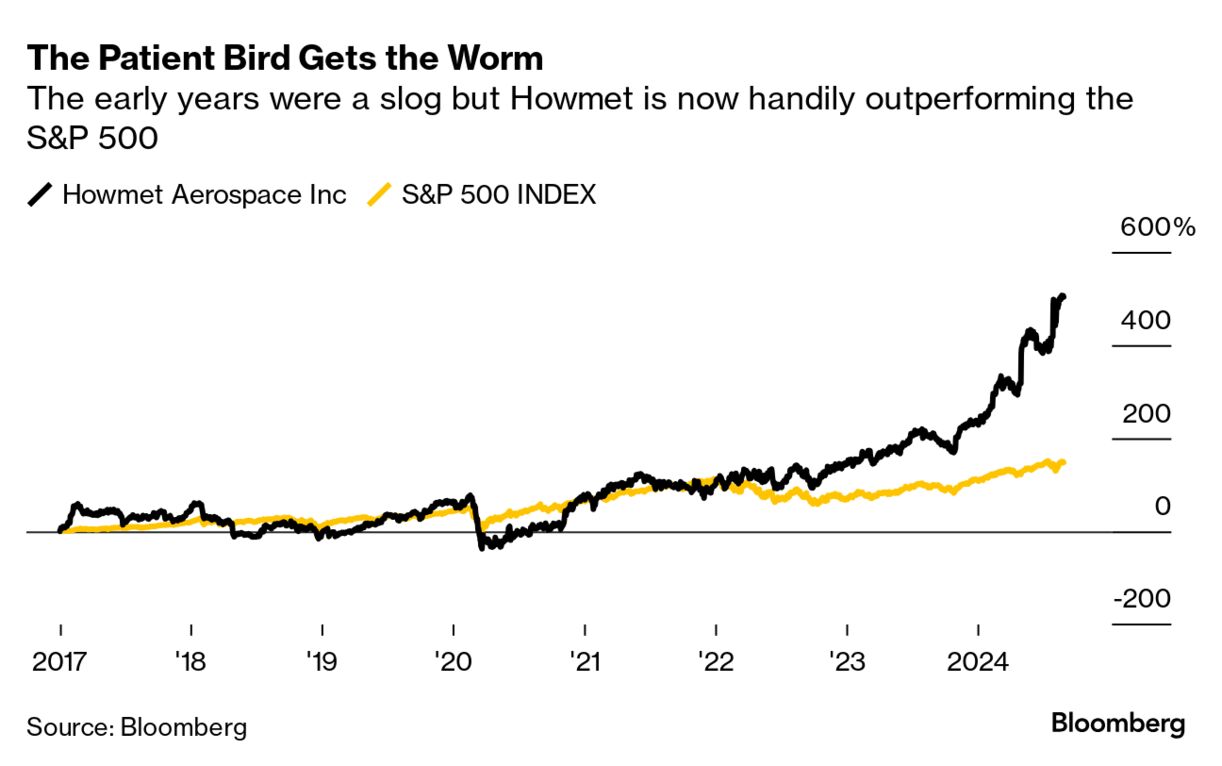

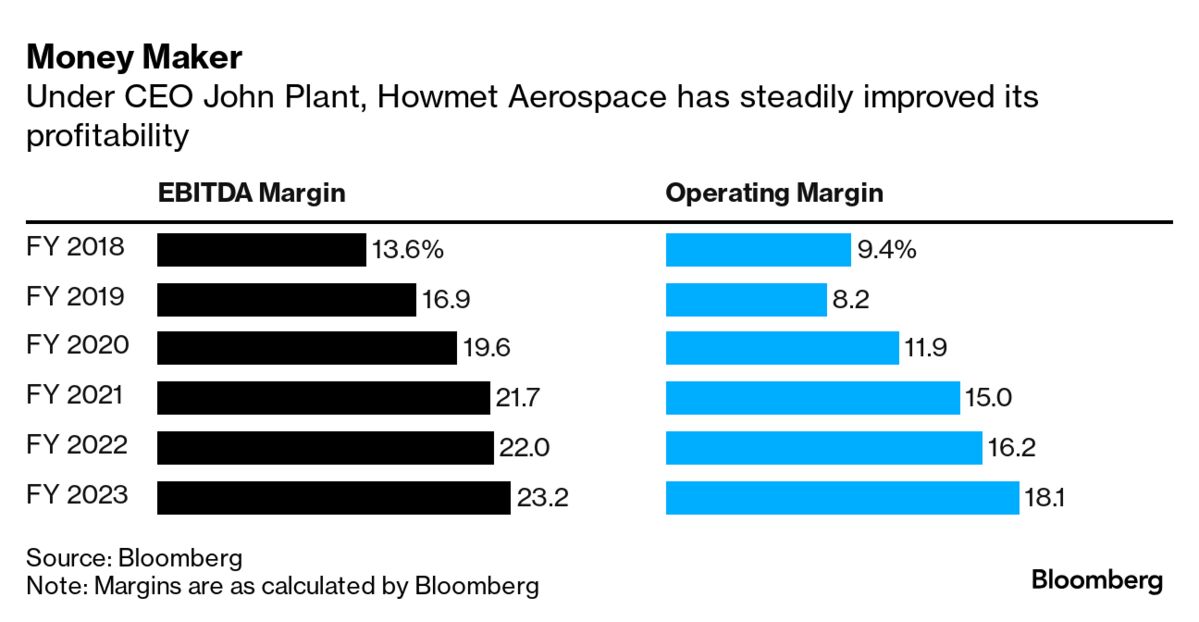

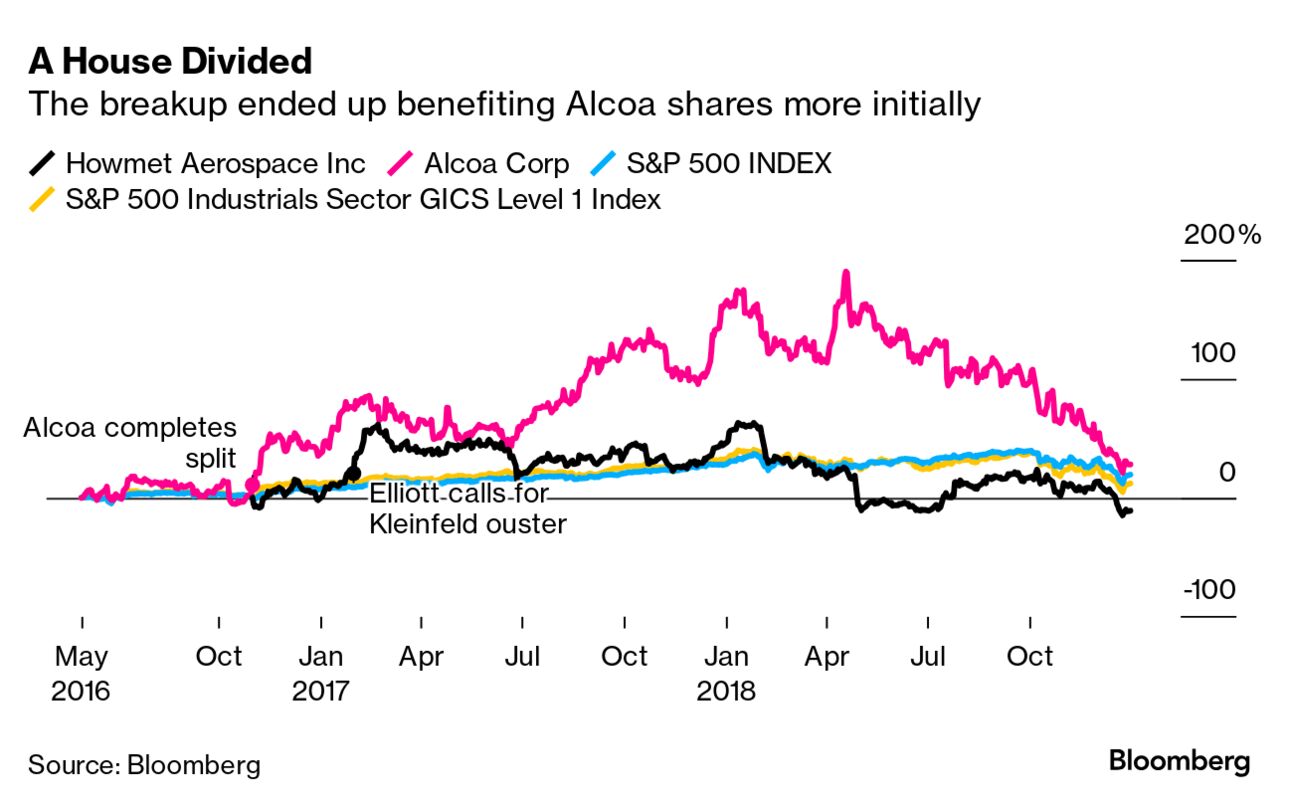

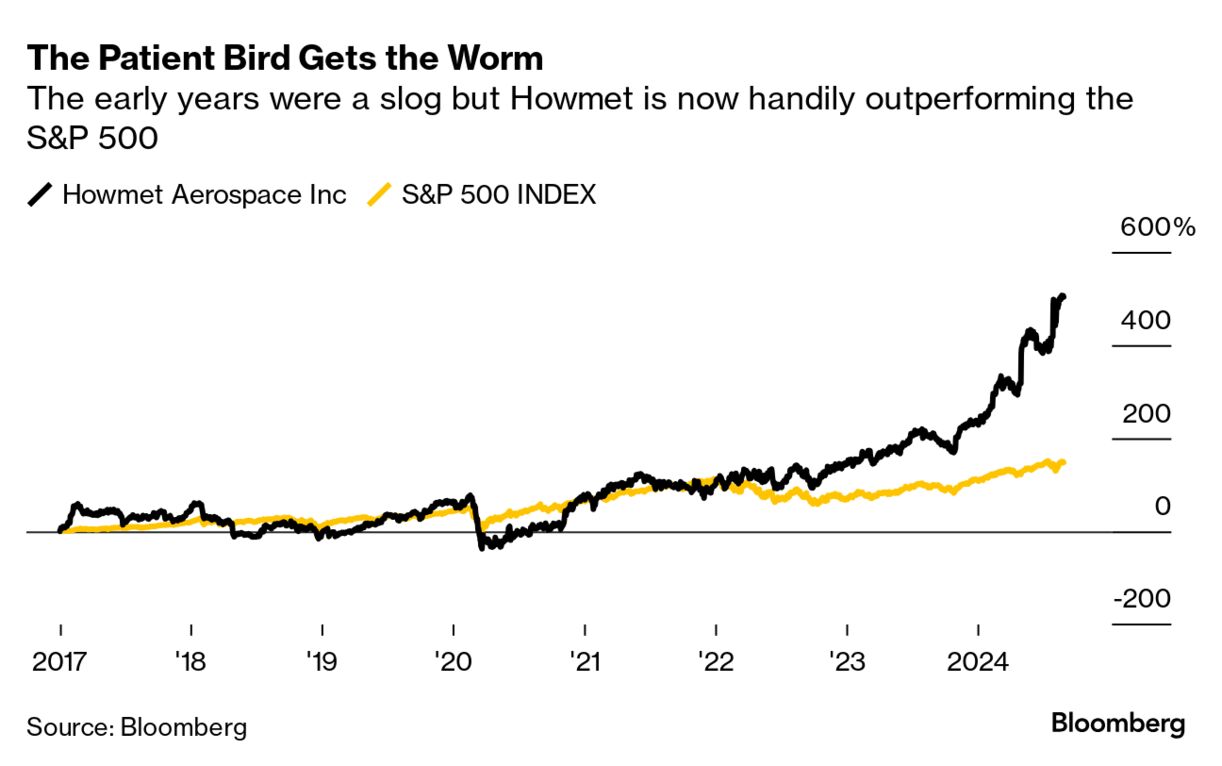

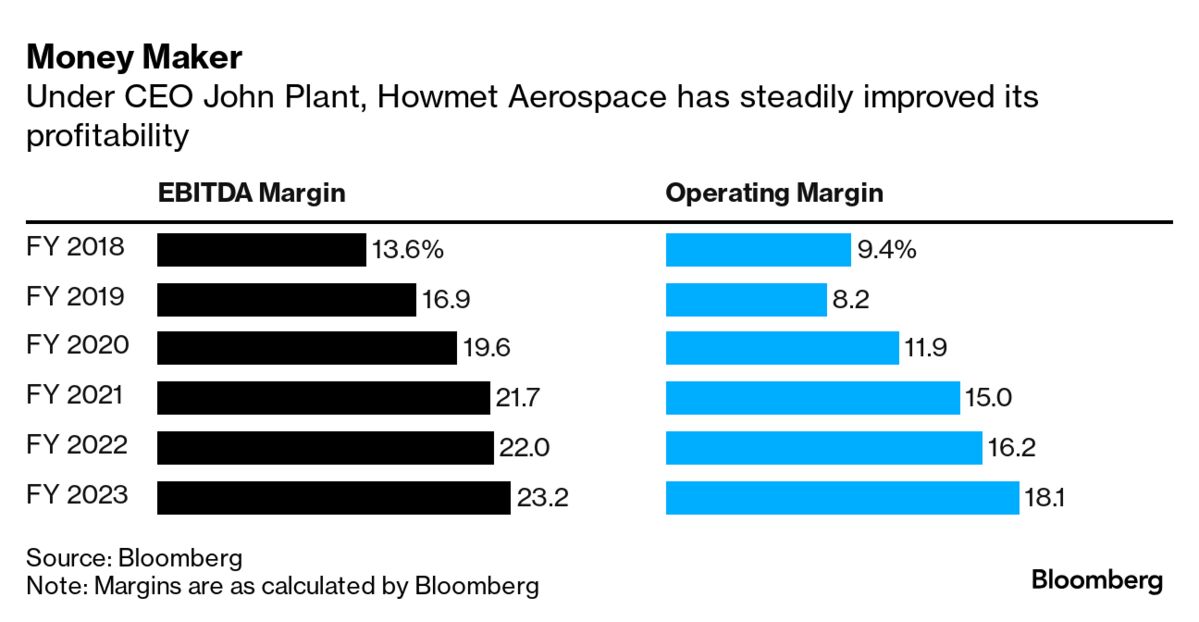

Elliott initially held a stake in Arconic's predecessor, Alcoa, and successfully negotiated board changes ahead of that company's breakup in 2016. Arconic's automotive- and aerospace-parts business was meant to be the higher-growth and more-richly valued part of Alcoa — but it didn't work out that way in the immediate aftermath of the split. A market shift favored the commodity-driven smelting arm Arconic let go of, allowing what was supposed to be the mundane part of the business to steal the limelight. Bungled financial targets, a bloated cost structure and outdated governance policies didn't help the remaining jet and auto parts unit, either. Elliott blamed Arconic CEO Klaus Kleinfeld for the company's lagging profit and stock — and Alcoa's lackluster performance before that. Kleinfeld, formerly CEO of Siemens AG, had led Alcoa since 2008 and was appointed to run Arconic after the separation.  In 2017, mere months after the breakup, Elliott launched a campaign to replace Kleinfeld and overhaul Arconic's board. It lambasted Kleinfeld for "globe-trotting" rather than focusing on the business and for overseeing a "House of Governance Horrors" that included a staggered board that wasn't subject to annual elections, a disconnect between sizable pay deals and company performance, lax rules about the CEO's ability to serve on outside boards and a ritzy headquarters on New York's Park Avenue. "Immediate change in leadership is needed for Arconic to reliably and sustainably create shareholder value," Elliott said in a 2017 letter. Sound familiar? Like Southwest, Arconic stuck by its leader — until a bizarre turn of events forced it to pivot. Kleinfeld sent a soccer ball to Elliott founder Paul Singer, along with a letter that referenced "colorful memories" made in Berlin during the 2006 soccer World Cup and alluded to, among other things, the show tune Singing in the Rain. Kleinfeld was ousted over the ill-advised letter but the Arconic board continued to push back for another month. The two sides eventually struck a deal to give three more board seats to Elliott-preferred nominees just days before a proxy contest that Arconic looked set to lose. Dave Miller, now an equity partner at Elliott, joined separately as a director later in 2017 and has remained on the board ever since. Apart from being Elliott's last full-blown proxy fight, there are other parallels between the Arconic situation and its latest campaign at Southwest. In both situations, other shareholders publicly rallied to Elliott's cause. (In the case of Southwest, Artisan Partners has also urged the company to "immediately" overhaul its board and leadership.) At Arconic and now at Southwest, Elliott primarily focused on the companies' operations and the opportunity to run things differently under a new CEO, rather than demanding some kind of quick-turn financial engineering. This was a relatively new concept in shareholder activism back in 2017 when Elliott targeted Arconic — in part because hiring the right person to lead a deep-rooted turnaround is much harder and can require a lot more patience than a breakup or buyback.  Elliott's campaign at Arconic wasn't an overnight success. The stock price lagged Elliott's targets in the initial years after Kleinfeld's ouster. That was partly because the operational and spending missteps that the activist investor criticized weren't easy to undo and partly because Arconic got hit with plenty of bad news. Volatility linked to aluminum tariffs and sanctions drove up Arconic's input costs and pinched its profitability, while the company faced legal challenges over its role in providing components for combustible cladding that was blamed for the rapid spread of a tragic fire at Grenfell Tower in the UK in 2017. A $15 billion deal to sell the company to Apollo Global Management Inc. went bust in 2019. It also took a few tries to find the right CEO to replace Kleinfeld — more on that in a moment. Read More: Arconic Breakup Is More Logical Than Buyout For shareholders who were willing to be a bit patient, the returns have paid off, particularly after John Plant took over the CEO job in 2019. The company did end doing another breakup: It spun off the aluminum sheet operations in 2020 (which retained the Arconic name), leaving the remaining Howmet Aerospace business focused on engineered metal parts for airplanes. The Arconic spinoff sold itself to Apollo in 2023 for about $5.2 billion, including debt. Howmet, meanwhile, is the best-performing industrial stock on the S&P 500 this year and is up more than 500% on a split-adjusted basis from what it traded for at the start of 2017.

Howmet has boosted margins by tightening cost controls and renegotiating long-term agreements with companies further up the aerospace supply chain to capture more pricing power for itself. The company has also increased its market share, helping it to outgrow the more pedestrian production rates at Boeing Co. and Airbus SE. "Simply put, Howmet is indispensable to the aerospace industry," Melius Research analyst Robert Spingarn wrote in a July report. And that's a lot more obvious now that the business has been streamlined and is in the hands of a capable CEO.  Elliott had initially wanted Larry Lawson — a hard-nosed operator who previously ran Spirit AeroSystems Holdings Inc. — to take over the top job at Arconic. The press release announcing the proxy fight settlement even mentioned him by name as one of the possible candidates the board would consider for the CEO job. The role instead went to Chip Blankenship, a former General Electric Co. executive, in 2018 with Elliott's support. He lasted only about a year. The third time was the charm: Plant, a former automotive manufacturing executive who was among the directors Elliott originally backed for Alcoa's board in 2016, kickstarted the company's operational improvements.

The CEO roulette underscores the challenges of handpicking a new leader from the outside looking in, particularly ahead of a contentious proxy fight that's likely to generate some hard feelings among the legacy board directors that remain. Notably, in its campaign against Southwest, Elliott is pointedly not naming a specific alternative to replace CEO Jordan, saying only that it wants someone from outside of the company. It's not a guarantee that fresh eyes will make Southwest a better company in the way that they have at Howmet. But it's not clear that the same old eyes will be able to do so, either. Canada's two main railroads are almost back to normal operations after the Canada Industrial Relations Board ordered a return to work and required binding arbitration to resolve labor contract disputes. Canadian National Railway Co. and Canadian Pacific Kansas City Ltd. briefly locked out more than 9,000 employees last week after failing to reach an agreement with the Teamsters Canada Rail Conference, raising alarms in both Canada and the US about the economic impact of shuttering a key trade artery. The Teamsters union has said it plans to appeal the labor board's ruling.

Delta Air Lines Inc. Chief Operating Officer Mike Spanos is leaving the company after only about a year in the role. He will become CEO of Bloomin' Brands Inc., which operates restaurant chains including Outback Steakhouse and Carrabba's Italian Grill. Before joining Delta in 2023, Spanos was CEO at amusement park company Six Flags Entertainment Corp. and held various executive roles at PepsiCo Inc. |

No comments:

Post a Comment