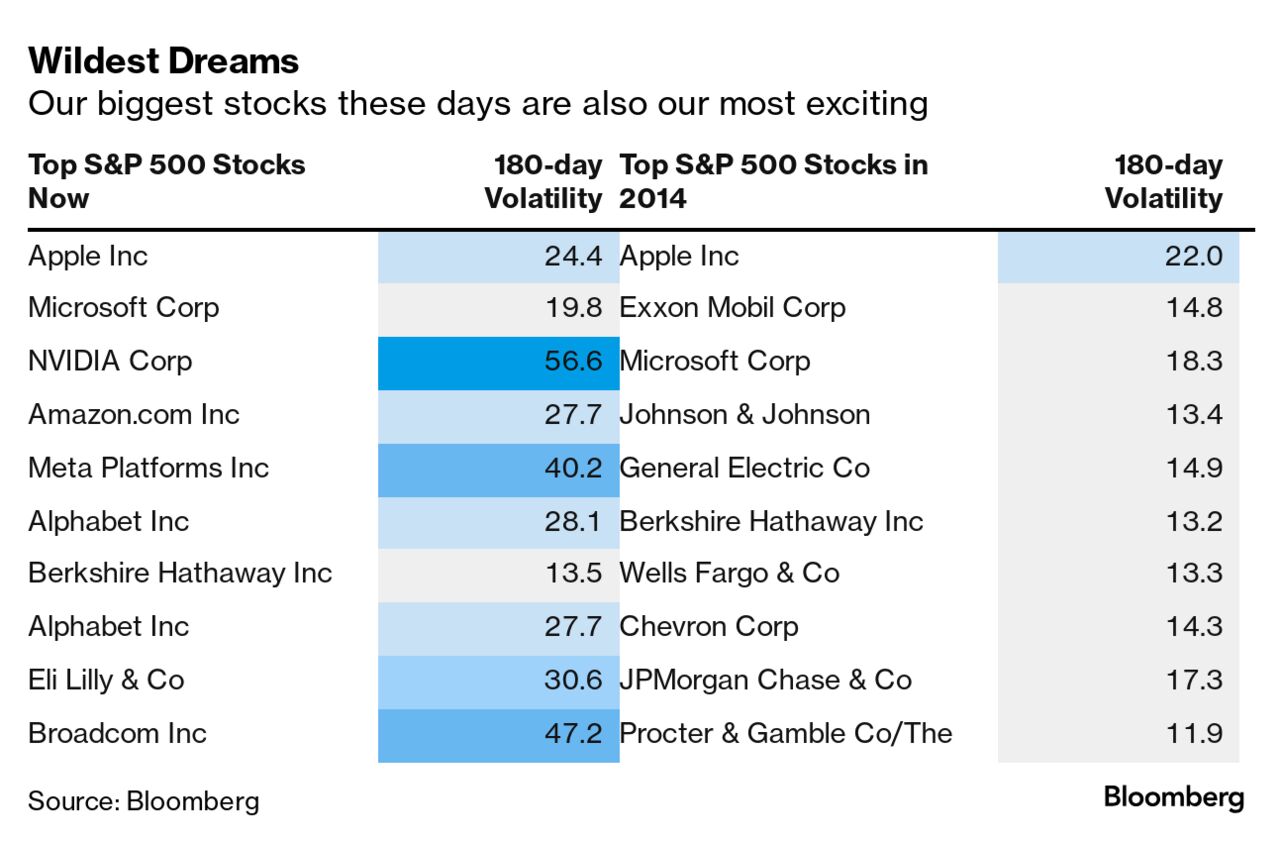

| Good morning. Markets await US inflation data, Treasuries head for their longest monthly winning streak since 2021 and European stocks hit a new record. Here's what traders are talking about. — David Goodman Want to receive this newsletter in Spanish? Sign up to get the Five Things: Spanish Edition newsletter. US futures gained on Friday as traders awaited the release of the Federal Reserve's preferred inflation measure, the personal consumption expenditure index. A gauge tracking the dollar was little changed, while Treasuries were also flat. Bloomberg Economics sees the inflation report reviving talk of a "Goldilocks" economy that allows the Federal Reserve to start cutting rates next month. Those hopes of monetary easing have left Treasuries poised for their longest monthly winning streak in three years. US government bonds returned 1.5% in August through Thursday. They're set for a fourth month of gains, which would be the longest run since July 2021, according to the Bloomberg US Treasury Total Return Index. August might have begun with an eye-watering selloff in stocks, but a solid recovery since then means global equities are now also closing in on a fourth month of gains. In the US, the S&P 500 has only seen one negative month since late last year, translating into a 17% gain so far in 2024. European stocks are also enjoying a bout of optimism, closing in on a fourth week of gains, and hitting record highs. They got another boost on Friday, after a run of good inflation data culminated in a report showing price gains in the euro-area plunged to the lowest level since mid-2021. The figures, which followed similar slowdowns in France, Spain and German, bolsters the case for the European Central Bank to lower interest rates further. The other big boost for markets came from China. Bloomberg News reported the nation is considering allowing homeowners to refinance as much as $5.4 trillion of mortgages to lower borrowing costs for millions of families and boost consumption. Following the report, a Bloomberg index of Chinese developers jumped more than 8% in afternoon trading Friday. This is what's caught our eye over the past 24 hours. Nvidia, the stock with the third-heaviest weight in the S&P 500, is exciting enough to warrant an earnings watch party and to fall 6% in a day, which doesn't even count as a big daily swing by its standards. It reminds me of a comment I often heard when I wrote about equity dispersion, which is that we're in a market now where the largest stocks are also quite volatile. I haven't looked at the full data but a quick glance at history suggests it wasn't always like this. A decade ago you still had the likes of Johnson & Johnson and General Electric among the 10 largest S&P 500 members -- steady behemoths that weren't going to change the world. Now our megacaps are at the forefront of the most exciting developments, from AI to GLP-1s. This has been a tailwind for the dispersion trade, which goes long single-stock volatility and short index volatility. Because of liquidity needs, the strategy mostly trades large-cap options. So you want your big stocks to swing around for idiosyncratic reasons like earnings, but also for correlation to be low so that volatility on the index level is suppressed. This is more or less what has been happening over the last few years. But an interview with the UCLA professor Valentin Haddad I listened to Thursday also made me think of another theory. He's been building on research about demand elasticity in the stock market -- in other words, how responsive investors are to changes in prices. The more recent literature suggests not very much. How is this related? This line of studies including a paper Haddad co-authored also says demand for larger stocks is less elastic. There are large institutions that take a buy-and-hold approach and are especially reluctant to adjust their holdings in large-caps. And of course, index funds are especially skewed toward large caps and by definition do not respond to price. This matters because lower elasticity means their prices are likely to move around even more in response to noise or news. It also means the growth of passive investing might be making demand less elastic over time. There's little doubt that the driver of mega-cap vol has been the nature of Big Tech: our biggest companies these days are also aggressive innovators. But demand elasticity is also an interesting theory to ponder. Justina Lee is a cross-asset reporter based in London. Follow Justina on X @Justinaknope. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

No comments:

Post a Comment