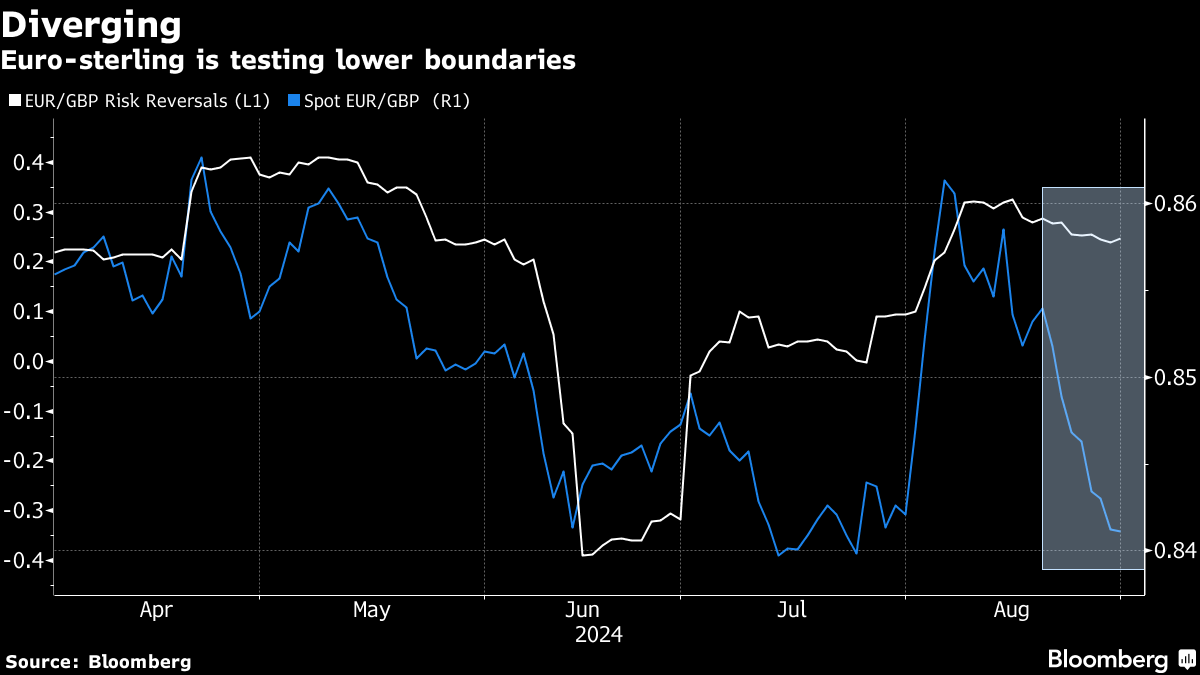

| Euro-Sterling's wild ride this month may be ending with the cross close to the levels where it began. But with trader positioning in the options complex looking for a stronger euro, the currency pair is vulnerable to a selloff as investors lose patience. Indeed, it wouldn't take much to trigger a slide which accelerates as euro-sterling heads toward fresh lows for this year. Part of the explanation for euro bulls holding out is monetary policy risks which lie ahead. Investors are looking into September when the European Central Bank will meet one week before the Bank of England. Traders seem to be hedging for an outcome where the nuances between forward guidance offered by the two rate setters is more favorable for the common currency than the pound. However, as foreign-exchange dealers go into a new profit and loss month next week, some players may be willing to test the downside, hunting for stale positions which are vulnerable to getting flushed out. Indeed, forex traders aren't renowned for their patience, especially with next week's US employment report dropping well ahead of the Federal Reserve's policy meeting. And Germany's month-on-month CPI numbers this week came with a negative inflation print, which may influence the easing cycle in Europe. Moreover, implied volatility has drifted back into a neutral zone after spiking higher earlier in August, which suggests there is room for traders to jump on a downside move should the euro slip next week. Mark Cranfield is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment