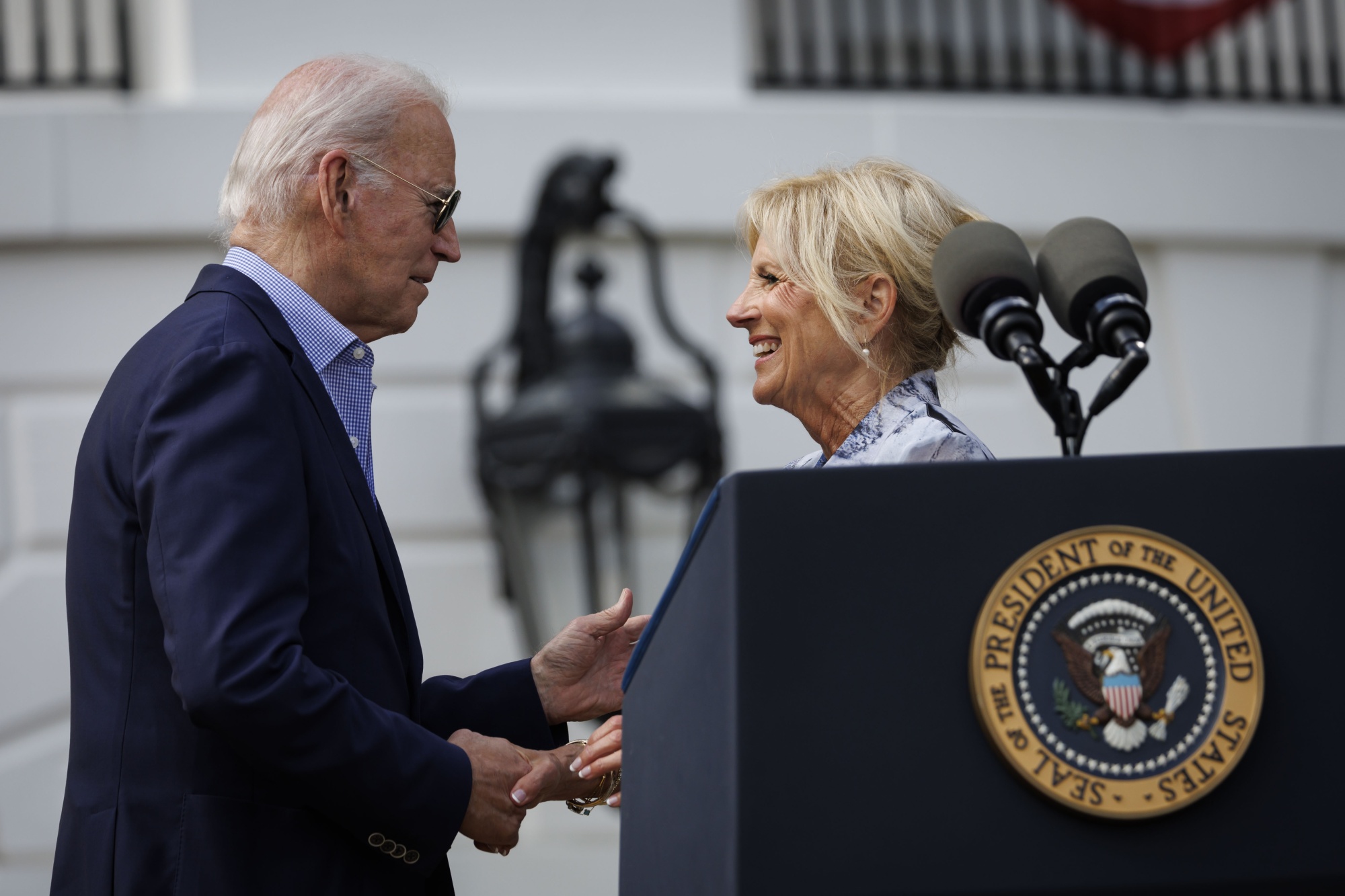

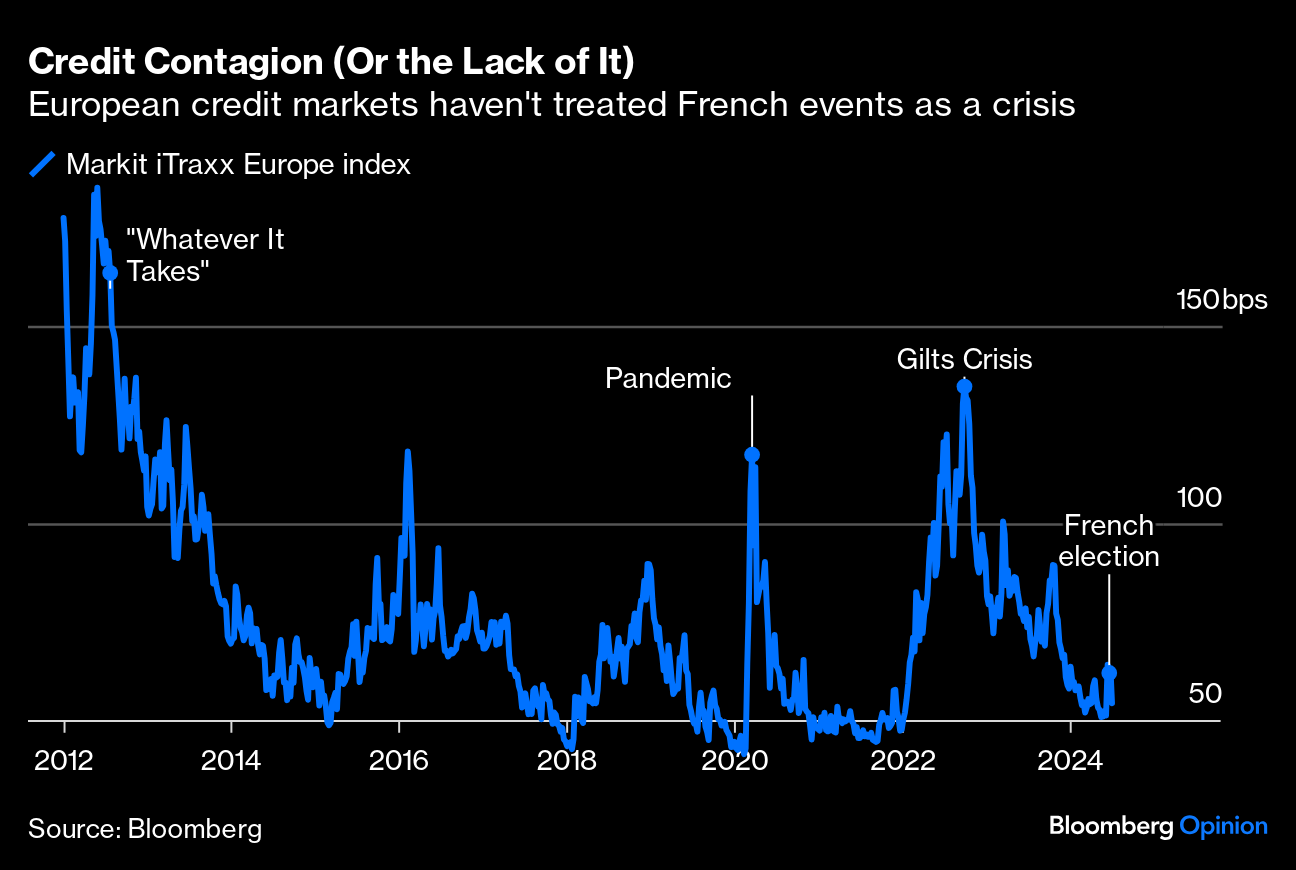

| The crisis over whether President Joe Biden should continue to run for another term appears to be coming to the boil, just in time for Americans to celebrate independence from Britain, and for Britons to elect a new government. It's a ghastly and sad situation, which generates great uncertainty, but has so far had minimal impact on markets. That's mainly because investors think Donald Trump was already likely to win, and that a new Democratic candidate in these circumstances couldn't offer any better opposition. For now, the latest signs from the macroeconomy look more important. Bond yields fell ahead of the holiday as stocks held firm, thanks in large part to data suggesting that layoffs were beginning to tick up, while the services sector was feeling some pressure. That improves the chances of rate cuts from the Federal Reserve later this year, and investors still seem to think this is more important than the chaos in the Democratic Party.  July 4, 2023: A year is a long time in politics. Photographer: Ting Shen/Bloomberg Whatever decision Joe Biden comes to (or is forced into), we know that we'll have greater certainty about the immediate future of France very soon. The second and decisive round of legislative elections will take place Sunday, and the identity of the next prime minister takes shape. Momentum may be slipping that Jordan Bardella of Marine Le Pen's Rassemblement National can attain an outright majority as rival parties, ranging from the extreme left to battered centrists, team up to keep him out of power. Some kind of coalition can't be ruled out. Neither can an ungodly mess. All these outcomes remain possible. But the behavior of the bond market suggests that investors have growing confidence in a result that they can live with. The spread of the yield on 10-year French government bonds, known as OATS, over equivalent German bunds shot up after President Emanuel Macron called the snap election a month ago. Since last Sunday's first round of voting, that spread has come down significantly, implying there is perceived to be less reason to price France as more risky. They are breathing more easily: The spread is still very high given that France and Germany share the same currency and monetary policy, and are both bound by the same fiscal rules under EU treaties. The sense that the situation is dangerous remains. But calm does appear to be breaking out. Other parties have done what looks like a good job of standing down candidates to leave clear opposition to the RN in as many seats as possible. But we still need to see the votes. The RN's share was a third in the first round, and they seem highly likely to emerge with at least a plurality of seats, close enough to an overall majority that they will effectively exercise power.  Marine Le Pen and protégé Jordan Bardella. Photographer: Nathan Laine/Bloomberg If this seems less threatening than it once did, it's in part because the RN no longer talks about a Frexit, or attempting to leave the European Union like the UK. It's asserting that it would continue to send aid to Ukraine, assuaging somewhat the worries over what might happen to EU foreign policy and security given Le Pen's historic soft spot for Vladimir Putin. But another reason government bonds remain calm is that the credit market gives them license to stand easy. Trouble for corporate credit tends to be a necessary condition for any serious financial crisis to break out. If companies' borrowing costs remain under control, the situation is far less dangerous. And looking at the Markit iTraxx Europe index, which shows the market-based default risk on 150 European companies derived from the credit default swap market, shows that the French election only ever elicited a relatively mild reaction that is already dissipating:  Corporate credit very much tends to respond to worries about government debt. This means that the current spread, which is scarcely visible compared to the panicked valuations during the eurozone sovereign debt crisis over a decade ago, can be taken as quite a strong sign that there's no perceived contagion, at least as yet. Since the promise by the European Central Bank then-President Mario Draghi to do "whatever it takes" to save the euro drew a line under that crisis in 2012, the biggest selloff for the iTraxx came during Britain's gilts crisis in October 2022, which briefly threatened an all-out implosion. Rightly or wrongly, credit investors don't perceive the French situation to be anything like as dangerous. That is good news. It also implies that there's room for negative surprises when the market opens on Monday. But while corporate credit seems secure, the judgment seems increasingly to be that whatever happens in France is containable. That's probably right. But the risk of something worse persists, and may not be quelled by French voters. A rally in oil prices has followed a familiar script. Escalating tensions in the Middle East coincided with a shockingly early start to the Atlantic hurricane season. As crude prices surged to a two-month high, however, the question over how long the rally will continue requires going beyond these immediate factors. There's no doubt oil prices got a boost from Hurricane Beryl, which reached Category 5 earlier this week, one of the strongest ever storms at this time of the year. It's already wrought a tragedy for the inhabitants of the island of Carriacou. However, TD Securities' Bart Melek notes that although there's only a 30% to 40% chance that a weakened Beryl will hit the oil-producing parts of the Gulf of Mexico, the market is concerned that such a historically powerful storm could signal an unusually disruptive season ahead. That could interrupt US production and tighten market conditions. If that wasn't enough, tensions in the Middle East, which drove a spike in oil prices last fall, have remained elevated and are rising again. The latest catalyst is a drone attack by Iran-backed Hezbollah that wounded Israeli soldiers. Any escalation to the ongoing conflict in Gaza to include direct confrontation between Israel and Iran would take the potential damage to the oil market to a new scale — although it's notable after the exchange of attacks by the two countries earlier this year that neither seems to have the appetite just yet.  Beryl the peril. Source: CIRA/RAMMB How much have geopolitical risks added to the current prices? Or put differently, are oil investors already projecting the impact that an escalation in hostilities might have? Bloomberg Economics' Ziad Daoud argues that so far, these risks have added $2 to crude prices — which compares to the $15 that he calculates has been contributed by strengthening demand: The oil market is sending a signal about the global economy: The demand-driven rally suggests growth momentum is hitting its stride. But it's also delivering a warning: An escalation of geopolitical risks, especially in the Middle East, could derail this recovery, sending inflation higher — and growth lower.

From the following chart, geopolitical risk's contribution to the price buildup is still far from this year's highs recorded during the Israel-Iran brinkmanship in April: While this so-called geopolitical risk premium has remained primarily muted, it might not should tensions escalate. Regardless, Bloomberg Intelligence's Salih Yilmaz and David Zhong believe that $86 a barrel is fair value even with the prevailing risks. Still, they argue that any ratcheting in the Middle East conflict could nudge prices closer to $100, even though it's done little to dent Iran's output, which picked up last year as US sanctions enforcement loosened. Beyond the war threats, supply has kept up with demand and helped contain prices, with surpluses expected earlier next year, as producers have decided against cutting back, even with prices still lower than they'd like. Melek argues that should be enough to prevent a sustained ongoing rally: We don't see Saudi Arabia increasing supply, given the demand environment and supply growth from non-OPEC+ producers. The Kingdom needs Brent oil prices of $96.17/b to balance its fiscal books. As such, it will not want to increase production, as that would collapse prices and its revenues. Conversely, it may not cut much either, as that would incentivize more non-OPEC+ production and market share loss without any revenue benefit.

As the Middle East tensions ease, Melek forecasts a moderation in West Texas Intermediate prices toward $80 per barrel, with Brent easing to $84: For now, crude is closing in on the $90 mark, but remains at levels that many oil importers would have settled for when Russia invaded Ukraine two years ago. Whether it stays relatively contained depends on the technical and fundamental factors underpinning this rally. Central bankers around the world, with inflation barely coming under control and the prices of essentials continuing to cause much grief, would surely be hoping that the containment continues.

—Richard Abbey The UK goes to the polls today. There's no point speculating about the result at this stage, but it's worth reminding all and sundry that British election nights are top entertainment. The crank candidates, from the Monster Raving Looney Party to Lord Buckethead, help make sure that happens. The sight of Elmo sharing a stage with prime ministers is irresistible.  That's entertainment. Photographer: Jose Sarmento Matos/Bloomberg Key drama from recent years: The "Portillo Moment" from 1997 when Michael Portillo, regarded as a future Conservative prime minister, lost his seat in Tony Blair's New Labour landslide; the Basildon Moment from 1992 when the grin on the face of the late Conservative MP Sir David Amess made clear that Labour were not going to win as expected; and the unbridled joy of the Scottish Nationalist leader Nicola Sturgeon five years ago when her party successfully defeated the Liberal Democrats' leader Jo Swinson. It's exciting, and the British get it all over with so much more quickly than the Americans. Tune in and enjoy. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment