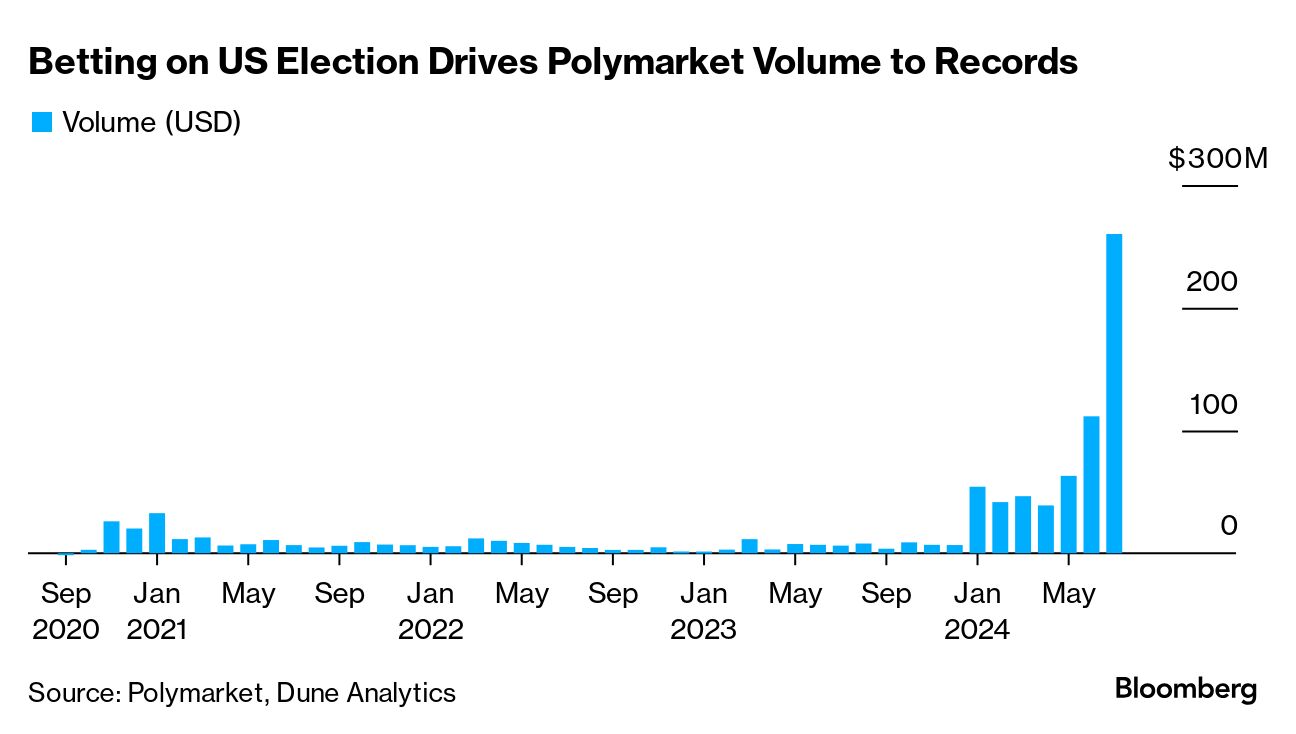

| It's become somewhat trendy for the political chattering class to look beyond polls to betting markets to gauge what the electorate is thinking. There are pitfalls, though, as Emily Nicolle writes today. Plus: Businessweek introduces an amazing tool to determine whether an MBA will pay off for you. It's the Business School ROI Calculator. If this email was forwarded to you, click here to sign up. In 2016, prediction markets put the likelihood of the UK voting for Brexit around 30%. Then, about a month before the US election, bettors gave Donald Trump a 1-in-4 chance of victory. Suffice to say, both those votes defied the odds. To be fair, polls didn't do much better that year. But as we prepare for the 2024 US presidential election, the question remains: Have betting markets improved on their odds of correctly telling us about the future? Betting isn't a science, and crowds don't always have wisdom. One way the accuracy of election betting could improve would be if more people spent money on such wagers. Polymarket, a crypto-based betting platform that covers sports and pop culture events, as well as politics, has seen demand for its services skyrocket since the start of the election year. The heightened liquidity theoretically makes its markets more representative of wider sentiment. More than $600 million has been wagered on Polymarket in 2024 so far. Operating on top of a blockchain network means information about its trading volume is publicly available, which the company says makes it a better source of real-time data about public sentiment than polling or traditional media. Daily betting volumes have repeatedly set records, spurred by quick reactions to key events such as the July 15 selection of JD Vance as Trump's running mate or Trump's July 18 speech at the Republican National Convention. Joe Biden's exit from the race on July 21 holds the daily record on Polymarket, per blockchain data visible on Dune Analytics, charting some $28.3 million in trading volume. "We've really found an insane amount of product-market fit recently, as we're currently in the US going through probably the most unpredictable and volatile election in living memory," David Rosenberg, Polymarket's vice president of strategy, told me in an interview last week. "People, especially since 2016 but perhaps even more so now, are growing more distrustful of polling and the media's use of polling as a predictive source." Prediction markets still have some inherent flaws. The largest one is that they end up reflecting the biases that also exist in investment. Bettors are typically male or, at the very least, are representative of the views of people with money to spend. In crypto, those factors are even more stark: Buyers are often younger, willing to take greater financial risks and are comfortable with engaging in unregulated territory. Polls, on the other hand, make a concerted effort to reach the widest possible variety of demographics before producing a conclusion.  The PredictIt betting market remains available in the US. Photographer: Getty Images It also should be noted that Polymarket isn't open to US residents, thanks to a 2022 settlement with the Commodity Futures Trading Commission. Logic would follow, then, that its markets more accurately reflect the views of those not eligible to vote. (It's possible, of course, that some users dodge the geographical restrictions, as crypto traders' capacity for evading geotargeting is well-documented, but it's impossible to know how prevalent that is. The company didn't respond to a request for comment about how it blocks US access.) Rival platform PredictIt remains available in the US but only because it won a court injunction last year. The debate around prediction markets' usefulness may be short-lived. The CFTC proposed a ban on so-called event contracts in May, arguing the widespread nature of such activity would go far beyond its mandate and turn the regulator into an "election cop." For the moment, insights like Trump's odds of victory increasing by 10% after an assassination attempt could prove a popular investment tool. Related: In the latest Bloomberg News/Morning Consult poll, Kamala Harris wiped out Donald Trump's lead across seven battleground states. |

No comments:

Post a Comment