- After a huge upset, the chances are that France's government will move to the left.

- But, unlike the new Labour government in the UK, it's going to have limited freedom of action.

- Most likely outcome: crisis averted, drift toward serious trouble continues.

- US employment is weakening enough to raise the chance of rate cuts — June CPI is needed for confirmation.

- AND: Try the definitive cover of Poupée de Cire, Poupée de Son.

Last week, Britain held a totally predictable election, ditching a tired and undisciplined Conservative Party from power after 14 years, and in lukewarm fashion letting the Labour Party have a try for the next five years. With a massive overall majority, the checks and balances on Labour will be minimal. On Sunday, across the English Channel, the French pulled quite a stunner. After weeks of fretting over whether Marine Le Pen's far-right National Rally (RN) could win an overall majority, the people have instead — according to exit polls — given the biggest delegation in the National Assembly to the far-left New Popular Front. Desperate attempts by the centrist President Emmanuel Macron and his supporters to stop Le Pen's party appear to have succeeded all too well. (Bloomberg's superb graphical updates on the complicated picture can be found here). No one got an outright majority, and Macron's centrists slipped to second, with Le Pen and her allies trailing third.

Jean-Luc Mélenchon, the firebrand who dominates the Popular Front (a coming together of his hard-left France Unbowed, Socialists, Greens and Communists), has in the past inveighed against "parasitic capitalism" that "inevitably leads to disaster." He was on the left wing of the Socialist Party before breaking away in 2008. After Sunday's first exit polls showed the Popular Front with the biggest share, he stated his intention to form a government that would enact its agenda. That appears little more than a negotiating position, as the group doesn't seem to have the seats to govern alone — but still, it's not at all clear that international capital markets should be any happier with this than the outcome they'd braced for with Le Pen. However, the early reaction in currency markets has been relatively muted, as shown in this chart of the euro exchange rate with the dollar since Macron stunned the world by calling the election after a weak result in voting for the European Parliament. That date is circled, along with the moments when results of the first and second rounds were released:  David Roche of Independent Strategy suggests that in terms of fiscal policy, the Popular Front might be even "more extreme than an RN government." Their platform includes rolling back Macron reforms in areas such as pensions and refusing to comply with the European Union's excessive deficit procedure. If they actually managed to put this agenda into practice, it would be deeply market-unfriendly — which, to be fair, would not be regarded as a serious drawback by politicians opposed to the market.

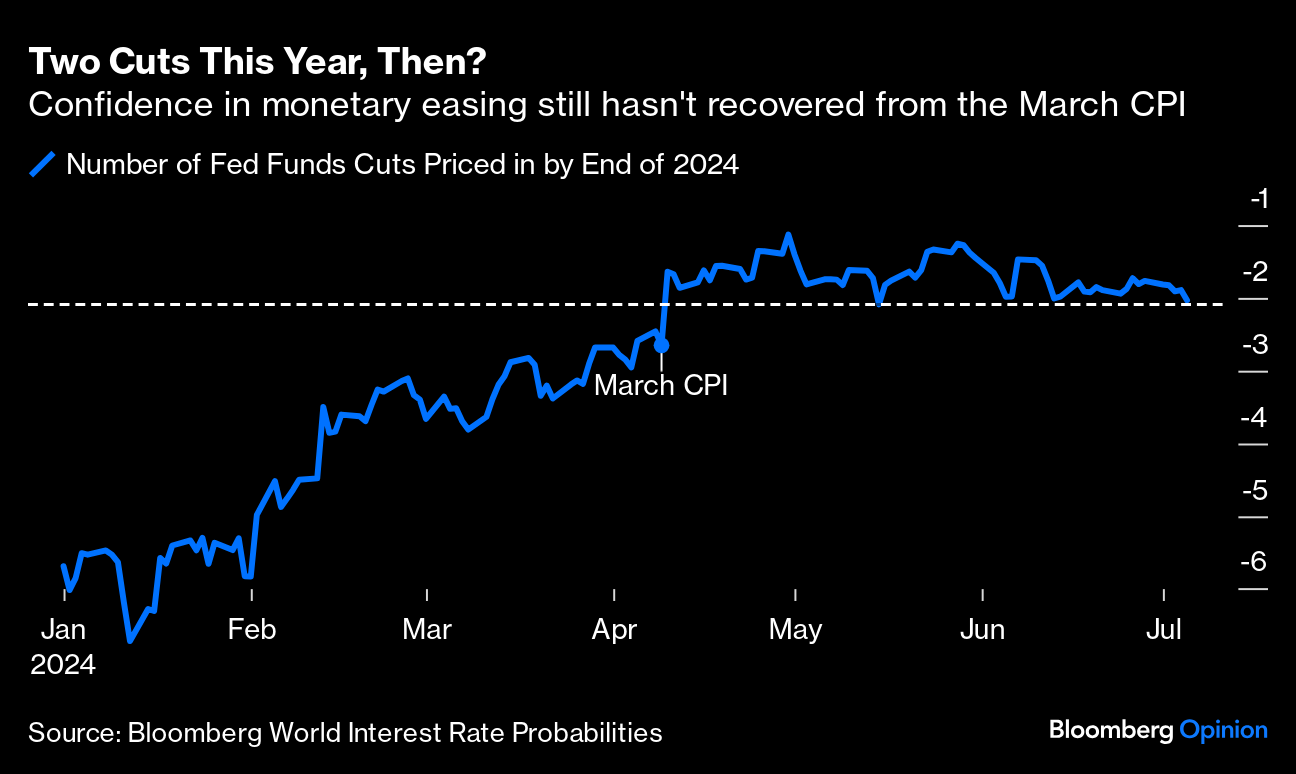

"Any relief at avoiding an RN outright victory will be short lived," predicted Roche. He suggested it was still a good idea to short French OATS government bonds relative to German bunds. The spread between them is only 70 basis points after investors reassured themselves last week that there would not be an RN government — that now looks vulnerable to widen. What might be the most market-friendly outcome would come from a coalition of Macron's party with groups from the Popular Front, but excluding Mélenchon's hardliners from France Unbowed. However, it's not clear that such a coalition will have enough seats for a majority, and it would have to be significantly to the left of the outgoing government. Nico FitzRoy of Signum Global Advisors suggested that an attempt at a left-wing government led by a more moderate Socialist was the most likely outcome, as anything else would require members of the Popular Front, fresh from a victory, to accept the status of junior partners. "I don't think this government would last long," FitzRoy added. "And, probably to the relief of markets, I don't think it would be able enact much radical fiscal policy."  Macron clarifies nothing. Photographer: Ludovic Marin/AFP Tina Fordham of Fordham Global Foresight suggested that the best case for markets might be a technocratic government, followed swiftly by new elections — although Macron cannot call one until next year. There's also the possibility that he loses patience and resigns the presidency, which would scramble the possibilities even more. What happens next? Macron has to appoint a prime minister. (Which, Lionel Laurent points out, gives him a chance to play kingmaker.) If legislators thrash out a viable coalition, the premier will come from that group. If the situation is messier, it's just possible that Macron will choose a technocrat, much as Italy resorted to calling in Mario Monti and Mario Draghi when coalitions collapsed. That would be very unusual in France. "Macron's gamble hasn't clarified anything, it has complicated matters," Fordham said. "He now has to negotiate with a bunch of disparate left-wingers who will want to roll back his reforms, and they will still try to clip his wings on foreign and security policy too, which will irritate him and undermine France abroad." This doesn't augur well for a period of great French governance. It does, however, suggest that the worst can be averted and a serious financial crisis avoided. Nagging underperformance and drift seem much more likely. As we learned during the eurozone's sovereign debt crisis, European politicians are able to kick the can down the road, but making decisive improvements is another matter altogether. Economists and financiers tend to look down their noses at political science. It lacks the rigor and precision of economics, and produces a lot of hot air. The dramatically contrasting outcomes in the UK and France of the last few days argue that political institutions really do matter, even for people trading in markets. The bare facts are that Labour won 33.7% of the vote in the UK and has a crushing mandate. Le Pen's National Rally received 33.2% in the first round and continues to be frozen out of power completely. Neither seems democratic. In Britain, the result was a quirk of one-round elections, with many parties running and the largest party getting a disproportionate share of seats. In France, the result is a quirk of the two-round system, with other parties having the opportunity to organize to stop the RN. Both elections were decided by people voting against something, rather than making an affirmation. That shows up in the turnout. In the UK, the mood to get rid of the Conservatives was overwhelming; nobody was too fussed at the prospect of Labour winning. Thus there were historically strong performances for the Greens, for the anti-immigration Reform UK party, and for a group of independents who ousted Labour MPs over the party's policy on Gaza — but all in the context of an assured Labour victory. Turnout was low. In France, the legacy of the Second World War's Vichy government still makes the far right unconscionable to many. Faced with the real threat that it would form a government, opponents came out in force, often voting for candidates they didn't like. Shifting turnout in the two countries since 1958 is remarkable. Both have seen steady decline. But the French seemed even more disillusioned than the British — until now: RN supporters are calling foul, saying that rival politicians stitched up the second round to exclude their party. But the important point is that a majority of voters went along with it. They didn't want the RN, either. The "Anyone But Le Pen" vote is still insurmountable (for which some of us might be grateful). For the future, the point is that political structures matter. The populaces of Britain and France are in similar places, but their governments at this point look very different. France's Fifth Republic was founded by Charles de Gaulle on the notion that it would provide a strong president governing with the aid of stable coalitions in parliament. Ironically, the rise of the far right has left France in exactly the kind of Fourth Republic mess that de Gaulle wanted to avoid. He had many problems with the British, but it's likely that he would have far preferred the way things are working out in the UK. Investors might well feel the same way. There are four months to go until American voters have their say in the presidential election. So far, the rampant uncertainty around whether President Joe Biden will stay in the race is having little impact on markets. However, macroeconomic data still has an effect, and it's showing signs of a consistent narrative. Last week's non-farm payroll data confirmed an emerging picture of an employment market that isn't in severe trouble, yet not as strong as a few months ago. The unemployment rate is low by historical standards, but ticked up again; the addition to non-farm payrolls was healthy, but lower than recently. The hit administered by the pandemic in 2020 is excluded from these charts for legibility: That doesn't look too terrifying. However, when unemployment rises, it tends to be little by little until reaching a tipping point, then shoots up and causes a recession. The Sahm Indicator, named for Bloomberg Opinion colleague Claudia Sahm, holds that when the three-month moving average of the unemployment rate is 0.5 percentage points or more above its lowest level for the preceding 12 months, a recession has started, even if it's not yet apparent. Back-testing the indicator shows that it's very powerful. The good news is that the Sahm Indicator doesn't say that the US economy is lapsing into a recession. The bad news is that it does show the economy closer to the recessionary tipping point than ever before during this cycle: This is a sign that the Fed's tighter money is beginning to work in slowing the labor market, but also a growing danger that money will prove to have been too tight for too long. The Fed has a dual mandate and is expected to aim for full employment as well as low inflation. Even a relatively gentle rise in the unemployment rate gives a strong reason to cut rates. And indeed, fed funds futures moved Friday to price in two full cuts of 25 basis points by year-end. Traders are as confident of such an outcome as they have been at any time in the last three months:  Why hasn't the market moved more aggressively? There's congressional testimony to come from Fed Chair Jerome Powell this week, followed Thursday by inflation numbers for June. It was the March CPI data that convinced traders that two cuts were the absolute maximum they could hope for this year. At that point, disinflation appeared to have ground to a halt. Subsequent data have showed it's continuing, but painfully slowly. Traders are reluctant to bet more confidently on three or more rate cuts. Some moderate, caveated words from Powell, and a further reduction in inflation, could change that. If so, it will more than counteract the scary revolutionary vibes coming out of France. Continuing the French theme, this might be a good time to return to Les Misérables. But I'd also like to suggest watching this definitive cover version of France Gall's Eurovision winner, Poupée de Cire, Poupée de Son. Regular readers will note that I've linked to this often. That's because it invariably cheers me up. It was recorded in Paris 17 years ago by my favorite band, the Canadian outfit Arcade Fire. On the day after the British election, I was lucky enough to see them perform at the Brixton Academy. Yes, you can tell they're getting older, and they've had their troubles, but they have a musicianship and a zest hat never fails to inspire. Catch them if you can. Points of Return may need to be a little irregular this week, as I'm still on my travels. Have a great week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Adrian Wooldridge: Tories Pay the Price for the Harms of Brexit

- Robert Burgess: The US Economic Slowdown Is Looking More Threatening

- Adam Minter: Only Locals Should Be Allowed to Attend the Olympics

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment