| More Articles | Free Reports | Premium Services Hello, Fellow Navigator. The news cycle is always noisy, but this year it’s been deafening. And with the presidential election still ahead, the noise is just getting started. So let’s take a minute to unpack this chaotic whirlwind of a year-to-date and separate the durable trends that actually matter from the barrage of distracting noise. We’ll start with the stock market… As I write this, the S&P 500 is up about 15% for the year. Of course, the stock market is a market of stocks… and the particular basket of stocks driving this surge is the so-called Magnificent Seven of Microsoft (MSFT), Apple (APPL), Nvidia (NVDA), Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META), and Tesla (TSLA), which together make up close to a third of the S&P 500’s market cap… and over 60% of its returns in the first half of this year. The average stock was up only about 4%. That’s a narrow market by any definition, but it gets even more extreme than that. As our Freeport Society friend Jeff Remsberg points out in his InvestorPlace Digest, Nvidia alone accounted for about 30% of the S&P 500’s return in the first half of the year on its way to its $3 trillion market cap. At its high point, the company had more than tripled in value.  Why did Nvidia explode higher? Two words… | SPONSORED  The Wall Street icon who forecasted Black Monday and the dot-com crash says a new economic event will hit the American economy like a tsunami. It doesn’t matter if you’re blue collar, white collar, working, or retired. He says, “I am literally afraid for my family’s future. I’m taking drastic steps to prepare for what I know will inevitably happen next.”

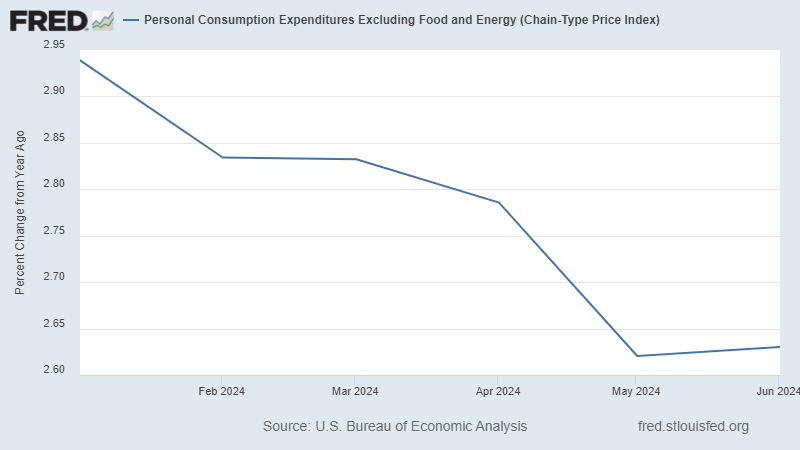

Click here to see his new prediction. | Artificial Intelligence Nvidia’s chips are critical hardware for the computers running artificial intelligence applications. AI is not only the biggest investment theme of 2024, but also easily the biggest investment theme of this decade… and will almost certainly be the biggest theme well beyond that. This ties back to several of the investment themes we cover in The Freeport Society. The marriage of free-market capitalism and technology creates the conditions for exponential progress. This has been the case since the dawn of the Industrial Revolution, and it’s only accelerated in the computer age, the internet age, and now the AI age. Before the Industrial Revolution, the philosopher Thomas Hobbes described life for the ordinary man as “nasty, brutish, and short.” But thanks to the exponential progress of industrialization, we now live in a world of almost absurd abundance in which even minimum-wage workers carry “supercomputer” smartphones that would have been the stuff of Star Trek not long ago and have access to creature comforts that not even royalty could have dreamed of a century ago. AI – along with robotics and automation – reduces the need for human labor, which matters because it ties back to two other major themes we cover in The Freeport Society: The collapse of globalization and the continued erosion of the dollar’s value due to inflation. I’ll have more to say about the collapse of globalization in my look forward, which I’ll send to you later this week. For now, let’s talk about inflation. Inflation Trended Lower in 2024… Sort of “Core” PCE inflation, the Federal Reserve’s preferred metric, has dropped from about 3% at the beginning of the year to about 2.6% as of June.  That’s an improvement… and we’ll take it. But it’s still fully 30% higher than the Fed’s target of 2%. Of course, it’s hard to materially lower inflation when Congress is running budget deficits of over 6% of GDP – figures you might normally see when the government is proactively trying to boost spending and raise inflation. I’ll have more to say on this subject later this week, but suffice it to say that the first half of 2024 was defined by grinding… if somewhat slowing… inflation. The inflation debate has been tied to another of 2024’s trends… the endless debate over if and when the Fed will start cutting rates. At the beginning of this year, the futures markets were pricing in a 100% chance that the Fed would lower rates by their July meeting… and a 66% chance that rates would be a full 1% lower than current levels, at 4.25% or lower. That’s clearly not happening. The same futures markets are now predicting that the Fed funds rate stands pat at the current 5.25% to 5.5% range through the July meeting this Wednesday. So, where do rates go from here? Tune in later this week for the answer. Of course, no discussion of the first half of 2024 would be complete without mentioning the twists and turns of the election… |

No comments:

Post a Comment