| Welcome to the inaugural edition of the Mideast Money newsletter, I'm Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that's become one of the most influential in global finance. You can sign up here.

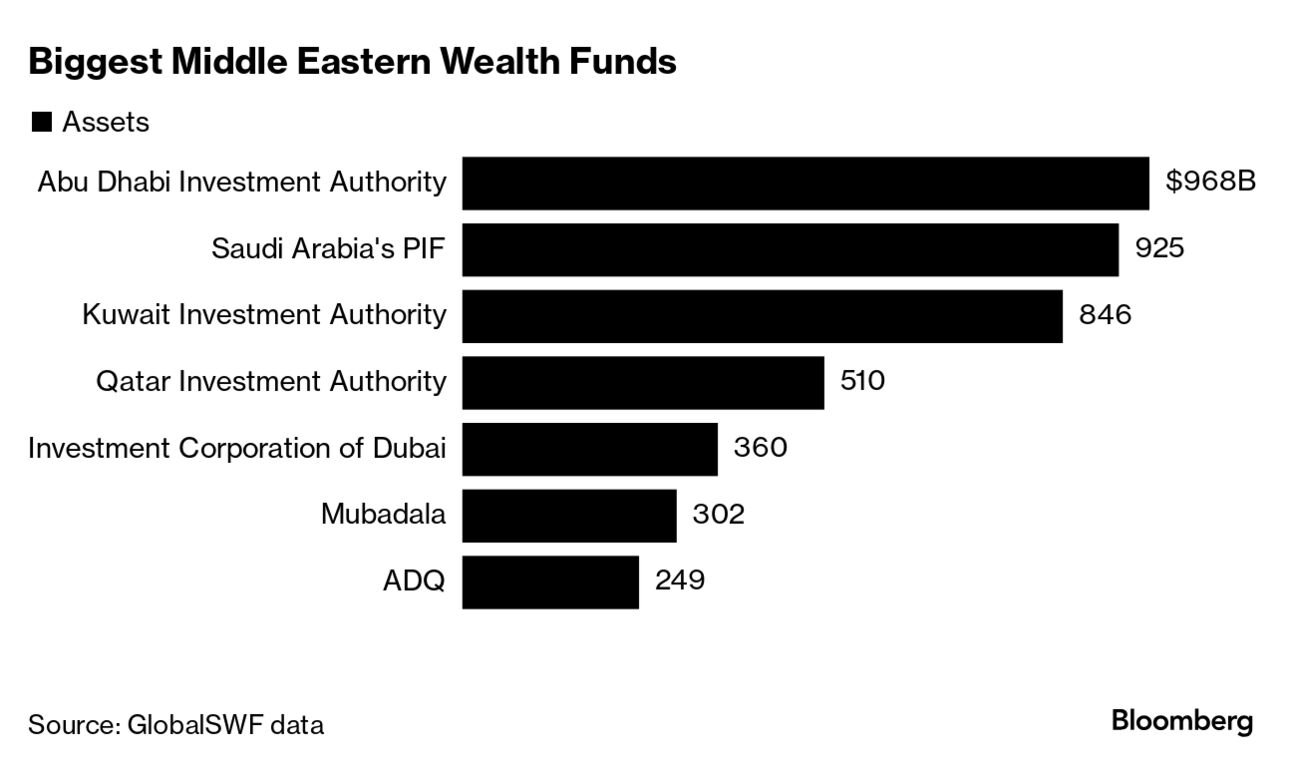

Middle Eastern wealth funds, which together control over $4 trillion in assets, have emerged as bankers to the world. The latest example as Bloomberg News reported last week was Bobby Jain's new multistrategy hedge fund, which has secured backing from Abu Dhabi's ADIA, marking the biggest fundraising haul since ExodusPoint's record debut. Gulf funds have deployed money around the world to diversify away from oil and in the process, upended the world of business, finance and even sport. Bets on the technology sector have also been a key part of this push, with both the United Arab Emirates and Saudi Arabia joining the fray.  Riyadh, for its part, recently launched the National Semiconductor Hub to develop so-called fabless chip companies that design new semiconductors. Its head, Naveed Sherwani, joined my colleague Joumanna Bercetche on Bloomberg TV earlier today to lay out the organization's goals.

"Over the next five to six years, we'd like to have about 50 fabless chip design companies to be relocated or started here — the whole point is that we would like to see design activity take off in the region," he said. "The purpose of the hub is to put together a package of incentives, training programs and financing so that we can welcome companies from all over the world."

He made clear that Saudi Arabia's goals at this point are to focus on chips for everyday use, in everything from microwaves to cars, ensure they're available at a reasonable cost and sidestep any supply-chain constraints that have hamstrung the industry in the past. "We want to build that human resource and the ecosystem to work on the kind of chips that we can over the next five to seven years," Sherwani said. "Once we have that capability, we can start doing a little bit more complicated chips."

Read More: Saudis' Lenovo Deal Shows How Kingdom Uses Cash to Lure Tech It's a tad different over in the UAE, where authorities have put artificial intelligence at the center of its economic future. The country is seeking to become a producer of advanced semiconductors — a crucial component of the supply chain for the technology. It recently set up a new technology investment fund that could surpass $100 billion in assets. Those plans come against the backdrop of the US limiting chip exports to the Middle East. Part of the concern is that cutting-edge American technology could be diverted to China, where companies are largely cut off from it. In an interview with Bloomberg News, the Gulf nation's minister for artificial intelligence and digital economy acknowledged those concerns are valid. "Any country that has adversaries would think that way," Omar Al Olama said. He added, though, that the UAE has "proven to be a strategic partner with the US." Those comments came after the country's main AI firm, G42, drew a $1.5 billion investment from Microsoft. That followed behind-the-scenes negotiations between the US and the Abu Dhabi-based company in which G42 agreed to divest from China and pivot to American technology. To aid their efforts to build AI capabilities — and as they vie to become the regional tech superpower — both countries are also rushing to build data centers to support the technology. Read More: UAE Backs Sam Altman Idea to Turn Itself into AI Testing Ground The stakes are high. In a recent report, PriceWaterhouseCoopers estimates that the Middle East is expected to accrue 2% of the total global benefits of AI in 2030 — equivalent to $320 billion. In absolute terms, Saudi Arabia is set to be the biggest beneficiary with AI expected to contribute over $135 billion in 2030 to the economy, equivalent to 12.4% of GDP. In relative terms, the UAE will see the largest impact, about 14% of 2030 GDP or about $96 billion, PwC said. Regional governments are faced with a choice between being a part of the technological disruption or being left behind, PwC said in the report. "When we look at the economic impact for the region, being left behind is not an option." Middle Eastern sovereign wealth funds backed deals worth around $52 billion in the first half of 2024, according to data from consultancy GlobalSWF. That's 54% of the total $96 billion deployed by state-controlled funds globally — the highest proportion since 2009. Mizuho Financial Group received a license from Saudi Arabia to set up its regional headquarters in Riyadh, becoming the latest Wall Street firm to comply with the kingdom's diktat to foreign companies to set up their Middle Eastern base there.

Saudi Arabia is set to become the world's largest construction market as the kingdom pours vast amounts of money into projects aimed at diversifying the economy, according to Knight Frank.  Qiddiya performing arts center project announced on June 24 Bloomberg Turkish equities fell sharply after Treasury and Finance Minister Mehmet Simsek said he's studying a possible tax on investors' profits from stock market trades. Turkey has been removed from anti-money laundering watchdog Financial Action Task Force's so-called gray list, a move likely to boost the nation's efforts to attract foreign capital. Abu Dhabi's Mubadala is set to take a controlling stake in Getir after leading a $250 million capital injection into the Turkish food delivery startup. Qatar is starting work on a new $5.5 billion tourism development centered around a large amusement park, which is poised to be bigger than Walt Disney's iconic Magic Kingdom.  A digital rendering of the Simaisma Project. Photographer: A digital rendering of the Smaisma Project . Qatar Airways is in talks to acquire about 20% of Virgin Australia Airlines, a deal that would grant the Gulf carrier access to a market where its expansion plans were scuppered by the government last year. Bernard Arnault's LVMH bought up many of the world's major luxury brands. And he's not finished shopping. UBS is growing its wealth management team in the Middle East with senior hires from Deutsche Bank and HSBC. Abu Dhabi's Adnoc is using its $150 billion budget to transform itself into one of the world's most active energy dealmakers. The world's best private equity returns are luring giants like Blackstone and KKR to India as China's outlook sours.

India has won the T-20 Cricket World Cup after 17 years. That's likely to further boost revenue for the sport that already attracts millions of dollars in advertising. Saudi oil giant Aramco was among the events' sponsors. Saudi Arabia's foreign reserves rose to $445 billion at the end of May — the highest in 18 months — after state-controlled oil producer Aramco boosted dividend payments. The country has shifted its investment strategy over the past few years, seeking bigger returns and taking on more risk both internationally and domestically. When one of the largest private school operators on the planet was looking to pull off a deal involving buyout titans Brookfield Asset Management Ltd. and CVC Capital Partners, it wasn't the usual coterie of Wall Street banks that stepped in to help. Instead, it was four Emirati banks that financed a 10-year $3.25 billion loan to GEMS Education. The loan was part of a roughly $5.2 billion deal that involved a Brookfield-led consortium injecting almost $2 billion of equity to acquire a stake in the education giant, and allowed CVC to largely exit the company. Also Read: Kuwait Finance House Explores Bid for Stake in Saudi Investment Bank The lenders — flush with deposits as oil revenue buoys the region — are chasing ever-bigger deals, often offering terms that the likes of Citigroup Inc. and JPMorgan Chase & Co. can't compete with. "Local companies will mainly work with local banks because they know each other — it's easier for banks to oversee them and to underwrite risks" said Anton Lopatin, a senior director at Fitch Ratings in Dubai, adding that "they can usually provide better pricing."

As well as using the four Emirati banks, GEMS also looked locally for advisers. It leaned on deNovo Partners — a Dubai-based boutique founded by former Morgan Stanley banker May Nasrallah — along with Goldman Sachs. If you'd like to get the Mideast Money newsletter in your email inbox every Monday, please subscribe using this link. Thanks! |

No comments:

Post a Comment