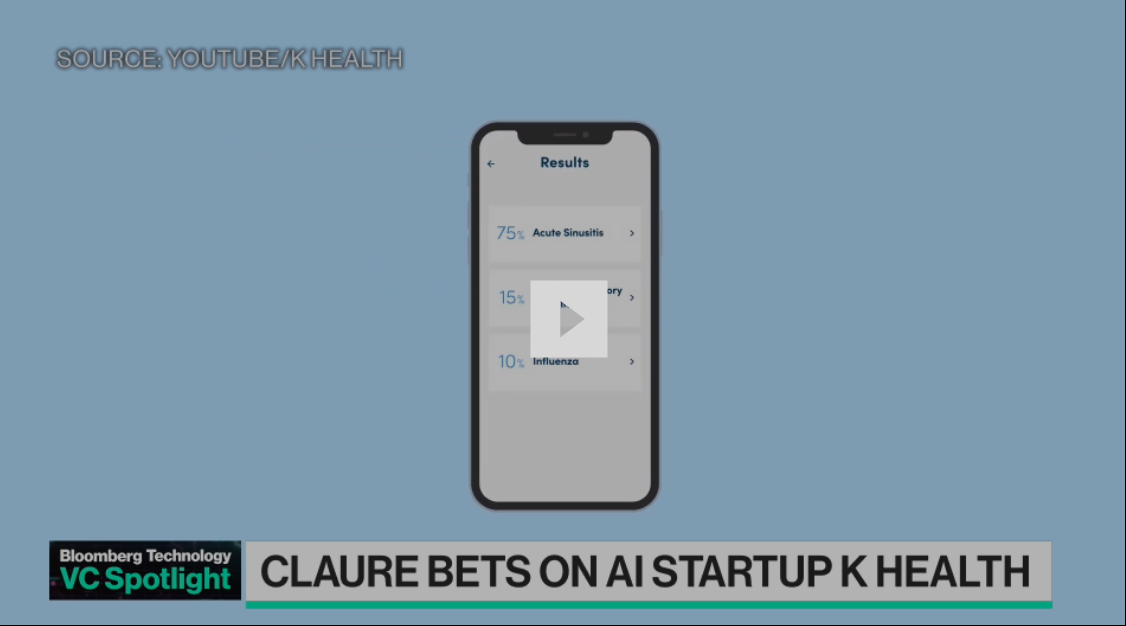

| Hi, this is Takashi in Tokyo. A wave of consolidation is washing across Japan's games industry, as new competition and old problems demand a rethink. But first... Three things you need to know today: The 70-member studio behind mobile hit Touken Ranbu, Nitroplus Co., seemed to be doing just fine until last week when it sold a 72.5% stake to multimedia group CyberAgent Inc. for ¥16.7 billion ($104 million). It was the latest in an accelerating series of moves among smaller players to fortify their finances by partnering with larger entities. While the global video games market keeps expanding, Japan's has stagnated, especially in the mobile arena. An industry reliant on churning out new content has been stifled by soaring production costs and an explosion of alternative entertainment options. With a shrinking user base and more fragmented attention, studios are feeling the pressure. Call it the TikTok effect. Streaming services can offer endless torrents of amusing, interesting or surprising videos produced by their millions of eager users. Game creators don't have the same luxury of self-generating content, and to stand out, they're finding they need the backing of a well-resourced partner. Sony Group Corp. and Koei Tecmo Holdings Co. got into a ¥5.3 billion capital alliance with Akatsuki Inc. at the tail end of last year, which grants the two bigger firms significant chunks of the Tokyo-traded games studio in exchange for their support in development and promotion. Super State Holdings KK and Gumi Co. — which works on adapting popular Japanese titles to overseas markets — announced a similar arrangement last week. Octopath Traveler developer Acquire was, um, bought by Kadokawa Corp., which already has Elden Ring creator FromSoftware in its portfolio. This is all in recognition of an impending moment of reckoning for one of Japan's signature industries. Downloads of smartphone games in the country were down to 468 million last year, 25% off their 2020 peak, according to market intelligence firm Sensor Tower. Revenue is also falling. The trend suggests Japanese creators may need to welcome new owners for better or worse. Yuta Maeda, a senior vice president at major mobile game maker Gree Inc., said in a recent earnings call that the market has saturated and only a few big players would be allowed to survive. Big foreign publishers like China's Mihoyo Co. joining the fray and adding competitive pressure is making the situation worse for the locals. Major domestic publishers are narrowing their focus to sustaining the profitability of their biggest existing titles, at the cost of new projects and contract work for smaller firms. Square Enix Holdings Co., one of the highest-profile firms in Japan that outsources many projects, said that it will make fewer games going forward. "Because a lot of titles in development are getting canceled recently and competition keeps getting harder, there's not much that small studios can do to survive without financial ties with bigger ones," said Naoko Kino, who runs consultancy firm Kyos Co. in Tokyo. The consolidation push runs the risk of what we've seen happen at Embracer Group — which went on a big acquisition spree before having to cancel many projects and lay off thousands — but Japanese firms have few alternatives. Macquarie Capital Senior Japanese Equity Analyst Hiroshi Yamashina said creative studios must expand their offering beyond games — to genres such as anime, theater productions and merchandise — to sustain growth and improve returns. Increasing touch points with consumers is the key for success, he said, and that's exactly what Nintendo Co. is doing with movies, theme parks and a history museum. But such ambitious multiplatform strategies require serious financial muscle and expertise, which are difficult for small companies to acquire. That's why a marriage like the one between well-resourced CyberAgent and the more modest Nitroplus is seen as ideal. It raises the ceiling on what the smaller company can achieve, and it nets scarce creative talent and a moneymaking franchise for the bigger business. The Japanese games industry went through a big consolidation phase in the early 2000s, which created firms such as Square Enix, Sega Sammy Holdings Co., Koei Tecmo and Bandai Namco Holdings Inc. as the console market matured. What I see today is another such wave, this time triggered by the saturation of the smartphone market for attention.—Takashi Mochizuki Qualcomm has become the new front-shirt sponsor of Manchester United. The deal is part of the chipmaker's effort to spotlight its Snapdragon brand amid a broader PC push.  K Health, an AI company that provides a chatbot to patients before they speak with primary care physicians, raised $50 million in an equity round led by Marcelo Claure's Claure Group. K Health CEO Allon Bloch joins Ed Ludlow and Caroline Hyde to discuss. Samsung union plans three-day walkout in push for higher pay. Turkey is using AI to clamp down on runaway tax evasion. Robinhood is buying AI investment advice platform Pluto. |

No comments:

Post a Comment