- The Magnificent Seven endure a 10% correction.

- The yield curve is closest to disinverting in two years.

- Both have something to do with Donald Trump, but there's more to it than politics.

- The much-touted strength of the US consumer is showing signs of deterioration.

- That adds to the pressure to cut rates.

- AND a guide to Kamala Harris memes for those afraid to ask…

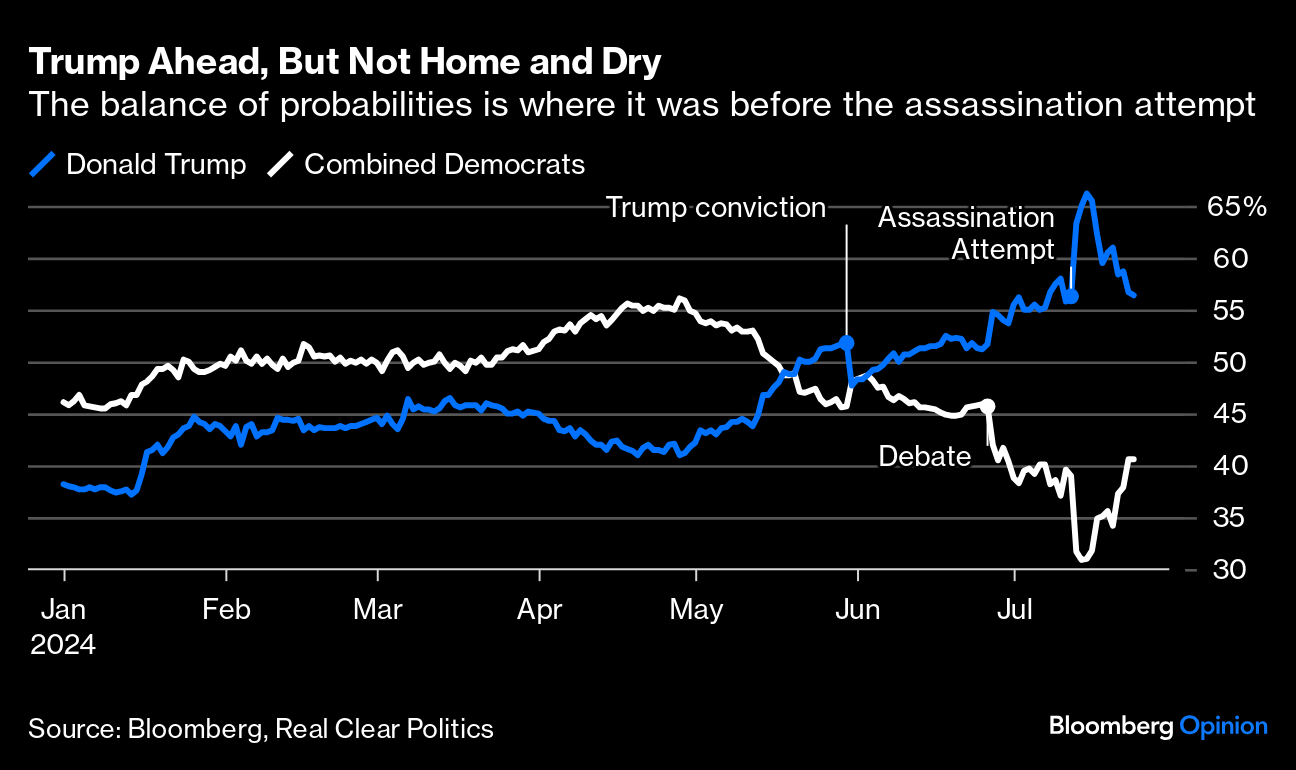

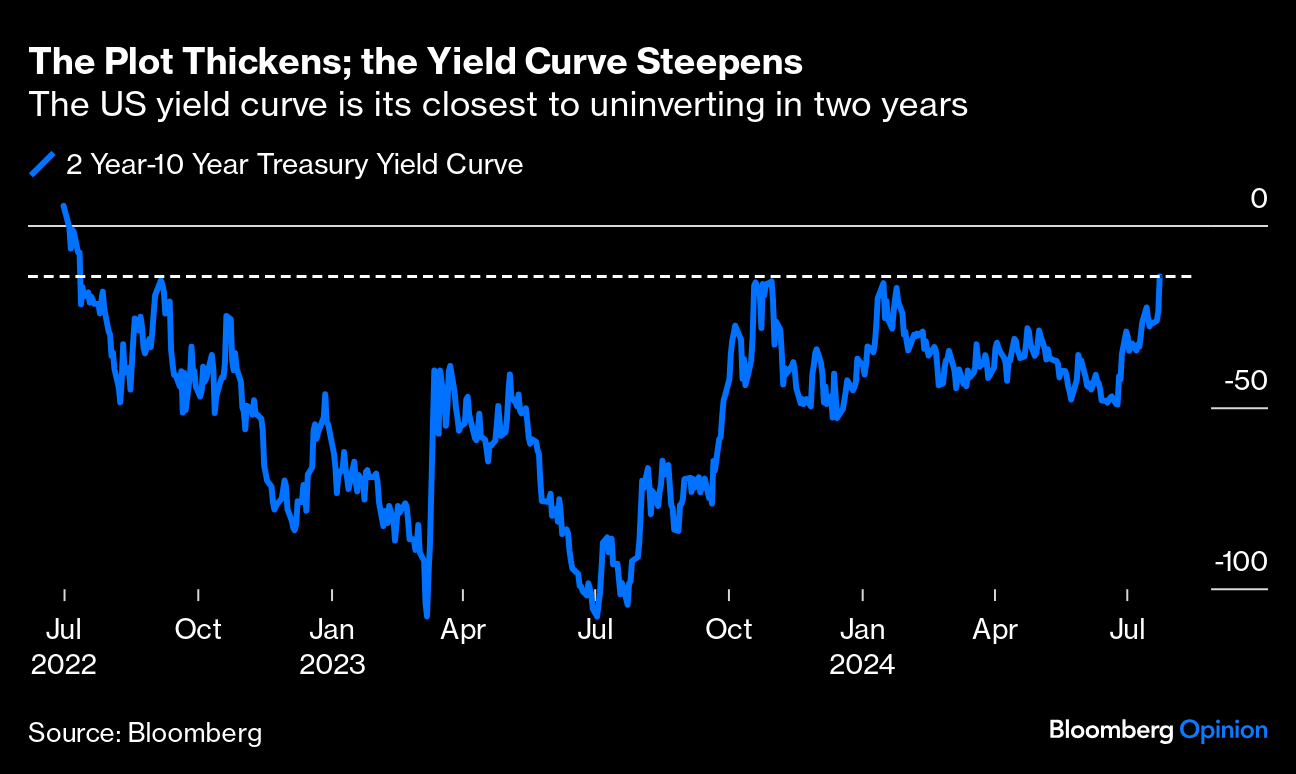

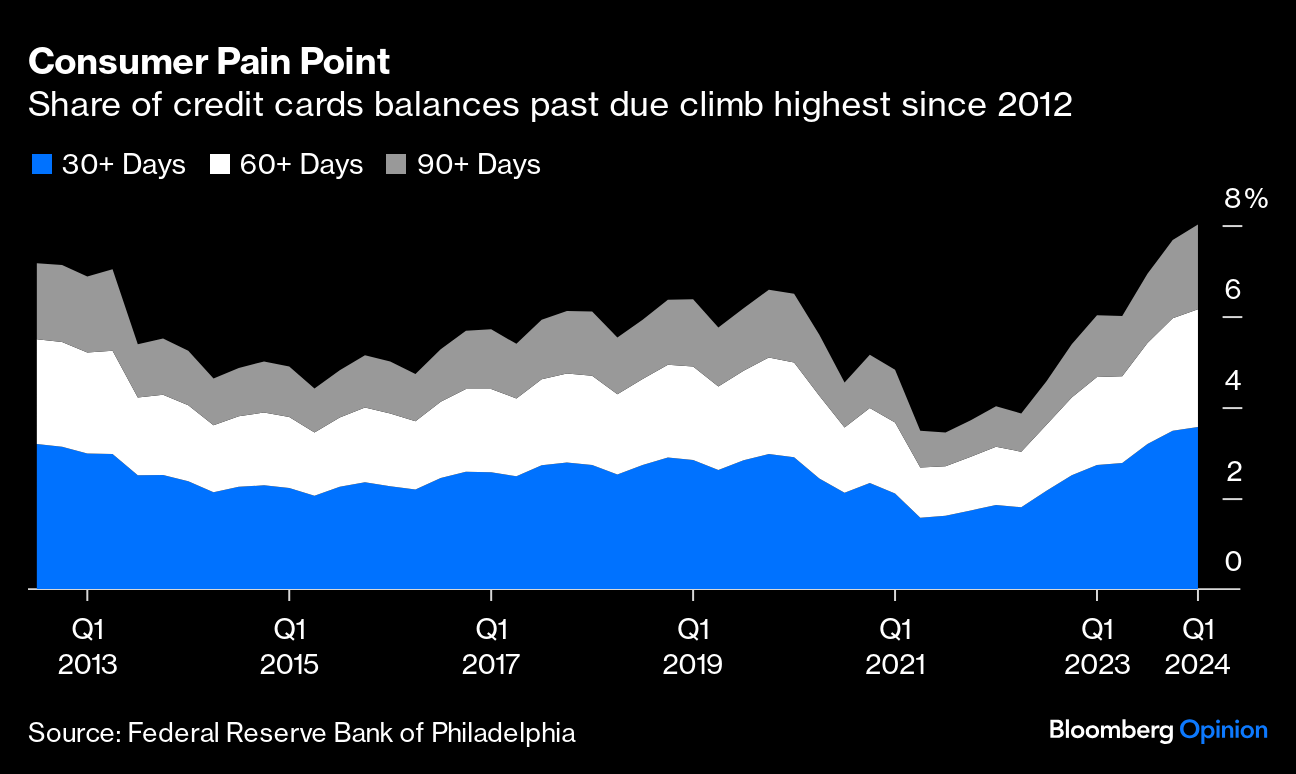

Something is stirring. It's still too soon to say that the strongest trends of the last year have reversed, but a number are certainly being yanked back, having gone too far. There's a natural impression that the extraordinary developments of the last few weeks in US politics have something to do with this. That's only partially true. Here is an attempt at a summary: It appears that Vice President Kamala Harris will replace President Joe Biden as the Democratic nominee relatively smoothly, and she is enjoying a bump of publicity. Her ascendancy follows Biden's decision to stand down, the attempted assassination of Donald Trump, and the selection of Senator JD Vance as the Republican vice-presidential nominee. As far as markets are concerned, these shocking developments have canceled each other out. The Real Clear Politics average of the odds on offer in betting markets suggests that Trump's chances are right back where they were before the attempt on his life. However, he has retained the gains he made after Biden's awful debate performance a month ago. Biden's decision to leave the race hasn't affected that:  Trump 2.0 looks likely but far from certain, and no more than it did at the beginning of the month. It's hard, therefore, to attribute everything that's happening in financial markets to Trump. It's clear, however, that his policy agenda is beginning to have an effect. It's not the most exciting subject for most humans, but the US yield curve is its least inverted in two years. That is a bigger deal than it sounds. The yield curve is the standard shorthand for the spread between two-year and 10-year Treasury yields. Usually longer-term yields are higher because there is greater risk attached to the long term. When the curve inverts, with two-year yields higher, it's historically been a great recession indicator. Somehow, the curve has been inverted for more than two years. Now, it is its closest to disinverting since July 2022. That generally happens on the eve of a recession:  What's moving this? The growing likelihood of cuts by the Federal Reserve can be expected directly to bring down two-year yields. With former New York Fed president Bill Dudley arguing in Bloomberg Opinion that the first cut should come at next week's Federal Open Market Committee meetings, an option that many had dismissed, sentiment is fast turning back toward rate cuts. Meanwhile, Trump 2.0 would likely mean fiscal spending and tariffs, which all else equal would mean higher long-term yields. Thus a "curve steepener" (betting on the 10-year yield to move upward faster than the two-year) has been a popular way to make a "Trump trade." The brief but brutal regional banking crisis in the spring of 2023, which saw the collapse of Silicon Valley Bank and others, has been followed by protracted underperformance for the banking sector. That now appears over. The KBW banks index is its strongest relative to the S&P 500 since March 2023: A steeper yield curve traditionally helps banks, who make their profits from the gap between long and short interest rates. There's also a Trumpy element as likely deregulation would probably help bank shares. As banks have barely started to make up the ground lost over the last 15 months, there is very much further for this trade to run. As covered by Points of Return yesterday, the Magnificent Seven big tech platforms have already seen quite a change in direction. Wednesday's trading, in the wake of results from Tesla Inc. and Alphabet Inc., brought the Bloomberg Magnificent Seven index down more than 10% from its recent peak, satisfying the conventional definition of a correction. It's also broken below its 50-day moving average. Investors may be grasping that the Magnificent Seven companies do compete with each other, and won't necessarily rise together. Investors didn't like Alphabet's increased spending to ready for improved artificial intelligence, and they also reacted to the comments by CEO Elon Musk that Tesla would try to reduce its reliance on Nvidia Corp. for the chips needed for AI. So there are signs of a reassessment. That said, the Mag 7 phenomenon remains intact. The Russell 2000 index (RTY in the chart below) enjoyed a startling rally following the June inflation data. That combined with a spectacular fall for the Nasdaq 100, which includes most of the largest tech groups. It was a very direct rotation. Since then, the Russell has settled down, while tech has continued to sell off. At this point, it's not clear that small caps can go much further: One final sinister development has been a sharp selloff for industrial metals, long regarded as a great leading indicator for the global economy, and particularly for China. With copper and aluminum both in a protracted downturn, it's natural to be concerned about a broader global slowdown. This has helped confidence about rate cuts. It also adds to a generalized angst coming in to a traditionally low-volume period for trading when big moves can happen on low liquidity: In foreign exchange, the balance appears to be turning decisively against carry traders — investors who borrow in low interest-rate currencies like the Japanese yen and park in currencies with higher rates, such as the Mexican peso. It's a trade that works beautifully unless the currency in which you're borrowing starts to gain. Now Bloomberg's index of that carry trade has dropped below its 200-day moving average. The peso is under pressure following the startling election success for the incumbent left-wing Morena party, while Trump's ascendancy raises the risk that exporters could soon face higher US tariffs. The yen appears finally to have hit rock bottom. This is not necessarily an unhealthy development. The carry trade has looked overblown for a while. The risk, shown by past collapses, is that it could snowball into something more severe: The tectonic plates are shifting in part because of a possible Trump return, in part because of evidence that the economy is slowing down, and in part because several trades — particularly in the Magnificent Seven — were blatantly overdone. So far, it's not clearly anything more than a correction. That doesn't mean that it will stay that way. The health of the US consumer faces enduring scrutiny. The Fed's aggressive rate hikes in recent years haven't thwarted consumers' strength, thanks largely to stimulus checks doled out during the pandemic. As this cushion wears out, consumers must confront tighter money. While it's hard to tell how much of the stimulus wealth is left, using proxies to diagnose consumer health in the face of tight lending standards makes sense, and suggests weakness. Jerome Powell's recent admission of the risks that tight monetary policy poses to jobs is stark evidence of cracks forming. With data pointing to cooling inflation and slowing growth, the focus on whether the consumer can keep spending grows more intense. Concerningly, the share of credit card balances past due has risen to the highest since 2012, according to data from the Federal Reserve Bank of Philadelphia. The share of balances past 60 due days climbed to 2.6%, compared to 1.1% in 2021 when consumers were flushed with pandemic support programs:  The recent earnings of the so-called Systemically Important Financial Institutions or SIFI banks showed revolving credit, including credit cards, accounted for nearly two-thirds of the $11.4 billion rise in credit recorded in May. Within this growth, there are stories of consumer stress. BCA Research's Doug Peta notes that a rise in consumer credit is noteworthy when the labor market is softening and excess savings are dwindling. It may contribute more to consumption growth. A respite through a rate cut cannot come soon enough for consumers enduring high interest rates. As noted by Charles Ashley, portfolio manager at Catalyst Funds, easing policy requires a delicate balance. Although recent data show weakness on the labor front, it looks more like a normalization from the record highs of the post-pandemic era. Still, the so-called normalization risks degenerating if it persists for too long without support from monetary policy. The softening labor market increases the difficulty of finding work, shifting the balance of power to employers. As shown in this chart from Bureau of Labor Statistics data, the average hourly earnings rose by the smallest percentage since 2022:  Determining the consumer's well-being using the performance of cyclical and non-cyclical stocks is far from foolproof. Still, it at least offers insight into the market's perception of consumers' strengths. As Points of Return noted, other factors could mask the use of benchmarks like S&P 500 discretionary and non-discretionary stocks. That said, they are still helpful, and recent readings showing consumer staples stocks holding firm and discretionary slowing down back the narrative of a consumer making hard choices:  Based on new home sales, down slightly in June and well below expectations after May's 15% decline, the consumer pain is broad. While transactions for previously owned properties dropped for a fourth month, the market for luxury homes worth over $1 million rose, according to the National Association of Realtors. Why does this matter? Consumers need houses to change hands to enhance their equity, and this latest data points to a slowdown that continues to raise house prices without producing cash for consumption. It's not a comfortable situation. —Richard Abbey You might have noticed a sudden profusion of memes about Kamala Harris. This is to help explain what's going on. At the weekend, the British popstar Charli XCX endorsed Harris by saying that she "IS brat." That's the title of her latest album, a hugely successful rendition of what is known as hyper-pop. Teenagers like my daughter love it. Charli XCX herself was first known for simpler songs like Boom Clap, but she's moved on to more complicated stuff like Sympathy Is a Knife, and Girl So Confusing with Lorde. The "Brat" album cover is in a distinctive lime green, and there's already a site, called bratgenerator.com, where you can generate your own lime-green memes. My daughter kindly made this one for me: It's easy to make memes, and there is plenty of internet footage of Harris dancing, and so she's been meme-ified. Whether this will make much political difference remains to be seen, as a lot of XCX fans are still too young to vote, but it's all good fun. Points of Return will now take a long weekend. One final recommendation is to remember to slump on the sofa and enjoy the Olympics. Have a good weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment