|

Brought to you by: |

|

|

Welcome back to 0xResearch. Here's what we've got for you today: |

|

|

|

Read between the headlines. |

Coming out of the Nashville Bitcoin conference featuring Donald Trump as a headliner, bitcoin had a strong close to the week. We heard a lot of promises — red meat to a Keto crowd — some of which, like commuting the sentence of Ross Ulbrich, are actually possible for a president to do alone. |

Simple actions that are empirically testable and binary are few and far between, however. |

For instance, while a Trump administration may well engineer an exit for Gary Gensler or remove him as SEC Chair, Trump can't legally "fire Gensler on Day 1." He'd have to resign himself. |

Sen. Lummis' "strategic reserve" sounds like a boon to BTC holders, but there are significant, probably insurmountable, practical and political problems with the idea of the "US accumulating 5% of BTC supply," as some characterize it. |

That's why guys who actually bother to think carefully, like Ari Paul, are willing to give 10:1 odds against such a proposal being executed in the next four years. |

Trump didn't endorse the Lummis concept explicitly, but he did call for a moratorium on US government sales of seized bitcoin. One problem there is that around half of this bitcoin ultimately belongs to Bitfinex. |

As Taylor Monahan says, "[Trump] makes a lot of promises he can't keep unless he forcibly upends the rule of law and all the checks and balances that are in place." And in that case, we have much bigger problems. |

The legit good news is none of this likely matters. Bitcoin trades on technicals, and the high-timeframe charts indicate that BTC is ready to try for a breakout from its multi-month consolidation. |

BTC's June 5 daily closing high was at $71,111, so reclaiming there would be a good start. |

— Macauley Peterson (X: @yeluacaM | Farcaster: @Macauley) |

|

Brought to you by: |

|

re.al is the permissionless L2 for tokenized RWAs built on Arbitrum Orbit, bringing off-chain yields onchain. re.al is the first L2 to return chain and protocol fees back to users in reETH, ensuring they benefit from the growth of the ecosystem. We've just launched a fully-transparent rewards program returning 10% of $RWA supply to early users. Get started, trading, borrowing, and leveraging a diverse selection of RWAs. Not investment advice or product solicitation and not aimed at US persons. |

|

|

|

Polymarket hits a billy: |

|

Crypto-based prediction market Polymarket has surpassed $1 billion in cumulative betting volume. |

The parabolic growth comes as a record $325 million in volume was notched in July, which represents about a third of the total. That's almost entirely due to political markets around the US election. |

As election season continues, the figure looks poised to head much higher. The real test will come after November to see if the Polygon-based predictions venue will be able to sustain these numbers. |

Meanwhile, others are building leveraged derivatives as a "cherry on top." |

— Macauley Peterson (X: @yeluacaM | Farcaster: @Macauley) |

|

|

Compound under attack? |

Compound, the fourth largest DeFi lending protocol by TVL, is apparently under a governance attack. Proposal 289, by an anon group known as the "Golden Boys," was narrowly passed by a 52% margin on Sunday to approve the transfer of 499,000 COMP ($24 million) to a third-party treasury. |

The funds would be supposedly deployed toward a DeFi strategy where users deposit COMP for a liquid wrapped "goldCOMP" that would generate yield in a 99% goldCOMP:1% WETH Balancer pool. |

What actually constitutes a governance attack is ultimately subjective, but there are a few damning facts contributing to this perception in Compound's case. Firstly, yesterday's proposal marks the third attempt by the Golden Boys to approve funds. The first two attempts, on May 6 (proposal 247) and July 19 (proposal 279), were unanimously shot down despite their far smaller ask of 92,000 COMP. |

Secondly, yesterday's approved proposal was largely thanks to a whale swing vote by Golden Boy de-facto leader "Humpy," who brazenly bought $4.5 million of COMP from ByBit 88 days ago. |

Third, "expert" opinions matter. Back in May, OpenZeppelin had flagged the possibility of a "coordinated governance attack," while Wintermute had condemned the first proposal due to its lack of community engagement and feedback sourcing — the usual procedure in DAO culture before going straight to an onchain vote. |

In the Golden Boys' defense, they seem to be engaging the community in good faith, having addressed many of the previous security concerns that were raised. Yet, it's hard to shake the perception of an "attack" when Golden Boys' own GOLD token is up 130% in the past day, while COMP has tumbled 6%. |

In response, Compound governance is now rushing through a vote to introduce a two-day timelock delay on future governance fund approvals. |

— Donovan Choy (X: @donovanchoy | Farcaster: @donovan) |

|

|

Updating AAVEnomics |

Two proposals entered the Aave Governance forum this week, outlining several upgrades to the protocol and revised tokenomics. The Umbrella proposal redesigns the Aave Safety Module to implement aTokens as the slashing asset, eliminating the price impact and execution risks associated with selling AAVE to cover bad debts. The AAVEnomics update introduces a "Buy-and-Distribute" program where net excess revenues (operating profits) will be used to buy AAVE on the secondary market and return these tokens to stkAAVE holders. |

Read more → |

|

Why Solana Mobile Should 100x Their Phone Production |

Solana Mobile is a highly ambitious foray into the mobile consumer hardware market, seeking to open up a crypto-native distribution channel for mobile-first applications. The market for Solana Mobile devices has demonstrated a phenomenon whereby external market actors (e.g. Solana-native projects) continuously underwrite subsidies to Mobile consumers. The value of these subsidies, coming in the form of airdrops, trial programs and exclusive NFT mints, have consistently covered the cost of the phone and generated positive returns for consumers. Given this trend in subsidies, the unit economics in the market for Mobile devices, and the initial growth rate and trajectory of sales, it should be expected that Solana mobile can clear 1 million to 10 million units over the coming years. As more devices circulate amongst users, Solana Mobile presents a promising venue for the emergence of killer-applications uniquely enabled by this mobile-first, crypto-native distribution channel. |

Read more → |

|

|

Get your game face on - we're about to make history with the first-ever Permissionless Pickleball Tournament! |

We're talking epic matches from a who's who roster of crypto. Think Bankless vs. Blockworks… |

Team submissions are now open if you think you've got what it takes. Register for Permissionless III and submit your team to play today. |

|

|

|

What if the US really bought 1 million BTC? |

Bitcoin is being tossed around as a potential US reserve asset, like gold and foreign currencies. |

Read more → |

|

Funding Wrap: Franklin Templeton backs Bitcoin L2 Bitlayer |

Plus, Galaxy Ventures unveils a new fund focused on early-stage crypto firms. |

Read more → |

|

|

| Bob Elliott @BobEUnlimited |  |

| |

The Fed is not going to cut rates because treasury interest expense is too high. It's not part of their mandate and therefore doesn't influence their decision making. | | | 12:04 AM • Jul 29, 2024 | | | | | | 409 Likes 35 Retweets | 109 Replies |

|

|  | Jon Charbonneau @jon_charb |  |

| |

We need to get better with stats, see these often The Jito # is just all tip payments sent through Jito MEV platform, not fees for Jito The Lido # is all value generated by Lido staked ETH (ie, ~30% of all ETH issuance, fees, etc), not fees for Lido Kinda useless & not comps |  SolanaFloor @SolanaFloor SolanaFloor @SolanaFloor

🚨JUST IN: Jito overtakes Lido in 24H fees collected to become the top fees generating protocol across all blockchains. |

| | | 11:36 AM • Jul 29, 2024 | | | | | | 111 Likes 11 Retweets | 5 Replies |

|

|  | vitalik.eth @VitalikButerin |  |

| | Replying to@peter_szilagyi | > The research team fully embraced the idea to centralise everything as long as it can be verified Having just come out of EF research workshops going on for the past week, I can confirm this is false, we had all kinds of discussions on minimizing centralization. This includes:… x.com/i/web/status/1… | | | 6:30 AM • Jul 27, 2024 | | | | | | 561 Likes 83 Retweets | 23 Replies |

|

| |

|  | George Selgin @GeorgeSelgin |  |

| |

A thread on some issues raised by @SenLummis's proposal, so far as I'm able to understand it. |  Senator Cynthia Lummis @SenLummis Senator Cynthia Lummis @SenLummis

We will convert excess reserves at our 12 Federal Reserve banks into #bitcoin over five years. We have the money now! |

| | | 7:13 AM • Jul 29, 2024 | | | | | | 148 Likes 35 Retweets | 13 Replies |

|

|  | Michael Egorov @newmichwill |  |

| |

ve-Tokenomics was designed specifically to avoid such issues. Could this attack happen on @CurveFinance? * Attacker would need to lock the tokens for 4 years.

* Amount of tokens to unilaterally reach quorum is around 200M CRV currently. Quorums are high because governance is… x.com/i/web/status/1… |  Michael Bentley @euler_mab Michael Bentley @euler_mab

Potential governance attack on Compound seems to have passed. |

| | | 7:56 AM • Jul 29, 2024 | | | | | | 214 Likes 39 Retweets | 2 Replies |

|

|  | vitalik.eth @VitalikButerin |  |

| |

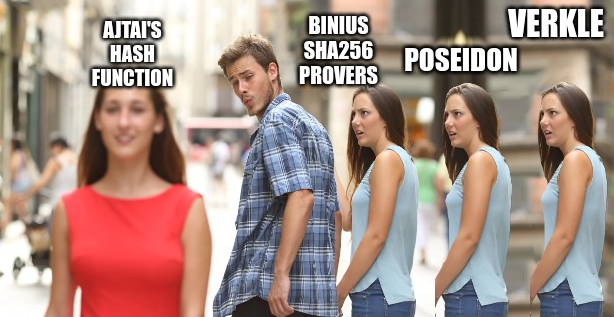

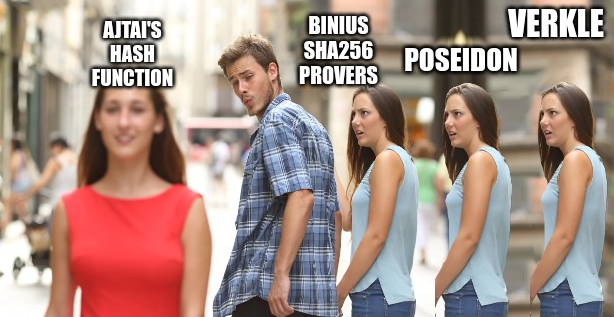

The last week of Ethereum state tree research be like... |  | | | 2:48 AM • Jul 28, 2024 | | | | | | 2.23K Likes 261 Retweets | 392 Replies |

|

| |

|

|

The insights, views and outlooks presented in the report are not to be taken as financial advice. Blockworks Research analysts are not registered broker/dealers or financial advisors. Blockworks Research analysts may hold assets mentioned in this report, further outlined in the Firm's Financial Disclosures. |

|

No comments:

Post a Comment