| FOMC is this week and you want to allocate as much as you can on the next move the Fed wants and may have to make.

You see, the Fed will always choose the rich.

It is not that difficult to see.

The Fed does not care about Democrats or Republicans.

Money goes with the Rich and will never choose the Poor. |  | Next to the Fed, you have two more Central Banks ready to choose the Rich: the Bank of Japan (BoJ) and the Bank of England (BoE) none will pick the poor. Jerome Powell has and will set the tone for the first-rate cut. The Bank of Japan has to balance its act to open the liquidity gates. The United Kingdom is as broke as Germany, so they need rate cuts.

Shocking; don't you think?

Every single Central Bank is set to cut rates. If they allow another recession just after one dramatic recession in 2020 and a 2022 cascade bear market, rest assured "the many" will not be that happy, and such can lead to events with enough power to hurt the rich.

Jerome Powell and friends are not going to let that happen. |  | So, where do you want to be…?

Initially, everyone talks now about those small-caps; right…?

Still, the biggest question is this one:

Do you think the new liquidity from Central Banks wants to be around small companies with no clue if they will be around next year?

I don't think so and YOU agree with me on this one.

Don't miss out on the scorching Summer 2024 action in US Equities! Elevate your investment strategy with Surveillance Capitalism's cutting-edge tools and insights. Click now to join MSA's Memberships and seize this golden opportunity!

Fresh Liquidity from Central Banks is and will find the assets with the strongest positions…

Bitcoin is now trading above 60,000 dollars, it is a 5-digit asset class going to and above 100,000 which means the market cap will expand.

Big companies get bigger, they are predictable, that's your Dow Jones (DIA) do not get confused, bigger gets way bigger, and size matters for those who are RICH. |  | And…

How do you think Jerome and Co. will accomplish a new run higher in risk assets?

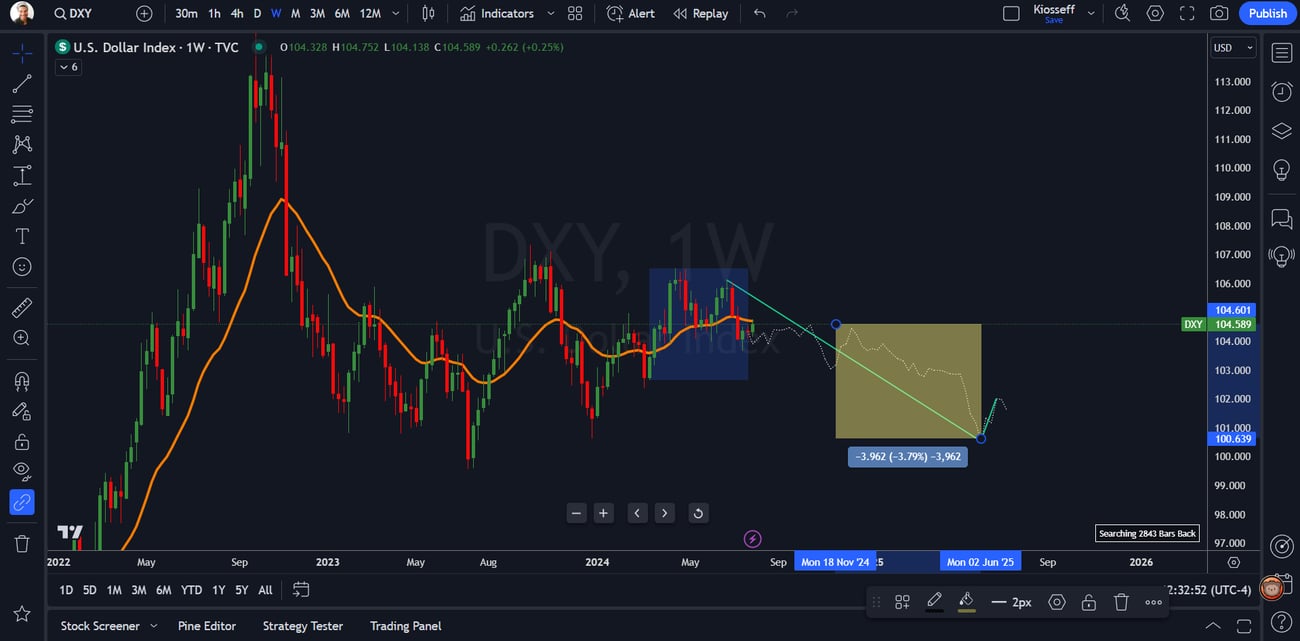

With the easiest move in any Central Bank playbook; currency devaluation.

So Trump is wrong on this one; the US dollar will be devaluated right away because it works for the rich, not for the poor.

Blue or Red; Red or Blue; does not matter.

Liquidity (fresh capital) goes where is treated the best.

I think YOU should do the same with your capital.

Dare to dream, dare to invest, dare to win. ¡Viva América!: Home of the Brave and Land of the Free, |

|

|

|

J.R. Jaén

Editor, Market Surveillance Alliance

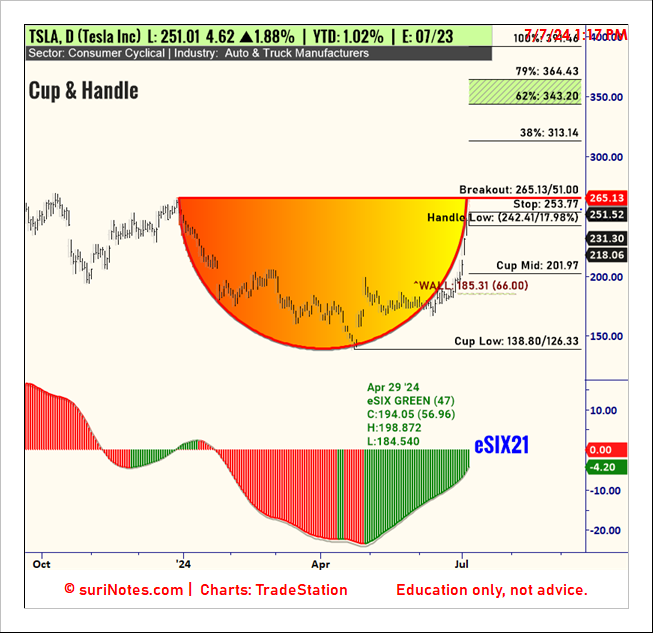

Editor's note: let's look at Tesla (TSLA) now, inflated, but what to do.

If you review the stock monthly chart, you can easily tell it made a buck as it ran 90% from April's lows. To be honest, decent chunk if you were betting on the expected volatility of probably the number one cult stock in the world right now.

Yes, not even Nvidia (NVDA) has such a following.

|  | Our friend Suri from Surinotes shared his latest view on the matter.

If you pay attention, the stock can revisit 201 and nothing will change. It can even attempt to shake out buyers near 180; it does not matter. |  | Bottom line: if you review Kiosseff's structure it goes as high as 1,400…

I am not joking, and you know this too.

Equities in the US Stock Market move based on "expectations" that's it.

If we want higher equity prices, and if everyone wants to keep their jobs on Wall Street this narrative better continue past 2030.

Your duty if you accept, make money on stocks when they move, no matter the reasons triggering such price action.

It's simple, so…Keep it simple.

Go ahead, dare to dream, and dare to win: Act Today — Surveillance Capitalism's intel is one step ahead of the herd.

| ABOUT US: At Global Profit Systems International LLC, we hold the conviction that financial literacy and freedom should be accessible to everyone, not just the seasoned investors. Our mission is to democratize the world of investing through comprehensive educational services and products. We simplify trading with our online platform, featuring an extensive collection of trading strategies designed to empower you at the start of your investment journey. We provide interactive webinars and training sessions because we are passionate about teaching. Regardless of the market opportunity, we foster a vibrant community of traders with shared interests, dedicated to dissecting daily market news together.

DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Global Profit Systems International are for your informational purposes only. Neither Global Profit Systems International nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user's own risk.

DISCLAIMER: TRADE AT YOUR OWN RISK; TRADING INVOLVES RISK OF LOSS; SEEK PROFESSIONAL ADVICE. Global Profit Systems International is not responsible for any losses that may occur from transactions effected based upon information or analysis contained in the presented. To the extent that you make use of the concepts with the presentation material, you are solely responsible for the applicable trading or investment decision. Trading activity, including options transactions, can involve the risk of loss, so use caution when entering any option transaction. You trade at your own risk, and it is recommended you consult with a financial advisor for investment, legal or tax advice relating to options transactions. Please visit https://www.markettradersdaily.com/tos/ for our full Terms and Conditions |

|

|

|

|

No comments:

Post a Comment