| Good morning. US stocks rise at start of crucial week. Tesla analyst nearly crashes while using 'full self-driving.' Olympics security tripped up by infrastructure sabotage. Here's what's moving markets. — Isabelle Lee Stocks rose ahead of major central bank decisions, economic data and earnings from four megacaps worth nearly $10 trillion. Following a rotation that drove the Nasdaq 100 to the brink of a correction, big tech climbed as small caps got hit. Results from Microsoft, Meta, Apple and Amazon will be crucial after a weak start to the megacap reporting season. The S&P 500 hovered near 5,465. A gauge of the "Magnificent Seven" rose while the Russell 2000 fell. Treasuries barely budged, on track for a third straight month of gains, the longest run since 2021. Federal Reserve officials are expected to start lowering interest rates within months, a move Jerome Powell may signal on Wednesday. Rate decisions in Japan and the UK will also be closely watched — the former for a hike, the latter for a cut. Elon Musk has said during Tesla's earnings calls that investors won't understand the company unless they're using the driver-assistance system marketed as Full Self-Driving. William Stein, a Truist Securities analyst, took this as his cue to test-drive one of the carmaker's vehicles, and narrowly avoided a crash. "The Model Y accelerated through an intersection as the car in front of us had only partly completed a right turn," Stein wrote. "My quick intervention was absolutely required to avoid an otherwise certain accident." Stein, who maintained his rating and $215 price target, emerged from the experience "befuddled at what Tesla might show" at an unveiling of robotaxi prototypes in October. Musk said last week that Tesla decided to delay the event by about two months. Italian Prime Minister Giorgia Meloni offered to broker better trade relations between China and the European Union, calling on President Xi Jinping to "balance out" commercial relations between the bloc and the world's second-biggest economy. "Italy can have an important role in EU relations and creating balanced relations," Meloni said Monday in her first official visit to China since coming to power in 2022. Getting the EU-China relationship back on track may prove a challenge because Meloni has limited sway over the bloc's trade policy, which is run by the European Commission. The Italian premier was sidelined following European parliamentary elections in June, when she was left out of the negotiations. During the Olympics, Paris has become a maximum security-site on high alert for potential terrorist attacks. Instead, saboteurs attempted to knock out train and internet infrastructure. Both incidents involved fiber optic cables. Attacks on France's high-speed railway hours before the opening ceremony on Friday targeted signaling cables. Then, overnight Sunday across France, cables in multiple locations carrying broadband service were cut. Unlike previous infrastructure attacks, the scale and coordination have taken authorities by surprise. France has about 35,000 kilometers of railway tracks and a vast network of long-distance internet cables, with 120,000 kilometers alone for SFR, the carrier that was targeted. Investors are becoming desperate for answers to questions about the near-term path of global monetary policy after conflicting signals from key economies upended markets. Major central banks are set to meet in Tokyo and Washington on Wednesday and London on Thursday, with traders struggling to decide if the Bank of Japan will hike interest rates, and then when and by how much the Federal Reserve and Bank of England will cut them. Here's what caught our eye over the past 24 hours: - Protests erupt across Caracas after Maduro Claims Reelection

- Biden calls for strict new limits on Supreme Court justices

- Israel weighs its response to Golan attack as US urges calm

- Sixth Street, Mnuchin to buy insurer Enstar for $5.1 billion

- IMF approves $3.4 billion funding program for Ethiopia

- Global smash 'Deadpool & Wolverine' finishes No. 2 in China

- Olympic athletes choose cardboard beds over king-size luxury

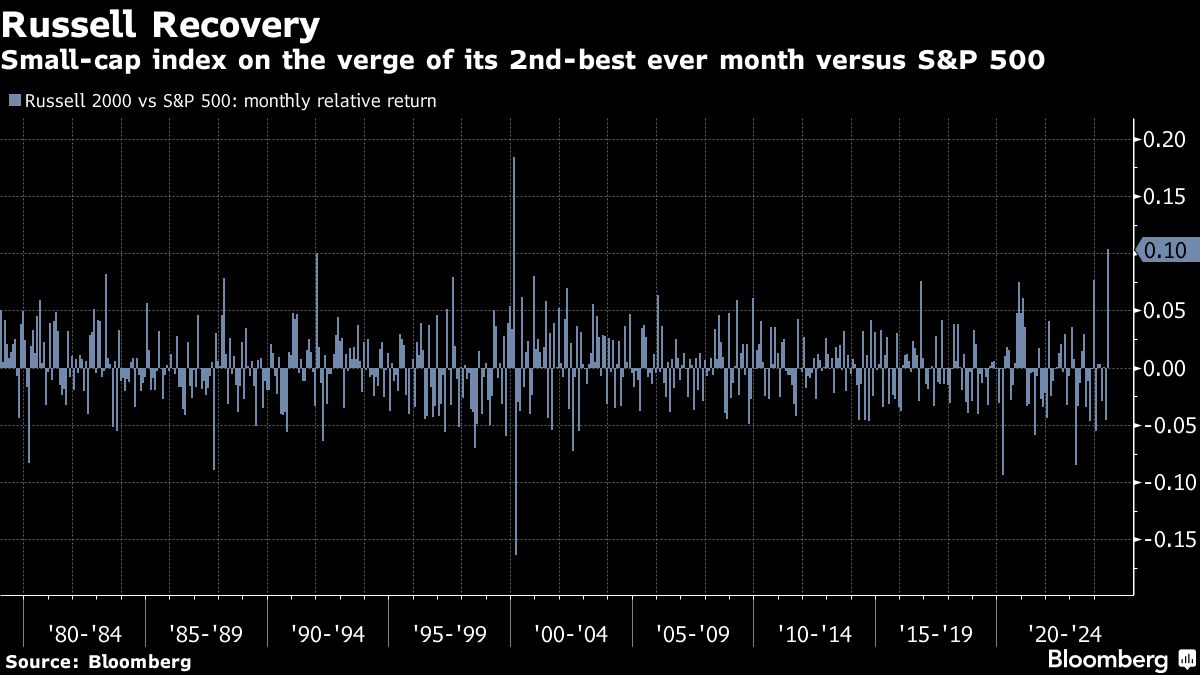

Survey: There is a lot of debate over whether high interest rates in the US have a cooling or stimulating effect on the American economy. From your perspective, did the Fed's monetary tightening help you get richer? Do you expect your personal investments to gain or lose once the Fed starts cutting rates? Share your views in Bloomberg's latest MLIV Pulse survey. It's a little curious that despite all the gyrations of the US equity market this month, on Friday the S&P 500 ended virtually unchanged from June's closing level. Of course, the major story has been one of rotation rather than market beta per se and the surge in the Russell 2000 versus the likes of the SPX or NDX. In fact, through Friday's close the Russell 2000 had posted its second-best month ever versus the S&P 500, trailing only February 2000. That's as good a sign as any of the disequilibrium underlying some of this price action.  Given the heavy weight of financials in the Russell 2000, it has arguably benefited from the dovish tilt in Federal Reserve pricing in recent weeks. That has reached something close to an extreme, at least for the rest of 2024 (insofar as each of the final three meetings of the year have discounted at least a two-thirds probability of a rate cut.) We once again rotate to the question of whether the Fed will be cutting rates because it wants to (ie, the data affords it the opportunity to gradually ratchet policy settings down and then see what happens) or because it has to (due to a sudden loss of economic momentum or a financial shock.) Financial markets have whiffed on their assessment of the Fed through this prism in recent years, grossly underestimating the capacity for rate hikes in 2022 and then overestimating the forthcoming scale and timing of easing at the end of last year. Could they be making the same mistake once again? Perhaps. December 2025 SOFR futures are now 50 basis points higher than they were the day before the June Fed meeting. While the Fed seems all but certain to signal this week that it has gained more confidence that inflation is heading to target, it seems unlikely that it will hint that aggressive rate cuts over the next 18 months are a foregone conclusion. Cameron Crise is a macro strategist who writes for Bloomberg's Markets Live blog. |

No comments:

Post a Comment