| This is Bloomberg Opinion Today, a whiny compilation of Bloomberg Opinion's opinions. Sign up here. The members of Generation Z have a lot of complaints. Inflation is high, student loans are oppressive and the national debt is ballooning thanks to expensive entitlements for boomers. Even hiring has slowed from its frenzied pace. Rather than sympathize, many older Americans tend to dismiss the whiny whippersnappers as entitled slackers who should just suck it up and pay their dues like others before them. The reality is somewhere between those two extremes, Allison Schrager says in her latest column. When you widen your lens, life has indeed gotten economically easier for younger generations as compared to their parents. "But that does not take away from the fact that getting a start in the world is hard," Allison writes. "All sides have a point — and we'd be better off if we had more realistic expectations for ourselves and empathy for each other." The early years of adulthood have always been difficult. As Allison points out, most young adults start with little money, and many have to live in high-rent cities (at least if they want to learn a trade and maximize their pool of potential partners.) But although this generation is more rent-burdened, they also have significantly more financial assets than preceding generations. All told, Allison says kids today should just appreciate the pleasures and challenges of this complex phase. "And I hope that you will grow old enough to complain about the ingratitude and laziness of the younger generation," Allison says.

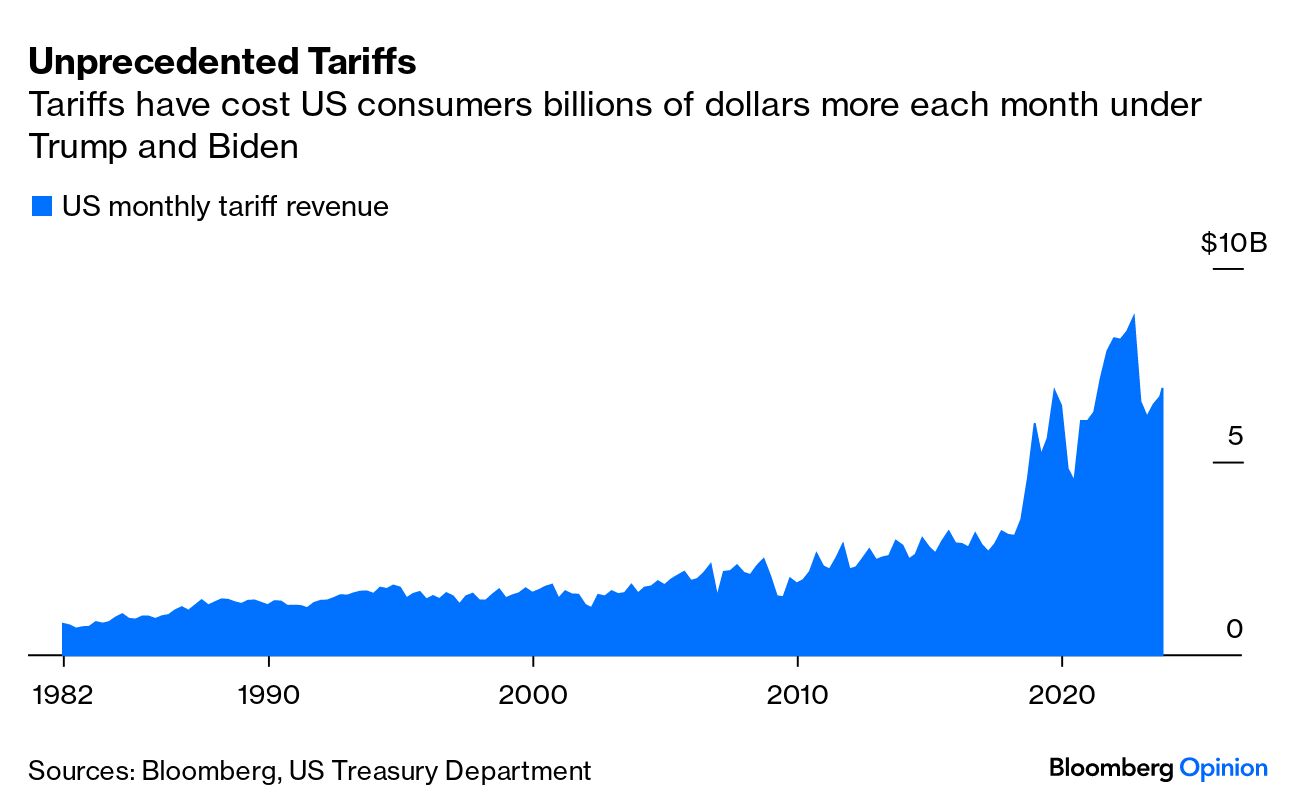

Speaking of economic gripes, has anyone flown commercial lately? Not only are flights busy and expensive, but airlines are increasingly using surge pricing for extras such as bags and assigned seats, as Chris Bryant writes. In the early days of optional add-ons, many customers used to work around the extra expense by squeezing their belongings into carry-ons. But now many companies are charging for larger carry-ons as well. Chris says that this panoply of new charges is confusing and surprising flyers and making it harder to compare offers. It also risks sowing distrust: "Customers might pick another airline next time, or simply stay home," Chris says. Continuing on our theme, here's something we can all agree to dislike: the cost of insurance. In particular, the cost of auto insurance has surged in recent years, thanks in part to pricier automobiles, a spate of weather-related claims and an uptick in serious accidents. But lately, Tesla's Elon Musk has been fanning hopes that autonomous vehicles might dramatically cut the number of crashes, thus slashing the demand for and price of insurance. Warren Buffett, who owns Geico through his company Berkshire Hathaway, recently acknowledged that such an outcome would hurt auto insurers' volumes. In my column today, I argue that scenario should be the least of the insurance industry's worries. Insurers already face a multitude of near-and-present challenges, including runaway litigation and the task of retooling risk models for a changing climate. Meanwhile, the costs of repairing higher-tech autos keeps rising, as does the total miles traveled by automobile. With all the uncertainty in the world, I certainly agree that auto insurers should hedge their bets with small positions in potentially disruptive technologies. And certainly, it will be great for humanity if Musk – or anyone else – manages to bring a truly autonomous car to market that manages to dramatically curb accidents, one of the leading causes of the death in the US. But self-driving cars have been "just around the corner" for a decade or more, and there's no guarantee that we're much closer today. So as I write in the column, "I'm dubious that `too few accidents' is the tail risk that should most concern" the insurance industry going forward. Today's progressives are getting away from their free-trade roots. In his column Wednesday, Adrian Wooldridge says that the modern crop has abandoned the economic policies that Bill Clinton and Tony Blair embraced, favoring subsidization and trade barriers, among other things. He points to the way that President Joe Biden has kept the Donald Trump era tariffs and added new policies in favor of US industries, as the chart below shows. That's a trend that's catching on around the world.  Switching gears to retail, Macy's is under siege from firms trying to buy up the legendary department store chain. But Andrea Felsted writes that the company "doesn't need the activists when it can be its own." She says Macy's is plenty capable of becoming a better retailer in the hands of new Chief Executive Officer Tony Spring, without the sort of financial engineering that new ownership would bring. Macy's shares currently reflect some skepticism that there will be a deal, as the chart shows. "If the bidders do walk away, at least shareholders can console themselves with Spring's potential for self help," Andrea says. Fed Chair Jerome Powell isn't actually playing politics. — John Authers Howard Schultz needs to stop posting on social media. — Beth Kowitt There's a problem with Tiktok's free speech lawsuit. — Stephen L. Carter The FDIC's toxic workplace culture shouldn't exist. — Paul J. Davies Don't crush human creativity to sell iPads. — Dave Lee The Patriots owner just sold his apartment at the Plaza hotel. Prosecutors are examining whether Tesla committed fraud. Crypto exchange FTX has billions more than it needs to cover customer losses. John Leguizamo turned down Stanley Tucci's part in The Devil Wears Prada. A Florida fisherman and a gator. Tom Selleck's new memoir. Madonna's awesome Rio de Janeiro show. Baby gorillas are cute. Notes: Please send kvetching about generational disadvantages and feedback to Jonathan Levin at jlevin20@bloomberg.net. |

No comments:

Post a Comment