|

This issue is brought to you by: |

|

|

"Shoot for the moon. Even if you miss, you'll land among the stars." |

- Norman Vincent Peale |

|

|

|

Thursday Moon Math Mailbag |

Q: How high could we go? |

No idea, but that is now the right question to ask. |

Last mailbag, I said we were in the regret-minimization phase of the market, in which you might want to err on the side of taking risk just in case things work out the way the bulls expect them to. |

One week later, it feels like we've already progressed to the moon-math phase of the market, in which you err on the side of assuming that everything will definitely work out in the best imaginable way. |

It won't, of course. But prices may not make any sense to you for the next while unless you pretend that it will. |

A lot of prices have looked nonsensical to me for a long while already, but that's because I haven't been using the moon math — there is always some metric that, when paired with the most optimistic assumptions, can justify the price of any stock or token price. |

With bitcoin back above $60,000, now may be the time to start using those metrics — at least if you want to understand what's going on. |

In the case of crypto — where there is so little by way of earnings or revenue to put a valuation metric on — the moon-math thinking might simply be: How silly did it get last time? |

Filecoin's FIL token, for example, got to a fully diluted value (FDV) of $360 billion in 2021. |

$360 billion! |

Filecoin did little or no revenue at the time, so people must have been doing some serious moon math on the decentralized storage market to think that was a good idea. |

2024's version of decentralized storage tokens in 2021 is decentralized AI tokens and, while these all look absurdly expensive to me, none of them are peak-Filecoin expensive — the largest AI token (TAO) has an FDV of "just" $13 billion. |

I don't think things will get 2021 silly again, but it's not impossible — bitcoin hasn't even made a new high yet, so, who knows?

However silly you might think things are now, know that they could get a lot sillier. |

Q: Is retail back? |

As good as ETF flows have been, I'd guess the vast majority of TradFi money hasn't even noticed that bitcoin is back — and I don't expect they will until it makes headlines for hitting new all-time highs. |

In a headline last week, Bloomberg referred to the crypto market as "battered" — if Bloomberg hasn't yet noticed that crypto is booming again, I doubt that many others have either. |

Q: Are we only mooning because of ETFs? |

I think so, yes — there's other stuff happening, as well, of course, but nothing that seems explanatory of current prices. |

Yes, the Bitcoin ecosystem is becoming more dynamic, but usage metrics (transactions, fees, ordinals, wallets) are down across the board. |

|

The only two bitcoin metrics that are rising are ETF inflows and its price, so I'm sure that's not just correlation. |

I'd argue also that everything else in crypto is drafting in Bitcoin's slipstream: If you're making money in any cryptocurrency — memecoins included — you probably have the SEC's reluctant approval of spot ETFs to thank. |

This is not how crypto was expecting to win, of course — bitcoin was supposed to win by disrupting TradFi, not by being co-opted by it. |

But you don't have to call your shots — in both trading or investing, you win by making money, not by being right. |

Q: What's the moon math on Worldcoin? |

If Nvidia is this cycle's version of Cisco in 1999, Worldcoin is TheGlobe.com. |

Like Worldcoin, TheGlobe.com had been left for dead just weeks before it exploded higher. |

After finding scant interest among institutional investors, bankers priced the IPO at $9 — the shares then traded as high as $97 before closing at $63 for the largest-ever first-day gain. |

That was partly because (like Worldcoin) the float was very small: Just 3.1 million shares were issued at IPO — not nearly enough to meet the market's insatiable demand for exposure to that new-fangled thing, the internet. |

As with Worldcom, no one knew exactly how TheGlobe.com would make money, but the bull case was simply "internet." |

Similarly, the bull case for Worldcom is simply "AI" — and its total addressable market is literally every human on Earth, which makes for excellent moon math. |

If WLD becomes the primary way that people prove they are human or, even better, if it becomes the Universal Basic Income we receive when the robots take all our jobs, you could easily do some moon math to justify its $76 billion FDV. |

Q: Who cares about FDV? |

Seemingly no one at the moment, but that will eventually change. |

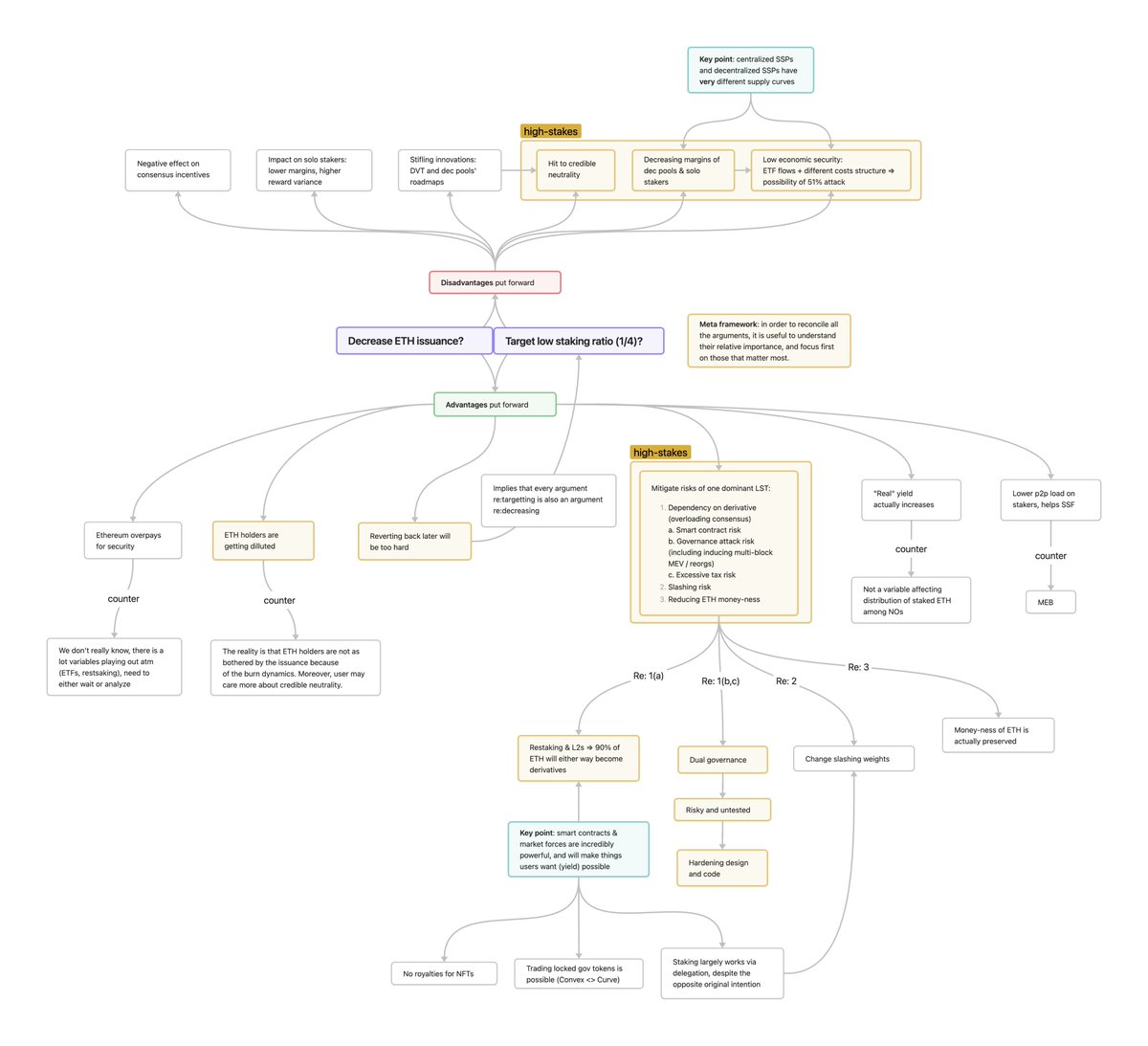

For example: IMX token holders who bought at the $8 top in 2021 still need the token to more than double to get back to break-even. |

But the token's market cap is already more than double the previous high of $1.7 billion. |

|

The yawning difference between the red and blue lines above is why token holders should care about FDV. |

(Eventually.) |

Q: What's the moon math on UNI? |

On a 0xResearch podcast this week, Blockworks Research analyst Westie Capital did the math on the Uniswap governance proposal that would start returning fees to token holders for the first time. |

As proposed, with the revenue derived from a limited number of training pairs and assuming current volumes, Westie found that UNI holders can expect a 0.75% yield for staking their tokens. |

That is hardly something to get excited about, so Westie tried again, but with moon math: Assuming fees from all Uniswap pairs are distributed to stakers and assuming that Uniswap does its highest-ever monthly volume (last achieved in 2021) and it maintains that level of volume for an entire year, stakers could then expect a payout of 5.3%. |

If the very best UNI token holders can ever hope for is 5.3%, I'd have thought that would be received as bad news. |

And yet, the token was up 50%. |

They must be using Mars math. |

― Byron Gilliam |

|

This issue is brought to you by: |

|

|

With thousands of Solana validators, how do you know you're staking to the right one? Enter Marinade: the ultimate solution to stake SOL. |

Marinade monitors all Solana validators and automatically stakes with hundreds of top performers, constantly rebalancing for peak performance along the way. |

Stake with Marinade Native for no smart contract risk, or go liquid with mSOL to use in DeFi. It's Max Decentralization for Solana and Max Performance for you. |

|

|

Top Stories | Bitcoin ETF trade volumes retreat from record level — but stay high — Read House Committee passes resolution to block SAB 121 — Read Wells Fargo, Merrill to offer bitcoin ETFs to wealth management clients: Bloomberg — Read Ethereum devs debate future of account abstraction — Read Bitcoin halving will benefit publicly listed miners: JPMorgan — Read

|

|

|

|

We're Watching |

|

We're are so ₿ack! On today's episode of 1000x, Jonah and Avi discuss recent market price action as Bitcoin rips above $60,000 & ETF flows continue. |

Watch or listen to 1000x on YouTube, Spotify or Apple. |

|

Thank you to our sponsor: |

|

|

Arbitrum is the leading Ethereum Layer 2 scaling solution, home to over 600+ applications. |

Arbitrum allows you to interact with Ethereum the way it was meant to be - with lower fees and faster transactions. Whether you're exploring the leading DeFi ecosystem, the strong infrastructure options, a flourishing NFT and creator ecosystem, and a rapidly growing gaming hub, the Arbiturm ecosystem has a solution for you. |

|

|

Daily Insights |

| Logan | X @LoganJastremski |  |

| |

The more people I talk with in Denver the more bearish I become on the Ethereum ecosystem I'm going to restake my L2 tokens into my L3, and then bridge from Arbitrum and settle on Celestia... The infinite VC bid for infra will come to an end, and the focus will shift back to… twitter.com/i/web/status/1… | | | Feb 29, 2024 | | |  | | | 502 Likes 61 Retweets 106 Replies |

|

|

| Artem @artofkot |  |

| |

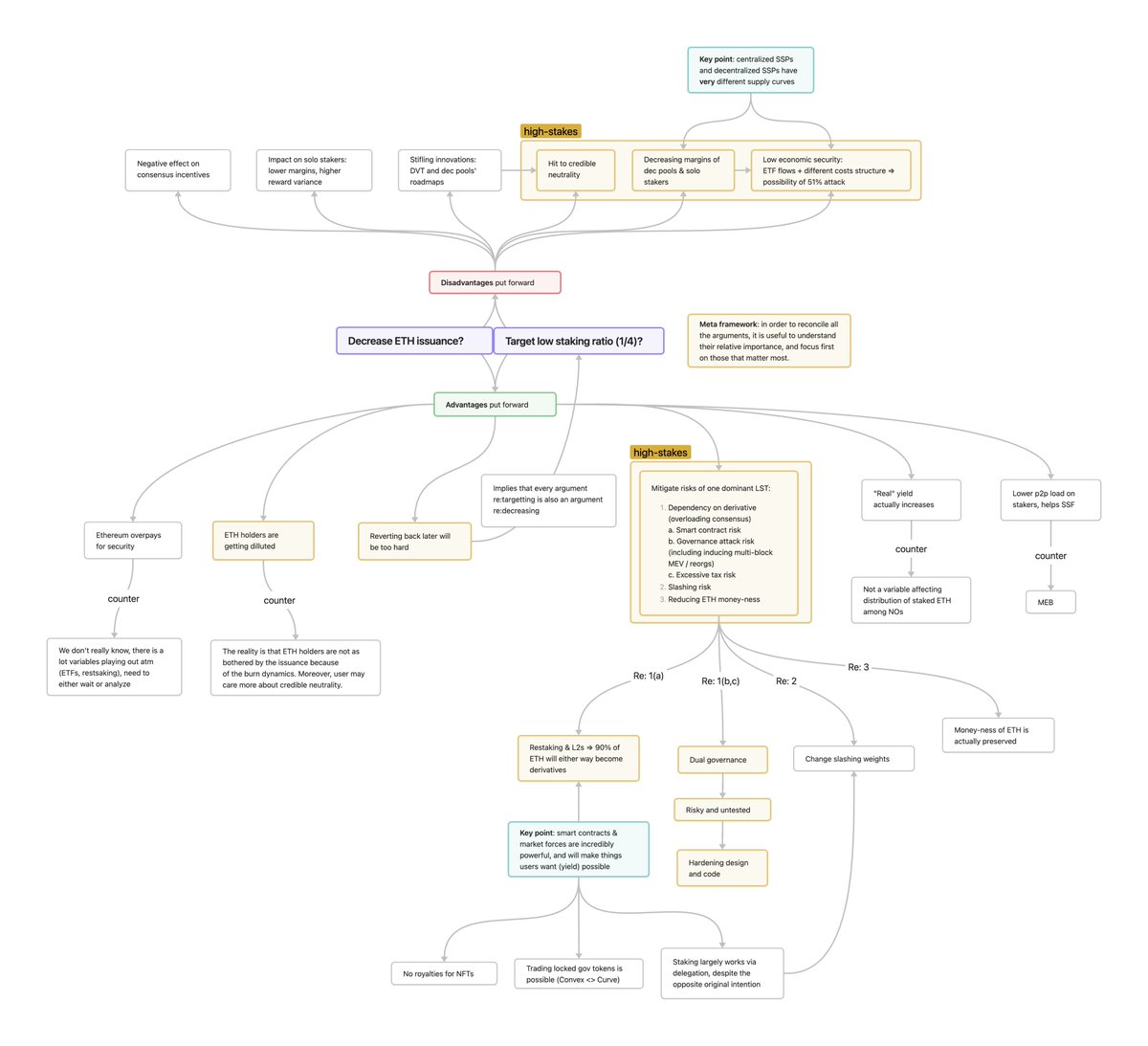

Staked ETH concentration.

Distribution of staked ETH is a critical aspect of Ethereum PoS, and it is under-analyzed in the current proposal. The case for capping stake low (1/4 level of staking ratio) may appear reasonable under the current stake distribution. However, a severe… twitter.com/i/web/status/1… | caspar @casparschwa staking economics endgame: issuance curve adjustment proposal for electra: |

|  | | | Feb 29, 2024 | | |  | | | 45 Likes 14 Retweets 2 Replies |

|

|

| mert | helius.dev @0xMert_ |  |

| |

product mistakes holding back the entire crypto industry i) thinking UX is the bottleneck UX is not the bottleneck, while not perfect, it's good enough — the actual bottleneck is things worth using ii) defining your market segment wrong in crypto, devs have a tendency to use… twitter.com/i/web/status/1… | | | Feb 29, 2024 | | |  | | | 92 Likes 8 Retweets 14 Replies |

|

|

|

|

No comments:

Post a Comment