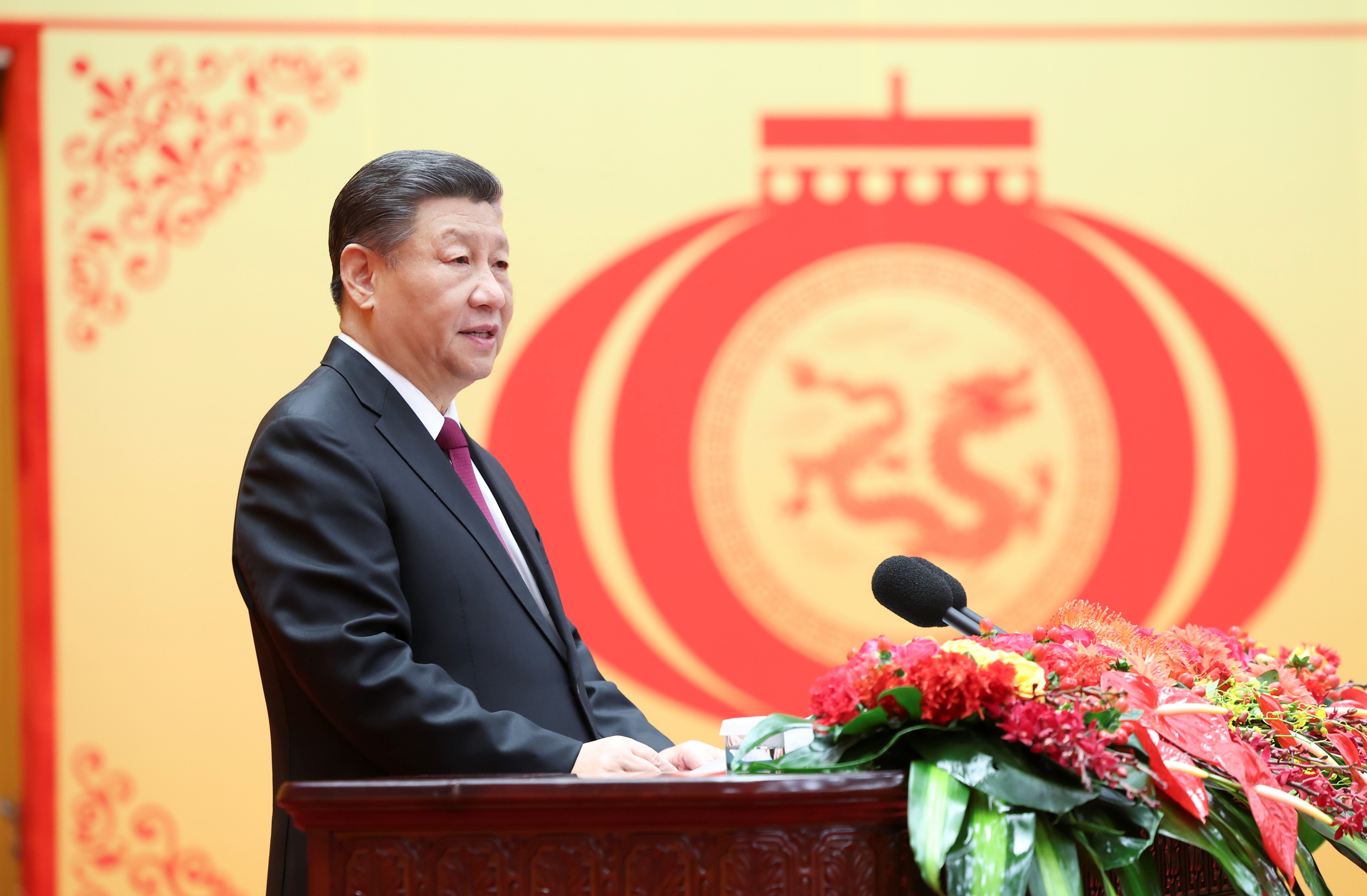

| Hello, this is Colum Murphy in Beijing. China's most significant annual political event of the year — the National People's Congress — kicks off Tuesday, when Xi Jinping shares his vision for the world's second-largest economy in 2024. I'll be at the imposing Great Hall of the People, just off Beijing's Tiananmen Square, as the Chinese leader delivers his key speech. We'll get a bunch more details on policy direction as well, including this year's economic growth target.  Xi Jinping Photographer: Xinhua News Agency/Xinhua News Agency This year, access for foreign media is finally expected to return to the levels seen before the pandemic. That means more opportunities to chase down delegates, though in a sign of how long the tail from Covid controls remains, we still need to take PCR tests when we pick up our credentials. Now a year into his third term, Xi's consolidation of power has cleared the way for him to break China's cycle of debt-driven growth and put the economy on a more sustainable footing. But that also means the buck stops with the man at the top as the nation contends with economic pressures including a property crisis and persistent deflation.

The danger for Xi is that the "fallout of the decline of the old growth model might be so great it prevents him from moving into the new growth model," said Yuen Yuen Ang, a professor of China's political economy at Johns Hopkins University.

"The big question is, can you make that change fast enough?"  We've seen concerns play out all over the economy from the multi-trillion dollar stock market rout to falling prices and muted activity. Foreigners are holding back on investing, too, with one measure of direct investment slumping to a 30-year low in 2023.

The economic malaise has spread to regular Chinese people, who have cited concerns about job cutbacks and falling wages as growth slows.

"I had never imagined myself getting laid off. I thought only those who made serious mistakes would get fired. So my first reaction when I got laid off was, why me?" said Stephanie Ming, who spoke to Bloomberg Originals about her experience in the tumultuous job market.

Ming has since found new work at an insurance company where she is making less pay: "My income can go up and down like a roller coaster." The risk for Xi is whether concern about the economy spirals into widespread discontent. The China Dissent Monitor — a project of US-based Freedom House that collects information on protests — said economic demonstrations have remained elevated since August, with many focused on labor disputes and real estate. Compounding the problems is a broad drop in wages among civil servants who have seen bonuses slashed in recent years as indebted local governments struggle to earn enough revenue. That risks disenfranchising the vast bureaucracy charged with implementing Xi's vision on the ground. "As long as my income was decent, I didn't complain," one mid-level policeman from southwestern China told my colleagues. He asked to be identified only by his surname, Zhou. "But now the economy is in bad shape, the leadership needs to show us some hope." Beijing has found a new scapegoat to explain why the stock market is in such turmoil: quant funds. These funds, which rely on computer algorithms to carry out trades, are drawing increasing scrutiny from regulators amid concern they amplified a stock selloff that has wiped out more than $6 trillion of market valuation in China and Hong Kong since a peak in 2021.

The quants' outsized exposure to small-cap stocks has been blamed for this year's market rout. A popular trade for these funds involves buying small-caps, which are more prone to mispricing and more profitable for computer programs to exploit. To hedge their broad market exposure, the funds would short index futures. These strategies have proven profitable for the funds during the multi-year market downturn. However, in the aftermath of the "quant quake" and growing concern that the funds were also exacerbating declines by unloading big blocks of shares or making short bets, authorities have been imposing new restrictions on them on an almost daily basis.

That's spooking investors at a time when the stock market is finally showing signs of life. Among the recent moves: Banning some funds from placing sell orders and limiting their ability to make short trades; shrinking the size of a popular quantitative trading strategy; and even banning a top-performing quant fund from the stock-index futures market. Quant funds will also be scrutinized and new entrants will have to report their strategies to regulators before trading.  "Bloomberg: The China Show" is your definitive source for news and analysis on the world's second-biggest economy. Yvonne Man and David Ingles give global investors unique insight with the newsmakers who matter. Airing Monday-Friday from 9 to 11 a.m. Hong Kong time. While the new measures have helped prop up share prices at least temporarily, they raise bigger questions of how far Xi's government will go to meet short-term goals at the expense of maintaining some pretense of a free market. |