| Welcome to 2024, which I can exclusively reveal looks a lot like 2023 so far. That doesn't mean it will continue that way. As many of us in the media have raked over during the holiday season, last year didn't go as the great majority of economists and investors had expected. Those who were confident that there would be no US recession, or broad geopolitical conflict were proved correct. They should have made a lot of money as a result. That's led to a natural assumption that 2023 ended the issue, and recession will still be staved off in 2024. To a lesser extent, it's fostered a belief that those who were right will continue to be proved right. That's where Rudyard Kipling comes in. Back in August 2007, the stock market sold off drastically as it felt the first waves of the subprime credit implosion. But it rebounded and even set new all-time highs in October. Those who'd made a big market-timing bet at the low looked really clever. It turned out from research I covered at the time that the opportunistic buyers were mostly retail investors, while the professionals running hedge funds tended to be on the wrong side of the trade. I began my column about it by adapting Kipling: "If you can keep your head while all about [you] are losing theirs/Then you're a man my son."

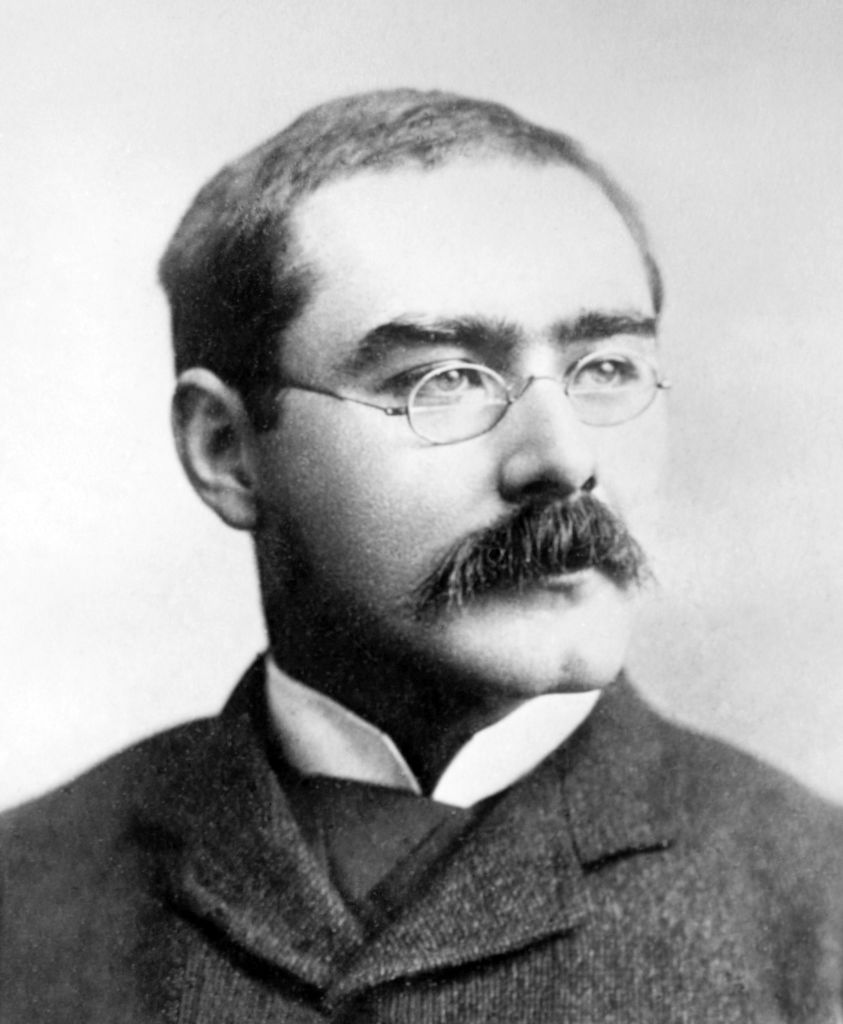

One response I received offered an alternative rendering of the poem: "If you can keep your head while all about [you] are losing theirs/Then you have no grasp of the situation." Sure enough, the market made a final peak on Halloween, and then began a dreadful 17-month slide. The hedge funds who'd taken evasive action in the summer were a little early, but by the end of 2008 they looked like the ones who'd kept their heads. The retail investors who piled in at or close to the top looked like the headless chickens. They took the loss.  Keeping your head was different in Kipling's day. Photographer: Pictures from History/Universal Images Group Editorial/Getty I learned from this. The next time I cited "If," I added the alternative version. And hence I am inclined to be careful now. I, in common with many others, didn't expect what happened last year. Others got it right. But think of the hedge fund managers who got out of the market a bit too early in the summer of 2007. What we've just experienced doesn't mean that the issue is settled. Having been incorrectly bearish in 2023, I'd like to structure this by looking at the reasons to be bullish, then check how confident we can be about them. So I'll be guided by the veteran market economist Ed Yardeni, who called it right last year and has offered nine reasons to be bullish, along with three not to be too bearish, to counter negative points out there in the market. Here they are, with my comments: - Interest rates are back to normal

We can cavil about exactly what a normal rate should be at this point, but it's undeniable that rates have already come down a long way (apart from the shortest-term overnight rates over which the Federal Reserve has the greatest influence). The market has already executed a pivot on behalf of the Fed. One of the greatest reasons to avoid stocks and to fear for the economy has been removed. That said, real rates are positive now (higher than inflation), and still higher than at virtually any point since the Global Financial Crisis. There's no question of returning to the rather weird normal that persisted from 2009 until the pandemic. The new one we're entering still likely involves higher rates than that (unless the bulls are surprised by a recession). - Consumers have purchasing power

This was the crucial cause of many bearish mistakes in 2023. The assumption was that the excess savings built up during the enforced low spending of the pandemic would be used up by now. They haven't been. Is that enough reason to expect the current good times to keep rolling? That's where it gets more complicated. Financial conditions have already started to ease, so some of the worst possibilities are off the table — people won't be spending down their savings and facing intensely high interest rates. The fact that the US has continued this long without a recession, and is already easing conditions, strongly improves the chances that a recession can be avoided altogether.  Christmas shopping in New York. The new year won't end the spree. Photographer: Eilon Paz/Bloomberg But if the chances of a "soft landing" have improved over the last 12 months, that doesn't mean that they've become overwhelming. Doug Peta of BCA Research managed to be right for the right reasons in 2023. He predicted that the consumer was in stronger shape than many thought, and that this would buoy both the economy and risk assets. His projection is that the excess savings will soon be used up. At that point, there's likely to be a recession (although milder than once seemed possible.) "While we welcome the heartening data that have swollen Team Soft Landing's ranks," he says, "we won't be applying for membership. A 2024 recession remains our base case and we think overheating is more likely than a soft landing if the expansion survives the coming year." The mechanism for this: The excess savings, which Peta still estimates at $400 billion, will be exhausted by mid-year, while the lagged effects of all the higher interest rates will at last start to hurt. Given the current excitement among investors, that prompts BCA to predict a bear market for stocks as well. Timing, as many learned to their cost in 2023, is everything. Confidence will not be allowed to give way easily, and so the market can keep rallying. Peta suggests not turning bearish until it's possible to see "the whites of the eyes" of a recession. - Households are wealthy and liquid

This is another area where the market has helped to create its own reality. Higher stock prices cheer up people who hold equities in their retirement portfolios, particularly when those savings vehicles are transparent and you can see your nest egg recovering in real time. That means a wealth effect — when people are wealthier, they tend to behave accordingly. America's "mass affluent" are able to keep spending now, even if their extra savings from the pandemic have been spent down. Yardeni points out that a record $5.9 trillion is in money market mutual funds with a record $2.3 trillion in retail funds. These might turn out to be the conditions for a melt-up, but they do not suggest any great risk of a recession.  Especially in the services sector. Photograph: Bloomberg - Demand for labor is strong

There are still 8.6 million job openings begging for willing workers. That implies a more robust economy than has been experienced at any time since 2008, and demonstrates that corporations believe they can grow further. That said, the record high vacancies showing up in the data were viewed with trepidation throughout 2023 as a sign that the labor market remained tight, and that wage pressures were rising. This applies particularly to the services sector, which is where the inflation and most of the jobs are these days. The labor market is consistent with a soft landing, but the risk of an over-heat or of "stagflation" as wage inflation propels broader inflation remain intact. - The onshoring boom is boosting capital spending

This creates problems if you happened to be investing directly in China. Assume that China has enough shock absorbers in place not to fall into crisis as foreign direct investment turns negative and companies leave for the US or Western Europe (or at least for Mexico and Eastern Europe). But the mere act of "onshoring" involves new investment in plant. While onshoring continues — and the extent of offshoring over the previous generation means there could be much further to go — this will be a powerful force helping the economy.  US sales of previously owned homes are picking up. Above: Hercules, California. Photographer: David Paul Morris/Bloomberg - Housing is set for a recovery

Mortgage rates have plunged over the last two months. They remain high. But the sense that homeowners were trapped in their houses, unable to move because they couldn't afford the extra costs that would come with it, should be much reduced. That's all good. This scenario would be vulnerable to another reverse in rates, and would be helped by further cuts. - Corporate cash flow is at a record high — $3.4 trillion during the third quarter of 2023.

- Inflation is turning out to be transitory

Yardeni points out that goods inflation was back down to 0% in November. The core measure of the Personal Consumption Expenditures deflator, reported quarterly with a lag and possibly the most influential data series for the Fed, weighed in at exactly 2% (the central bank's target) for the third quarter. So it's certainly very defensible to claim that inflation has passed through. What's not so clear as yet is whether services inflation is also transitory. That largely depends on wages (see above). If wage inflation persists, and sticky services inflation stays at its current level or rises, that would be a nasty shock for the emerging consensus.  ZL Technologies at The AI Summit New York 2023. Photographer: Bing Guan/Bloomberg - The high-tech revolution is boosting productivity

Artificial intelligence promises to relieve human beings from doing medium-skilled and generally boring jobs. That should be really good for productivity, both because of the money it saves and the human capital it releases to do something else. We can argue over how great the effect will be, and whether it's been priced in already, but there's definitely something behind the AI hype. It shouldn't be ignored. Now for the Yardeni responses to the most important bear points: - The leading indicators are mostly misleading

The leading economic indicators have forecast a recession since late 2022. In particular, the yield curve has been inverted (meaning that short-term rates are higher than long term, a close-to-foolproof recession forecaster in the past) for more than a year as the Fed hiked short-term rates. Something is plainly up. At the very least, the continued expansion in the economy as the indicators suggest deterioration shows that this cycle is very unusual, something most of us had grasped already. But how safe is it to assume that they're outright wrong? Yardeni argues: The LEI has misfired its recession signals because its composition is biased toward predicting the goods sector more than the services sector of the economy. There has been a rolling recession in the goods sector, but it has been more than offset by strength in services, nonresidential private and public construction, and high-tech capital spending.

- Global challenges should remain contained

We already have two very active wars that have caused great suffering and death. And yet neither the conflict in Ukraine, approaching its third year, nor the fighting between Israel and Hamas stopped the great market rally in the final months of 2023. Both have prompted big expenditures from the US and Western European allies, but neither as yet has expanded much beyond the initial direct combatants. A more aggressive China has not attempted to invade Taiwan, which has an election coming up.  Russia accused Ukraine of shelling Belgorod on Saturday Russia Emergency Situations Ministry Telegram channel Counterintuitively, some of the effects have been positive for the US economy. Marc Thiessen, a conservative columnist at The Washington Post, points out that the great majority of the money being spent on aid and armaments for Ukraine is going to businesses in the US. Building weapons to help Ukrainians defend themselves against Russia creates jobs in America.

Yardeni does have one bear point — all the government debt. It looks highly unlikely that the next US administration will start by taking strong action to rein it in. Both the leading candidates have presided over big increases in the deficit. The talk is of tax cuts, or more big government investments, depending who wins. - And finally: What about 2025? And politics?

The presidential election is bound to bring a bumpier ride, because it always does. Heightened emotions will only create a more difficult environment for risk assets. But usually, investors make their peace with the result — just think back to 2016, when markets sold off on polls suggesting that Donald Trump might have a chance of winning, and then rallied massively once he surprised everyone by doing so.  Swing-state politics: Biden at the Wisconsin Black Chamber of Commerce... Photographer: Jamie Kelter Davis/Bloomberg There are big problems with both likely candidates, and no need to rehearse them here. Sizeable numbers of people think either Joe Biden or Trump could be disastrous for the economy. What's important to note about the "bull" thesis is that it implies that the economy keeps getting better. Generally, when that happens noticeably as an election approaches, the incumbent wins — as both Ronald Reagan and Margaret Thatcher managed after first guiding their countries through a recession. If rates come down and juice the economy, the odds are that Biden will win (which would be decidedly bearish for many). He would then face the risk of resurgent inflation, with minimal fiscal flexibility.  And a retired Ford Motor Co. employee in Detroit, Michigan. Photographer: Matthew Hatcher/Bloomberg If the economy does finally lapse into recession, it's hard to imagine Biden winning reelection. The nation would start 2025 in bad economic shape, with very little flexibility to spend. Trump would be back in the White House for a second term. Not everyone will find this prospect appealing. Brace for a year in which the campaign, the markets, and the economy collide and clash in ways that are hard to predict. And if others panic about this, try to keep your head about you… As it's the new year, here are some songs to ring it in: New Year's Day by U2, Happy New Year by ABBA, New Year's Day by Taylor Swift, Same Auld Lang Syne by Dan Fogelberg, or New Year's Day by Bon Jovi. Have a good 2024 everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment